Unovis Asset Management

-

DATABASE (696)

-

ARTICLES (331)

CFO and Co-founder of Solatom

Raul Villalba Van Dijk is currently an energy management consultant at KPMG Madrid, having spent time in the consulting industry in Spain, South Africa and the UK. Since 2016, he has been CFO and a member of the founding team of Solatom, a startup developing solar concentrators for industrial applications. He graduated with a masters in science specializing in thermal energy systems for solar plants. He also holds an MBA from the London Business School.

Raul Villalba Van Dijk is currently an energy management consultant at KPMG Madrid, having spent time in the consulting industry in Spain, South Africa and the UK. Since 2016, he has been CFO and a member of the founding team of Solatom, a startup developing solar concentrators for industrial applications. He graduated with a masters in science specializing in thermal energy systems for solar plants. He also holds an MBA from the London Business School.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

The independent VC arm of Legend Holdings, Legend Capital currently manages several USD funds and RMB funds with over RMB 26 billion in assets under management. It focuses on early- and expansion-stage investment and has invested in over 300 companies as of 2016, of which more than 40 were exited via IPO, and around 40 were exits through M&A.

The independent VC arm of Legend Holdings, Legend Capital currently manages several USD funds and RMB funds with over RMB 26 billion in assets under management. It focuses on early- and expansion-stage investment and has invested in over 300 companies as of 2016, of which more than 40 were exited via IPO, and around 40 were exits through M&A.

Co-Stone is one of the earliest venture capital firms in China, with about RMB 30 billion in assets under management today. It operates growth-stage investments and pre-IPO financings, focusing on TMT, biotechnology, consumer and services sectors in China. It has invested in more than 80 companies, where Co-Stone was the lead investor in over 60% of the financings.

Co-Stone is one of the earliest venture capital firms in China, with about RMB 30 billion in assets under management today. It operates growth-stage investments and pre-IPO financings, focusing on TMT, biotechnology, consumer and services sectors in China. It has invested in more than 80 companies, where Co-Stone was the lead investor in over 60% of the financings.

Founder of DST Global, a late-stage investment firm with US $10 billion under management. Yuri Milner is one of the most influential tech investor in Russia. Under his leadership, DST Global invested in industry leading companies like Facebook, Twitter, Airbnb, Alibaba and Xiaomi. Together with Mark Zuckerberg and Sergey Brin, Yuri Milner founded the Breakthrough Prize to reward top scientists.

Founder of DST Global, a late-stage investment firm with US $10 billion under management. Yuri Milner is one of the most influential tech investor in Russia. Under his leadership, DST Global invested in industry leading companies like Facebook, Twitter, Airbnb, Alibaba and Xiaomi. Together with Mark Zuckerberg and Sergey Brin, Yuri Milner founded the Breakthrough Prize to reward top scientists.

Andy Zain is a veteran businessman, executive and angel investor. The Monash University graduate worked in management roles in various Indonesian tech companies and also co-founded companies like Elastisitas and Numedia Global. He is well-known as a founding partner and managing director at VC Kejora Ventures. Andy is also part of ANGIN, the Indonesian network of angel investors that collaborates with Grupara Ventures.

Andy Zain is a veteran businessman, executive and angel investor. The Monash University graduate worked in management roles in various Indonesian tech companies and also co-founded companies like Elastisitas and Numedia Global. He is well-known as a founding partner and managing director at VC Kejora Ventures. Andy is also part of ANGIN, the Indonesian network of angel investors that collaborates with Grupara Ventures.

Established in 2009, TCL Capital is the investment arm of TCL Corporation, which makes home appliances. TCL Capital has founded 12 venture capital funds in partnership with other stakeholders in China. Its assets under management are valued at billions of RMB. As of April 2017, it had invested in 76 startups, with an emphasis on display technology, high-end manufacturing, integrated circuits and high-end software services.

Established in 2009, TCL Capital is the investment arm of TCL Corporation, which makes home appliances. TCL Capital has founded 12 venture capital funds in partnership with other stakeholders in China. Its assets under management are valued at billions of RMB. As of April 2017, it had invested in 76 startups, with an emphasis on display technology, high-end manufacturing, integrated circuits and high-end software services.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

Spring Fund was founded in Beijing in May 2015 with RMB 300m initial funding. Its cornerstone investors include government guidance funds and Chunyu Mobile Health. Spring Fund mainly invests in the early stages of mobile healthtechs and startups with focus on intelligent hardware, smart assistance, online diagnosis, chronic disease management, cross-border healthcare, rural areas and the elderly population.

