Union of Musicians

-

DATABASE (996)

-

ARTICLES (811)

Andy Zain is a veteran businessman, executive and angel investor. The Monash University graduate worked in management roles in various Indonesian tech companies and also co-founded companies like Elastisitas and Numedia Global. He is well-known as a founding partner and managing director at VC Kejora Ventures. Andy is also part of ANGIN, the Indonesian network of angel investors that collaborates with Grupara Ventures.

Andy Zain is a veteran businessman, executive and angel investor. The Monash University graduate worked in management roles in various Indonesian tech companies and also co-founded companies like Elastisitas and Numedia Global. He is well-known as a founding partner and managing director at VC Kejora Ventures. Andy is also part of ANGIN, the Indonesian network of angel investors that collaborates with Grupara Ventures.

Founded in Shenzhen in 1993, Grandland Holdings comprises four companies - Grandland Group, Grandland Property, Grandland Capital, and Grandland Investment. It operates in the sectors of decoration, real estate, high-tech and finance. Grandland Holdings has total assets of RMB 30 billion, which are invested in more than 30 listed companies. It acquired the Permasteelisa Group, a leading Italian curtain wall corporation, for RMB 3.66 billion in 2017.

Founded in Shenzhen in 1993, Grandland Holdings comprises four companies - Grandland Group, Grandland Property, Grandland Capital, and Grandland Investment. It operates in the sectors of decoration, real estate, high-tech and finance. Grandland Holdings has total assets of RMB 30 billion, which are invested in more than 30 listed companies. It acquired the Permasteelisa Group, a leading Italian curtain wall corporation, for RMB 3.66 billion in 2017.

Orza focuses on direct investments in Basque startups looking to expand and internationalize. It is part of the Elkarkidetza and Geroa pension fund system and typically takes minority stakes, forking out between €1.5 million and €8 million per investment. It actively manages its investee companies while offering them access to its network of local and international contacts.

Orza focuses on direct investments in Basque startups looking to expand and internationalize. It is part of the Elkarkidetza and Geroa pension fund system and typically takes minority stakes, forking out between €1.5 million and €8 million per investment. It actively manages its investee companies while offering them access to its network of local and international contacts.

EDB Investments (EDBI) is an investment arm of Singapore's Economic Development Board. It has invested in emerging technologies since 1991, with particular focus on healthcare and information/communication tech. EDBI seeks companies with the potential to support Singapore's economy through existing economic pillars or the development of new industry sectors, as well as companies that can potentially go global through Singapore.

EDB Investments (EDBI) is an investment arm of Singapore's Economic Development Board. It has invested in emerging technologies since 1991, with particular focus on healthcare and information/communication tech. EDBI seeks companies with the potential to support Singapore's economy through existing economic pillars or the development of new industry sectors, as well as companies that can potentially go global through Singapore.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

Qinghan Fund was founded in 2017 by Crystal Stream, New Hope Group and Chinese celebrity Lu Han. Its largest shareholder is Wang Mengqiu, former vice president of Baidu. Qinghan Fund invests primarily in teams (e.g., small groups of people running a WeChat Official Account) that create professionally generated content, media and platforms which cater to the next generation's lifestyle and consumption upgrade needs.

Qinghan Fund was founded in 2017 by Crystal Stream, New Hope Group and Chinese celebrity Lu Han. Its largest shareholder is Wang Mengqiu, former vice president of Baidu. Qinghan Fund invests primarily in teams (e.g., small groups of people running a WeChat Official Account) that create professionally generated content, media and platforms which cater to the next generation's lifestyle and consumption upgrade needs.

Singtel Innov8 is the venture arm of Singapore-based telecommunications company Singtel. It invests in companies that can potentially bolster Singtel's own capabilities in communications technologies, media services and customer experience. Innov8 has invested in companies at home and abroad, including in Indonesia, China, the USA and Israel. It has made exits through the sale of its portfolio companies (Viki and Tempo.AI) and via IPOs.

