Union of Musicians

-

DATABASE (996)

-

ARTICLES (811)

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2003, Hina Group is an investment bank that provides financial consulting services. It has helped more than 180 companies close their funding and perform M&As. The total value of these transactions is US$56 billion. Hina Group oversaw Alibaba’s acquisition of Ele.me and the merger Qunar.com and Ctrip. Hina Group manages over RMB 10 billion. It has invested in unicorns such as Hujiang.com and Youbao.

Founded in 2003, Hina Group is an investment bank that provides financial consulting services. It has helped more than 180 companies close their funding and perform M&As. The total value of these transactions is US$56 billion. Hina Group oversaw Alibaba’s acquisition of Ele.me and the merger Qunar.com and Ctrip. Hina Group manages over RMB 10 billion. It has invested in unicorns such as Hujiang.com and Youbao.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Tianjin Venture Capital was co-founded by Tianjin Municipal Science & Technology Commission and Tianjin Municipal Finance Bureau in 2003. It invests mainly in the sectors of advanced manufacturing, TMT, energy conservation & environmental protection, healthcare and consumer services. The firm manages RMB 8bn in capital. Of the 100+ tech startups in which the firm has invested, nearly 10 have gone public in China.

Tianjin Venture Capital was co-founded by Tianjin Municipal Science & Technology Commission and Tianjin Municipal Finance Bureau in 2003. It invests mainly in the sectors of advanced manufacturing, TMT, energy conservation & environmental protection, healthcare and consumer services. The firm manages RMB 8bn in capital. Of the 100+ tech startups in which the firm has invested, nearly 10 have gone public in China.

Founded in 2012, Heyi Group was established via the merger of China’s two leading internet video channels, Youku and Tudou. The group promotes the creation of original video content through IP licensing, native content production and collaborating with users to generate content. In August 2015, it announced a plan to invest RMB 10 billion in content projects. It was acquired by Alibaba Group in 2016.

Founded in 2012, Heyi Group was established via the merger of China’s two leading internet video channels, Youku and Tudou. The group promotes the creation of original video content through IP licensing, native content production and collaborating with users to generate content. In August 2015, it announced a plan to invest RMB 10 billion in content projects. It was acquired by Alibaba Group in 2016.

Renhe Group was founded in Jiangxi Province by Yang Wenlong in 2001. The group, including its flagship listed Renhe Pharmacy, earned total sales revenue of RMB 11.23bn in 2018 with a year-on-year profit growth of 25%. The group comprises 20 subsidiaries dealing in cosmetics, household chemicals, pharmaceutical, medical supplies and equipment.

Renhe Group was founded in Jiangxi Province by Yang Wenlong in 2001. The group, including its flagship listed Renhe Pharmacy, earned total sales revenue of RMB 11.23bn in 2018 with a year-on-year profit growth of 25%. The group comprises 20 subsidiaries dealing in cosmetics, household chemicals, pharmaceutical, medical supplies and equipment.

KDDI Open Innovation Fund is a joint corporate VC operated by Japanese telecommunications firm KDDI and investment firm Global Brain. It forms one part of KDDI's venture programs, the other being a Japan-only accelerator program, KDDI Infinity Labo. With the support of other companies in the group, such as au Financial Holdings and Soracom, KDDI is able to provide extensive and relevant support to its portfolio companies.

KDDI Open Innovation Fund is a joint corporate VC operated by Japanese telecommunications firm KDDI and investment firm Global Brain. It forms one part of KDDI's venture programs, the other being a Japan-only accelerator program, KDDI Infinity Labo. With the support of other companies in the group, such as au Financial Holdings and Soracom, KDDI is able to provide extensive and relevant support to its portfolio companies.

Ladies Investment Club (LIC) is a group of self-funded women investors, put together with a mission to find, support and nurture female founders on their journey to business ownership. Driven by a desire to see more women-led startups, LIC touts its extensive experience across multiple industries and disciplines, and offers not just capital, but guidance and mentoring to increase female founders' likelihood of success.

