Union of Musicians

-

DATABASE (996)

-

ARTICLES (811)

Established in 1996, SBI Investment is a venture capital firm that focuses on growth sectors such as information technology, biotechnology, life science, mobile, environment and energy. The VC arm of the SBI Group is developed to quickly find new, emerging technologies and investing in those technologies to further the development of the group. SBI Group then introduces the new technologies to existing businesses in order to help them stay ahead in the market, as well as to revitalize local industries in Japan, particularly in the financial and banking sectors.

Established in 1996, SBI Investment is a venture capital firm that focuses on growth sectors such as information technology, biotechnology, life science, mobile, environment and energy. The VC arm of the SBI Group is developed to quickly find new, emerging technologies and investing in those technologies to further the development of the group. SBI Group then introduces the new technologies to existing businesses in order to help them stay ahead in the market, as well as to revitalize local industries in Japan, particularly in the financial and banking sectors.

Pegasus Tech Ventures (Fenox Venture Capital)

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Established in October 2015, Cantor Jungle incubates businesses and invests in early-stage high-tech startups in the fields of integrated circuit and artificial intelligence.

Established in October 2015, Cantor Jungle incubates businesses and invests in early-stage high-tech startups in the fields of integrated circuit and artificial intelligence.

Lanjun Invest is an investment subsidiary of Zjlander Group, a conglomerate across industries such as sports, finance, media, internet, education, hospitality, airlines and agriculture.

Lanjun Invest is an investment subsidiary of Zjlander Group, a conglomerate across industries such as sports, finance, media, internet, education, hospitality, airlines and agriculture.

An experienced private investor, Chen Yuxing is a shareholder of over 12 companies including Hangzhou Bailing (Biolynx) Biotechnology Co Ltd and Hangzhou HuaAn Biotechnology Co Ltd (HuaBio).

An experienced private investor, Chen Yuxing is a shareholder of over 12 companies including Hangzhou Bailing (Biolynx) Biotechnology Co Ltd and Hangzhou HuaAn Biotechnology Co Ltd (HuaBio).

JoinHope Capital is a venture capital firm founded in 2010. Its focus is on early-stage investment in TMT companies. The portfolio of JoinHope includes 3W Coffee, Lagou.com, Carlife, etc.

JoinHope Capital is a venture capital firm founded in 2010. Its focus is on early-stage investment in TMT companies. The portfolio of JoinHope includes 3W Coffee, Lagou.com, Carlife, etc.

Founded in 2015, Zuoyu Capital is a research investment firm focused on the travel & tourism and consumer services sectors. It manages an angel fund of RMB 100 million.

Founded in 2015, Zuoyu Capital is a research investment firm focused on the travel & tourism and consumer services sectors. It manages an angel fund of RMB 100 million.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

Founded in 2009, Andreessen Horowitz is based in Menlo Park in California. The numeronym is the first and last letter of the firm’s brand with the characters count in-between. Starting with initial capital of $300m, the VC quickly raised a second venture fund of $650m in 2010 and another worth $1.5bn in 2014. In 2019, a new office was set up in San Francisco.Founded by Marc Andreessen and Ben Horowitz, the firm has invested in tech pioneers like Skype, Facebook, Groupon and Twitter. Andreessen is the software engineer who pioneered web browser Mosaic and co-founded Netscape. In 1995, Horowitz joined Andreessen as product manager at Netscape that was sold to AOL for $4.2bn in 2016. He also co-founded Opsware (Loudcloud), an automation software company that was sold to Hewlett Packard for $1.6bn in 2007.

Founded in 2009, Andreessen Horowitz is based in Menlo Park in California. The numeronym is the first and last letter of the firm’s brand with the characters count in-between. Starting with initial capital of $300m, the VC quickly raised a second venture fund of $650m in 2010 and another worth $1.5bn in 2014. In 2019, a new office was set up in San Francisco.Founded by Marc Andreessen and Ben Horowitz, the firm has invested in tech pioneers like Skype, Facebook, Groupon and Twitter. Andreessen is the software engineer who pioneered web browser Mosaic and co-founded Netscape. In 1995, Horowitz joined Andreessen as product manager at Netscape that was sold to AOL for $4.2bn in 2016. He also co-founded Opsware (Loudcloud), an automation software company that was sold to Hewlett Packard for $1.6bn in 2007.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Norfund is the sovereign investment fund of Norway, established by the parliament in 1997 and owned by the Ministry of Foreign Affairs. The company has committed NOK 28.4bn in investments into 170 projects in developing countries as of 2020. Norfund has regional offices in Thailand, Costa Rica, Kenya, Mozambique and Ghana to support its activities in Asia, Africa and Latin America. In Asia, its core investment targets are Indonesia, Cambodia, Laos, Vietnam, Myanmar, Bangladesh and Sri Lanka. Norfund primarily invests in three key areas: clean energy, agriculture and fintech. The fund has invested in solar power projects and various food companies in India and various African countries. In Asia, Norfund has invested in Amartha, an Indonesian P2P lending fintech company providing loans to women-led microbusinesses. Norfund also invests in other venture funds, such as Southeast Asia-focused Openspace Ventures Fund III, to expand and diversify their portfolio.

