Unovis Asset Management

DATABASE (696)

ARTICLES (331)

Carbonstop claims to be China’s first company providing tools to help enterprises make low-carbon choices by analyzing and managing their carbon footprint.

Carbonstop claims to be China’s first company providing tools to help enterprises make low-carbon choices by analyzing and managing their carbon footprint.

Founder and CEO of Creams

Founder and CEO of Creams. A serial entrepreneur and senior real estate sales expert, Xiang founded Juji Real Estate in 2011. In 2015, he launched Souban, an O2O platform for leasing office space. With the launch of Creams, Xiang shifted his business focus to intelligent real estate asset management.

Founder and CEO of Creams. A serial entrepreneur and senior real estate sales expert, Xiang founded Juji Real Estate in 2011. In 2015, he launched Souban, an O2O platform for leasing office space. With the launch of Creams, Xiang shifted his business focus to intelligent real estate asset management.

Co-founder of Halofina

Eko Pratomo graduated from Bandung Institute of Technology (ITB) with a degree in Flight Engineering. He holds an MBA from IPMI International Business School in Jakarta. In the late '80s, he studied Aeronautical Engineering at the Delft University of Technology. Pratomo and his wife run the Syamsi Dhuha Foundation, a social enterprise for people with lupus and low vision. Since 2010, he has been a senior advisor at BNP Paribas Investment Partners. In 2017, he started Halofina with Adjie Wicaksana. Pratomo won Indonesia’s Asset Manager CEO of the Year 2008 award from Asia Asset Management.

Eko Pratomo graduated from Bandung Institute of Technology (ITB) with a degree in Flight Engineering. He holds an MBA from IPMI International Business School in Jakarta. In the late '80s, he studied Aeronautical Engineering at the Delft University of Technology. Pratomo and his wife run the Syamsi Dhuha Foundation, a social enterprise for people with lupus and low vision. Since 2010, he has been a senior advisor at BNP Paribas Investment Partners. In 2017, he started Halofina with Adjie Wicaksana. Pratomo won Indonesia’s Asset Manager CEO of the Year 2008 award from Asia Asset Management.

Connecting landlords directly with tenants seeking well-located rentals in big Chinese cities, Mogoroom also partners Ant Financial to scrap the deposit requirement for Alipay users.

Connecting landlords directly with tenants seeking well-located rentals in big Chinese cities, Mogoroom also partners Ant Financial to scrap the deposit requirement for Alipay users.

Founded in 2013, China Merchants Wealth is a wholly owned asset management unit of China Merchants Fund, with RMB 200 billion under management.

Founded in 2013, China Merchants Wealth is a wholly owned asset management unit of China Merchants Fund, with RMB 200 billion under management.

Tapping into the rapid growth of Indonesia’s small and medium-sized enterprises sector, Jurnal has designed a fully integrated cloud accounting software for SMEs.

Tapping into the rapid growth of Indonesia’s small and medium-sized enterprises sector, Jurnal has designed a fully integrated cloud accounting software for SMEs.

Foresee Capital was set up as the asset management division of Phoenix Finance, an investment platform under Hong Kong-based Phoenix Television, in 2014. In 2017, it became the independent firm Beijing Foresee Asset Management Co., Ltd. As of Q1 2018, assets under management have exceeded RMB 69.5 billion, including fixed-income investment, real estate equity, private equity and overseas investment.

Foresee Capital was set up as the asset management division of Phoenix Finance, an investment platform under Hong Kong-based Phoenix Television, in 2014. In 2017, it became the independent firm Beijing Foresee Asset Management Co., Ltd. As of Q1 2018, assets under management have exceeded RMB 69.5 billion, including fixed-income investment, real estate equity, private equity and overseas investment.

Co-Founder and CEO of Cicil

Former banker Leslie Lim is Singaporean and holds a bachelor’s degree in Engineering with Business Finance from University College London. As an undergraduate, Leslie was on the Dean’s List and graduated with first class honors, and received the Goldsmid Sessional Prize for Mechanical Engineering. He met Cicil co-founder while pursuing an MBA at INSEAD. Prior to co-founding Cicil, Leslie had worked at Barclays, HSBC, BNP Paribas Securities and Duxton Asset Management (Deutsche Bank Group).

