University of Cambridge

-

DATABASE (993)

-

ARTICLES (811)

Cambridge Enterprise Venture Partners

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

Yangtze Delta Region Institute of Tsinghua University, Zhejiang

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

SyndicateRoom is a Cambridge-based VC authorized and regulated by the Financial Conduct Authority (FCA), founded in 2013 by Gonçalo de Vasconcelos and Tom Britton, after studying together at the University of Cambridge. The company was initially started as an equity crowdfunding platform allowing its members to co-invest with experienced angel investors and high-net-worth individuals. Each investor is offered the same investment opportunities as lead investors, with the same share class and price per share.In July 2019, Gonçalo de Vasconcelos stepped down as CEO and was replaced by Graham Schwikkard. Soon afterward, the company announced a pivot of its investment model, becoming a VC fund that no longer offers individual crowdfunding investment opportunities. In the same year, SyndicateRoom launched Access EIS, the first data-driven Enterprise Investment Scheme fund.

SyndicateRoom is a Cambridge-based VC authorized and regulated by the Financial Conduct Authority (FCA), founded in 2013 by Gonçalo de Vasconcelos and Tom Britton, after studying together at the University of Cambridge. The company was initially started as an equity crowdfunding platform allowing its members to co-invest with experienced angel investors and high-net-worth individuals. Each investor is offered the same investment opportunities as lead investors, with the same share class and price per share.In July 2019, Gonçalo de Vasconcelos stepped down as CEO and was replaced by Graham Schwikkard. Soon afterward, the company announced a pivot of its investment model, becoming a VC fund that no longer offers individual crowdfunding investment opportunities. In the same year, SyndicateRoom launched Access EIS, the first data-driven Enterprise Investment Scheme fund.

Stanford Graduate School of Business

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Co-Founder of Qraved

Cambridge and Stanford graduate Adrian Li was born in London to parents from Hong Kong and Malaysia. He holds a bachelor’s degree in Economics from Cambridge University and an MBA from Stanford University. He is currently a board member of dating startup Paktor, media company MBDC, female online community Female Daily Network, technology development company Imaginato and food social network startup Qraved. He is also the founding and managing partner of venture capital firm Convergence Ventures.

Cambridge and Stanford graduate Adrian Li was born in London to parents from Hong Kong and Malaysia. He holds a bachelor’s degree in Economics from Cambridge University and an MBA from Stanford University. He is currently a board member of dating startup Paktor, media company MBDC, female online community Female Daily Network, technology development company Imaginato and food social network startup Qraved. He is also the founding and managing partner of venture capital firm Convergence Ventures.

Co-founder of Meatable

Mark Kotter is the Austrian co-founder at Dutch cell-based meat startup Meatable, the first to use pluripotent stem cells and claim a highly scalable culture technology, which was developed by Kotter prior to founding the startup in 2018. He is also founder at his biotech startup, bit.bio, which is based in Cambridge, UK, since 2016, where he applies his cellular technological innovation to human stem cell research and has raised investments totaling $42m. His main full-time position is at the University of Cambridge, where he has worked since 2009. He has spent more than five years as a clinician-scientist in stem cell research and was previously a lecturer in neurosurgery. Kotter also lectures at Paris Descartes University and is a team leader at the UK’s National Institute for Health Research’s Brain Injury MedTech Co-operative. He also founded Myelopathy.org to raise awareness of cervical myelopathy. His past positions were as a research group leader at the Max Planck Institute for Experimental Medicine for one year, and for two years spent at the Medical University of Vienna. Kotter holds two doctorates; one in philosophy from the University of Cambridge and the other in medicine from the University of Graz in Austria. Kotter also holds a master’s in philosophy from the University of Cambridge.

