Unovis Asset Management

-

DATABASE (696)

-

ARTICLES (331)

SFund, aka Guangzhou Industrial Investment Fund Management Co Ltd, was established in March 2013 by the Guangzhou Municipal Government to boost industrial upgrading in the city. Its business covers government fund management, private equity investment and venture capital investment.In July 2018, SFund became a subsidiary of Guangzhou City Construction Investment Group. The decision was made by the Guangzhou Municipal Government and the State-owned Assets Supervision and Administration Commission of the State Council.SFund has set up seven funds, managing total assets worth RMB 139bn. It has invested in 343 companies, 13 of which have become public-listed.

SFund, aka Guangzhou Industrial Investment Fund Management Co Ltd, was established in March 2013 by the Guangzhou Municipal Government to boost industrial upgrading in the city. Its business covers government fund management, private equity investment and venture capital investment.In July 2018, SFund became a subsidiary of Guangzhou City Construction Investment Group. The decision was made by the Guangzhou Municipal Government and the State-owned Assets Supervision and Administration Commission of the State Council.SFund has set up seven funds, managing total assets worth RMB 139bn. It has invested in 343 companies, 13 of which have become public-listed.

Established in 2007, Exago is an innovation management software and service provider for companies in 19 countries across four continents. Its clients include Shell, Carrefour and Barclays. Exago has offices in Lisbon, London, and São Paulo, Brazil.

Established in 2007, Exago is an innovation management software and service provider for companies in 19 countries across four continents. Its clients include Shell, Carrefour and Barclays. Exago has offices in Lisbon, London, and São Paulo, Brazil.

Founded in Shenzhen in 2011, Leaguer Finance is a fund management company with branches in Hong Kong and Jilin. It invests mainly in the intelligent device manufacturing, tourism, new energy and robotics fields.

Founded in Shenzhen in 2011, Leaguer Finance is a fund management company with branches in Hong Kong and Jilin. It invests mainly in the intelligent device manufacturing, tourism, new energy and robotics fields.

Headquartered in Beijing, Mingtai Capital was founded in 2013. Its total assets under management has surpassed RMB 15 billion. It invests mainly in the following sectors: Internet of things (Iot), advanced manufacturing, culture, media and medtech.

Headquartered in Beijing, Mingtai Capital was founded in 2013. Its total assets under management has surpassed RMB 15 billion. It invests mainly in the following sectors: Internet of things (Iot), advanced manufacturing, culture, media and medtech.

Founded by former IDG Capital partner Zhang Suyang in May 2016, the Shanghai-based VC firm invests mainly in early-stage startups working on tech innovations and healthcare. Total assets under management exceed RMB 2.2bn.

Founded by former IDG Capital partner Zhang Suyang in May 2016, the Shanghai-based VC firm invests mainly in early-stage startups working on tech innovations and healthcare. Total assets under management exceed RMB 2.2bn.

Ajaib’s online wealth management tool brings personalized mutual fund investing to the masses, potentially mobilizing billions of investable assets across Southeast Asia.

Ajaib’s online wealth management tool brings personalized mutual fund investing to the masses, potentially mobilizing billions of investable assets across Southeast Asia.

Flourish Libra Venture Capital

Established in 2010, Flourish Libra Venture Capital is a Fund of Funds (FOF) management firm and focuses on private equity in Greater China. It has invested some funds under Jiuding Capital, Fortune, NewMargin Ventures, Tiantu Capital, SAIF Partners, etc.

Established in 2010, Flourish Libra Venture Capital is a Fund of Funds (FOF) management firm and focuses on private equity in Greater China. It has invested some funds under Jiuding Capital, Fortune, NewMargin Ventures, Tiantu Capital, SAIF Partners, etc.

Founded by Ray Hu and Alex Yin in 2014, Blue Lake Capital has about US$200 million under management, focusing on early-stage investment in vertical industry such as O2O, social media, smart hardware, mobile internet and education.

Founded by Ray Hu and Alex Yin in 2014, Blue Lake Capital has about US$200 million under management, focusing on early-stage investment in vertical industry such as O2O, social media, smart hardware, mobile internet and education.

