Union of Musicians

-

DATABASE (996)

-

ARTICLES (811)

Established in 2003, Indonusa Dwitama is a holding company that manages and develops a range of investment portfolios in Indonesia, including mining, financial services and information technology. In the mining industry, it has a portfolio of andesite and bauxite mines, and it also invested in an oil and gas mining company. As a tech investor, it is a relatively early investor in Tokopedia when it joined in 2016. It has also invested in VOSPAY, a digital payment intermediary, and cross-border money transfer company Wallex.

Established in 2003, Indonusa Dwitama is a holding company that manages and develops a range of investment portfolios in Indonesia, including mining, financial services and information technology. In the mining industry, it has a portfolio of andesite and bauxite mines, and it also invested in an oil and gas mining company. As a tech investor, it is a relatively early investor in Tokopedia when it joined in 2016. It has also invested in VOSPAY, a digital payment intermediary, and cross-border money transfer company Wallex.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

Founded in 2014, Success Capital is an angel investor. It invests primarily in the fields of technology, media and telecom with capital ranging from RMB 1 to 10 million.

Founded in 2014, Success Capital is an angel investor. It invests primarily in the fields of technology, media and telecom with capital ranging from RMB 1 to 10 million.

GX Capital is a venture capital firm focusing on mid-stage investment in TMT, internet and healthcare companies. It has over RMB 3 billion of assets under management.

GX Capital is a venture capital firm focusing on mid-stage investment in TMT, internet and healthcare companies. It has over RMB 3 billion of assets under management.

Founded in 2015, Initial Capital focuses on early-stage investment in internet startups. It has backed 20+ projects, investing RMB 1 million–8 million in each of them.

Founded in 2015, Initial Capital focuses on early-stage investment in internet startups. It has backed 20+ projects, investing RMB 1 million–8 million in each of them.

Founded in 2014 by a group of former P&G consultants, Semilla Expiga usually co-invests with bigger VC funds in early-stage investment rounds.

Founded in 2014 by a group of former P&G consultants, Semilla Expiga usually co-invests with bigger VC funds in early-stage investment rounds.

Kingfisher is a privately owned, and independently managed financial services firm active for nearly three decades. The firm was established in Charlotte in the US in 1989 and acquired by WealthTrust, LLC in 2004. In 2009, it returned to operate as an independent investment adviser under the name of Kingfisher Capital, LLC and purchased all outstanding ownership interest from WealthTrust LLC. Kingfisher has supported affluent families, professionals, business owners, and institutions through financial advisory, smart investments and personalized client service.The firm is currently led by managing partners and co-founders Alexander Miles and H K Hallett. Prior to founding Kingfisher, Miles worked at WealthTrust Advisors, the Myers Limited Partnerships and Lehman Brothers in New York. Hallett worked for Trust Company Bank of Georgia and Peoples Bank of North Carolina before joining Carolina Securities Corporation, where he co-managed the Charlotte office.

Kingfisher is a privately owned, and independently managed financial services firm active for nearly three decades. The firm was established in Charlotte in the US in 1989 and acquired by WealthTrust, LLC in 2004. In 2009, it returned to operate as an independent investment adviser under the name of Kingfisher Capital, LLC and purchased all outstanding ownership interest from WealthTrust LLC. Kingfisher has supported affluent families, professionals, business owners, and institutions through financial advisory, smart investments and personalized client service.The firm is currently led by managing partners and co-founders Alexander Miles and H K Hallett. Prior to founding Kingfisher, Miles worked at WealthTrust Advisors, the Myers Limited Partnerships and Lehman Brothers in New York. Hallett worked for Trust Company Bank of Georgia and Peoples Bank of North Carolina before joining Carolina Securities Corporation, where he co-managed the Charlotte office.

PayPal is the US-based online payments company founded in 1999 and acquired by eBay in 2002. It is listed in NASDAQ under the ticker code PYPL.Besides facilitating online payments and money transfers for many e-commerce companies and other internet-based businesses, it is famous for its network of former founders and other alumni, many of whom went on to establish successful companies or became investors in the tech and internet industries. Some famous names linked to this network, sometimes called “PayPal Mafia”, include ex-CEO Peter Thiel, Elon Musk, Dave McClure (founder of 500 Startups), and Reid Hoffman (LinkedIn co-founder).PayPal has invested in several companies, including ride-hailing firms Gojek and Uber and e-commerce platform MercadoLibre. It has also established PayPal Ventures as a separate VC arm and PayPal Incubator to support early-stage startups.

