Unovis Asset Management

-

DATABASE (696)

-

ARTICLES (331)

Co-founder and COO of Triditive

José Camero is Co-founder and COO at Triditive additive manufacturing startup in Gijon, Spain. He has founded several businesses including Spanish telco provider Air Digital, manufacturing company All Madin España, and Asturian international cultural centre Spanish Up. Camero studied management at the University of Oviedo and telecoms engineering at the University of Vigo, both in Spain. He speaks six languages, including Mandarin Chinese.

José Camero is Co-founder and COO at Triditive additive manufacturing startup in Gijon, Spain. He has founded several businesses including Spanish telco provider Air Digital, manufacturing company All Madin España, and Asturian international cultural centre Spanish Up. Camero studied management at the University of Oviedo and telecoms engineering at the University of Vigo, both in Spain. He speaks six languages, including Mandarin Chinese.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Founded in 2009, Modara Technologies invests in SMEs in the Spanish startup ecosystem. Modara provides equity, as well as operational and organizational support. The firm comprises international partners offering a wide range of investment, management and business experience.

Founded in 2009, Modara Technologies invests in SMEs in the Spanish startup ecosystem. Modara provides equity, as well as operational and organizational support. The firm comprises international partners offering a wide range of investment, management and business experience.

Qianhai Fund of Funds (Qianhai FoF)

Headquartered in Shenzhen, Qianhai FoF was founded in 2015 with Shenzhen Capital Group as its only institutional partner. It is China's biggest FoF, with RMB 21.5bn in capital under management. Qianhai FoF is the largest single fundraising venture capital and private equity investment fund in China.

Headquartered in Shenzhen, Qianhai FoF was founded in 2015 with Shenzhen Capital Group as its only institutional partner. It is China's biggest FoF, with RMB 21.5bn in capital under management. Qianhai FoF is the largest single fundraising venture capital and private equity investment fund in China.

Shanghai Guohe Capital was set up in 2009 by Shanghai International Group, a state-owned financial institution. It is China’s first private fund management company to obtain the qualification of private equity fund manager. The firm currently runs multiple funds with assets worth over RMB 10bn.

Shanghai Guohe Capital was set up in 2009 by Shanghai International Group, a state-owned financial institution. It is China’s first private fund management company to obtain the qualification of private equity fund manager. The firm currently runs multiple funds with assets worth over RMB 10bn.

Redview Capital was founded in 2016 by Yu Jianming, Managing Partner and co-founder of New Horizon Capital. It is a private equity fund focused on sectors of advanced manufacturing, clean energy, new materials, consumer products and retail. Redview Capital currently has $560m in assets under management.

Redview Capital was founded in 2016 by Yu Jianming, Managing Partner and co-founder of New Horizon Capital. It is a private equity fund focused on sectors of advanced manufacturing, clean energy, new materials, consumer products and retail. Redview Capital currently has $560m in assets under management.

Hera Capital is a Singapore-registered private fund management firm with an entrepreneur-focused strategy. Specifically, it invests in digital, consumer retail and media-related businesses. Hera Capital’s portfolio features notable businesses such as Sophie Paris (direct-sales fashion firm founded in Indonesia), SaladStop and Gojek.

Hera Capital is a Singapore-registered private fund management firm with an entrepreneur-focused strategy. Specifically, it invests in digital, consumer retail and media-related businesses. Hera Capital’s portfolio features notable businesses such as Sophie Paris (direct-sales fashion firm founded in Indonesia), SaladStop and Gojek.

Ex-Yahoo COO Henrique De Castro is currently on the board of Target Corp. His work experience includes Google, Dell and McKinsey. He received his bachelor’s degree in Economics and Business from the Instituto Superior de Economia e Gestão, and his MBA from the International Institute for Management Development.

Ex-Yahoo COO Henrique De Castro is currently on the board of Target Corp. His work experience includes Google, Dell and McKinsey. He received his bachelor’s degree in Economics and Business from the Instituto Superior de Economia e Gestão, and his MBA from the International Institute for Management Development.

Established in 2014 as a private equity firm, Hawthorn Investment engages in equity investment, M&As and capital management. It invests mainly in the emerging automotive technology, healthcare, high-end manufacturing, culture and sports sectors.

Established in 2014 as a private equity firm, Hawthorn Investment engages in equity investment, M&As and capital management. It invests mainly in the emerging automotive technology, healthcare, high-end manufacturing, culture and sports sectors.

