Unovis Asset Management

-

DATABASE (696)

-

ARTICLES (331)

Founded in 2005, Fortune Link focuses on private equity investment. Its founder, Kan Zhidong was also the founder of Shenzhen Capital Group, one of the first few venture capitalists in China. As at March 2018, it had set up a number of funds and managed over 20 investment teams.With over RMB 30bn worth of assets under its management, Fortune Link mainly invests in sectors including TMT, environmental protection, advanced material, healthcare, high tech industries, culture and media.

Founded in 2005, Fortune Link focuses on private equity investment. Its founder, Kan Zhidong was also the founder of Shenzhen Capital Group, one of the first few venture capitalists in China. As at March 2018, it had set up a number of funds and managed over 20 investment teams.With over RMB 30bn worth of assets under its management, Fortune Link mainly invests in sectors including TMT, environmental protection, advanced material, healthcare, high tech industries, culture and media.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Founded in 2010, WestSummit Capital is a US-focused, growth-stage venture capital fund with a strong presence in Silicon Valley, Beijing, Hong Kong and Dublin. It has a total of over $400m under management, and invests in the mobile, internet, cloud computing, big data and IoT sectors. In 2013, it participated in a Series C $20m investment in Twitch, the world's leading video platform and community for gamers, which was acquired by Amazon in August 2014 for close to $1bn.

Founded in 2010, WestSummit Capital is a US-focused, growth-stage venture capital fund with a strong presence in Silicon Valley, Beijing, Hong Kong and Dublin. It has a total of over $400m under management, and invests in the mobile, internet, cloud computing, big data and IoT sectors. In 2013, it participated in a Series C $20m investment in Twitch, the world's leading video platform and community for gamers, which was acquired by Amazon in August 2014 for close to $1bn.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

Co-Founder and CEO of IDNtimes

Formerly from Google Singapore, Winston Utomo earned his bachelor’s degree from the University of Southern California (USC) in 2012 and a Master of Science degree from Columbia University in 2014. Hailing from Surabaya, he was the president of USC Association of Indonesian Students during his studies at USC. Before co-founding the media company PT IDN Media in June 2014, Winston was a Senior Account Strategist at Google Singapore until October 2015. He was also a project manager at St. John Capital Management in 2012.Besides being the co-founder and CEO of IDN Media, he is also the Editor-in-Chief of IDN Media that owns IDNtimes.

Formerly from Google Singapore, Winston Utomo earned his bachelor’s degree from the University of Southern California (USC) in 2012 and a Master of Science degree from Columbia University in 2014. Hailing from Surabaya, he was the president of USC Association of Indonesian Students during his studies at USC. Before co-founding the media company PT IDN Media in June 2014, Winston was a Senior Account Strategist at Google Singapore until October 2015. He was also a project manager at St. John Capital Management in 2012.Besides being the co-founder and CEO of IDN Media, he is also the Editor-in-Chief of IDN Media that owns IDNtimes.

Co-founder & CPO of Ontruck

Escribano is a computer engineer with a master's in IT Management from the Illinois Institute of Technology. He was Co-founder and Product Manager of TouristEye, a company sold to Lonely Planet in 2013.In 2014, he co-founded Seltag, a marketplace for buying and selling second-hand goods. Seltag was used by over 200,000 users across Spain but was unable to compete against larger platforms in the market so the business was closed down at the end of 2015.in 2016, he co-founded OnTruck, a leading innovation-oriented logistics company that optimizes road freight transportation through technology, and has since been its chief procurement manager.

Escribano is a computer engineer with a master's in IT Management from the Illinois Institute of Technology. He was Co-founder and Product Manager of TouristEye, a company sold to Lonely Planet in 2013.In 2014, he co-founded Seltag, a marketplace for buying and selling second-hand goods. Seltag was used by over 200,000 users across Spain but was unable to compete against larger platforms in the market so the business was closed down at the end of 2015.in 2016, he co-founded OnTruck, a leading innovation-oriented logistics company that optimizes road freight transportation through technology, and has since been its chief procurement manager.

