Unovis Asset Management

-

DATABASE (696)

-

ARTICLES (331)

Co-founder of Therapixal

Pierre Fillard is Chief Science Officer and co-founder of Therapixel, creator of AI-powered breast cancer screening and diagnosis software MammoScreen. At Therapixel, he previously held the positions of CEO and CTO. Before founding Therapixel, Fillard was a senior research scientist at INRIA (National Institute for Research in Digital Science and Technology), where he focused on medical imaging and image processing. He has also been a visiting lecturer at CPE Lyon, a research associate at the French Alternative Energies and Atomic Agencies Commission, a PhD candidate at INRIA, and a research assistant at the University of North Carolina. He has a diploma from the HEC School of Management, a master’s in science, mathematics and computer science from the Université Jean Monnet Saint-Etienne and a degree in engineering, computer science, and applied mathematics from the Ecole Supérieure de Chimie Physique Electronique de Lyon.

Pierre Fillard is Chief Science Officer and co-founder of Therapixel, creator of AI-powered breast cancer screening and diagnosis software MammoScreen. At Therapixel, he previously held the positions of CEO and CTO. Before founding Therapixel, Fillard was a senior research scientist at INRIA (National Institute for Research in Digital Science and Technology), where he focused on medical imaging and image processing. He has also been a visiting lecturer at CPE Lyon, a research associate at the French Alternative Energies and Atomic Agencies Commission, a PhD candidate at INRIA, and a research assistant at the University of North Carolina. He has a diploma from the HEC School of Management, a master’s in science, mathematics and computer science from the Université Jean Monnet Saint-Etienne and a degree in engineering, computer science, and applied mathematics from the Ecole Supérieure de Chimie Physique Electronique de Lyon.

Chief Project Manager and co-founder of IXON Food Technology

Elton Ho completed a master’s in food analysis and food safety management at Hong Kong Baptist University in 2015. Ho met Felix Cheung during the master’s program and they continued to develop the advanced sous-vide aseptic packaging (ASAP) technology after their graduation. They went on to co-found IXON Food Technology in January 2017, with funding from an angel investor.Ho had previously worked as a laboratory supervisor for nine years at the Vegetable Marketing Organization (VMO), monitoring the levels of pesticide chemical residues and heavy metals in domestic and imported fruits and vegetables. The VMO is a self-financing, non-profit organization established in 1946 to support local vegetable wholesalers and customers in Hong Kong. It also ensures food safety standards compliance and supports the sustainable development of local agriculture.

Elton Ho completed a master’s in food analysis and food safety management at Hong Kong Baptist University in 2015. Ho met Felix Cheung during the master’s program and they continued to develop the advanced sous-vide aseptic packaging (ASAP) technology after their graduation. They went on to co-found IXON Food Technology in January 2017, with funding from an angel investor.Ho had previously worked as a laboratory supervisor for nine years at the Vegetable Marketing Organization (VMO), monitoring the levels of pesticide chemical residues and heavy metals in domestic and imported fruits and vegetables. The VMO is a self-financing, non-profit organization established in 1946 to support local vegetable wholesalers and customers in Hong Kong. It also ensures food safety standards compliance and supports the sustainable development of local agriculture.

Formerly known as Google Ventures and established in 2009, GV is the VC arm of Alphabet, Inc. and stresses that it invests in the “best companies, not strategic investment for Google”. GV is headquartered in Mountain View, California, with offices in San Francisco, Boston, New York, and London and it currently has over US$3.5 billion under management. It has invested in more than 600 companies across different sectors and stages, with more than 160 as lead investor and has seen 120 exits. Its recent investments include in Lemonade and KeepTruckin's Series D rounds and in Harness' Series B.

Formerly known as Google Ventures and established in 2009, GV is the VC arm of Alphabet, Inc. and stresses that it invests in the “best companies, not strategic investment for Google”. GV is headquartered in Mountain View, California, with offices in San Francisco, Boston, New York, and London and it currently has over US$3.5 billion under management. It has invested in more than 600 companies across different sectors and stages, with more than 160 as lead investor and has seen 120 exits. Its recent investments include in Lemonade and KeepTruckin's Series D rounds and in Harness' Series B.