Norfund is the sovereign investment fund of Norway, established by the parliament in 1997 and owned by the Ministry of Foreign Affairs. The company has committed NOK 28.4bn in investments into 170 projects in developing countries as of 2020. Norfund has regional offices in Thailand, Costa Rica, Kenya, Mozambique and Ghana to support its activities in Asia, Africa and Latin America. In Asia, its core investment targets are Indonesia, Cambodia, Laos, Vietnam, Myanmar, Bangladesh and Sri Lanka. Norfund primarily invests in three key areas: clean energy, agriculture and fintech. The fund has invested in solar power projects and various food companies in India and various African countries. In Asia, Norfund has invested in Amartha, an Indonesian P2P lending fintech company providing loans to women-led microbusinesses. Norfund also invests in other venture funds, such as Southeast Asia-focused Openspace Ventures Fund III, to expand and diversify their portfolio.

Google co-founder Larry Page is controlling shareholder of Alphabet Inc, Google’s parent company. As of June 2021, Page’s net worth was $106.2bn, making him the sixth richest person in the world. To date, he has made disclosed investments in five tech companies. The two most recent were both in 2016: an undisclosed quantum of investment in US-based electric personal aircraft startup Kitty Hawk Corporation, as well as participation in space mining company Planetary Resources’ $21m Series A round.

Google co-founder Larry Page is controlling shareholder of Alphabet Inc, Google’s parent company. As of June 2021, Page’s net worth was $106.2bn, making him the sixth richest person in the world. To date, he has made disclosed investments in five tech companies. The two most recent were both in 2016: an undisclosed quantum of investment in US-based electric personal aircraft startup Kitty Hawk Corporation, as well as participation in space mining company Planetary Resources’ $21m Series A round.

David Spector is the president and co-founder of the online lingerie company ThirdLove. A former partner at Sequioa Capital, he is a prolific angel investor with investments in around 30 startups across different geographies and market segments. Spector’s most recent disclosed investments are from 2020 and include participation in the $4.6m seed round of US fintech provider CapChase and in the $70m Series C round of US mobile marketing company Attentive.

David Spector is the president and co-founder of the online lingerie company ThirdLove. A former partner at Sequioa Capital, he is a prolific angel investor with investments in around 30 startups across different geographies and market segments. Spector’s most recent disclosed investments are from 2020 and include participation in the $4.6m seed round of US fintech provider CapChase and in the $70m Series C round of US mobile marketing company Attentive.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