Former banker Leslie Lim is Singaporean and holds a bachelor’s degree in Engineering with Business Finance from University College London. As an undergraduate, Leslie was on the Dean’s List and graduated with first class honors, and received the Goldsmid Sessional Prize for Mechanical Engineering. He met Cicil co-founder while pursuing an MBA at INSEAD. Prior to co-founding Cicil, Leslie had worked at Barclays, HSBC, BNP Paribas Securities and Duxton Asset Management (Deutsche Bank Group).

Rewriting real-estate and hospitality models, leveraging technology, to expand and boost efficiencies, first-mover Tujia is China’s largest vacation rental platform offering high-quality accommodation, undercutting hotels.

Rewriting real-estate and hospitality models, leveraging technology, to expand and boost efficiencies, first-mover Tujia is China’s largest vacation rental platform offering high-quality accommodation, undercutting hotels.

Based in Jakarta, Maloekoe Ventures is an Indonesian-focused venture capital firm headed by Adrien Gheur, a former MD of hedge fund APS Asset Management.

Based in Jakarta, Maloekoe Ventures is an Indonesian-focused venture capital firm headed by Adrien Gheur, a former MD of hedge fund APS Asset Management.

Headquartered in Guangzhou, Mobai Capital (Shenzhen Qianhai Asset Management Co Ltd) was founded in 2015 with an investment focus on big data and fintech companies.

Headquartered in Guangzhou, Mobai Capital (Shenzhen Qianhai Asset Management Co Ltd) was founded in 2015 with an investment focus on big data and fintech companies.

CEO of Fundeen

Born in Ávila, Spain, Juan Ignacio Bautista Sánchez holds a Master of Science in Civil Engineering and a Bachelor of Science in Environmental Sciences from Alfonso X el Sabio University in Madrid. After working in asset management and due diligence in the renewable energy industry, first in Blue Tree Assets Management and later in Vela Energy, he presented his startup at Santander Bank's Yuzz entrepreneurship program. He won at the local level and was able to travel to Silicon Valley. Subsequent awards encouraged him to focus on Fundeen, where he has been serving as CEO since July 2017.

Born in Ávila, Spain, Juan Ignacio Bautista Sánchez holds a Master of Science in Civil Engineering and a Bachelor of Science in Environmental Sciences from Alfonso X el Sabio University in Madrid. After working in asset management and due diligence in the renewable energy industry, first in Blue Tree Assets Management and later in Vela Energy, he presented his startup at Santander Bank's Yuzz entrepreneurship program. He won at the local level and was able to travel to Silicon Valley. Subsequent awards encouraged him to focus on Fundeen, where he has been serving as CEO since July 2017.

China Reform Capital Corporation, Ltd.

China Reform Capital Corporation, Ltd. is a wholly-owned subsidiary of China Reform Holdings Corporation, Ltd. It was established in August 2014 in Beijing and has registered capital RMB 10 billion. Its business includes equity investment, project investment, investment management, asset management and investment consulting.

China Reform Capital Corporation, Ltd. is a wholly-owned subsidiary of China Reform Holdings Corporation, Ltd. It was established in August 2014 in Beijing and has registered capital RMB 10 billion. Its business includes equity investment, project investment, investment management, asset management and investment consulting.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

B2B asset reuse marketplace for local lending, exchange or sales, with the SaaS platform doubling up as company equipment register, while rewarding employee participation.

B2B asset reuse marketplace for local lending, exchange or sales, with the SaaS platform doubling up as company equipment register, while rewarding employee participation.