Founded by Wu Yongming, a co-founder of Alibaba, and Wang Qi in 2015. With nearly RMB 2 billion under management, Vision Plus Capital invests in startups mainly in their Series A and Series B financing rounds.

Founded by Wu Yongming, a co-founder of Alibaba, and Wang Qi in 2015. With nearly RMB 2 billion under management, Vision Plus Capital invests in startups mainly in their Series A and Series B financing rounds.

Founded by a group of Tsinghua alumni in 2013, Innoangel Fund has invested in 200+ startups. With over RMB 2 billion under management, Innoangel Fund focuses on artificial intelligence and robotics, Internet of Things and the cultural creative industry.

Founded by a group of Tsinghua alumni in 2013, Innoangel Fund has invested in 200+ startups. With over RMB 2 billion under management, Innoangel Fund focuses on artificial intelligence and robotics, Internet of Things and the cultural creative industry.

Founded in 2004 by one of China’s best-known venture capitalists Cao Guoxiong (Tony Cao), Puhua Capital currently has RMB 1 billion under management. It has invested about 300 startups, including 40+ that have gone public.

Founded in 2004 by one of China’s best-known venture capitalists Cao Guoxiong (Tony Cao), Puhua Capital currently has RMB 1 billion under management. It has invested about 300 startups, including 40+ that have gone public.

Huaxin Capital is a private equity fund management platform that was set up by Luxin Venture Capital Group in 2011. Huaxin Capital invests in the fields of biomedicine, medical equipment, internet, IoT, clean energy, high-end equipment manufacturing, among others.

Huaxin Capital is a private equity fund management platform that was set up by Luxin Venture Capital Group in 2011. Huaxin Capital invests in the fields of biomedicine, medical equipment, internet, IoT, clean energy, high-end equipment manufacturing, among others.

Founded in 2015, GaoZhang Capital invests exclusively in new media. With RMB 300 million assets under management, it had invested in 35 projects as of the end of 2017.

Founded in 2015, GaoZhang Capital invests exclusively in new media. With RMB 300 million assets under management, it had invested in 35 projects as of the end of 2017.

Since 2019, Javier Gayoso has been a board member, partner and advisor at Voikers, a management consultancy based in Madrid. He is also the former CEO of Spotify Iberia and advertising director of Vocento, a Madrid-based broadcast media.

Since 2019, Javier Gayoso has been a board member, partner and advisor at Voikers, a management consultancy based in Madrid. He is also the former CEO of Spotify Iberia and advertising director of Vocento, a Madrid-based broadcast media.

Capricorn Investment Group is one of the world’s largest mission-aligned investment companies, managing more than $6bn in multi-asset class portfolios for families, foundations and institutional investors. Notably, it manages the investment portfolio of Jeff Skoll, the first President of eBay, and his charitable organization. The company has offices in Silicon Valley and New York. It has invested in 63 companies to date, many aimed at tackling key challenges facing our world today. It has managed 14 exits to date, including Tesla. Its main focus is on technology and sustainability, with a particular interest in deeptech, aerospace, transport, agtech, healthcare and energy. The firm’s most recent disclosed investments were in May 2021, via participation in the $100m Series B round of Canadian quantum computing startup Xanadu and the $28m Series B round of US geothermal tech company Fervo Energy.

Capricorn Investment Group is one of the world’s largest mission-aligned investment companies, managing more than $6bn in multi-asset class portfolios for families, foundations and institutional investors. Notably, it manages the investment portfolio of Jeff Skoll, the first President of eBay, and his charitable organization. The company has offices in Silicon Valley and New York. It has invested in 63 companies to date, many aimed at tackling key challenges facing our world today. It has managed 14 exits to date, including Tesla. Its main focus is on technology and sustainability, with a particular interest in deeptech, aerospace, transport, agtech, healthcare and energy. The firm’s most recent disclosed investments were in May 2021, via participation in the $100m Series B round of Canadian quantum computing startup Xanadu and the $28m Series B round of US geothermal tech company Fervo Energy.