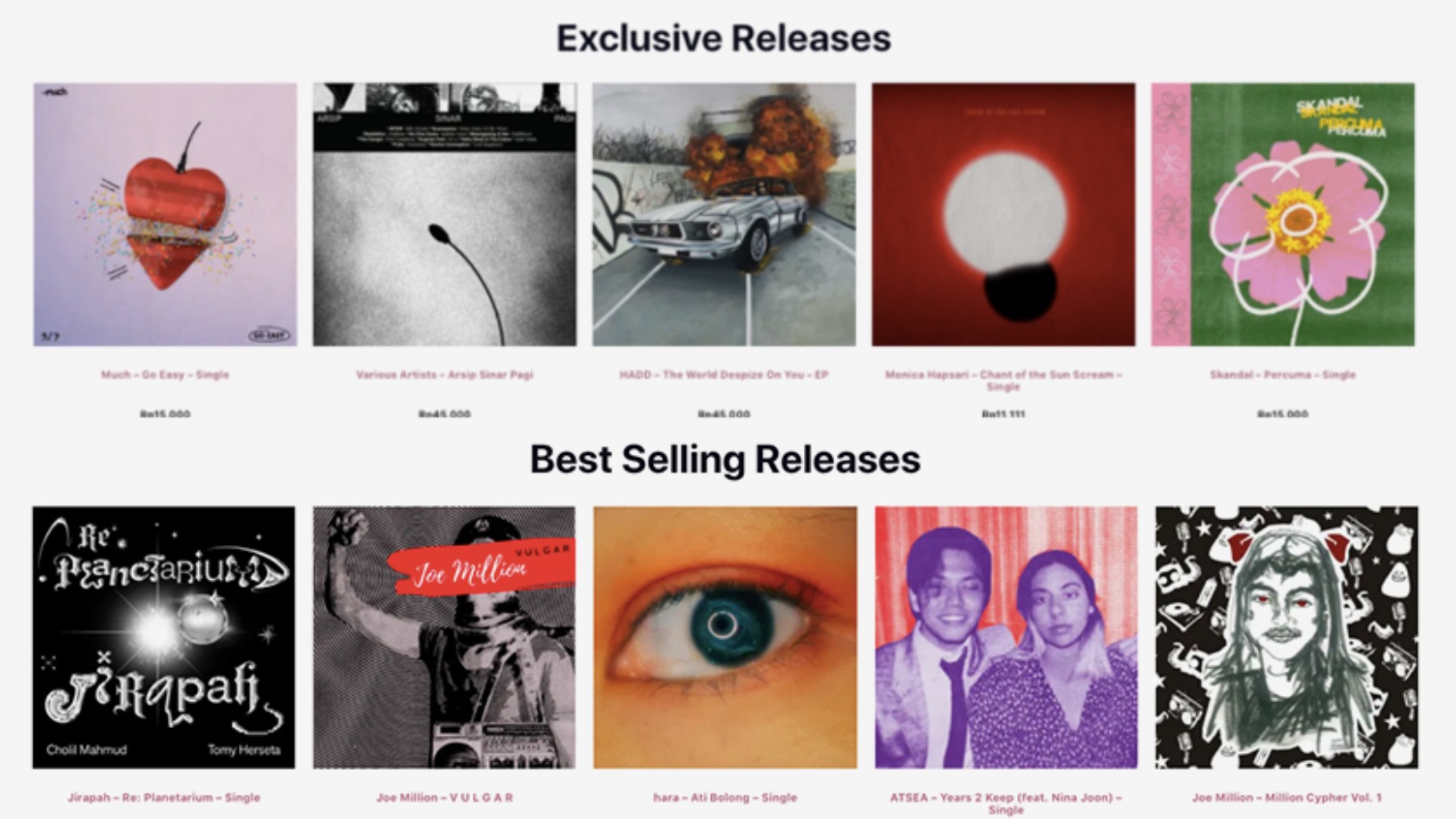

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

Kolase: Crowdfunding platform for Indonesian musicians

Started by music industry veterans, Kolase sees a promising online market in contemporary music fandom

SFTC: Riding on the rise of independent music and alternative media

From recording music sessions for its YouTube channel, Sounds From The Corner has expanded into content production, reflecting Indonesia’s fast-evolving media landscape

This Portuguese startup lets you bet on your favorite musicians

Whether you’re a fan, groupie or just a good old-fashioned music lover, Tradiio is selling crowdfunding as the best way to put your money where your mouth is

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

TMiRob's medical robots lighten the load of doctors and nurses in hospitals

The robots also reach an operating room three minutes faster than human nurses – that's more time for saving lives

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

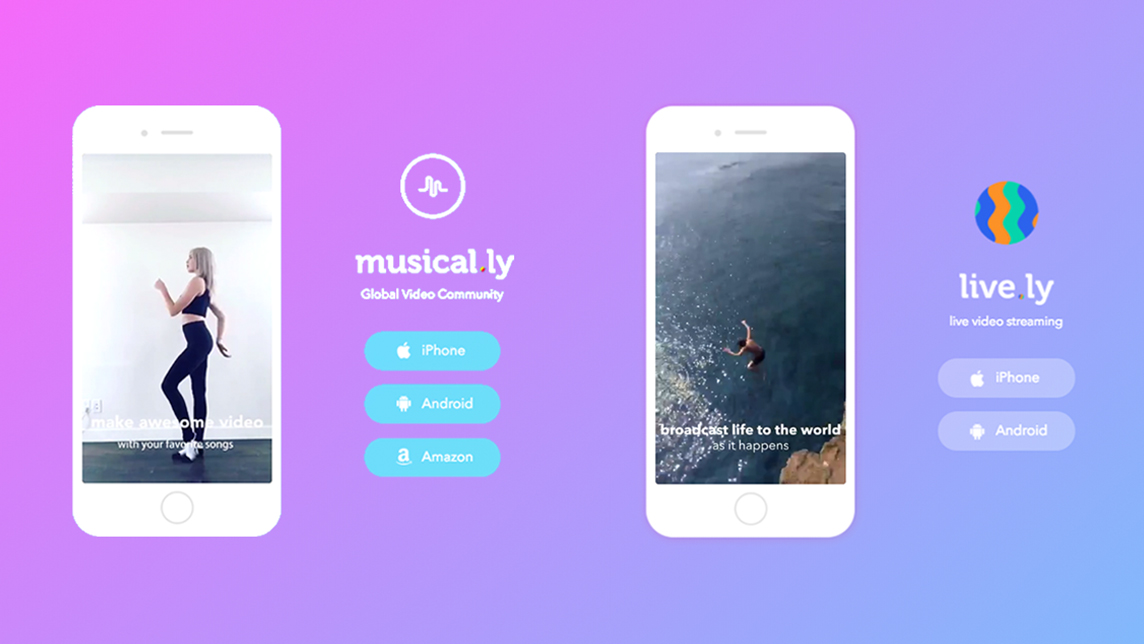

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

From Naples to Dhaka: Italo-Dutch precision farming startup Evja eyes funding for R&D, sales boost

Evja has a second office in the Dutch “Food Valley” and is investing to boost its advanced agronomic modeling, to stave off rising competition

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

MatMap: Making the construction sector more sustainable

Alicante-based startup MatMap gives a second lease of life to used construction materials that account for almost a third of EU waste

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Sorry, we couldn’t find any matches for“Union of Musicians”.