Founder, CEO of Zero 2 Infinity

López-Urdiales is a Spanish aeronautical engineer. In 2009, he founded space transportation company, Zero 2 Infinity, and is also its CEO. Prior to that, he lectured at the Polytechnic University of Catalonia in space vehicles and space propulsion and was General Manager at the Barcelona Aeronautics and Space Association. He has previously worked at Boeing and Boston Consulting Group. He holds an MBA in Management from Paris' Institute of Engineers and two master's degrees, one in Aeronautical Engineering from the University Polytechnic of Madrid, and the other in Aeronautics and Astronautics from the Massachusetts Institute of Technology (MITT).

López-Urdiales is a Spanish aeronautical engineer. In 2009, he founded space transportation company, Zero 2 Infinity, and is also its CEO. Prior to that, he lectured at the Polytechnic University of Catalonia in space vehicles and space propulsion and was General Manager at the Barcelona Aeronautics and Space Association. He has previously worked at Boeing and Boston Consulting Group. He holds an MBA in Management from Paris' Institute of Engineers and two master's degrees, one in Aeronautical Engineering from the University Polytechnic of Madrid, and the other in Aeronautics and Astronautics from the Massachusetts Institute of Technology (MITT).

CEO and Co-founder of Nusantics

Self-styled “bio-based economy enabler”, Sharlini Eriza Putri has held various industrial engineering roles since graduating in 2009 with a bachelor's in Chemical Engineering from Institut Teknologi Bandung. She joined Nestle as a management trainee and later became a process engineer until 2013. She left Nestle to read a master's in Sustainable Energy (Mechanical Engineering) at Imperial College London. In 2015, she started an independent consultancy for sustainable energy in Jakarta.In 2016, she became the head of center of excellence for the sugar industry conglomerate Samora Group. In 2019, she set up Nusantics to sell skincare products with natural ingredients. In 2020, Putri left Samora to work full-time at Nusantics as CEO.

Self-styled “bio-based economy enabler”, Sharlini Eriza Putri has held various industrial engineering roles since graduating in 2009 with a bachelor's in Chemical Engineering from Institut Teknologi Bandung. She joined Nestle as a management trainee and later became a process engineer until 2013. She left Nestle to read a master's in Sustainable Energy (Mechanical Engineering) at Imperial College London. In 2015, she started an independent consultancy for sustainable energy in Jakarta.In 2016, she became the head of center of excellence for the sugar industry conglomerate Samora Group. In 2019, she set up Nusantics to sell skincare products with natural ingredients. In 2020, Putri left Samora to work full-time at Nusantics as CEO.

Co-CEO and co-founder of Elio

Walton Hartanto graduated in Business Administration and Management at the University of Southern California in 2014. While in the US, he worked for over a year as a financial analyst at Houlihan Lokey, an American multinational independent investment bank and financial services company in San Francisco. In 2016, he worked as an analyst for private equity firm General Atlantic in Singapore. He returned to Jakarta in August 2018 and worked in business development for Wahyu Abadi, an Indonesian company that focused on printing, packaging, digital and supply chain technology. Walton and his older brother Waldo co-founded Elio in April 2018, an Indonesian online health clinic for men.

Walton Hartanto graduated in Business Administration and Management at the University of Southern California in 2014. While in the US, he worked for over a year as a financial analyst at Houlihan Lokey, an American multinational independent investment bank and financial services company in San Francisco. In 2016, he worked as an analyst for private equity firm General Atlantic in Singapore. He returned to Jakarta in August 2018 and worked in business development for Wahyu Abadi, an Indonesian company that focused on printing, packaging, digital and supply chain technology. Walton and his older brother Waldo co-founded Elio in April 2018, an Indonesian online health clinic for men.

Co-founder, COO of Kibus Petcare

Marta Arisa is co-founder and COO at Kibus Petcare, the first hardware that automatically cooks and dispenses healthy pet food. She has worked there since 2018. She simultaneously continues to work at the Catalan Tourist Board, where she is currently budget manager. Prior to this, she worked in human resources at Innova Humana Consultores for one and a half years and for two years in business support at the Polytechnic University of Catalonia's corporate innovation program Innova. She also briefly worked as a consultant at the business transfer Marketplace for SMEs in Catalonia.Arisa holds a Master's degree in Financial Management and Accounting from Barcelona's Pompeu Fabra University.