Singtel Innov8 is the venture arm of Singapore-based telecommunications company Singtel. It invests in companies that can potentially bolster Singtel's own capabilities in communications technologies, media services and customer experience. Innov8 has invested in companies at home and abroad, including in Indonesia, China, the USA and Israel. It has made exits through the sale of its portfolio companies (Viki and Tempo.AI) and via IPOs.

China Creation Ventures (CCV) was founded in 2017 by Wei Zhou, the former managing partner of KPCB China. Headquartered in Beijing, it invests mainly in early-stage startups in sectors such as finance and TMT. Series A funding accounts for around 70% of total investment. CCV manages USD and RMB funds collectively worth over RMB 3 billion.

China Creation Ventures (CCV) was founded in 2017 by Wei Zhou, the former managing partner of KPCB China. Headquartered in Beijing, it invests mainly in early-stage startups in sectors such as finance and TMT. Series A funding accounts for around 70% of total investment. CCV manages USD and RMB funds collectively worth over RMB 3 billion.

Established by Chinese Academy of Sciences Holdings Co., Ltd., and several other conglomerates in 2011, Cash Capital invests mainly in high-tech startups in the IoT, intelligent manufacturing, mobile internet, big data, artificial intelligence, fintech, healthcare, medical equipment and pharmaceutical sectors. The firm manages assets of more than RMB 10 billion and has invested in nearly 100 companies.

Established by Chinese Academy of Sciences Holdings Co., Ltd., and several other conglomerates in 2011, Cash Capital invests mainly in high-tech startups in the IoT, intelligent manufacturing, mobile internet, big data, artificial intelligence, fintech, healthcare, medical equipment and pharmaceutical sectors. The firm manages assets of more than RMB 10 billion and has invested in nearly 100 companies.

Albert Armengol is the CEO and co-founder of Doctoralia, an online platform for searching and booking medical assistance. He is also the founder of eConozco (sold to XING AG).Armengol has a healthcare and business background and developed his professional career in the healthcare and insurance sector. He later moved to technology and internet startups as an entrepreneur and angel investor.

Albert Armengol is the CEO and co-founder of Doctoralia, an online platform for searching and booking medical assistance. He is also the founder of eConozco (sold to XING AG).Armengol has a healthcare and business background and developed his professional career in the healthcare and insurance sector. He later moved to technology and internet startups as an entrepreneur and angel investor.

Based in Madrid, Ultano Kindelan works at US-based monetization platform Fyber as VP for Sales covering various regions. He has over 15 years of experience in digital advertising and adtech. He previously worked at Madrid-based Falk Realtime adtech. In 2017, he participated in the first seed round of Spanish AI-driven femtech WOOM, his only disclosed investment to date.

Based in Madrid, Ultano Kindelan works at US-based monetization platform Fyber as VP for Sales covering various regions. He has over 15 years of experience in digital advertising and adtech. He previously worked at Madrid-based Falk Realtime adtech. In 2017, he participated in the first seed round of Spanish AI-driven femtech WOOM, his only disclosed investment to date.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

With New Hope Group, one of China’s biggest agriculture and food businesses, as its cornerstone investor, HosenCare Brothers had operated as a PE arm within the group for nearly a decade. In 2017, it began to operate under its current name. It currently manages assets worth more than RMB 3bn, and mainly invests in sectors of medtech, healthcare, biotechnology and smart manufacturing.

With New Hope Group, one of China’s biggest agriculture and food businesses, as its cornerstone investor, HosenCare Brothers had operated as a PE arm within the group for nearly a decade. In 2017, it began to operate under its current name. It currently manages assets worth more than RMB 3bn, and mainly invests in sectors of medtech, healthcare, biotechnology and smart manufacturing.

Ping An is China's second largest insurer, with over US$645 billion worth of assets (2015).