PayPal is the US-based online payments company founded in 1999 and acquired by eBay in 2002. It is listed in NASDAQ under the ticker code PYPL.Besides facilitating online payments and money transfers for many e-commerce companies and other internet-based businesses, it is famous for its network of former founders and other alumni, many of whom went on to establish successful companies or became investors in the tech and internet industries. Some famous names linked to this network, sometimes called “PayPal Mafia”, include ex-CEO Peter Thiel, Elon Musk, Dave McClure (founder of 500 Startups), and Reid Hoffman (LinkedIn co-founder).PayPal has invested in several companies, including ride-hailing firms Gojek and Uber and e-commerce platform MercadoLibre. It has also established PayPal Ventures as a separate VC arm and PayPal Incubator to support early-stage startups.

Media Digital Ventures is the first Spanish Cross-Media fund focusing on Media for Equity. It holds multichannel advertising assets across major media sectors. Based in Barcelona, MDV also creates multimedia and advertising campaigns for scaling high-growth startups in return for equity.MDV is co-founded by Gerard Olivé and Miguel Vicente. Both are serial entrepreneurs, investors and co-founders of Antai Venture Builder, Wallapop, Deliberry and Chicplace. Vicente, who exited LetsBonus which he founded in 2009, is also the president of Barcelona Tech City.

Media Digital Ventures is the first Spanish Cross-Media fund focusing on Media for Equity. It holds multichannel advertising assets across major media sectors. Based in Barcelona, MDV also creates multimedia and advertising campaigns for scaling high-growth startups in return for equity.MDV is co-founded by Gerard Olivé and Miguel Vicente. Both are serial entrepreneurs, investors and co-founders of Antai Venture Builder, Wallapop, Deliberry and Chicplace. Vicente, who exited LetsBonus which he founded in 2009, is also the president of Barcelona Tech City.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Founded in 2011, the knowledge capital fund is an initiative from the InKemia IUCT Group to focus on innovation and the licensing of patents in the biotech sectors. InKemia supports the life science industry through R&D grant programs, technical consultancy and training. It specializes in areas such as chemical synthesis, biotech, bio-catalysis, quality control and EU releases of new products. InKemia also supports local entrepreneurs through the Manuel Arroyo Award for Young Entrepreneurs with the aim to promote local cooperative economic development.

Founded in 2011, the knowledge capital fund is an initiative from the InKemia IUCT Group to focus on innovation and the licensing of patents in the biotech sectors. InKemia supports the life science industry through R&D grant programs, technical consultancy and training. It specializes in areas such as chemical synthesis, biotech, bio-catalysis, quality control and EU releases of new products. InKemia also supports local entrepreneurs through the Manuel Arroyo Award for Young Entrepreneurs with the aim to promote local cooperative economic development.

B4Motion is a Spanish venture capital fund led by Sebastian Canadell and supported by a board of advisors who have varied expertise in visual media production, mobile strategy, product design and law. B4Motion is focused on mobility-related technologies, including autonomous driving systems, Internet-of-Things (IoT) applications for transport as well as on-demand logistics, car sharing, parking and valet services. B4Motion invests across all funding stages from seed through Series D and IPO in the Spanish and Latin American markets.

B4Motion is a Spanish venture capital fund led by Sebastian Canadell and supported by a board of advisors who have varied expertise in visual media production, mobile strategy, product design and law. B4Motion is focused on mobility-related technologies, including autonomous driving systems, Internet-of-Things (IoT) applications for transport as well as on-demand logistics, car sharing, parking and valet services. B4Motion invests across all funding stages from seed through Series D and IPO in the Spanish and Latin American markets.

Jaume Gomà is the CEO and co-founder of Ulabox, one of the first online supermarkets in Spain. He has been involved in various internet businesses since the late 90s. Gomà has worked in business strategy and managerial roles in telecommunication companies like France Telecom and Orange Spain. In 2008, he became a director at Segundamano, that has now transformed into Vibbo, the leading portal for second-hand goods trading in Spain and Latin America. Gomà is a leading mentor, advisor and business angel within the Spanish ecosystem.