Marta Arisa is co-founder and COO at Kibus Petcare, the first hardware that automatically cooks and dispenses healthy pet food. She has worked there since 2018. She simultaneously continues to work at the Catalan Tourist Board, where she is currently budget manager. Prior to this, she worked in human resources at Innova Humana Consultores for one and a half years and for two years in business support at the Polytechnic University of Catalonia's corporate innovation program Innova. She also briefly worked as a consultant at the business transfer Marketplace for SMEs in Catalonia.Arisa holds a Master's degree in Financial Management and Accounting from Barcelona's Pompeu Fabra University.

CEO and co-founder of RecyGlo

Shwe Yamin Oo graduated in computer science at the University of Computer Studies in Yangon in 2007. She has also completed a business management diploma in 2013.In March 2009, she established Shwe Bon Thar computer training center and became the COO and co-founder of its internet center and mart until 2013. In 2014, she founded an accounting tech startup Modern Boss mobile POS for local SMEs. She exited the fintech in 2017 to set up RecyGlo as CEO.In 2019, she was nominated for the Women of the Future awards for Southeast Asia in the Science, Technology and Digital categories. She is also a mentor at Yangon’s Founder Institute.

Shwe Yamin Oo graduated in computer science at the University of Computer Studies in Yangon in 2007. She has also completed a business management diploma in 2013.In March 2009, she established Shwe Bon Thar computer training center and became the COO and co-founder of its internet center and mart until 2013. In 2014, she founded an accounting tech startup Modern Boss mobile POS for local SMEs. She exited the fintech in 2017 to set up RecyGlo as CEO.In 2019, she was nominated for the Women of the Future awards for Southeast Asia in the Science, Technology and Digital categories. She is also a mentor at Yangon’s Founder Institute.

Established in 2000. With RMB 15 billion under management, Fortune Capital focuses on companies in the TMT, consumer goods & services, modern agriculture and cleantech sectors. It has invested in about 300 startups including Qingke, Hammerhead Sharks, StoreMax and NTS Technology.

Established in 2000. With RMB 15 billion under management, Fortune Capital focuses on companies in the TMT, consumer goods & services, modern agriculture and cleantech sectors. It has invested in about 300 startups including Qingke, Hammerhead Sharks, StoreMax and NTS Technology.

The Chinese affiliate of top Silicon Valley venture capital firm Sequoia Capital was founded in 2005 by Neil Shen (Shen Nanpeng), a co-founder of Ctrip, China's largest travel booking site. With more than US$6 billion under management in 2015, the firm has invested in more than 300 startups in China, including some of the country's biggest brands: Alibaba, JD.com, Didi, DJI, Sina and Qihoo 360. Sequoia, together with China Broadband Capital, also helped to bring to China LinkedIn and AirBnB, companies that both have invested in.

The Chinese affiliate of top Silicon Valley venture capital firm Sequoia Capital was founded in 2005 by Neil Shen (Shen Nanpeng), a co-founder of Ctrip, China's largest travel booking site. With more than US$6 billion under management in 2015, the firm has invested in more than 300 startups in China, including some of the country's biggest brands: Alibaba, JD.com, Didi, DJI, Sina and Qihoo 360. Sequoia, together with China Broadband Capital, also helped to bring to China LinkedIn and AirBnB, companies that both have invested in.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

Xia Zuoquan (b. 1963) co-founded BYD in 1996, which makes cars as well as batteries for electric vehicles. BYD is about 10% owned by Warren Buffett's Berkshire Hathaway. Xia founded Zhengxuan Capital in 2004, an investment firm having over RMB 10 billion in assets under management. Zhengxuan Capital has invested in more than 30 companies in gene sequencing, robotics, smart hardware, chip design, supply chain finance and talent assessment sectors. Xia was placed no. 256 in the 2015 Forbes China Rich List, with an estimated net worth US$1.2 billion.

Xia Zuoquan (b. 1963) co-founded BYD in 1996, which makes cars as well as batteries for electric vehicles. BYD is about 10% owned by Warren Buffett's Berkshire Hathaway. Xia founded Zhengxuan Capital in 2004, an investment firm having over RMB 10 billion in assets under management. Zhengxuan Capital has invested in more than 30 companies in gene sequencing, robotics, smart hardware, chip design, supply chain finance and talent assessment sectors. Xia was placed no. 256 in the 2015 Forbes China Rich List, with an estimated net worth US$1.2 billion.