Co-founder of Investree

Amir Amiruddin graduated from Erasmus University in the Netherlands in 1994 and the University of Western Australia in 2011. Amir was formerly the managing director of AAA Securities, a director at Deutsche Bank Singapore and the managing director of Nomura Singapore. He is currently a partner at business and management consultancy Pascal Capital Asia in Singapore. Amir became a co-founder of Investree in October 2015.

Amir Amiruddin graduated from Erasmus University in the Netherlands in 1994 and the University of Western Australia in 2011. Amir was formerly the managing director of AAA Securities, a director at Deutsche Bank Singapore and the managing director of Nomura Singapore. He is currently a partner at business and management consultancy Pascal Capital Asia in Singapore. Amir became a co-founder of Investree in October 2015.

Co-founder of Ngorder

Informatics Engineering graduate Agus E Setiyono is no stranger to entrepreneurship. After graduating in 2013 from Universitas Negeri Malang, Indonesia, he worked for a year as a web designer for vKios, an online store development service. At the same time, he also managed his own clothing store and co-founded FLAT Studio, a digital creative agency. In 2016, he established Ngorder, a full suite of e-commerce management tools for online shop owners.

Informatics Engineering graduate Agus E Setiyono is no stranger to entrepreneurship. After graduating in 2013 from Universitas Negeri Malang, Indonesia, he worked for a year as a web designer for vKios, an online store development service. At the same time, he also managed his own clothing store and co-founded FLAT Studio, a digital creative agency. In 2016, he established Ngorder, a full suite of e-commerce management tools for online shop owners.

Co-founder, CFO and Chief of Real Estate of GoWork

Richard Lim is a co-founder of Jakarta-based coworking operator GoWork. After GoWork's merger with Rework, he became the company's CFO and Chief of Real Estate. Prior to establishing GoWork, Richard had worked at the Monetary Authority of Singapore, Bain & Company and business consultancy firm Quvat Management. Richard graduated from Singapore's Nanyang Technological University with a bachelor's degree in Accounting. He also holds an MBA from Harvard Business School.

Richard Lim is a co-founder of Jakarta-based coworking operator GoWork. After GoWork's merger with Rework, he became the company's CFO and Chief of Real Estate. Prior to establishing GoWork, Richard had worked at the Monetary Authority of Singapore, Bain & Company and business consultancy firm Quvat Management. Richard graduated from Singapore's Nanyang Technological University with a bachelor's degree in Accounting. He also holds an MBA from Harvard Business School.

Co-founder and CTO of GoWork

Donny Tandianus is a co-founder of coworking space GoWork. After GoWork's merger with Rework, Donny became the company's CTO. Before establishing GoWork in 2016, Donny worked for nine years as a director at MagicBox, an advertising company specializing in outdoor advertisements. Donny holds a bachelor's degree in Computer Science from the University of Western Australia and attended the Business and Management program at the University of Melbourne.

Donny Tandianus is a co-founder of coworking space GoWork. After GoWork's merger with Rework, Donny became the company's CTO. Before establishing GoWork in 2016, Donny worked for nine years as a director at MagicBox, an advertising company specializing in outdoor advertisements. Donny holds a bachelor's degree in Computer Science from the University of Western Australia and attended the Business and Management program at the University of Melbourne.

Co-founder and CEO of Medigo

Harya Bimo was a freelance digital designer before starting his first business, digital agency Definite, in 2009. Over the years, Definite spawned smaller teams and subsidiaries, including the mobile-focused Flipbox, which Harya headed from 2013 to 2018. After shutting down Flipbox and leaving Definite in February 2018, Harya established Medigo, a hospital management platform. He is also co-founder and advisor of Qasir, a point-of-sale system startup.

Harya Bimo was a freelance digital designer before starting his first business, digital agency Definite, in 2009. Over the years, Definite spawned smaller teams and subsidiaries, including the mobile-focused Flipbox, which Harya headed from 2013 to 2018. After shutting down Flipbox and leaving Definite in February 2018, Harya established Medigo, a hospital management platform. He is also co-founder and advisor of Qasir, a point-of-sale system startup.

Co-founder and Chief of Integration of Medigo

Between 2011 and 2018, Eriza "Riza" Hanif was managing director and producer at digital agency Definite and its subsidiary, Flipbox. He later joined Definite CEO Harya Bimo and colleague Faizal Rahman to establish Medigo, a medical records digitization startup. He is currently Medigo's Chief of Integration, leading the integration of hospital and clinic data into Medigo's platform. Riza graduated from Universitas Indonesia with a bachelor's degree in Marketing Management.