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Fumi Technology: Getting ahead of human wealth managers with its Webull robo-advisors

Fumi's AI-based fintech platform offers real-time quotes and free trading to over 10m punters in 100 countries

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

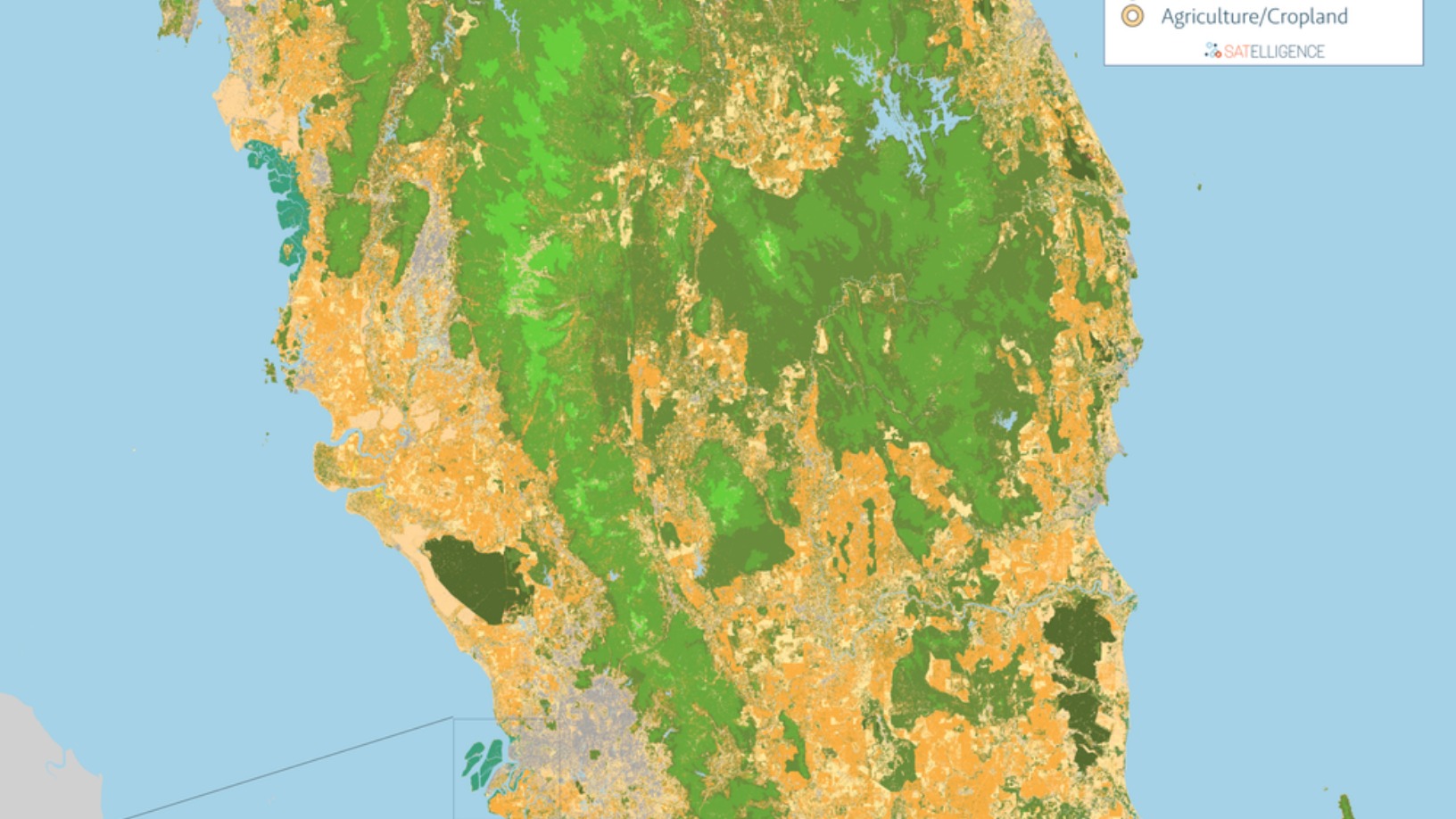

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Sorry, we couldn’t find any matches for“Unovis Asset Management”.