Union of Musicians

-

DATABASE (996)

-

ARTICLES (811)

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Concept Investimentos is a Brazilian mid-market private equity investor based in São Paulo. Focusing mainly on medtech, the firm was established in 2016 with its first investment in Maquira, a leading manufacturer of dental products in Brazil. It has invested in three companies so far, including participation in the R$1.7m seed investment round of Brazilian edtech Blox.Founding partner Rafael Pilotto Gonçalez previously worked at Pacific Investimentos’ private equity division and Pacific’s partnership with One Equity Partners, JPM’s former global private equity arm in Brazil. He has also worked for the private equity arm of Banco Votorantim and London-based private equity firm Actis.

Concept Investimentos is a Brazilian mid-market private equity investor based in São Paulo. Focusing mainly on medtech, the firm was established in 2016 with its first investment in Maquira, a leading manufacturer of dental products in Brazil. It has invested in three companies so far, including participation in the R$1.7m seed investment round of Brazilian edtech Blox.Founding partner Rafael Pilotto Gonçalez previously worked at Pacific Investimentos’ private equity division and Pacific’s partnership with One Equity Partners, JPM’s former global private equity arm in Brazil. He has also worked for the private equity arm of Banco Votorantim and London-based private equity firm Actis.

DSM Venturing is the investment arm of major Dutch biotech company DSM that has been investing in startups since 2006. The company currently has 36 startups in its portfolio across geographies and has managed three exits to date. It typically invests between €100,000 and €5m, with a lifetime investment varying from €1m–20m and usually requires board membership alongside investment. It has offices in the Netherlands and the US, both on the east and west coast. Its recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the same month, in the $8m Series A round of British anti-pollution biotech Deep Branch Biotechnology.

DSM Venturing is the investment arm of major Dutch biotech company DSM that has been investing in startups since 2006. The company currently has 36 startups in its portfolio across geographies and has managed three exits to date. It typically invests between €100,000 and €5m, with a lifetime investment varying from €1m–20m and usually requires board membership alongside investment. It has offices in the Netherlands and the US, both on the east and west coast. Its recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the same month, in the $8m Series A round of British anti-pollution biotech Deep Branch Biotechnology.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

Founded in 2015, Mandiri Capital Indonesia (MCI) is the venture capital arm of Bank Mandiri, Indonesia’s largest bank. With the full weight of the Mandiri assets, network and knowhow at its disposal, MCI positions itself as a gateway for fintech firms looking to tap into Indonesia’s vast market potential. It also hosts Mandiri Digital Incubator and StartupBerbagi (Startups Share) to help SMEs go digital by connecting them to startups that can provide free services.

Founded in 2015, Mandiri Capital Indonesia (MCI) is the venture capital arm of Bank Mandiri, Indonesia’s largest bank. With the full weight of the Mandiri assets, network and knowhow at its disposal, MCI positions itself as a gateway for fintech firms looking to tap into Indonesia’s vast market potential. It also hosts Mandiri Digital Incubator and StartupBerbagi (Startups Share) to help SMEs go digital by connecting them to startups that can provide free services.