Ping An is China's second largest insurer, with over US$645 billion worth of assets (2015).

Yang Dengfeng is the co-founder and CEO of online-to-offline pet services startup Zhuazhua.

Yang Dengfeng is the co-founder and CEO of online-to-offline pet services startup Zhuazhua.

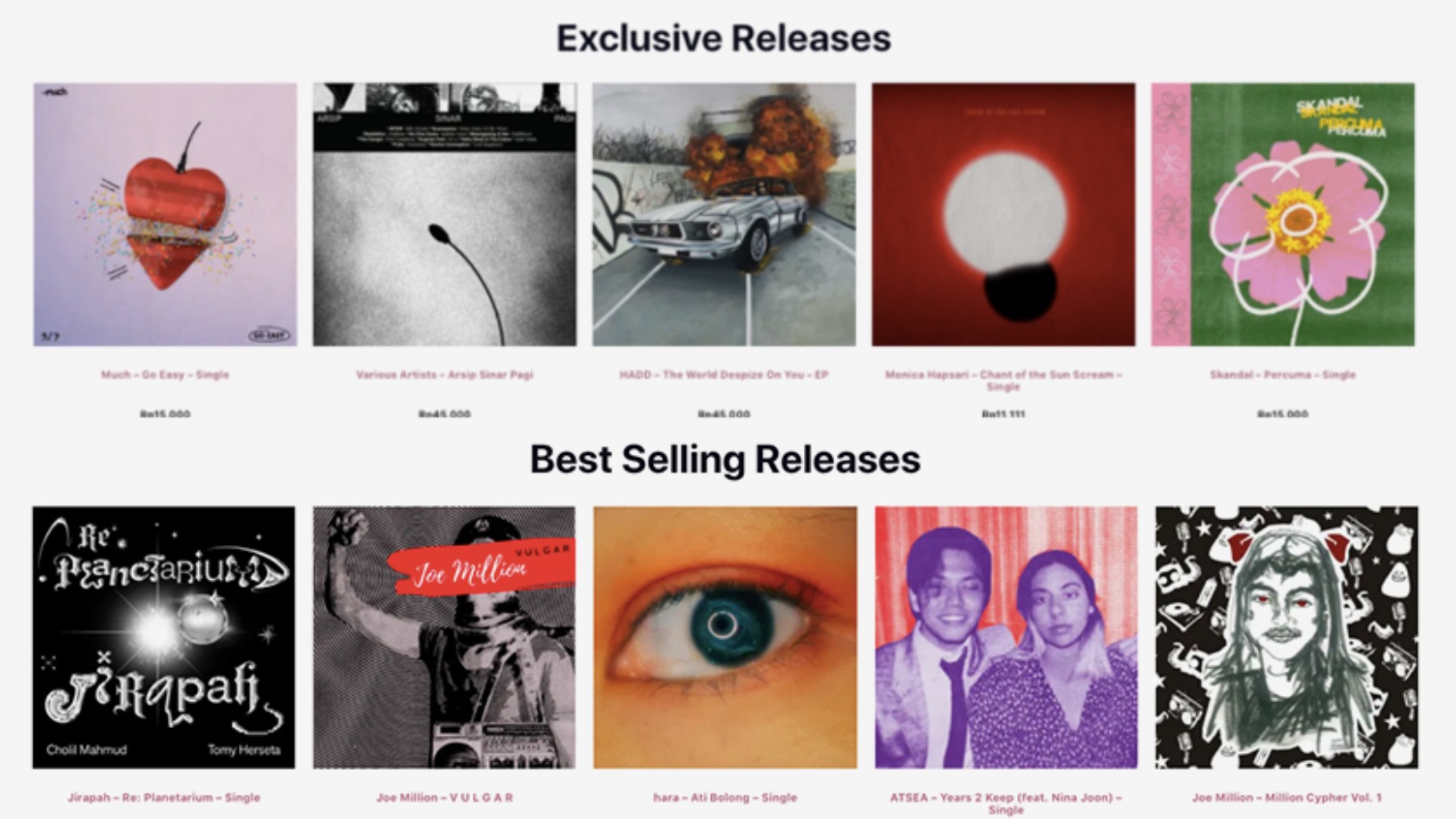

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

Kolase: Crowdfunding platform for Indonesian musicians

Started by music industry veterans, Kolase sees a promising online market in contemporary music fandom

