Unovis Asset Management

-

DATABASE (696)

-

ARTICLES (331)

Blanca Hernández Rodriguez holds a Master's Degree in Finance from CUNEF, a private Spanish university specializing in banking and finance that is based in Madrid. She has over 20 years’ experience in value investing. Her career started in the Arcalia group. She later established and managed a family office fund.Today, Hernández Rodriguez is the CEO of Magallanes Value Investors SA SGIIC, a Spanish asset management company offering portfolio management, equity, financial planning and advisory services.

Blanca Hernández Rodriguez holds a Master's Degree in Finance from CUNEF, a private Spanish university specializing in banking and finance that is based in Madrid. She has over 20 years’ experience in value investing. Her career started in the Arcalia group. She later established and managed a family office fund.Today, Hernández Rodriguez is the CEO of Magallanes Value Investors SA SGIIC, a Spanish asset management company offering portfolio management, equity, financial planning and advisory services.

Zriser Group is a Valencia-based family office fund started in 2007 by Ana and Pablo Serratosa Luján as a way to diversify their family investment strategy. The decision led to a diversified asset management scheme previously based on corporate acquisitions, then to a diversified portfolio of business and real estate investments.The firm has invested to date in eight tech-startups in the Spanish ecosystem.

Zriser Group is a Valencia-based family office fund started in 2007 by Ana and Pablo Serratosa Luján as a way to diversify their family investment strategy. The decision led to a diversified asset management scheme previously based on corporate acquisitions, then to a diversified portfolio of business and real estate investments.The firm has invested to date in eight tech-startups in the Spanish ecosystem.

Founded in October 1995, CITIC Securities is China's first securities company listed in Shanghai and the Hong Kong. CITIC is its major shareholder, with 15.47% stake in it. The company provides services from securities trading, brokerage, asset management to investment banking. In 2013, CITIC Securities acquired CLSA to extend its international businesses. With branches in 13 countries and regions, it now has over 40,000 business clients and more than 10.3m individual customers home and abroad.

Founded in October 1995, CITIC Securities is China's first securities company listed in Shanghai and the Hong Kong. CITIC is its major shareholder, with 15.47% stake in it. The company provides services from securities trading, brokerage, asset management to investment banking. In 2013, CITIC Securities acquired CLSA to extend its international businesses. With branches in 13 countries and regions, it now has over 40,000 business clients and more than 10.3m individual customers home and abroad.

Guangdong China Science & Merchants Capital Management

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

TusPark Technology Asset Management Co., Ltd., and TusPark Business Incubator Co., Ltd., were both founded in 2001 as the investment arms of Tsinghua Science Park. Affiliated with Tsinghua University, Tsinghua Science Park promotes technology innovation and entrepreneurship. In 2007, the two companies were merged and became TusPark Ventures. The firm employs an “investment + incubation” model when investing in Chinese high-tech startups. TusPark Ventures currently manages over RMB 3 billion in assets.

TusPark Technology Asset Management Co., Ltd., and TusPark Business Incubator Co., Ltd., were both founded in 2001 as the investment arms of Tsinghua Science Park. Affiliated with Tsinghua University, Tsinghua Science Park promotes technology innovation and entrepreneurship. In 2007, the two companies were merged and became TusPark Ventures. The firm employs an “investment + incubation” model when investing in Chinese high-tech startups. TusPark Ventures currently manages over RMB 3 billion in assets.

Citic Private Equity Funds Management

A private equity arm of China state-backed conglomerate Citic Group Corp., CITICPE is one of the largest PE investors in China, with RMB 9 billion under management.

A private equity arm of China state-backed conglomerate Citic Group Corp., CITICPE is one of the largest PE investors in China, with RMB 9 billion under management.

Co-founder, CPO of Rheaply

Tyler Skelton is the CPO and co-founder of pioneering circular economy B2B asset reuse platform Rheaply, where he has worked full-time since 2016. Before that, he worked at online mortgage company Guaranteed Rate as a senior designer. He has also worked as a designer or tech engineer in several other Chicago-based startups including Palantir.net, The Nines and Analyte Health. Skelton also worked in marketing and design early in his career. He hold’s a Bachelors degree in Telecommunications: Design and Production from Indiana University Bloomington.