Domínguez has been CFO at Fundeen since June 2018 and senior manager of Globant Ventures since September. He holds a degree in IT Engineering from the Polytechnic University of Valencia (UPV), a Doctorate in Financial Economics from the Autonomous University of Madrid and an EMBA from IE Business School. He began his career as a financial consultant and project director in Cuenca's public administration, later assuming other managerial posts and working in IT at department store chain El Corte Inglés. From 2015 to 2018, he specialized in risk management at PwC Spain and Accenture.

Domínguez has been CFO at Fundeen since June 2018 and senior manager of Globant Ventures since September. He holds a degree in IT Engineering from the Polytechnic University of Valencia (UPV), a Doctorate in Financial Economics from the Autonomous University of Madrid and an EMBA from IE Business School. He began his career as a financial consultant and project director in Cuenca's public administration, later assuming other managerial posts and working in IT at department store chain El Corte Inglés. From 2015 to 2018, he specialized in risk management at PwC Spain and Accenture.

Alta Life Sciences (Alta LS) was established in 2016. Based in Barcelona, the management team is led by the co-founder of Alta Partners Guy Paul Nohra, a leading pioneer VC in life sciences. Alta Partners has funded over 150 companies since 1996. Alta LS specializes in the life sciences sector in Spain and abroad, targeting biotech, genomics, medical devices, diagnostics and digital health. It also acts as a bridge fund, connecting the Spanish life sciences ecosystem to VC experts in Silicon Valley. Investment is available for all stages of development, with focus mainly on seed and Series A funding.

Alta Life Sciences (Alta LS) was established in 2016. Based in Barcelona, the management team is led by the co-founder of Alta Partners Guy Paul Nohra, a leading pioneer VC in life sciences. Alta Partners has funded over 150 companies since 1996. Alta LS specializes in the life sciences sector in Spain and abroad, targeting biotech, genomics, medical devices, diagnostics and digital health. It also acts as a bridge fund, connecting the Spanish life sciences ecosystem to VC experts in Silicon Valley. Investment is available for all stages of development, with focus mainly on seed and Series A funding.

Eight Roads Ventures is the investment arm of Bermuda-based investment management giant Fidelity International Limited, which was founded in 1969. (It was formerly called Fidelity Growth Partners.) Its investment focus includes emerging technology and healthcare companies in North America, Europe and China in their go-to-market stage and early customer traction. It has offices in the UK, China, India and Japan and has seen 42 exits and has invested in over 300 companies to date. It also participates in Series A to D funding rounds and is a major investor in real estate.

Eight Roads Ventures is the investment arm of Bermuda-based investment management giant Fidelity International Limited, which was founded in 1969. (It was formerly called Fidelity Growth Partners.) Its investment focus includes emerging technology and healthcare companies in North America, Europe and China in their go-to-market stage and early customer traction. It has offices in the UK, China, India and Japan and has seen 42 exits and has invested in over 300 companies to date. It also participates in Series A to D funding rounds and is a major investor in real estate.

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

Caris LeVert is a professional basketball player in the USA’s National Basketball Association league, playing for the Brooklyn Nets. A graduate of the University of Michigan, he joined the Nets in 2016, after the Indiana Pacers swapped him for Thaddeus Young in that year’s draft. In 2019, the Nets signed a three year-extension for LeVert’s contract, worth $52.5m.LeVert is managed by Roc Nation, the entertainment and sports management firm founded by musician Jay-Z. He took part in Roc Nation’s investment (via venture arm Arrive) in Indonesian coffee brand Kopi Kenangan. LeVert is also the founder of the 22 Initiative, a youth mentorship program in New York.

Caris LeVert is a professional basketball player in the USA’s National Basketball Association league, playing for the Brooklyn Nets. A graduate of the University of Michigan, he joined the Nets in 2016, after the Indiana Pacers swapped him for Thaddeus Young in that year’s draft. In 2019, the Nets signed a three year-extension for LeVert’s contract, worth $52.5m.LeVert is managed by Roc Nation, the entertainment and sports management firm founded by musician Jay-Z. He took part in Roc Nation’s investment (via venture arm Arrive) in Indonesian coffee brand Kopi Kenangan. LeVert is also the founder of the 22 Initiative, a youth mentorship program in New York.