Ladies Investment Club (LIC) is a group of self-funded women investors, put together with a mission to find, support and nurture female founders on their journey to business ownership. Driven by a desire to see more women-led startups, LIC touts its extensive experience across multiple industries and disciplines, and offers not just capital, but guidance and mentoring to increase female founders' likelihood of success.

Maylis Chevalier is an executive director, mentor and angel investor in Spanish tech startups. She’s currently the Director of Innovation and Digital Product at Vocento, a Madrid-based media broadcaster.She was the Spanish country manager for Ligatus, a programmatic marketing solutions company. She was also an executive in the editorial and business development departments of media companies such as Gruner + Jahr GmbH and Axel Springer SE.

Maylis Chevalier is an executive director, mentor and angel investor in Spanish tech startups. She’s currently the Director of Innovation and Digital Product at Vocento, a Madrid-based media broadcaster.She was the Spanish country manager for Ligatus, a programmatic marketing solutions company. She was also an executive in the editorial and business development departments of media companies such as Gruner + Jahr GmbH and Axel Springer SE.

Indonesia’s first unicorn, Gojek started out providing on-demand app-powered motorcycle taxi services. The company quickly grew as it added more services, making use of its large fleet of riders and eventually branching out into logistics and payments. It has recently made investments in other companies, including Bangladeshi bike-taxi service Pathao, insurtech startup PasarPolis and has acquired payment tech companies Midtrans, Kartuku and Mapan.

Indonesia’s first unicorn, Gojek started out providing on-demand app-powered motorcycle taxi services. The company quickly grew as it added more services, making use of its large fleet of riders and eventually branching out into logistics and payments. It has recently made investments in other companies, including Bangladeshi bike-taxi service Pathao, insurtech startup PasarPolis and has acquired payment tech companies Midtrans, Kartuku and Mapan.

Launched in 2017 by the Mobile World Capital Barcelona, The Collider is a new venture builder that brings together scientists and entrepreneurs to carry out scientific and technological projects through highly innovative startups. It aims to foster the adoption and implementation of new technologies in the field of AI, IoT, Blockchain, VR and 5G networks to facilitate technological transitions and innovations through science and deep-tech knowledge.

Launched in 2017 by the Mobile World Capital Barcelona, The Collider is a new venture builder that brings together scientists and entrepreneurs to carry out scientific and technological projects through highly innovative startups. It aims to foster the adoption and implementation of new technologies in the field of AI, IoT, Blockchain, VR and 5G networks to facilitate technological transitions and innovations through science and deep-tech knowledge.

The venture arm of American cloud computing company Salesforce has invested in more than 150 companies since 2009.

The venture arm of American cloud computing company Salesforce has invested in more than 150 companies since 2009.

Will Hunting Capital was founded by Wang Xinguang, the former vice-president of Phoenix Media Fund, in 2014.

Will Hunting Capital was founded by Wang Xinguang, the former vice-president of Phoenix Media Fund, in 2014.

Capricorn Investment Group is one of the world’s largest mission-aligned investment companies, managing more than $6bn in multi-asset class portfolios for families, foundations and institutional investors. Notably, it manages the investment portfolio of Jeff Skoll, the first President of eBay, and his charitable organization. The company has offices in Silicon Valley and New York. It has invested in 63 companies to date, many aimed at tackling key challenges facing our world today. It has managed 14 exits to date, including Tesla. Its main focus is on technology and sustainability, with a particular interest in deeptech, aerospace, transport, agtech, healthcare and energy. The firm’s most recent disclosed investments were in May 2021, via participation in the $100m Series B round of Canadian quantum computing startup Xanadu and the $28m Series B round of US geothermal tech company Fervo Energy.

Capricorn Investment Group is one of the world’s largest mission-aligned investment companies, managing more than $6bn in multi-asset class portfolios for families, foundations and institutional investors. Notably, it manages the investment portfolio of Jeff Skoll, the first President of eBay, and his charitable organization. The company has offices in Silicon Valley and New York. It has invested in 63 companies to date, many aimed at tackling key challenges facing our world today. It has managed 14 exits to date, including Tesla. Its main focus is on technology and sustainability, with a particular interest in deeptech, aerospace, transport, agtech, healthcare and energy. The firm’s most recent disclosed investments were in May 2021, via participation in the $100m Series B round of Canadian quantum computing startup Xanadu and the $28m Series B round of US geothermal tech company Fervo Energy.