Tyler Skelton is the CPO and co-founder of pioneering circular economy B2B asset reuse platform Rheaply, where he has worked full-time since 2016. Before that, he worked at online mortgage company Guaranteed Rate as a senior designer. He has also worked as a designer or tech engineer in several other Chicago-based startups including Palantir.net, The Nines and Analyte Health. Skelton also worked in marketing and design early in his career. He hold’s a Bachelors degree in Telecommunications: Design and Production from Indiana University Bloomington.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

Formerly known as Guangdong Technology Venture Capital Group, Technology Financial Group is a state-owned firm based in Guangzhou. It has a subsidiary in Guangdong province and has set up nine offices in other provinces across China. Technology Financial Group began investing in companies when it was founded in 1992, and it has assets under management of RMB 50bn. With a focus on VC investment, it also provides financial services such as asset management.The firm invests mainly in the high-end equipment manufacturing; new-generation information technology; new material; art, entertainment and media; consumption; biotech and pharmacy; energy and environmental protection; and automotive sectors.

Formerly known as Guangdong Technology Venture Capital Group, Technology Financial Group is a state-owned firm based in Guangzhou. It has a subsidiary in Guangdong province and has set up nine offices in other provinces across China. Technology Financial Group began investing in companies when it was founded in 1992, and it has assets under management of RMB 50bn. With a focus on VC investment, it also provides financial services such as asset management.The firm invests mainly in the high-end equipment manufacturing; new-generation information technology; new material; art, entertainment and media; consumption; biotech and pharmacy; energy and environmental protection; and automotive sectors.

Co-founder and Group CFO of Orami, Co-founder and Managing Director of Xurya

Gusmantara Ekamukti Himawan, known as Eka, holds a degree in Electrical Engineering from Purdue University, USA. However, he chose a career in finance instead, beginning as a research associate at Independence Capital Asset Partners. After becoming an analyst there, he moved on to become an investment banker at Barclays for two years. He left Barclays in 2012 to co-found Bilna with fellow Purdue alumni Ferry Tenka and Jason Lamuda. He was the CFO of Bilna that merged with Moxy to become Orami. Eka is now the CFO and executive vice chairman of Orami.

Gusmantara Ekamukti Himawan, known as Eka, holds a degree in Electrical Engineering from Purdue University, USA. However, he chose a career in finance instead, beginning as a research associate at Independence Capital Asset Partners. After becoming an analyst there, he moved on to become an investment banker at Barclays for two years. He left Barclays in 2012 to co-found Bilna with fellow Purdue alumni Ferry Tenka and Jason Lamuda. He was the CFO of Bilna that merged with Moxy to become Orami. Eka is now the CFO and executive vice chairman of Orami.

Founder and CEO of Fumi Technology

Wang Anquan joined the Alibaba Group in 2006. He was the technology director at Ali Financial, director of Taobao Loan Division and assistant to the MD of Ali Financial.In 2013, Wang and a colleague at Ali jointly developed the MVP of Webull to provide market intelligence. He then joined HengFeng Bank in 2014 as the president of the Department of Online Financial Asset Transaction. Wang joined Xiaomi in 2015 as the general manager of Xiaomi Finance. In 2016, he founded Fumi Technology with Webull as its main platform. Xiaomi is one of Fumi's early investors.

Wang Anquan joined the Alibaba Group in 2006. He was the technology director at Ali Financial, director of Taobao Loan Division and assistant to the MD of Ali Financial.In 2013, Wang and a colleague at Ali jointly developed the MVP of Webull to provide market intelligence. He then joined HengFeng Bank in 2014 as the president of the Department of Online Financial Asset Transaction. Wang joined Xiaomi in 2015 as the general manager of Xiaomi Finance. In 2016, he founded Fumi Technology with Webull as its main platform. Xiaomi is one of Fumi's early investors.

CAS Investment Management Co., Ltd.

Established in 1987 by the National Economic Commission and the Chinese Academy of Sciences as the Foundation for Economic Development, the renamed CAS Investment Management Co., Ltd. was transformed into a limited liability company in 2006. It has invested in and made profitable more than 300 technology projects.

Established in 1987 by the National Economic Commission and the Chinese Academy of Sciences as the Foundation for Economic Development, the renamed CAS Investment Management Co., Ltd. was transformed into a limited liability company in 2006. It has invested in and made profitable more than 300 technology projects.

HuaGai Capital was founded in 2012. Its asset volume is in the tens of billions of RMB. It now manages multiple private equity funds.

HuaGai Capital was founded in 2012. Its asset volume is in the tens of billions of RMB. It now manages multiple private equity funds.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

China Science & Merchants Investment Management Group (CSC)

Founded in 2000, Shan Xiangshuang's private equity outfit China Science & Merchants Investment Management Group (CSC) has about US$10 billion under management. It has an extensive network in China and built relationships with more than 1,000 LPs. Dubbed "China's Schwarzman," Shan set up CSC with RMB 600,000. The company went public on China's New Third Board (NEEQ) in 2015, where it raised almost US$2 billion.

