Unovis Asset Management

-

DATABASE (696)

-

ARTICLES (331)

Being the first investment group in Zhejiang province to list on the NEEQ market, ZSVC has over 30 funds under its management today, amounting to nearly RMB 40 billion. Founded in 2007, it is the major investor for more than 130 Chinese startups across healthcare, media & entertainment, logistic and advanced manufacturing sectors, with more than 30 successful exits. Headquartered in Hangzhou, it has taken its widely acclaimed “Zhejiang Entrepreneur Experience” to a broader world with subsidiaries in Beijing, Shanghai, Shenzhen, Shenyang and the Silicon Valley.

Being the first investment group in Zhejiang province to list on the NEEQ market, ZSVC has over 30 funds under its management today, amounting to nearly RMB 40 billion. Founded in 2007, it is the major investor for more than 130 Chinese startups across healthcare, media & entertainment, logistic and advanced manufacturing sectors, with more than 30 successful exits. Headquartered in Hangzhou, it has taken its widely acclaimed “Zhejiang Entrepreneur Experience” to a broader world with subsidiaries in Beijing, Shanghai, Shenzhen, Shenyang and the Silicon Valley.

Álvaro Ortiz is a business angel with over 15 years of experience in the fields of User Experience, E-commerce, Communities, Online Marketing, Front-end development and Project Management.He founded Mumumío, an e-commerce platform that sold quality food directly from producers. Ortiz is currently the CEO and founder of Populate, a startup that builds tools and platforms for civic engagement.Besides being an internet expert and a founder of several startups, he has also been involved in fundraising for other startups.

Álvaro Ortiz is a business angel with over 15 years of experience in the fields of User Experience, E-commerce, Communities, Online Marketing, Front-end development and Project Management.He founded Mumumío, an e-commerce platform that sold quality food directly from producers. Ortiz is currently the CEO and founder of Populate, a startup that builds tools and platforms for civic engagement.Besides being an internet expert and a founder of several startups, he has also been involved in fundraising for other startups.

Founded in 2004, Polaris Capital Group is a Japanese private equity fund management firm. Since its inception, Polaris has invested in about 30 Japanese companies. It completed the fourth round of fundraising for its Polaris Private Equity Fund IV in April 2017, during which it raised JPY 75 billion. The new fund will invest in Japanese companies in the manufacturing sector with globally competitive technologies/patents as well as companies with strong brands or unique business models in the consumer goods, retail and logistics sectors.

Founded in 2004, Polaris Capital Group is a Japanese private equity fund management firm. Since its inception, Polaris has invested in about 30 Japanese companies. It completed the fourth round of fundraising for its Polaris Private Equity Fund IV in April 2017, during which it raised JPY 75 billion. The new fund will invest in Japanese companies in the manufacturing sector with globally competitive technologies/patents as well as companies with strong brands or unique business models in the consumer goods, retail and logistics sectors.

Partech Ventures is a global venture capital firm established in San Francisco in 1982 as Paribas Technologies, a subsidiary of French bank Paribas that currently holds €1.3 billion in assets under its management. In addition to San Francisco, Partech also has offices in Paris, Berlin and Dakar, Senegal, with the latter focused exclusively on African startups. The company is now based in Paris and has invested in over 300 companies across different funding stages with 48 exits to date.

Partech Ventures is a global venture capital firm established in San Francisco in 1982 as Paribas Technologies, a subsidiary of French bank Paribas that currently holds €1.3 billion in assets under its management. In addition to San Francisco, Partech also has offices in Paris, Berlin and Dakar, Senegal, with the latter focused exclusively on African startups. The company is now based in Paris and has invested in over 300 companies across different funding stages with 48 exits to date.

United Fund was founded in 2015 to provide Zhejiang's SME businesses with support in financing, business collaborations, operations and management. It now manages total of assets worth RMB 3bn.

United Fund was founded in 2015 to provide Zhejiang's SME businesses with support in financing, business collaborations, operations and management. It now manages total of assets worth RMB 3bn.

An experienced product manager, Mateo del Río graduated with a degree in Economics and International Business Management from the LUISS Business School in Rome. He also holds two master's degrees, one in Philosophy and another in Marketing Automation.Del Río worked for four years at Ticketbis (now owned by eBay) in multiple capacities, as product manager and in the financial departments for the APAC and LATAM regions.Since 2018, he's been a shareholder and CPO at Reclamador.es, a web platform that manages and automates consumer claims.