CM International Financial Leasing Co. Ltd.

Founded in 2015, CM International Financial Leasing is a subsidiary of CMIG Leasing, with RMB 40 billion in assets.

Founded in 2015, CM International Financial Leasing is a subsidiary of CMIG Leasing, with RMB 40 billion in assets.

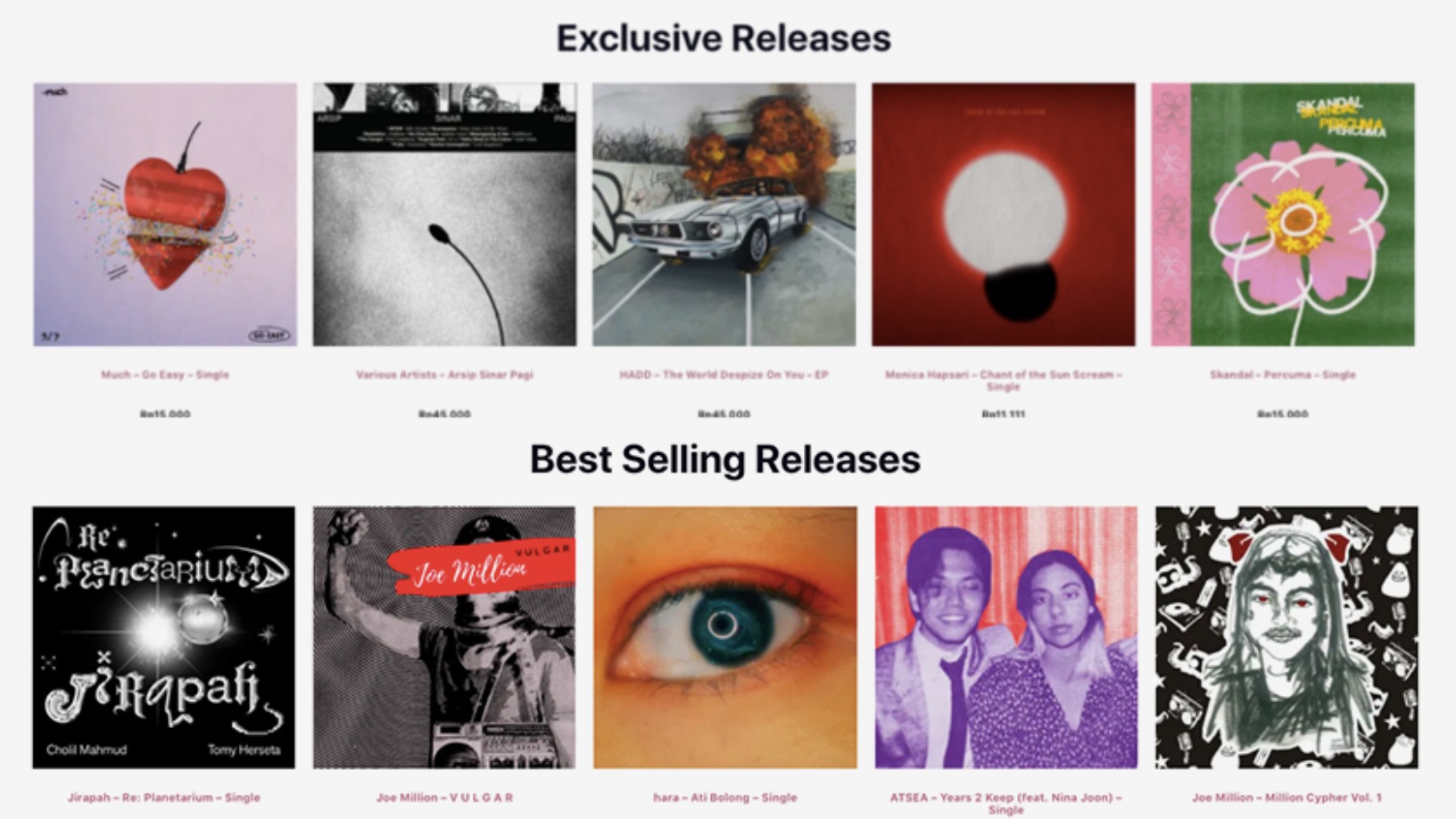

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

Kolase: Crowdfunding platform for Indonesian musicians

Started by music industry veterans, Kolase sees a promising online market in contemporary music fandom

SFTC: Riding on the rise of independent music and alternative media

From recording music sessions for its YouTube channel, Sounds From The Corner has expanded into content production, reflecting Indonesia’s fast-evolving media landscape

This Portuguese startup lets you bet on your favorite musicians

Whether you’re a fan, groupie or just a good old-fashioned music lover, Tradiio is selling crowdfunding as the best way to put your money where your mouth is