Founded in 2000, Shan Xiangshuang's private equity outfit China Science & Merchants Investment Management Group (CSC) has about US$10 billion under management. It has an extensive network in China and built relationships with more than 1,000 LPs. Dubbed "China's Schwarzman," Shan set up CSC with RMB 600,000. The company went public on China's New Third Board (NEEQ) in 2015, where it raised almost US$2 billion.

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Fumi Technology: Getting ahead of human wealth managers with its Webull robo-advisors

Fumi's AI-based fintech platform offers real-time quotes and free trading to over 10m punters in 100 countries

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

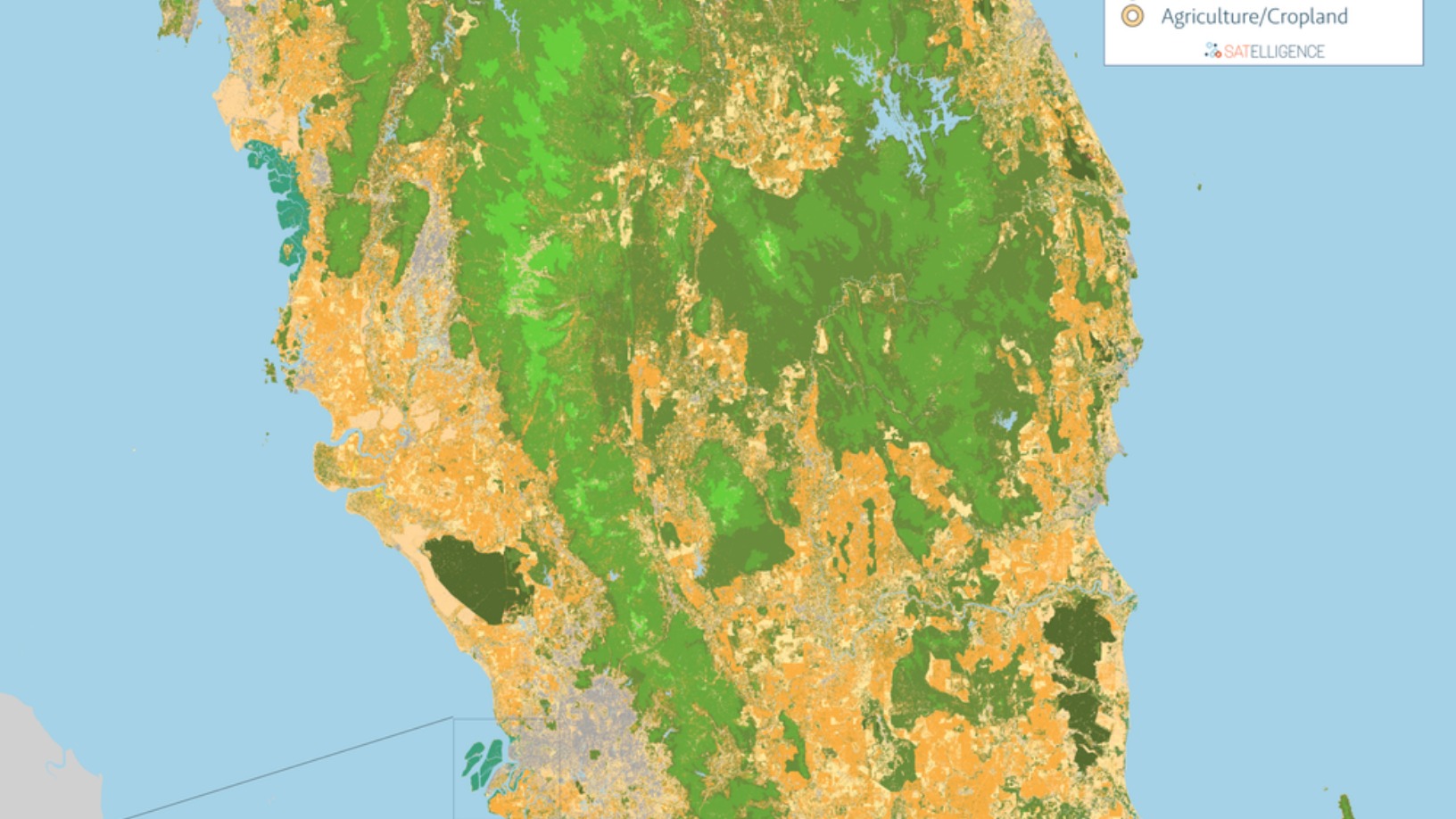

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Sorry, we couldn’t find any matches for“Unovis Asset Management”.