SFTC: Riding on the rise of independent music and alternative media

From recording music sessions for its YouTube channel, Sounds From The Corner has expanded into content production, reflecting Indonesia’s fast-evolving media landscape

This Portuguese startup lets you bet on your favorite musicians

Whether you’re a fan, groupie or just a good old-fashioned music lover, Tradiio is selling crowdfunding as the best way to put your money where your mouth is

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

TMiRob's medical robots lighten the load of doctors and nurses in hospitals

The robots also reach an operating room three minutes faster than human nurses – that's more time for saving lives

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

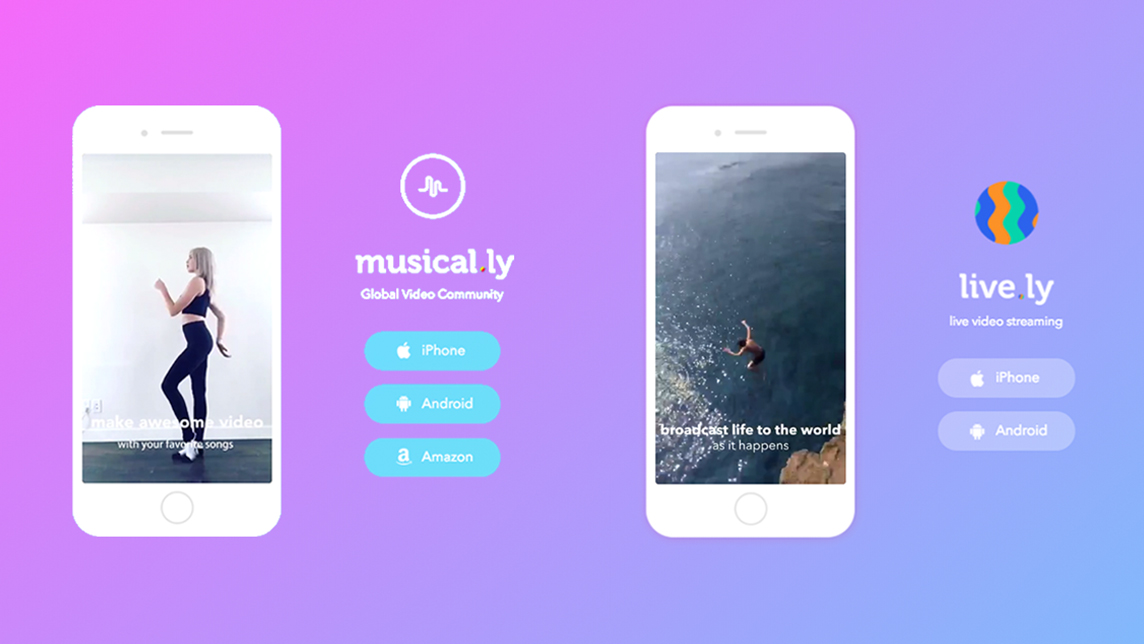

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

From Naples to Dhaka: Italo-Dutch precision farming startup Evja eyes funding for R&D, sales boost

Evja has a second office in the Dutch “Food Valley” and is investing to boost its advanced agronomic modeling, to stave off rising competition

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

MatMap: Making the construction sector more sustainable

Alicante-based startup MatMap gives a second lease of life to used construction materials that account for almost a third of EU waste

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Sorry, we couldn’t find any matches for“Union of Musicians”.