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

TMiRob's medical robots lighten the load of doctors and nurses in hospitals

The robots also reach an operating room three minutes faster than human nurses – that's more time for saving lives

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

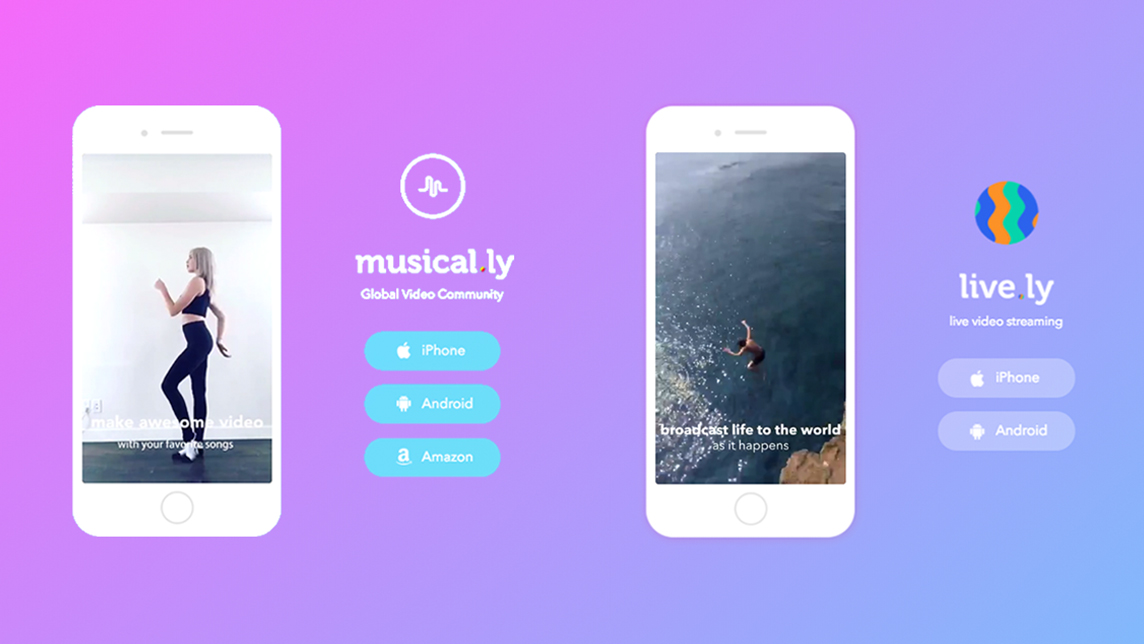

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

From Naples to Dhaka: Italo-Dutch precision farming startup Evja eyes funding for R&D, sales boost

Evja has a second office in the Dutch “Food Valley” and is investing to boost its advanced agronomic modeling, to stave off rising competition

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

MatMap: Making the construction sector more sustainable

Alicante-based startup MatMap gives a second lease of life to used construction materials that account for almost a third of EU waste

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Sorry, we couldn’t find any matches for“Union of Musicians”.