Mark Kotter is the Austrian co-founder at Dutch cell-based meat startup Meatable, the first to use pluripotent stem cells and claim a highly scalable culture technology, which was developed by Kotter prior to founding the startup in 2018. He is also founder at his biotech startup, bit.bio, which is based in Cambridge, UK, since 2016, where he applies his cellular technological innovation to human stem cell research and has raised investments totaling $42m. His main full-time position is at the University of Cambridge, where he has worked since 2009. He has spent more than five years as a clinician-scientist in stem cell research and was previously a lecturer in neurosurgery. Kotter also lectures at Paris Descartes University and is a team leader at the UK’s National Institute for Health Research’s Brain Injury MedTech Co-operative. He also founded Myelopathy.org to raise awareness of cervical myelopathy. His past positions were as a research group leader at the Max Planck Institute for Experimental Medicine for one year, and for two years spent at the Medical University of Vienna. Kotter holds two doctorates; one in philosophy from the University of Cambridge and the other in medicine from the University of Graz in Austria. Kotter also holds a master’s in philosophy from the University of Cambridge.

After a decade of technology and capability development, Alén Space's proprietary nanosatellites offer a faster, cheaper way to meet the growing demand for new Space applications.

After a decade of technology and capability development, Alén Space's proprietary nanosatellites offer a faster, cheaper way to meet the growing demand for new Space applications.

Co-founder of Xampla

Tuomas Knowles is co-founder of Britain’s Xampla, producer of plant-based biodegradable plastics made from protein, which was founded in 2018 based on his team’s pioneering research. Knowles is a professor of physical chemistry and biophysics at Cambridge University, where he has worked since 2010 and manages the Knowles Lab which focuses on researching protein self-assembly underlying neurodegenerative disorders like Alzheimer's and Parkinson's disease. Knowles holds a PhD in Biophysics from the University of Cambridge and a degree in physics from ETH Zurich, a science and technology university.

Tuomas Knowles is co-founder of Britain’s Xampla, producer of plant-based biodegradable plastics made from protein, which was founded in 2018 based on his team’s pioneering research. Knowles is a professor of physical chemistry and biophysics at Cambridge University, where he has worked since 2010 and manages the Knowles Lab which focuses on researching protein self-assembly underlying neurodegenerative disorders like Alzheimer's and Parkinson's disease. Knowles holds a PhD in Biophysics from the University of Cambridge and a degree in physics from ETH Zurich, a science and technology university.

Co-founder of Knokcare (formerly Knok Healthcare)

A licensed pharmacist, Carolina Relvas graduated from the University of Lisbon and has an MBA from the University of Cambridge, UK. She started her career at GSK and is currently a manager at ZS Associates, a pharmaceutical and healthcare consultancy.Relvas co-founded medical consultation app Knokcare, previously known as Knok Healthcare. She was the CMO of Knokcare from 2015 until late 2018.

A licensed pharmacist, Carolina Relvas graduated from the University of Lisbon and has an MBA from the University of Cambridge, UK. She started her career at GSK and is currently a manager at ZS Associates, a pharmaceutical and healthcare consultancy.Relvas co-founded medical consultation app Knokcare, previously known as Knok Healthcare. She was the CMO of Knokcare from 2015 until late 2018.

CEO and founder of Yigongli (1KMXC)

Born in 1987, Shi Hengzhi is a serial entrepreneur. Before founding Yigongli in 2013, he founded three startups including WishBird, a consultancy firm for overseas studies. He holds a master's degree in Economics from Cambridge University.

Born in 1987, Shi Hengzhi is a serial entrepreneur. Before founding Yigongli in 2013, he founded three startups including WishBird, a consultancy firm for overseas studies. He holds a master's degree in Economics from Cambridge University.

One of the world’s oldest venture capital firms, Greylock Partner was founded in 1965 in Cambridge, Massachusetts by Bill Elfers and Dan Gregory, and later Charlie Waite. It has offices in Silicon Valley, San Francisco and Wellesley and over US$3.5 billion under management. Focused on early-stage startups, Greylock has backed more than 120 profitable M&As and more than 170 IPOs, including Facebook, LinkedIn and Workday.

One of the world’s oldest venture capital firms, Greylock Partner was founded in 1965 in Cambridge, Massachusetts by Bill Elfers and Dan Gregory, and later Charlie Waite. It has offices in Silicon Valley, San Francisco and Wellesley and over US$3.5 billion under management. Focused on early-stage startups, Greylock has backed more than 120 profitable M&As and more than 170 IPOs, including Facebook, LinkedIn and Workday.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

CEO and Founder of AISpeech

After receiving his MPhil from Cambridge Judge Business School, Gao founded AISpeech in the UK in 2007. In 2008, he returned to China and settled down in Suzhou, where AISpeech is now headquartered.

