University of Barcelona

-

DATABASE (992)

-

ARTICLES (811)

Yangtze Delta Region Institute of Tsinghua University, Zhejiang

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

Francesc Riverola is a business angel and the chairman of FXStreet. He launched FXStreet in 2000 while working as an e-Research Manager at PwC and at the IESE e-Business Center. He was CEO of the worldwide forex reference portal until 2012.He is also an investor at Lanta Digital Ventures, a Barcelona-based VC for early-stage startups in Spain and Europe. Born in Palo Alto in California USA, he moved to Barcelona as a child. He has an Economics degree from the University of Barcelona and a PDD in management development for company directors run by IESE Business School.

Francesc Riverola is a business angel and the chairman of FXStreet. He launched FXStreet in 2000 while working as an e-Research Manager at PwC and at the IESE e-Business Center. He was CEO of the worldwide forex reference portal until 2012.He is also an investor at Lanta Digital Ventures, a Barcelona-based VC for early-stage startups in Spain and Europe. Born in Palo Alto in California USA, he moved to Barcelona as a child. He has an Economics degree from the University of Barcelona and a PDD in management development for company directors run by IESE Business School.

Stanford Graduate School of Business

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

After a decade of technology and capability development, Alén Space's proprietary nanosatellites offer a faster, cheaper way to meet the growing demand for new Space applications.

After a decade of technology and capability development, Alén Space's proprietary nanosatellites offer a faster, cheaper way to meet the growing demand for new Space applications.

Gerard Olivé is a serial entrepreneur based in Barcelona. He is currently the co-CEO and co-founder of Antai Venture Builder, in charge of a multimillion-euro advertising inventory. He graduated in Audiovisual Communications at Barcelona's Ramon Llull University. As an angel investor, Olivé made his first disclosed investment in 2016 when he participated in the pre-seed and subsequent seed funding rounds of Spanish femtech WOOM. He founded BeRepublic, a strategic consulting firm specializing in digital businesses in southern Europe and Latin America. In 2015, he co-founded BeAgency, an interactive marketing agency with offices in Barcelona and Madrid. He is also a co-founder and mentor of Connector Startup Accelerator. He has also co-founded startups like Wallapop, Glovo, CornerJob, Deliberry, Shoppiday, Shopery, BePretty, Mascoteros, Marmota, Havet, Prontopiso, Medox and Trendier.

Gerard Olivé is a serial entrepreneur based in Barcelona. He is currently the co-CEO and co-founder of Antai Venture Builder, in charge of a multimillion-euro advertising inventory. He graduated in Audiovisual Communications at Barcelona's Ramon Llull University. As an angel investor, Olivé made his first disclosed investment in 2016 when he participated in the pre-seed and subsequent seed funding rounds of Spanish femtech WOOM. He founded BeRepublic, a strategic consulting firm specializing in digital businesses in southern Europe and Latin America. In 2015, he co-founded BeAgency, an interactive marketing agency with offices in Barcelona and Madrid. He is also a co-founder and mentor of Connector Startup Accelerator. He has also co-founded startups like Wallapop, Glovo, CornerJob, Deliberry, Shoppiday, Shopery, BePretty, Mascoteros, Marmota, Havet, Prontopiso, Medox and Trendier.

Giving coworking centers a run for their money, Sheltair offers the convenience, flexibility and privacy of by the hour reservations at private meeting spaces.

Giving coworking centers a run for their money, Sheltair offers the convenience, flexibility and privacy of by the hour reservations at private meeting spaces.

Co-founder, CTO of Dycare

Ricardo Jauregui Telleria joined healthtech startup DyCare in Barcelona as CTO and co-founder in 2016. Previously, he was PMO at Roche/Emminens Healthcare Services in Sant Cugat, Barcelona, and Project Manager at engineering company Altran Spain, Barcelona. He has also worked in project management and research at the Polytechnic University of Barcelona, the Electromagnetic Compatibility Group, was General Manager at E&R Systems and an engineer at telco Movistar. Jauregui holds a PhD in Electronic and Electromagnetic Compatibility from the Polytechnic University of Barcelona and is a qualified Project Management Professional.

Ricardo Jauregui Telleria joined healthtech startup DyCare in Barcelona as CTO and co-founder in 2016. Previously, he was PMO at Roche/Emminens Healthcare Services in Sant Cugat, Barcelona, and Project Manager at engineering company Altran Spain, Barcelona. He has also worked in project management and research at the Polytechnic University of Barcelona, the Electromagnetic Compatibility Group, was General Manager at E&R Systems and an engineer at telco Movistar. Jauregui holds a PhD in Electronic and Electromagnetic Compatibility from the Polytechnic University of Barcelona and is a qualified Project Management Professional.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

Inspired by community-supported agriculture (CSA), Thousands of Farmers provides an e-commerce platform enabling consumers to subscribe to farm harvests in advance and share their profits.