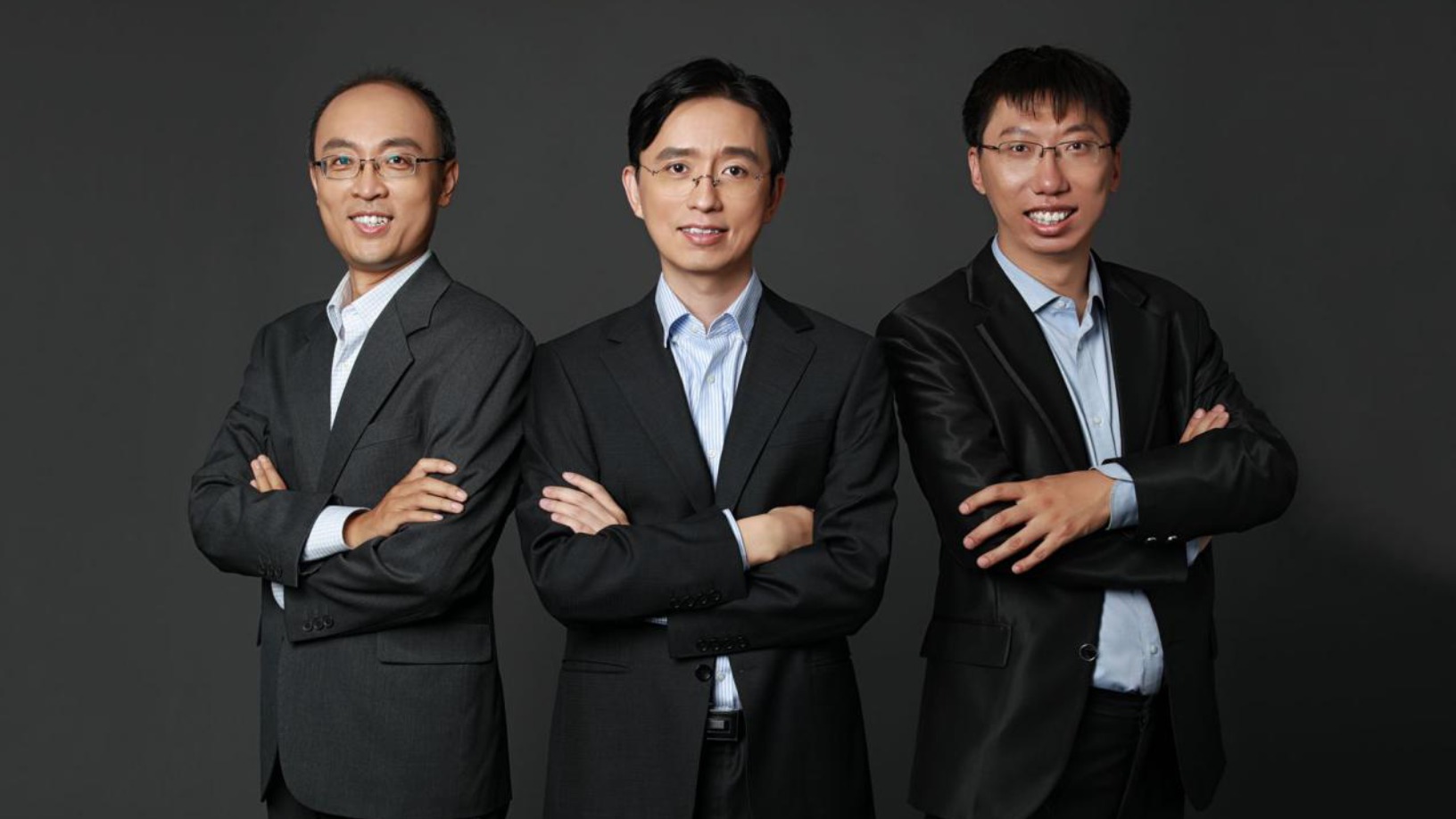

Shanghai Dingfeng Asset Management focuses on the management of securities investment and equity investment. With an AUM exceeding RMB 10 billion, the company is led by a group of core partners including Zhang Gao, Li Linjun, Wang Xiaogang, Liu Cheng, Chen Zhengxu and Wang Shaoyan. To date it has won 11 Golden Bull Awards and 50 others, including 2013 Forbes China Best Hedge Fund and 2014 Morningstar China Hedge Fund.

Shanghai Dingfeng Asset Management focuses on the management of securities investment and equity investment. With an AUM exceeding RMB 10 billion, the company is led by a group of core partners including Zhang Gao, Li Linjun, Wang Xiaogang, Liu Cheng, Chen Zhengxu and Wang Shaoyan. To date it has won 11 Golden Bull Awards and 50 others, including 2013 Forbes China Best Hedge Fund and 2014 Morningstar China Hedge Fund.

CRCM Ventures is a unit of US- and HK-listed ChinaRock Capital Management. Headquartered in San Francisco with branch offices in Palo Alto, Beijing and Hong Kong, CRCM Ventures invests in seed and early-stage Silicon Valley and China technology startups, with more than 20 years of experience in public and private investing.

CRCM Ventures is a unit of US- and HK-listed ChinaRock Capital Management. Headquartered in San Francisco with branch offices in Palo Alto, Beijing and Hong Kong, CRCM Ventures invests in seed and early-stage Silicon Valley and China technology startups, with more than 20 years of experience in public and private investing.

Novabase Capital is a Portuguese VC originally established in 1993 to invest in domestic technology projects. The firm has also invested in local tech startups since 2003. To date, it has invested in 21 companies, including 10 exits. It has invested €11m in four funds with a total investment value of over €27m. Recent investments include HypeLabs' US$3m seed round and the €1.5m seed round of IoT platform for industry Glartek.

Novabase Capital is a Portuguese VC originally established in 1993 to invest in domestic technology projects. The firm has also invested in local tech startups since 2003. To date, it has invested in 21 companies, including 10 exits. It has invested €11m in four funds with a total investment value of over €27m. Recent investments include HypeLabs' US$3m seed round and the €1.5m seed round of IoT platform for industry Glartek.

The Standards, Productivity and Innovation Board (SPRING Singapore) used to be a statutory board under the Ministry of Trade and Industry of Singapore. It was also the national standards and conformance body, tasked with developing and promoting internationally-recognized standards and quality assurance infrastructure.In April 2018, SPRING Singapore and International Enterprise Singapore were merged to form a single agency, Enterprise Singapore, a government agency championing enterprise development.

The Standards, Productivity and Innovation Board (SPRING Singapore) used to be a statutory board under the Ministry of Trade and Industry of Singapore. It was also the national standards and conformance body, tasked with developing and promoting internationally-recognized standards and quality assurance infrastructure.In April 2018, SPRING Singapore and International Enterprise Singapore were merged to form a single agency, Enterprise Singapore, a government agency championing enterprise development.