Spring Fund was founded in Beijing in May 2015 with RMB 300m initial funding. Its cornerstone investors include government guidance funds and Chunyu Mobile Health. Spring Fund mainly invests in the early stages of mobile healthtechs and startups with focus on intelligent hardware, smart assistance, online diagnosis, chronic disease management, cross-border healthcare, rural areas and the elderly population.

Founded in Shanghai in May 2015, CICC Zhide specializes in investment consultation, equity investment and management. The company is a subsidiary of CICC Capital that was established in 1995. The China International Capital Corporation (CICC) is China's first joint venture bank, with its HQ in Beijing. CICC was listed on the Hong Kong Stock Exchange in 2015.

Founded in Shanghai in May 2015, CICC Zhide specializes in investment consultation, equity investment and management. The company is a subsidiary of CICC Capital that was established in 1995. The China International Capital Corporation (CICC) is China's first joint venture bank, with its HQ in Beijing. CICC was listed on the Hong Kong Stock Exchange in 2015.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Formerly known as Tsinghua University Science Park (TusPark) Development Center founded in August 1994, Tus-Holdings was incorporated in 2000. The company takes full responsibility for developing, constructing, operating and managing TusPark.Tus-Holdings is the controlling shareholder, or shareholder, of over 800 listed and non-listed enterprises. The total assets under its management amount to nearly RMB 200bn.

Formerly known as Tsinghua University Science Park (TusPark) Development Center founded in August 1994, Tus-Holdings was incorporated in 2000. The company takes full responsibility for developing, constructing, operating and managing TusPark.Tus-Holdings is the controlling shareholder, or shareholder, of over 800 listed and non-listed enterprises. The total assets under its management amount to nearly RMB 200bn.

Founder and CEO of Infokost.id

Ex-Djarum employee Frandy Wirajaya Sugianto holds a Master of Management degree in Creative Marketing from the University of Surabaya (UBAYA). He joined clove cigarette manufacturer Djarum’s Sales and Marketing division in 2001 and worked for 10 years before being hired as the CEO of Infokost.id in 2011. In 2013, Frandy became the CEO of Global Visi Media (GVM) Networks, which includes companies such as Opini.id and Bolalob.com. Infokost.id is a company under GDP Venture group, founded and owned by Martin Hartono. The Hartono family also owns Djarum, Indonesia’s biggest cigarette manufacturer.

Ex-Djarum employee Frandy Wirajaya Sugianto holds a Master of Management degree in Creative Marketing from the University of Surabaya (UBAYA). He joined clove cigarette manufacturer Djarum’s Sales and Marketing division in 2001 and worked for 10 years before being hired as the CEO of Infokost.id in 2011. In 2013, Frandy became the CEO of Global Visi Media (GVM) Networks, which includes companies such as Opini.id and Bolalob.com. Infokost.id is a company under GDP Venture group, founded and owned by Martin Hartono. The Hartono family also owns Djarum, Indonesia’s biggest cigarette manufacturer.

Co-Founder and CEO of Gadjian

Nanyang Technological University of Singapore MBA graduate Afia Fitriati holds a bachelor’s in Marketing from Syracuse University, USA. Post-MBA, she held various roles in different companies, including as an editor at Aquila Magazine and a lecturer in Islamic Marketing at Paramadina University. She co-founded FAST8, a human resources tech company, in 2008 with her husband, Else Fernanda. They also founded Gadjian, an HR management SaaS startup. Currently, Afia is also a senior associate in the Halal Lifestyle Market at DinarStandard, a growth strategy research and advisory firm.

Nanyang Technological University of Singapore MBA graduate Afia Fitriati holds a bachelor’s in Marketing from Syracuse University, USA. Post-MBA, she held various roles in different companies, including as an editor at Aquila Magazine and a lecturer in Islamic Marketing at Paramadina University. She co-founded FAST8, a human resources tech company, in 2008 with her husband, Else Fernanda. They also founded Gadjian, an HR management SaaS startup. Currently, Afia is also a senior associate in the Halal Lifestyle Market at DinarStandard, a growth strategy research and advisory firm.

Co-founder and COO of Loket

After graduating in 1997 from the University of Indonesia, Bagus Utama became a long-time player in the events industry. Bagus co-founded RajaKarcis, an online ticketing company in 2003. After nine years as CEO, Bagus left the company in 2012 to set up Concertholic, a website promoting music concerts and events. In January 2016, he became the COO of PT Global Loket Sejahtera. He is also responsible for the business development of Loket, an event management and Big Data solutions company.