Inspired by community-supported agriculture (CSA), Thousands of Farmers provides an e-commerce platform enabling consumers to subscribe to farm harvests in advance and share their profits.

Javier Llorente Moral has extensive experience in managing and investing in internet startups and currently manages an investment portfolio of over 30 startups through his own investment company, Valderaduey Investments. A graduate in clinical psychology from the University of Barcelona, and in management from IESE Business School, he was a founding partner of Grupo Intercom in 1995.Since 1999, he has been a prolific investor in some of Spain's most successful internet businesses after his 10-year investment in Infojobs, until its acquisition by Schibsted. His other exited companies include Softonic and Bodas.net. He is also an investor in other startups including Emagister, Verticales Intercom, Buy Yourself, Red Points, Mailtrack and Camaloon, as well as in the startup investment platform Startupxplore.

Javier Llorente Moral has extensive experience in managing and investing in internet startups and currently manages an investment portfolio of over 30 startups through his own investment company, Valderaduey Investments. A graduate in clinical psychology from the University of Barcelona, and in management from IESE Business School, he was a founding partner of Grupo Intercom in 1995.Since 1999, he has been a prolific investor in some of Spain's most successful internet businesses after his 10-year investment in Infojobs, until its acquisition by Schibsted. His other exited companies include Softonic and Bodas.net. He is also an investor in other startups including Emagister, Verticales Intercom, Buy Yourself, Red Points, Mailtrack and Camaloon, as well as in the startup investment platform Startupxplore.

A co-founder and angel investor of HomeRun, Cheng Xiaohua graduated with a major in Automation at Changsha Railway University in 1983. The university is now known as Railway Campus, Central South University. From 1984 to 1988, he spent his postgraduate years at Graduate School, University of Chinese Academy of Sciences and earned a master’s degree in Automation. He co-founded Netac with Deng Guoshun in 1999 and became the chairman in September 2010.

A co-founder and angel investor of HomeRun, Cheng Xiaohua graduated with a major in Automation at Changsha Railway University in 1983. The university is now known as Railway Campus, Central South University. From 1984 to 1988, he spent his postgraduate years at Graduate School, University of Chinese Academy of Sciences and earned a master’s degree in Automation. He co-founded Netac with Deng Guoshun in 1999 and became the chairman in September 2010.

Media Digital Ventures is the first Spanish Cross-Media fund focusing on Media for Equity. It holds multichannel advertising assets across major media sectors. Based in Barcelona, MDV also creates multimedia and advertising campaigns for scaling high-growth startups in return for equity.MDV is co-founded by Gerard Olivé and Miguel Vicente. Both are serial entrepreneurs, investors and co-founders of Antai Venture Builder, Wallapop, Deliberry and Chicplace. Vicente, who exited LetsBonus which he founded in 2009, is also the president of Barcelona Tech City.

Media Digital Ventures is the first Spanish Cross-Media fund focusing on Media for Equity. It holds multichannel advertising assets across major media sectors. Based in Barcelona, MDV also creates multimedia and advertising campaigns for scaling high-growth startups in return for equity.MDV is co-founded by Gerard Olivé and Miguel Vicente. Both are serial entrepreneurs, investors and co-founders of Antai Venture Builder, Wallapop, Deliberry and Chicplace. Vicente, who exited LetsBonus which he founded in 2009, is also the president of Barcelona Tech City.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

The edtech startup formerly named Squiline hopes greater fluency in English can boost Indonesia's creative and tourism sectors

The rising Indonesian edtech star wants to help high-school dropouts earn their diploma and learn the relevant skills to find a job – with an innovative solution lauded at this year’s MIT Solve Challenge

Ajaib targets millennials with easy-to-use investment app

Y Combinator alumnus Ajaib recently acquired a local brokerage to add stock trading to its products

Haishen Tech: Scan image and find your product in one second

Haishen Tech's AI vending machines will revive unmanned retail economy and tap into growing on-demand consumerism worldwide

Indonesian edtechs attract funding even as students head back to school

With services that complement and support conventional schools at a fraction of offline tuition cost, edtech companies are likely to continue growing

Ruangguru cracks business model as it reaches 13 million student users

Holding pole position as Indonesia's popular tutoring services app, Ruangguru is revving up to expand into the lucrative corporate training sector