Toyota Tsusho Corp is a multi-market, multi-business listed company, focusing on industrial raw materials, agricultural products and technology. It is part of the Toyota Group with over 150 offices and 900 subsidiaries and affiliates around the world. Its diverse businesses span across the industrial, commercial and consumer sectors.In 2018, Toyota Tsusho and Microsoft started a partnership to build fish-farming tools using AI, IoT technologies and Microsoft Azure applications for improved water management. It also became Zipline’s first business investor to help expand the Silicon Valley unicorn’s drone operations to deliver lifesaving medical supplies to remote parts of the world.

Toyota Tsusho Corp is a multi-market, multi-business listed company, focusing on industrial raw materials, agricultural products and technology. It is part of the Toyota Group with over 150 offices and 900 subsidiaries and affiliates around the world. Its diverse businesses span across the industrial, commercial and consumer sectors.In 2018, Toyota Tsusho and Microsoft started a partnership to build fish-farming tools using AI, IoT technologies and Microsoft Azure applications for improved water management. It also became Zipline’s first business investor to help expand the Silicon Valley unicorn’s drone operations to deliver lifesaving medical supplies to remote parts of the world.

Baillee Gifford is a leading UK investment firm founded in Edinburgh in 1908. The firm is wholly owned by the partners, with its HQ in Edinburgh and offices in New York and London. A fourth office was opened in Hong Kong in 2015.Baillie Gifford was originally a law firm that switched to investments in 1909. Its first fund was The Straits Mortgage and Trust Company Limited that was set up to lend money to rubber planters in Asia. Clients include large US pension funds and international corporations in Japan and Australia. As of June 2020, assets under management were valued at £262bn.

Baillee Gifford is a leading UK investment firm founded in Edinburgh in 1908. The firm is wholly owned by the partners, with its HQ in Edinburgh and offices in New York and London. A fourth office was opened in Hong Kong in 2015.Baillie Gifford was originally a law firm that switched to investments in 1909. Its first fund was The Straits Mortgage and Trust Company Limited that was set up to lend money to rubber planters in Asia. Clients include large US pension funds and international corporations in Japan and Australia. As of June 2020, assets under management were valued at £262bn.

Visa is a US-based financial services company best known for its electronic payment system used worldwide for credit and debit cards. As the operator of the payment service, it also provides security and risk management solutions. It is listed in the New York Stock Exchange under the ticker code V.The firm prefers to invest and partner with innovative early-stage firms in the payments, fintech and emerging technology spaces to advance Visa's strategic and financial objectives. Some of its investments include Indonesian ride-hailing and payment super-app Gojek, cybersecurity firms MagicCube and LoginID, payment platforms Klarna and Flutterwave, as well as digital banking platform Greenwood Bank.

Visa is a US-based financial services company best known for its electronic payment system used worldwide for credit and debit cards. As the operator of the payment service, it also provides security and risk management solutions. It is listed in the New York Stock Exchange under the ticker code V.The firm prefers to invest and partner with innovative early-stage firms in the payments, fintech and emerging technology spaces to advance Visa's strategic and financial objectives. Some of its investments include Indonesian ride-hailing and payment super-app Gojek, cybersecurity firms MagicCube and LoginID, payment platforms Klarna and Flutterwave, as well as digital banking platform Greenwood Bank.

Founded in Boston in 2020, General Catalyst backs startups across all market segements at every growth stage, making seed stage investments between $500,000 and $2m. It has backed some of the most successful startups including Airbnb, Stripe and Deliveroo, and, to date, has invested in 243 companies, with 193 in its portfolio currently. A prolific investor, often making 10 investments or more per month, its most recent investments include in the July 2021 $5m seed round of US medtech, Evvy, designers of a vaginal microbiome test. In the same week, the investor participated in the $150m Series B round of Remote, a Silicon Valley-based platform for remote worker management and administration.