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Fumi Technology: Getting ahead of human wealth managers with its Webull robo-advisors

Fumi's AI-based fintech platform offers real-time quotes and free trading to over 10m punters in 100 countries

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

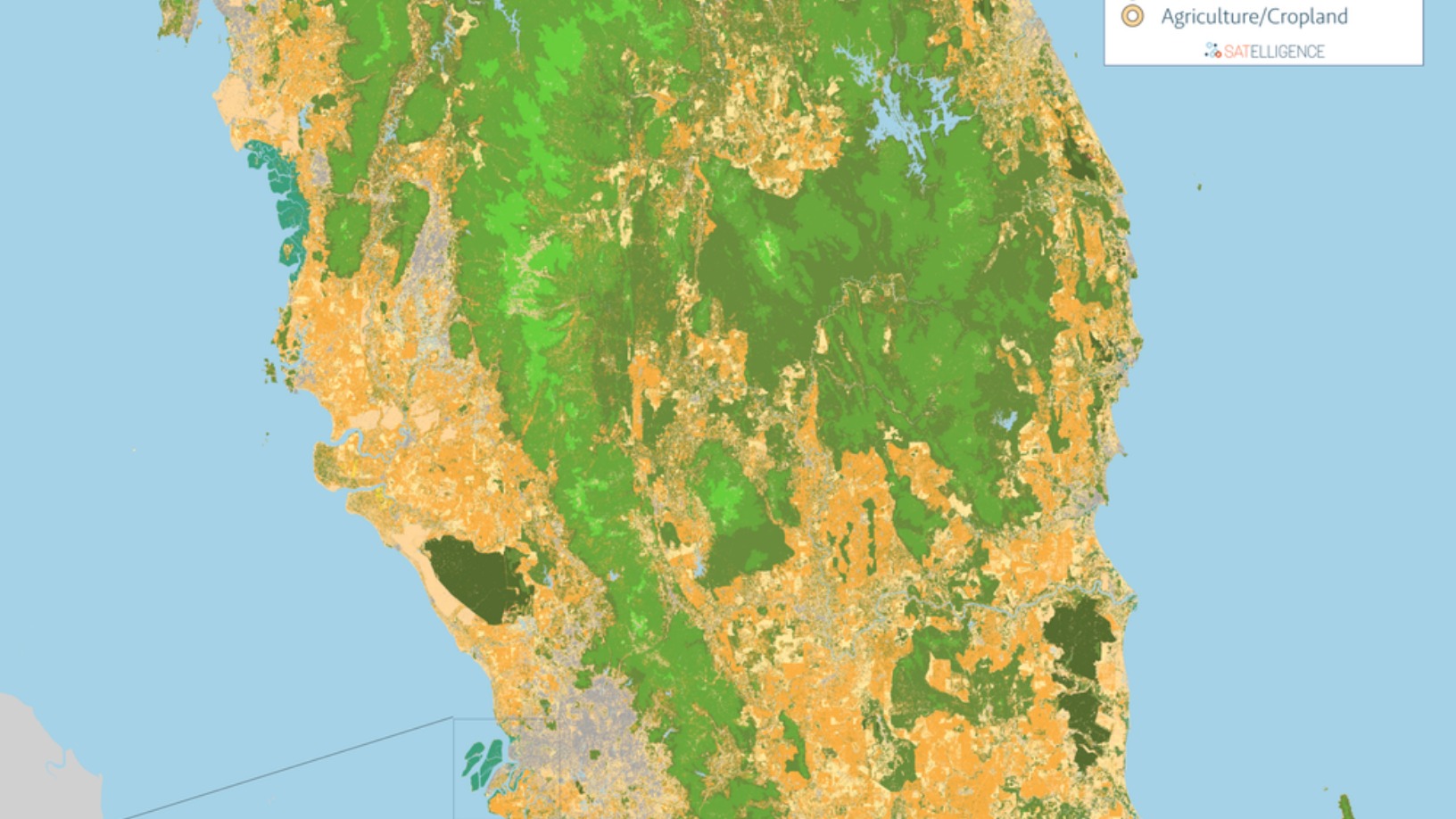

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Sorry, we couldn’t find any matches for“Unovis Asset Management”.