Farm Friend: World’s first agri-drone sharing platform wins over users, investors

Gone are the days of the lone Chinese farmer toiling under the sun. Now drones are here to help – and there’s even a drone sharing platform too

Modoo: Reducing stillbirth risk with fetal heart monitoring wearable

Weighing just 15g, the world’s smallest wearable “patch” with passive fetal monitoring technology by Modoo seeks to offer a safer alternative to ultrasound devices

Agate learns it's not all about the games – it's about the fun

Agate has evolved into one of the biggest game development companies in Indonesia over the past decade. We learned how it got there from Shieny Aprilia, Agate's Vice President of Enterprise Business

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

East Ventures raises funds, teams up with state agency to produce Covid-19 tests for Indonesia

East Ventures investee Nusantics has been working with state researchers to produce the prototype; expects mass production of the test kits soon

Zen Video: Using AI to automate video editing

Founded by a Carnegie Mellon roboticist, the Zen Video app reduces the time required to edit video clips to only a few minutes, meeting growing demand for short videos

NoMorePass: Free app for safe, easy password retrieval across platforms

NoMorePass is a password storage solution that employs military-grade encryption to guard against hackers and data leaks, rendering cloud-based password managers obsolete

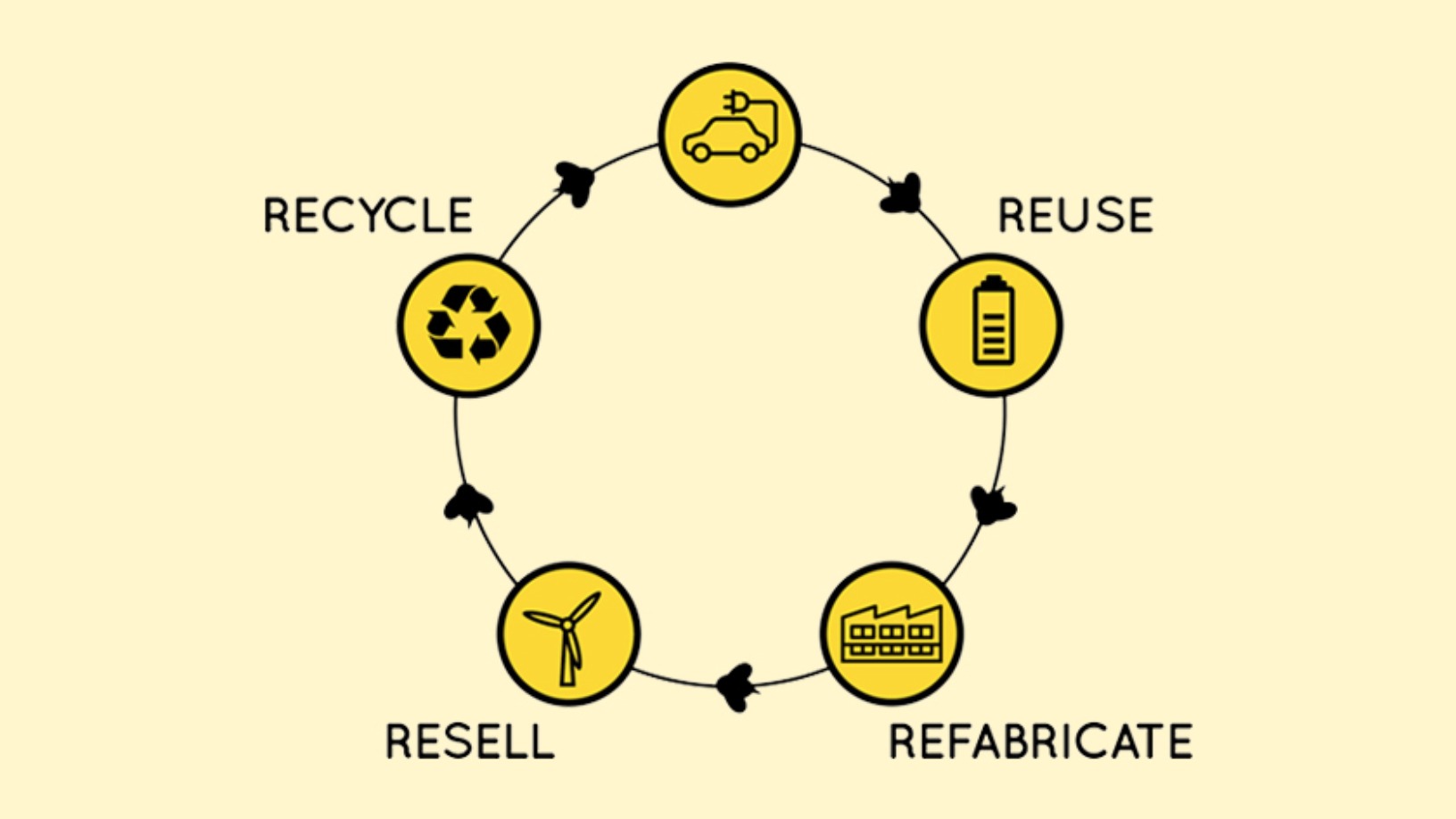

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

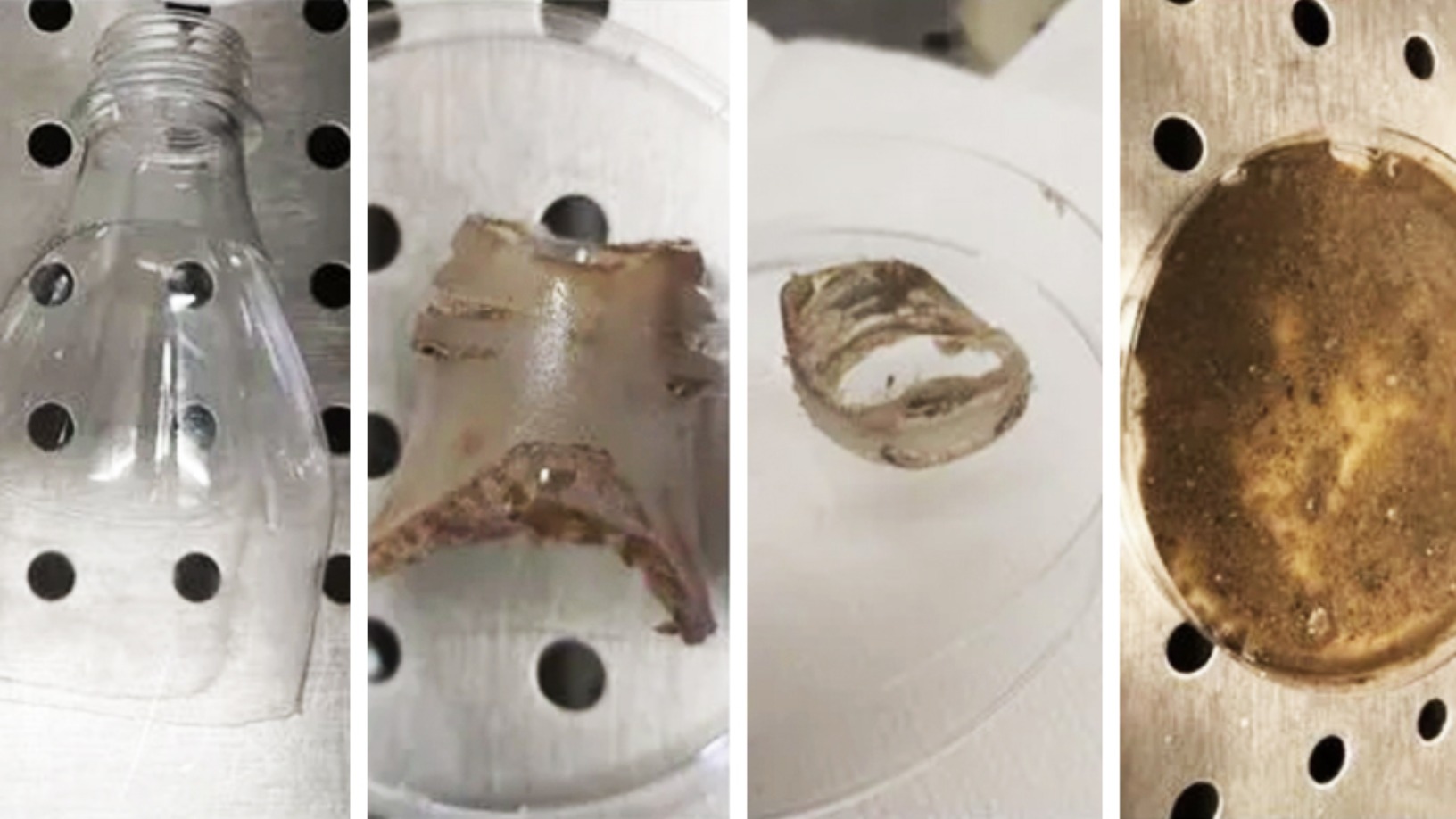

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

Sorry, we couldn’t find any matches for“University of Barcelona”.