An experienced product manager, Mateo del Río graduated with a degree in Economics and International Business Management from the LUISS Business School in Rome. He also holds two master's degrees, one in Philosophy and another in Marketing Automation.Del Río worked for four years at Ticketbis (now owned by eBay) in multiple capacities, as product manager and in the financial departments for the APAC and LATAM regions.Since 2018, he's been a shareholder and CPO at Reclamador.es, a web platform that manages and automates consumer claims.

LGT Venture Philanthropy is an independent charitable foundation that supports organizations and companies which implement solutions that contribute to the achievement of sustainable development goals. It strives to improve the quality of life of disadvantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. LGT supports the growth of innovative social organizations by providing them with a tailored combination of growth capital, access to business skills, management know-how and strategic advice.

LGT Venture Philanthropy is an independent charitable foundation that supports organizations and companies which implement solutions that contribute to the achievement of sustainable development goals. It strives to improve the quality of life of disadvantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. LGT supports the growth of innovative social organizations by providing them with a tailored combination of growth capital, access to business skills, management know-how and strategic advice.

Established in 2015, Olisipo Way is a Portuguese investor that funds early-stage investment in Portuguese tech and non-tech startups with a potential for international expansion acros all market verticals. It currently has 26 startups in its portfolio and recent investments include in the €125,000 pre-seed and €1.1m first phase seed round of healthy food service EatTasty. It has also invested in the €350,000 pre-seed round of revenue management for traveltech Climber and in the US$725,000 pre-seed round of adtech advertio.

Established in 2015, Olisipo Way is a Portuguese investor that funds early-stage investment in Portuguese tech and non-tech startups with a potential for international expansion acros all market verticals. It currently has 26 startups in its portfolio and recent investments include in the €125,000 pre-seed and €1.1m first phase seed round of healthy food service EatTasty. It has also invested in the €350,000 pre-seed round of revenue management for traveltech Climber and in the US$725,000 pre-seed round of adtech advertio.

Mubadala was founded in 2017 and was directly listed as a Public Joint Stock Company, merging the Mubadala Development Company and the International Petroleum Investment Company (IPIC).Mubadala is owned by the government of Abu Dhabi in the United Arab Emirates (UAE) with approximately $299bn assets under management and operations across 50 countries. Mubadala owns the Advanced Technology Investment Company (ATIC), a firm acting as an investment vehicle in high technology sectors.

Mubadala was founded in 2017 and was directly listed as a Public Joint Stock Company, merging the Mubadala Development Company and the International Petroleum Investment Company (IPIC).Mubadala is owned by the government of Abu Dhabi in the United Arab Emirates (UAE) with approximately $299bn assets under management and operations across 50 countries. Mubadala owns the Advanced Technology Investment Company (ATIC), a firm acting as an investment vehicle in high technology sectors.

Spain's first social impact investment fund Creas Foundation invests in business projects which prioritize the creation of social and environmental value. It acts as an investor and partner in financial, management and strategic decisions. Its goal is to facilitate access to funding and accelerate growth of social businesses which have an innovative approach and sustainable income model. It has fixed a target of €30m to invest in social enterprise startups. The fund offers participatory loans or capital injections ranging from €5,000 to €25,000.

Spain's first social impact investment fund Creas Foundation invests in business projects which prioritize the creation of social and environmental value. It acts as an investor and partner in financial, management and strategic decisions. Its goal is to facilitate access to funding and accelerate growth of social businesses which have an innovative approach and sustainable income model. It has fixed a target of €30m to invest in social enterprise startups. The fund offers participatory loans or capital injections ranging from €5,000 to €25,000.

A private equity arm of China state-backed conglomerate CITIC Group Corp., CITIC Private Equity Funds Management (also known as CITIC PE or CPE) is one of the largest PE investors in China. It was founded in June 2008, managing over RMB 100bn worth of assets including private equity, mezzanine and public market funds. With over 200 investors from home and abroad, CPE focuses on investment opportunities in diverse sectors like healthcare, consumer goods, Internet, technology, software, enterprise tech and real estate. The firm has made investments in more than 100 enterprises.