Jaume Gomà is the CEO and co-founder of Ulabox, one of the first online supermarkets in Spain. He has been involved in various internet businesses since the late 90s. Gomà has worked in business strategy and managerial roles in telecommunication companies like France Telecom and Orange Spain. In 2008, he became a director at Segundamano, that has now transformed into Vibbo, the leading portal for second-hand goods trading in Spain and Latin America. Gomà is a leading mentor, advisor and business angel within the Spanish ecosystem.

Qingdao Haier Venture Capital is the investment arm of China-based electronics manufacturer Haier Group. The Haier SAIF fund was established in September 2014, in partnership with private equity firm SAIF Partners and other investors. The RMB 320m investment fund is managed by SAIF Partners. The fund mainly invests smart home product developers and related sectors like AI, IoT and big data. As of December 2017, it has invested in 16 startups.

Qingdao Haier Venture Capital is the investment arm of China-based electronics manufacturer Haier Group. The Haier SAIF fund was established in September 2014, in partnership with private equity firm SAIF Partners and other investors. The RMB 320m investment fund is managed by SAIF Partners. The fund mainly invests smart home product developers and related sectors like AI, IoT and big data. As of December 2017, it has invested in 16 startups.

Headquartered in London, Apax Partners was founded in 1969. It is one of the biggest private equity funds in Europe. Apax Partners has offices in New York, Hong Kong, Mumbai, Tel Aviv, Munich and Shanghai. The Shanghai office opened in 2008. Apax Partners currently manages over US$50 billion in assets and invests mainly in the sectors of technology & telecommunications, healthcare and consumer products.

Headquartered in London, Apax Partners was founded in 1969. It is one of the biggest private equity funds in Europe. Apax Partners has offices in New York, Hong Kong, Mumbai, Tel Aviv, Munich and Shanghai. The Shanghai office opened in 2008. Apax Partners currently manages over US$50 billion in assets and invests mainly in the sectors of technology & telecommunications, healthcare and consumer products.

