Unovis Asset Management

-

DATABASE (696)

-

ARTICLES (331)

Founder and CEO of Alodokter

A graduate with a master’s in Management and Business Strategy from the ESSEC Business School Paris, Nathanael Faibis had worked for two years as a project manager in France, Kenya and Morocco for a pharmaceutical market research company Sanisphere. In 2012, he worked for Lazada in Vietnam and Indonesia before becoming the head of production and user experience of Lazada Southeast Asia. However, he left Lazada in March 2013 to rejoin Sanisphere in Jakarta as the country head and global head of data management. Finally in April 2014, he decided to set up an Indonesian health portal Alodokter.

A graduate with a master’s in Management and Business Strategy from the ESSEC Business School Paris, Nathanael Faibis had worked for two years as a project manager in France, Kenya and Morocco for a pharmaceutical market research company Sanisphere. In 2012, he worked for Lazada in Vietnam and Indonesia before becoming the head of production and user experience of Lazada Southeast Asia. However, he left Lazada in March 2013 to rejoin Sanisphere in Jakarta as the country head and global head of data management. Finally in April 2014, he decided to set up an Indonesian health portal Alodokter.

Founder and CEO of Ofo

A graduate of the Guanghua School of Management, Peking University, Dai Wei was the principal clarinetist of Peking University Symphony Orchestra, Chairman of Guanghua School Student Association and Chairman of Peking University Student Union.

A graduate of the Guanghua School of Management, Peking University, Dai Wei was the principal clarinetist of Peking University Symphony Orchestra, Chairman of Guanghua School Student Association and Chairman of Peking University Student Union.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

Co-founder of Mobvoi

Li holds a master’s in Information Management from the University of Maryland. She used to work as a senior manager for MicroStrategy, a US business intelligence, mobile software and cloud services provider.

Li holds a master’s in Information Management from the University of Maryland. She used to work as a senior manager for MicroStrategy, a US business intelligence, mobile software and cloud services provider.

Founder and Chairperson of Huidu Environmental

Chai Aina is a veteran marketing management professional. She was also a third-party logistics service supplier for Alibaba's B2C online e-tailer Tmall.com. She co-founded Huidu Environmental in August 2017.

Chai Aina is a veteran marketing management professional. She was also a third-party logistics service supplier for Alibaba's B2C online e-tailer Tmall.com. She co-founded Huidu Environmental in August 2017.

Born in 1972, Wang started out in finance in 1992 at Xiangcai Securities, where she was employed in multiple capacities. She founded Noah Wealth Management in 2005 and has served as chairperson and CEO ever since. In 2010, Noah became China's first wealth management firm to go public in the US. Wang holds an EMBA from China Europe International Business School.

Born in 1972, Wang started out in finance in 1992 at Xiangcai Securities, where she was employed in multiple capacities. She founded Noah Wealth Management in 2005 and has served as chairperson and CEO ever since. In 2010, Noah became China's first wealth management firm to go public in the US. Wang holds an EMBA from China Europe International Business School.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Founder and CEO of Pengyoufan

A former senior executive at Standard Chartered Bank and HP, Wang Huawei went on to set up his own business in internet investment/wealth management information services, Weitouhuirong (Beijing) Network Technology; and subsequently, P2P financing-social networking app Pengyoufan.

A former senior executive at Standard Chartered Bank and HP, Wang Huawei went on to set up his own business in internet investment/wealth management information services, Weitouhuirong (Beijing) Network Technology; and subsequently, P2P financing-social networking app Pengyoufan.

Head of Product and co-founder of Knokcare (formerly Knok Healthcare)

A serial entrepreneur who co-founded three startups, Tiago Craveiro graduated from the University of Porto with a master’s in Industrial Engineering Management. Craveiro co-founded HUUB, Iterar and Knokcare.

A serial entrepreneur who co-founded three startups, Tiago Craveiro graduated from the University of Porto with a master’s in Industrial Engineering Management. Craveiro co-founded HUUB, Iterar and Knokcare.

Co-founder, Co-president and COO of Zhang Tong Jia Yuan

Co-founder, co-president and COO of Zhang Tong Jia Yuan. After graduating from college, Feng joined the Chinese Armed Police Force. She co-founded Zhang Tong Jia Yuan with her husband Ye Renqian. Feng is responsible for regional partner management.

Co-founder, co-president and COO of Zhang Tong Jia Yuan. After graduating from college, Feng joined the Chinese Armed Police Force. She co-founded Zhang Tong Jia Yuan with her husband Ye Renqian. Feng is responsible for regional partner management.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

Co-founder and COO of Zelos

Chris Winston graduated from Les Roches International School of Hotel Management in Switzerland in 2013, with a diploma in Hospitality Management. His work experience included two months at the Ritz Carlton and four months at Eleven Madison Park. On returning home, he became the head chef of Winston Manusama Hospitality Group for eight months in Jakarta in 2014. He was also a consultant for Il Cielo restaurant in Bali for seven months. Chris met Votinc co-founders Markus Liman Rahardja and Alvin Evander Subagyo while working at a dining event. The three later co-founded an automated job matchmaking platform Zelos.

Chris Winston graduated from Les Roches International School of Hotel Management in Switzerland in 2013, with a diploma in Hospitality Management. His work experience included two months at the Ritz Carlton and four months at Eleven Madison Park. On returning home, he became the head chef of Winston Manusama Hospitality Group for eight months in Jakarta in 2014. He was also a consultant for Il Cielo restaurant in Bali for seven months. Chris met Votinc co-founders Markus Liman Rahardja and Alvin Evander Subagyo while working at a dining event. The three later co-founded an automated job matchmaking platform Zelos.