A private equity arm of China state-backed conglomerate CITIC Group Corp., CITIC Private Equity Funds Management (also known as CITIC PE or CPE) is one of the largest PE investors in China. It was founded in June 2008, managing over RMB 100bn worth of assets including private equity, mezzanine and public market funds. With over 200 investors from home and abroad, CPE focuses on investment opportunities in diverse sectors like healthcare, consumer goods, Internet, technology, software, enterprise tech and real estate. The firm has made investments in more than 100 enterprises.

Founded in 1904, Duke Energy is a North Carolina-based utilities company that has the objective of zero methane emissions by 2030. It occasianally invests in US tech startups looking to offset greenhouse gas emissions and has invested in four startups to date. Its most recent investments were in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2019 $5m round of energy management software producer Phoenix ET.

Founded in 1904, Duke Energy is a North Carolina-based utilities company that has the objective of zero methane emissions by 2030. It occasianally invests in US tech startups looking to offset greenhouse gas emissions and has invested in four startups to date. Its most recent investments were in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2019 $5m round of energy management software producer Phoenix ET.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

NGP Capital was founded in 2005 with Nokia and Bell Labs as its limited partners. It has investment teams in Asia (India and China), North America and Europe. It invests mainly in growth-stage companies with typical investments ranging from $8m–$12m.With more than $1.2bn under management, NGP Capital's portfolio includes Xiaomi, Deliveroo and UCweb. As of July 2019, NGP Capital had invested in more than 90 companies, including eight IPOs and 33 M&As. It focuses also on mobility and digital health sectors.

NGP Capital was founded in 2005 with Nokia and Bell Labs as its limited partners. It has investment teams in Asia (India and China), North America and Europe. It invests mainly in growth-stage companies with typical investments ranging from $8m–$12m.With more than $1.2bn under management, NGP Capital's portfolio includes Xiaomi, Deliveroo and UCweb. As of July 2019, NGP Capital had invested in more than 90 companies, including eight IPOs and 33 M&As. It focuses also on mobility and digital health sectors.

Founded in Hong Kong in 2018, Lake Bleu Capital currently operates in both Hong Kong and Shanghai. With assets worth billions of US dollars under management, it mainly invests in pharmaceuticals, biotech, medical devices and healthcare services companies in Asia, especially Greater China. Its limited partners include sovereign wealth funds, university endowments, foundations, pension funds, and family offices across the world.With a long-term investment strategy, Lake Bleu Capital invests through both public and private equity with a focus on mid- to late-stage companies.

Founded in Hong Kong in 2018, Lake Bleu Capital currently operates in both Hong Kong and Shanghai. With assets worth billions of US dollars under management, it mainly invests in pharmaceuticals, biotech, medical devices and healthcare services companies in Asia, especially Greater China. Its limited partners include sovereign wealth funds, university endowments, foundations, pension funds, and family offices across the world.With a long-term investment strategy, Lake Bleu Capital invests through both public and private equity with a focus on mid- to late-stage companies.

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Fumi Technology: Getting ahead of human wealth managers with its Webull robo-advisors

Fumi's AI-based fintech platform offers real-time quotes and free trading to over 10m punters in 100 countries