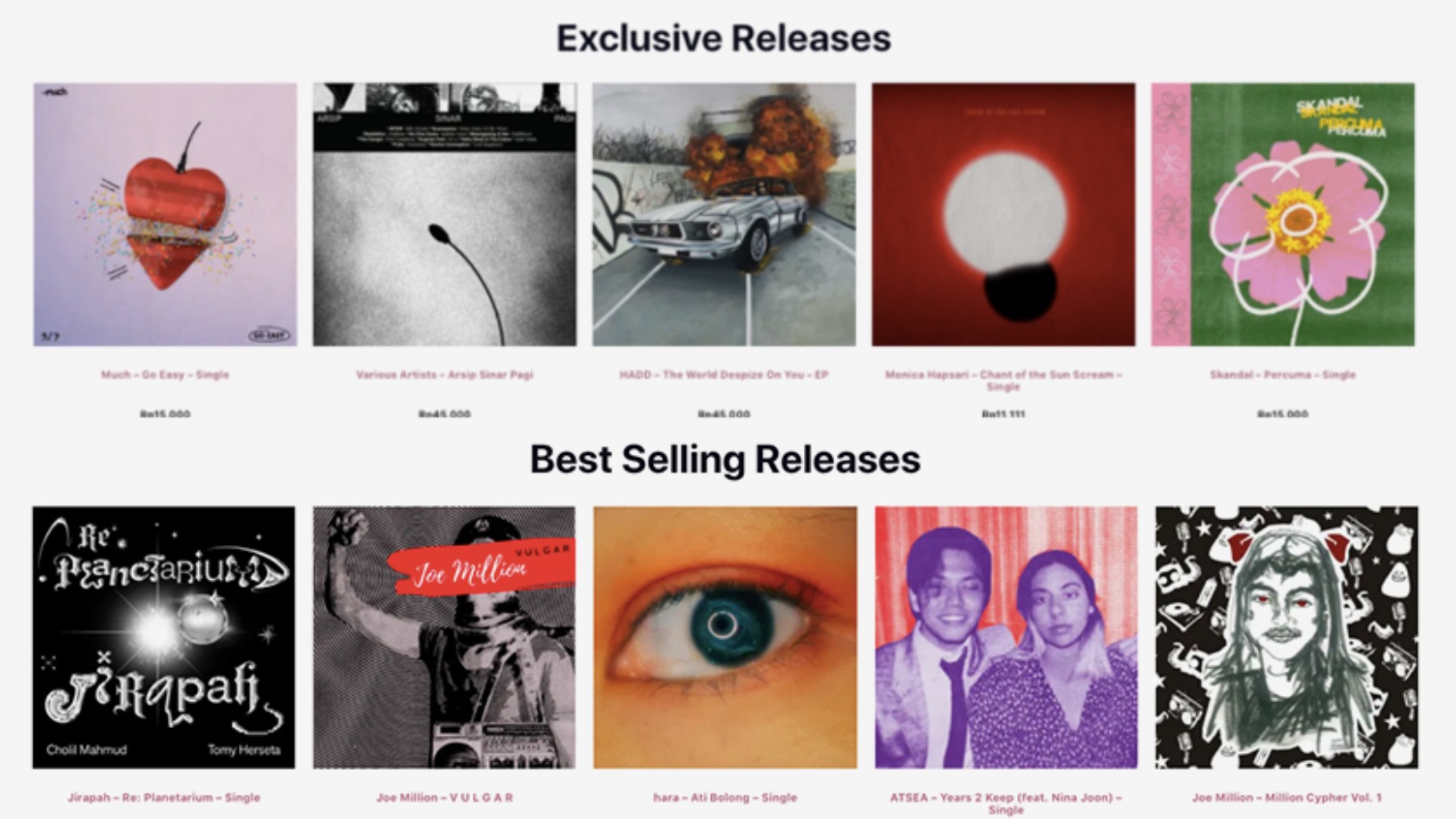

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

Kolase: Crowdfunding platform for Indonesian musicians

Started by music industry veterans, Kolase sees a promising online market in contemporary music fandom

SFTC: Riding on the rise of independent music and alternative media

From recording music sessions for its YouTube channel, Sounds From The Corner has expanded into content production, reflecting Indonesia’s fast-evolving media landscape

This Portuguese startup lets you bet on your favorite musicians

Whether you’re a fan, groupie or just a good old-fashioned music lover, Tradiio is selling crowdfunding as the best way to put your money where your mouth is

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

TMiRob's medical robots lighten the load of doctors and nurses in hospitals

The robots also reach an operating room three minutes faster than human nurses – that's more time for saving lives