Co-founder, CFO of Sea Water Analytics

Javier Moya Maier is the Spanish co-founder and CFO of Sea Water Analytics, a tourism-focused data aggregator with user app to measure seawater quality. The technology has been in development since 2017, though the company was formally launched in Madrid in April 2020. Moya previously spent more than a decade working as an industrial engineer, especially in the area of project management in different Madrid-based companies.Moya has worked at insurance company Prosegur, at travel management company Flightcare, and at engineering firms MOMO and Essentium Group. He holds a master's degree in Industrial Engineering from Madrid's Pontificia Comillas University and has completed a course in Lean Manufacturing.

Javier Moya Maier is the Spanish co-founder and CFO of Sea Water Analytics, a tourism-focused data aggregator with user app to measure seawater quality. The technology has been in development since 2017, though the company was formally launched in Madrid in April 2020. Moya previously spent more than a decade working as an industrial engineer, especially in the area of project management in different Madrid-based companies.Moya has worked at insurance company Prosegur, at travel management company Flightcare, and at engineering firms MOMO and Essentium Group. He holds a master's degree in Industrial Engineering from Madrid's Pontificia Comillas University and has completed a course in Lean Manufacturing.

Zhejiang Jinke Venture Capital

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Cobee automates and extends flexibility in compensation and benefits management to meal vouchers, childcare, healthcare, etc., helping firms increase their average employee benefits uptake fourfold.

Cobee automates and extends flexibility in compensation and benefits management to meal vouchers, childcare, healthcare, etc., helping firms increase their average employee benefits uptake fourfold.

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Fumi Technology: Getting ahead of human wealth managers with its Webull robo-advisors

Fumi's AI-based fintech platform offers real-time quotes and free trading to over 10m punters in 100 countries

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

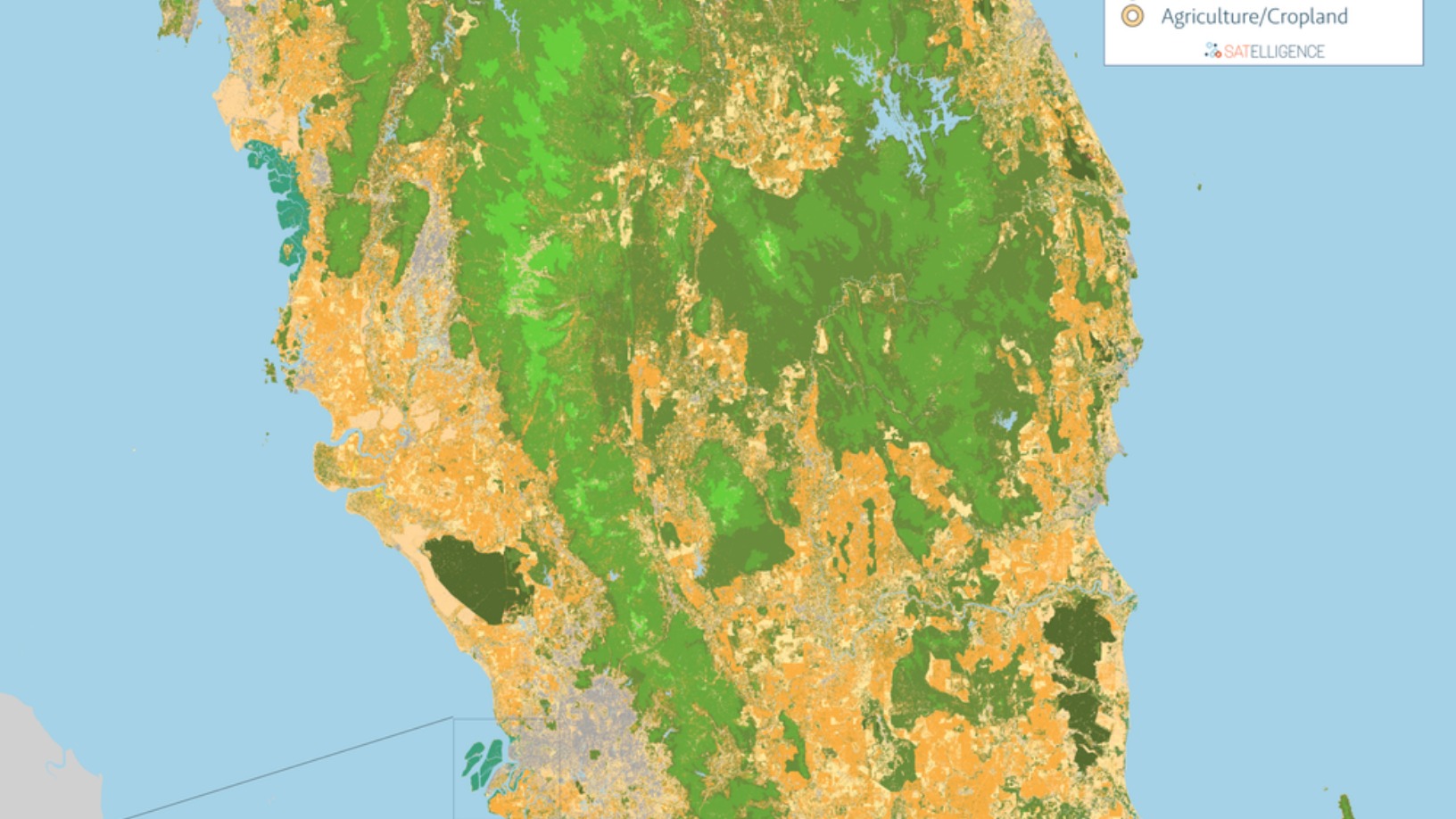

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Sorry, we couldn’t find any matches for“Unovis Asset Management”.