After graduating in 1997 from the University of Indonesia, Bagus Utama became a long-time player in the events industry. Bagus co-founded RajaKarcis, an online ticketing company in 2003. After nine years as CEO, Bagus left the company in 2012 to set up Concertholic, a website promoting music concerts and events. In January 2016, he became the COO of PT Global Loket Sejahtera. He is also responsible for the business development of Loket, an event management and Big Data solutions company.

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Fumi Technology: Getting ahead of human wealth managers with its Webull robo-advisors

Fumi's AI-based fintech platform offers real-time quotes and free trading to over 10m punters in 100 countries

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

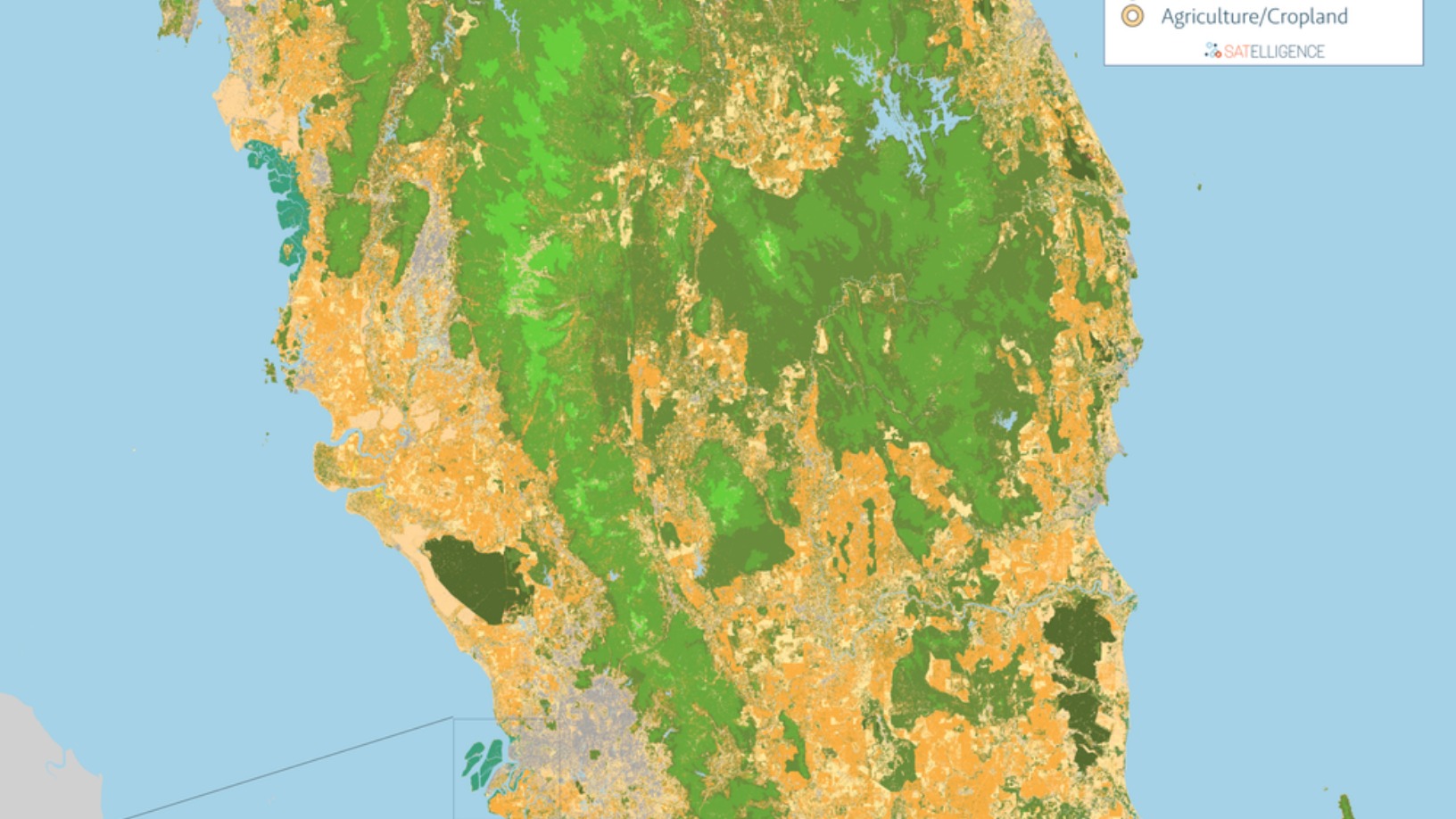

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Sorry, we couldn’t find any matches for“Unovis Asset Management”.