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

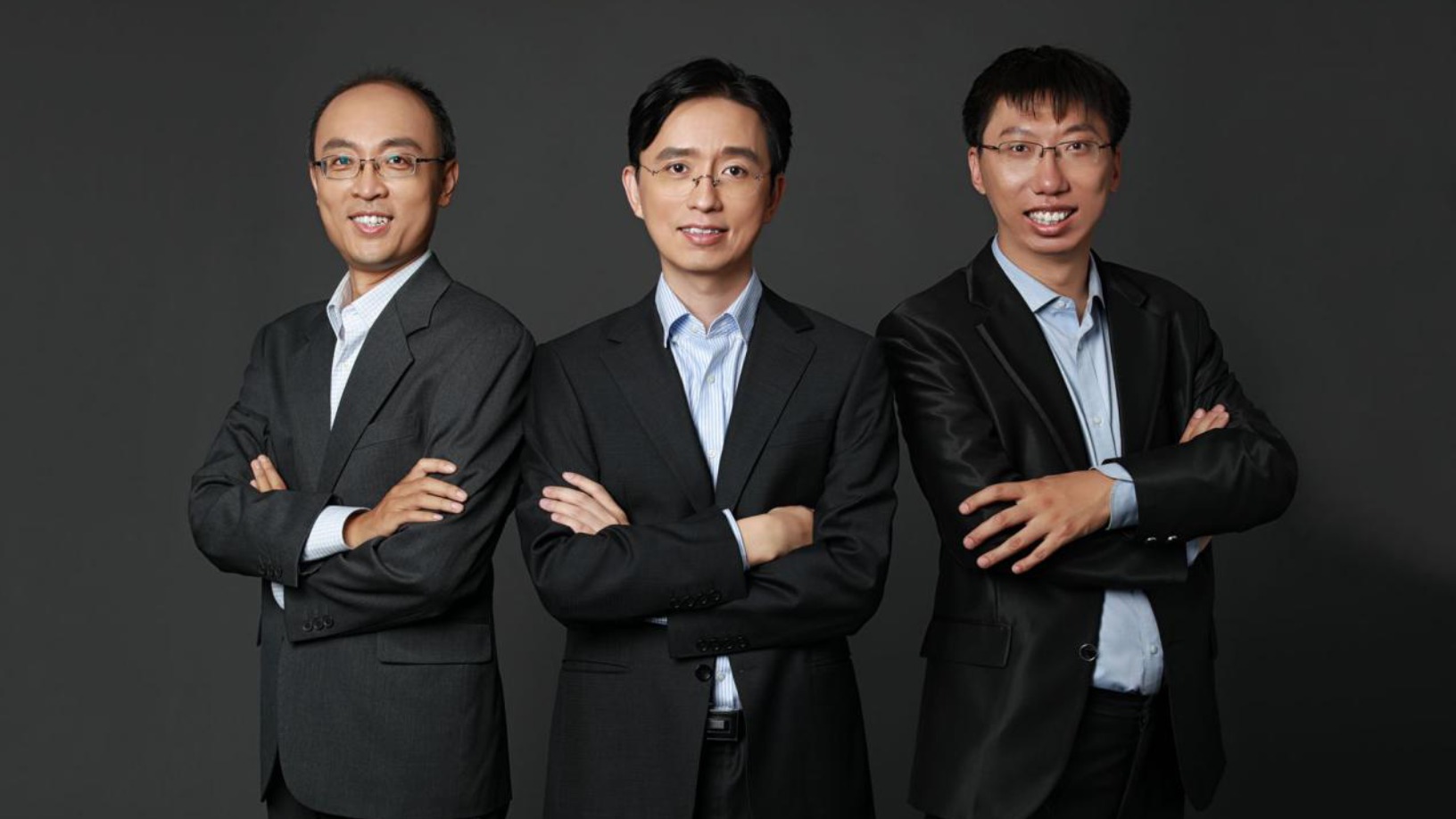

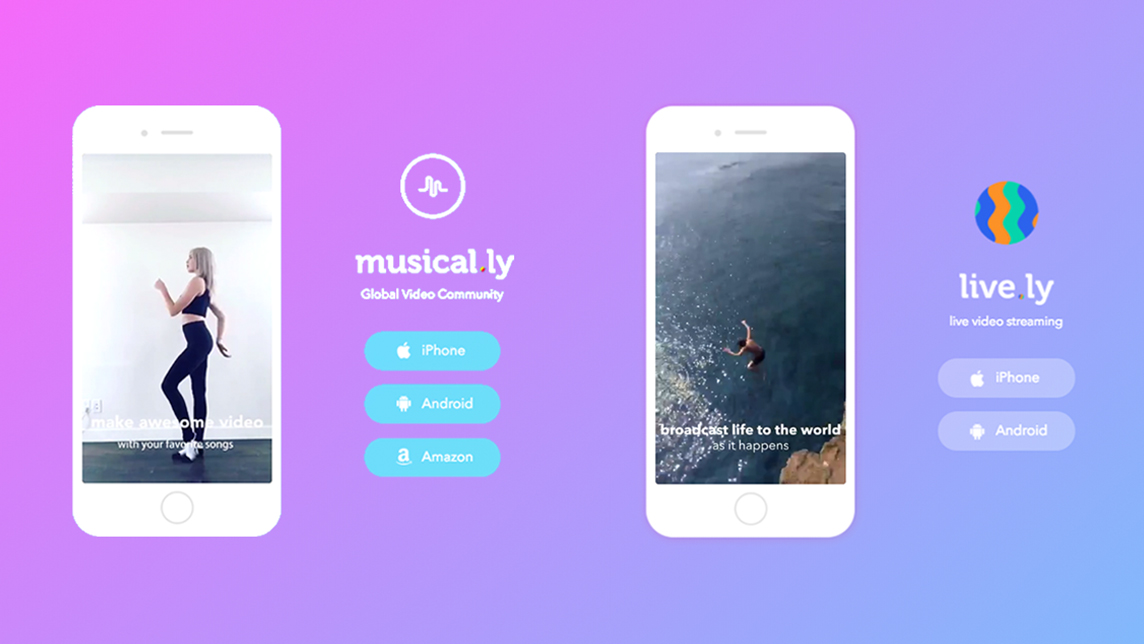

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

From Naples to Dhaka: Italo-Dutch precision farming startup Evja eyes funding for R&D, sales boost

Evja has a second office in the Dutch “Food Valley” and is investing to boost its advanced agronomic modeling, to stave off rising competition

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

MatMap: Making the construction sector more sustainable

Alicante-based startup MatMap gives a second lease of life to used construction materials that account for almost a third of EU waste

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Sorry, we couldn’t find any matches for“Union of Musicians”.