Founded in Boston in 2020, General Catalyst backs startups across all market segements at every growth stage, making seed stage investments between $500,000 and $2m. It has backed some of the most successful startups including Airbnb, Stripe and Deliveroo, and, to date, has invested in 243 companies, with 193 in its portfolio currently. A prolific investor, often making 10 investments or more per month, its most recent investments include in the July 2021 $5m seed round of US medtech, Evvy, designers of a vaginal microbiome test. In the same week, the investor participated in the $150m Series B round of Remote, a Silicon Valley-based platform for remote worker management and administration.

Known as one of the “big four” VC firms investing in early and growth stages in London, Europe-focused Balderton Capital was one of the early backers of today’s unicorns such as Revolut, Yoox, MySQL, CityMapper and Betfair. To date, Balderton Capital has made over 250 investments since its founding in 2000 and raised over $4bn across nine funds to date. In 2018, it launched the first fund to acquire equity from existing shareholders in European startups. The firm also focuses on Series A investments through its $400m fund Balderton VII launched in 2019. In June 2021, Balderton Capital launched its first growth fund with $680m under management.

Known as one of the “big four” VC firms investing in early and growth stages in London, Europe-focused Balderton Capital was one of the early backers of today’s unicorns such as Revolut, Yoox, MySQL, CityMapper and Betfair. To date, Balderton Capital has made over 250 investments since its founding in 2000 and raised over $4bn across nine funds to date. In 2018, it launched the first fund to acquire equity from existing shareholders in European startups. The firm also focuses on Series A investments through its $400m fund Balderton VII launched in 2019. In June 2021, Balderton Capital launched its first growth fund with $680m under management.

Founder and CEO of PesanLab

Dimas Prasetyo is the founder and CEO of PesanLab. He graduated with a degree in Medical Technology and Laboratory Science from Yogyakarta Health Polytechnic. He has over eight years of work experience in marketing, operations and management in the clinical laboratory diagnostics industry. He was also a product specialist at Non-invasive Genetic Abnormalities Test in Your Clinic and at Natera Inc. He co-founded Lab Panorama Bandung in 2009 and left in 2013 to become the founder of LabConX that was later rebranded as PesanLab.

Dimas Prasetyo is the founder and CEO of PesanLab. He graduated with a degree in Medical Technology and Laboratory Science from Yogyakarta Health Polytechnic. He has over eight years of work experience in marketing, operations and management in the clinical laboratory diagnostics industry. He was also a product specialist at Non-invasive Genetic Abnormalities Test in Your Clinic and at Natera Inc. He co-founded Lab Panorama Bandung in 2009 and left in 2013 to become the founder of LabConX that was later rebranded as PesanLab.

Co-founder, CEO of BEEVERYCREATIVE

Aurora Baptista has been a co-founding partner of BEEVERYCREATIVE since 2012 when it was known as bitBOX. She became its new CEO in August 2015. The Portuguese graduate in Business Management was also a postgrad at Harvard University in 2005.In 2008, Baptista started her own consultancy Cumprir Metas, Lda. She was an administrator at McKinsey for three years before becoming a partner at Arthur Andersen in 1990 for 11 years. She later became a partner at SGG Serviços Gerais deGestão (SGG) for over 18 years and a partner at Deloitte for seven years until 2008.

Aurora Baptista has been a co-founding partner of BEEVERYCREATIVE since 2012 when it was known as bitBOX. She became its new CEO in August 2015. The Portuguese graduate in Business Management was also a postgrad at Harvard University in 2005.In 2008, Baptista started her own consultancy Cumprir Metas, Lda. She was an administrator at McKinsey for three years before becoming a partner at Arthur Andersen in 1990 for 11 years. She later became a partner at SGG Serviços Gerais deGestão (SGG) for over 18 years and a partner at Deloitte for seven years until 2008.