Founded in 2019 in Silicon Valley, Concrete Rose is focused on diversity by investing in under-represented founders and companies serving under-represented consumers at the early-stage and across market segments. It currently has 14 companies in its portfolio and its most recent investments in January 2021 include the $3.5m seed round of inclusive car insurer Loop and in the $17.1m seed round of HR analytics software Syndio

Founded in 2019 in Silicon Valley, Concrete Rose is focused on diversity by investing in under-represented founders and companies serving under-represented consumers at the early-stage and across market segments. It currently has 14 companies in its portfolio and its most recent investments in January 2021 include the $3.5m seed round of inclusive car insurer Loop and in the $17.1m seed round of HR analytics software Syndio

Ventech China is a unit of France’s Ventech Capital, based in Shanghai. Its focuses on mobile commerce, big data, communities and fintech.

Ventech China is a unit of France’s Ventech Capital, based in Shanghai. Its focuses on mobile commerce, big data, communities and fintech.

Danhe Capital is the investment fund established by Chen Yidan, a Chinese internet entrepreneur and philanthropist. He is a co-founder of Tencent.

Danhe Capital is the investment fund established by Chen Yidan, a Chinese internet entrepreneur and philanthropist. He is a co-founder of Tencent.

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

Kolase: Crowdfunding platform for Indonesian musicians

Started by music industry veterans, Kolase sees a promising online market in contemporary music fandom

SFTC: Riding on the rise of independent music and alternative media

From recording music sessions for its YouTube channel, Sounds From The Corner has expanded into content production, reflecting Indonesia’s fast-evolving media landscape

This Portuguese startup lets you bet on your favorite musicians

Whether you’re a fan, groupie or just a good old-fashioned music lover, Tradiio is selling crowdfunding as the best way to put your money where your mouth is

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

TMiRob's medical robots lighten the load of doctors and nurses in hospitals

The robots also reach an operating room three minutes faster than human nurses – that's more time for saving lives

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

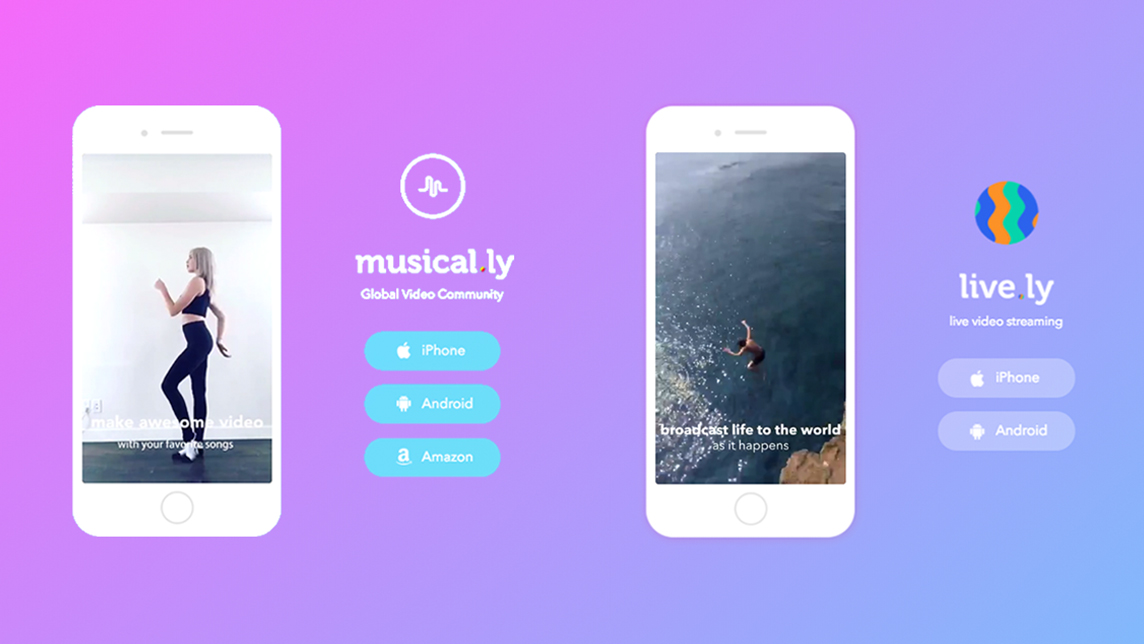

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

From Naples to Dhaka: Italo-Dutch precision farming startup Evja eyes funding for R&D, sales boost

Evja has a second office in the Dutch “Food Valley” and is investing to boost its advanced agronomic modeling, to stave off rising competition

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

MatMap: Making the construction sector more sustainable

Alicante-based startup MatMap gives a second lease of life to used construction materials that account for almost a third of EU waste

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Sorry, we couldn’t find any matches for“Union of Musicians”.