After receiving his MPhil from Cambridge Judge Business School, Gao founded AISpeech in the UK in 2007. In 2008, he returned to China and settled down in Suzhou, where AISpeech is now headquartered.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Despite a lack of infrastructure and threats from middlemen, Aruna continues to help Indonesian fishing communities find buyers for their catch and manage their money better.

Kobo360: Nigeria's Uber-style logistics startup turns pan-African dream into reality

Riding on Africa’s new free trade deal, Kobo360 aims to be the continent’s next unicorn by digitalizing logistics ops to transport goods quickly, reliably and more cheaply

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Zoundream: Deciphering and mining the data in baby cries

The world’s first algorithm to translate baby cries into actionable insights for parents and hospitals seeks to boost early detection of pathologies and developmental disorders

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

China’s online mutual aid market: A new battleground for tech giants and startups

Startups spotted the opportunity and tech giants too have entered a market seen tripling by 2025. But profitability is still in doubt amid regulatory uncertainty

Lesielle: Award-winning personalized cosmetics that adapt to changing skincare needs

This Spanish AI-powered device combines with a mobile app to track the daily condition of your skin and tailor-make cosmetics for each customer

Choose from over 10,000 mental health therapists at Yidianling

Startup's 24/7 services will include AI-powered chatbots to help more Chinese cope with mental health issues, amid lack of therapists

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

SWITCH Singapore: Embracing a circular economy, the whys and the hows

Its benefits for the environment aside, going circular could also lead to new economic growth, better public health and higher value-add employment, experts say

Future Food Asia: Covid-19 sparked dramatic shifts in agriculture in China and India

Key Chinese players from e-commerce giant Pinduoduo and and agritech VC Omnivore share their insights at last week’s agrifood conference by ID Capital

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

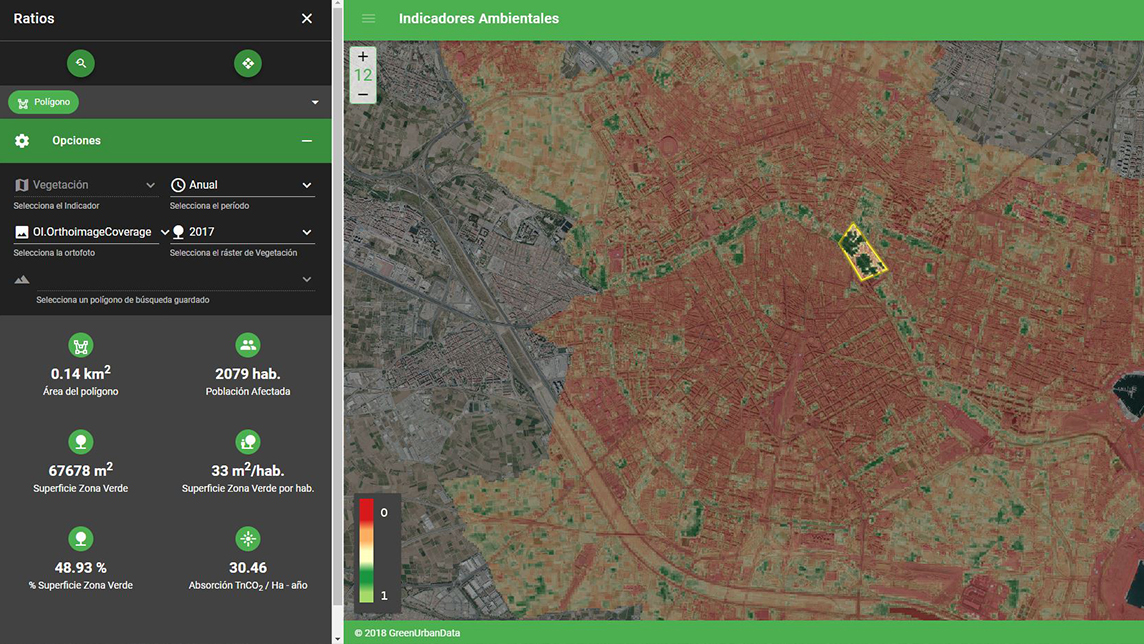

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Sorry, we couldn’t find any matches for“University of Cambridge”.