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Fumi Technology: Getting ahead of human wealth managers with its Webull robo-advisors

Fumi's AI-based fintech platform offers real-time quotes and free trading to over 10m punters in 100 countries

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

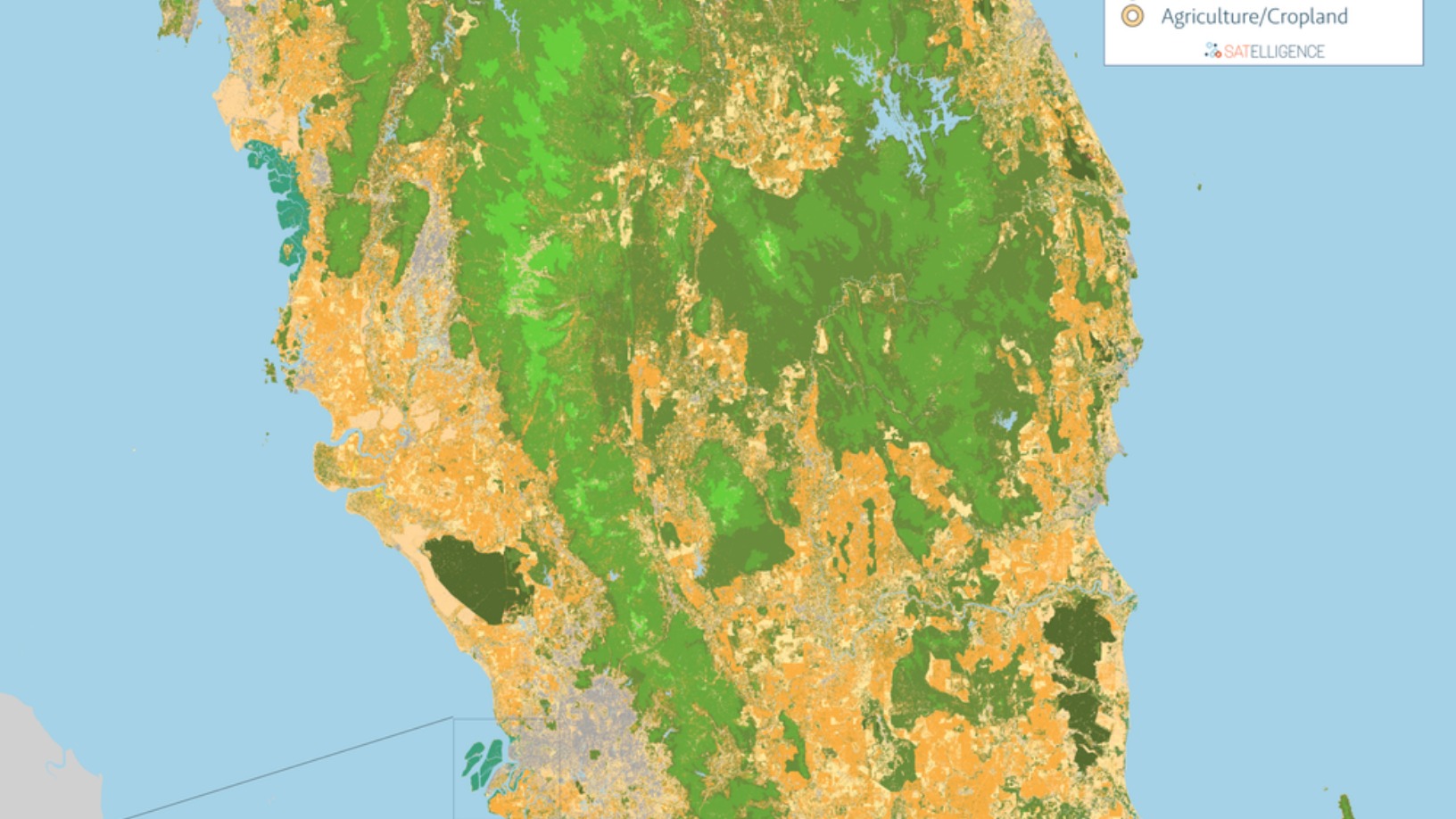

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Sorry, we couldn’t find any matches for“Unovis Asset Management”.