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Fumi Technology: Getting ahead of human wealth managers with its Webull robo-advisors

Fumi's AI-based fintech platform offers real-time quotes and free trading to over 10m punters in 100 countries

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

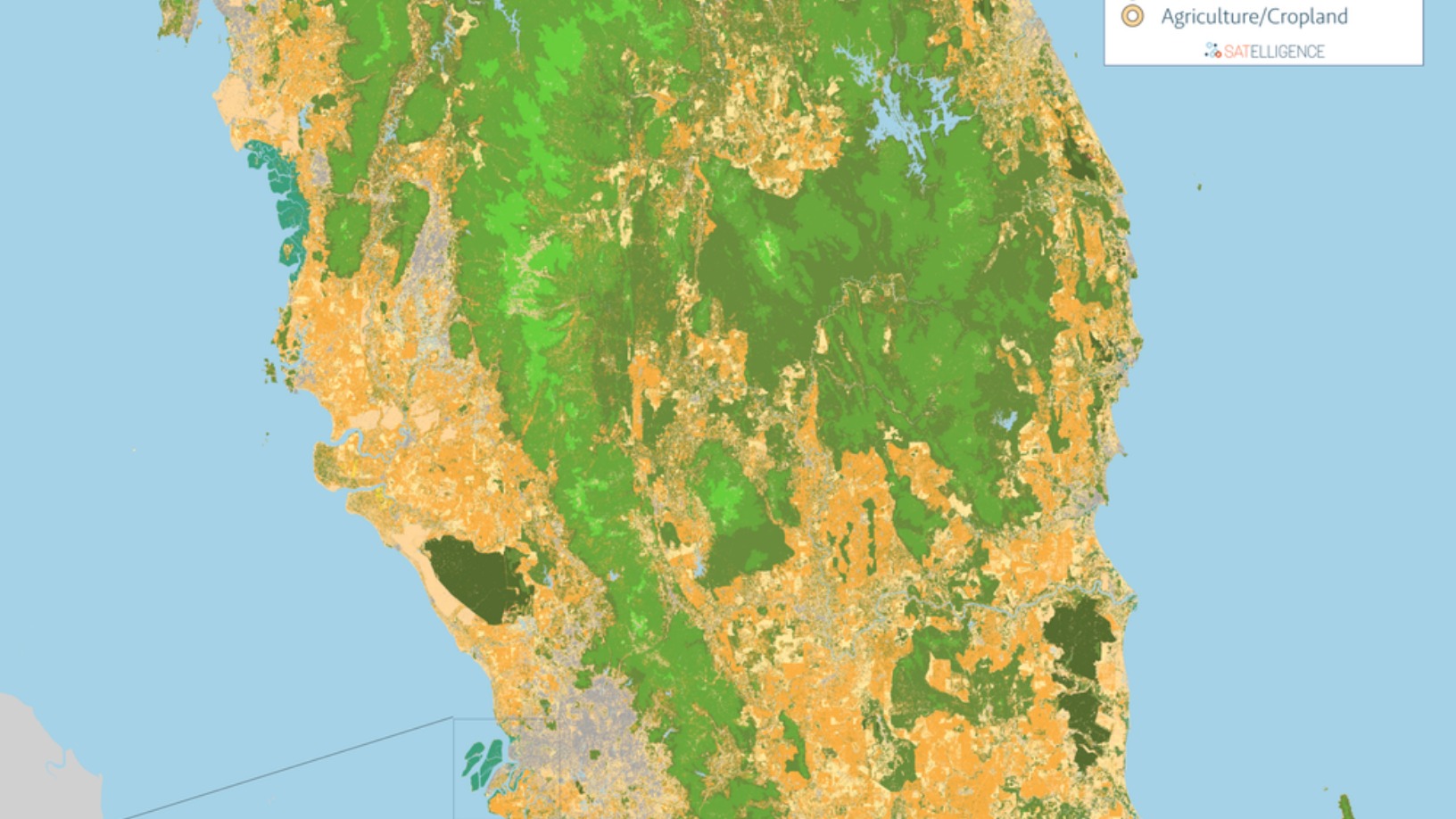

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Sorry, we couldn’t find any matches for“Unovis Asset Management”.