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

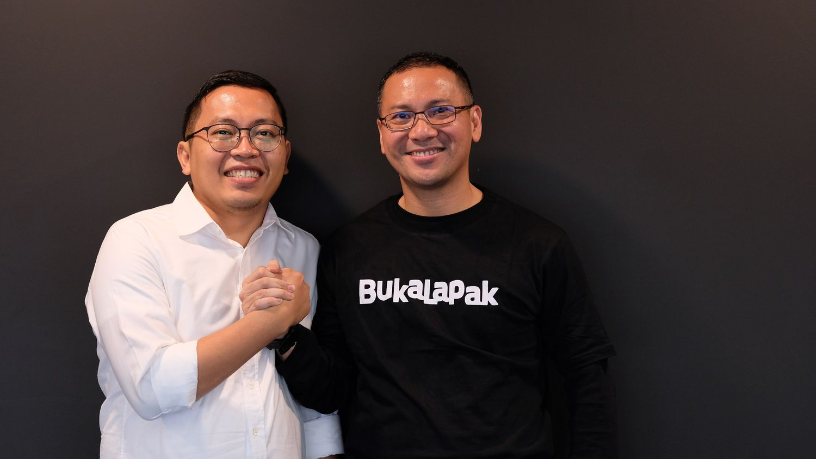

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

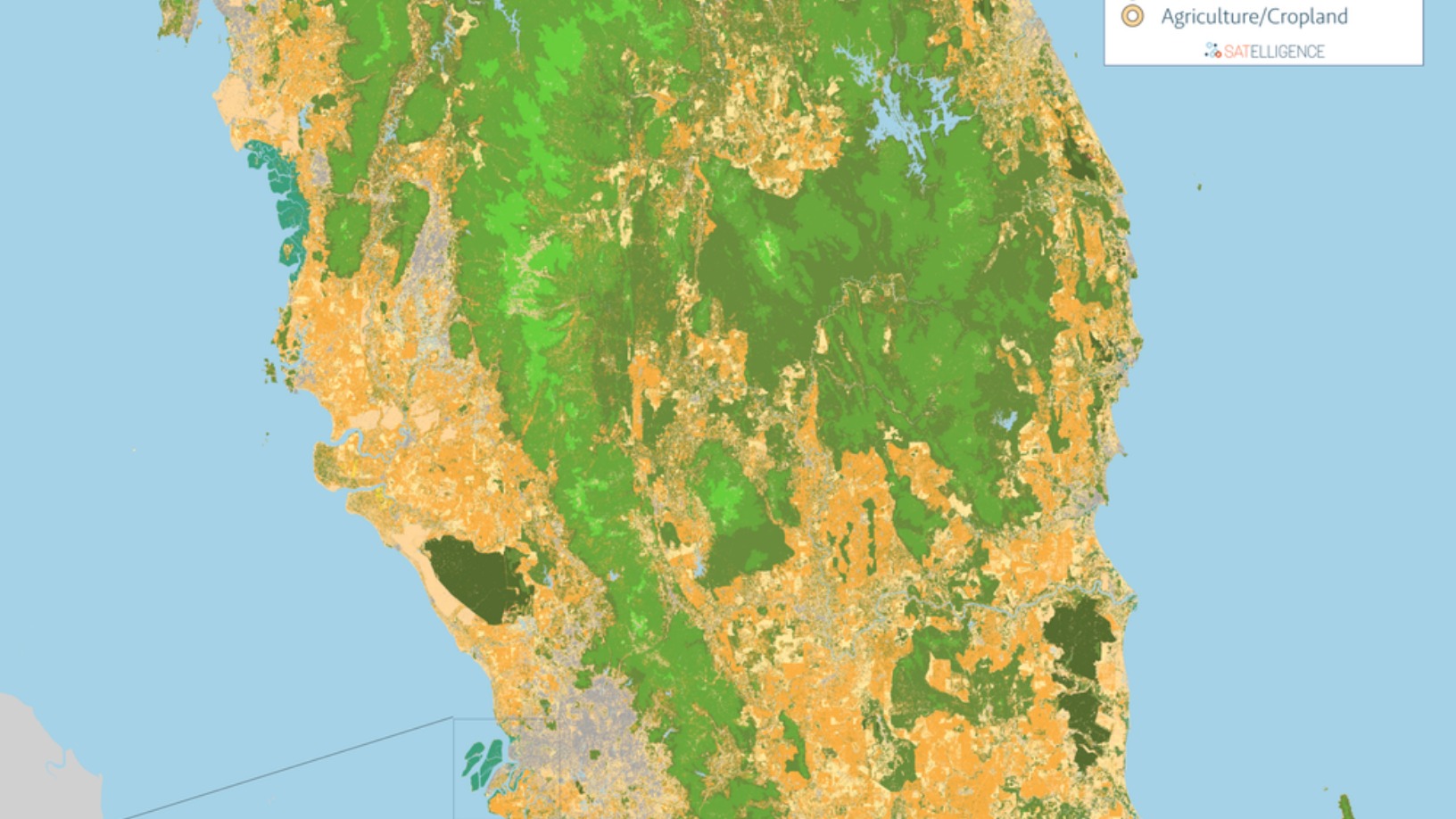

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Sorry, we couldn’t find any matches for“Unovis Asset Management”.