Between 2011 and 2018, Eriza "Riza" Hanif was managing director and producer at digital agency Definite and its subsidiary, Flipbox. He later joined Definite CEO Harya Bimo and colleague Faizal Rahman to establish Medigo, a medical records digitization startup. He is currently Medigo's Chief of Integration, leading the integration of hospital and clinic data into Medigo's platform. Riza graduated from Universitas Indonesia with a bachelor's degree in Marketing Management.

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Fumi Technology: Getting ahead of human wealth managers with its Webull robo-advisors

Fumi's AI-based fintech platform offers real-time quotes and free trading to over 10m punters in 100 countries

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

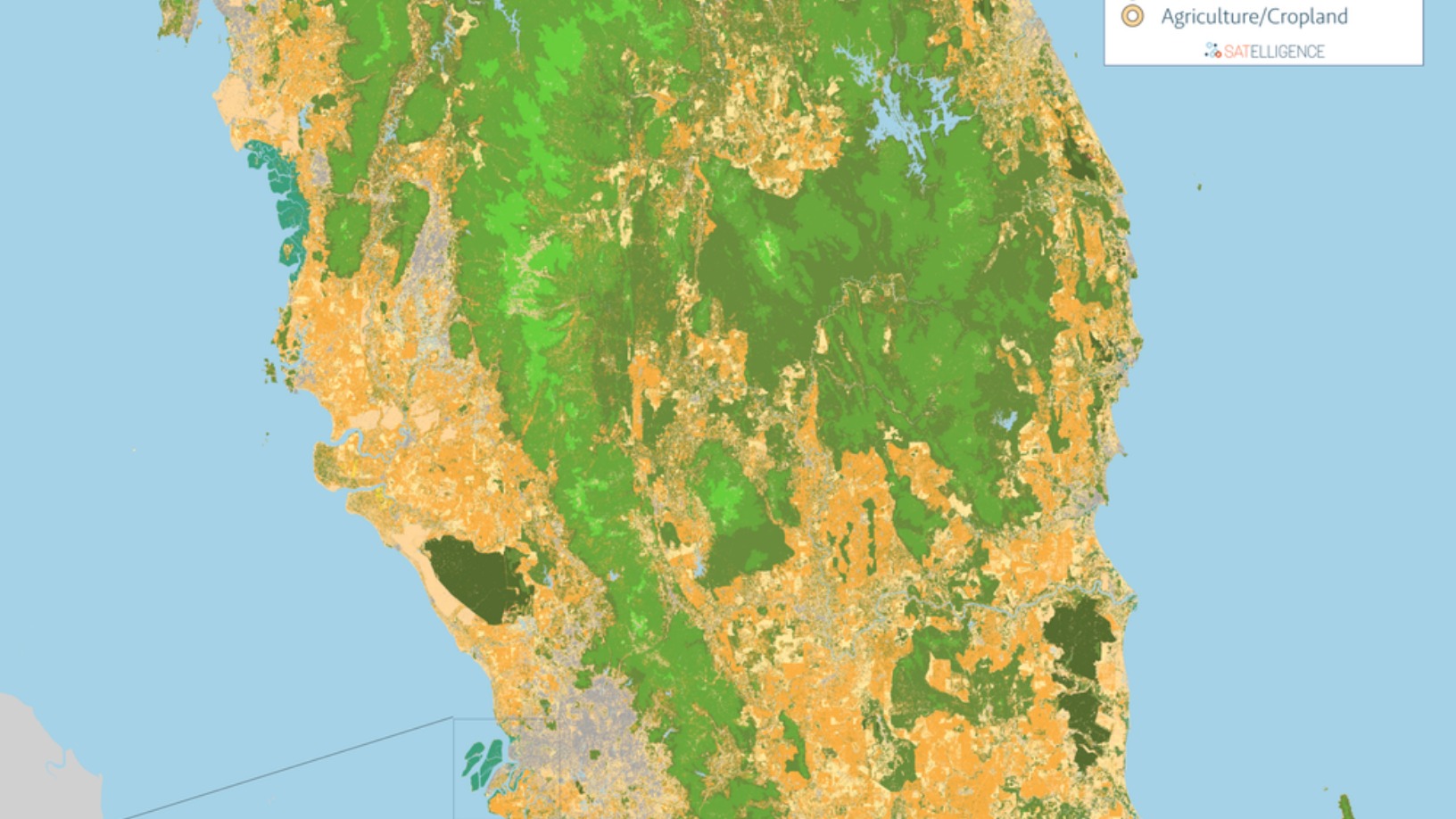

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Sorry, we couldn’t find any matches for“Unovis Asset Management”.