Unovis Asset Management

-

DATABASE (696)

-

ARTICLES (331)

Thanks to Ngorder’s suite of sales and inventory management tools, online shop owners can ditch cumbersome spreadsheets and shipping cost calculations.

Thanks to Ngorder’s suite of sales and inventory management tools, online shop owners can ditch cumbersome spreadsheets and shipping cost calculations.

Periksa.id’s web-based data management platform has a comprehensive suite of features to help improve profitability and productivity of Indonesia’s hospitals and clinics.

Periksa.id’s web-based data management platform has a comprehensive suite of features to help improve profitability and productivity of Indonesia’s hospitals and clinics.

Suzhou Wujiang Orient State-Owned Capital Investment Management

Suzhou Wujiang Orient State-Owned Capital Investment Management is a state-owned company established in 2001 in Suzhou with the mission to facilitate industrial development in Wujiang District, Suzhou. It currently manages assets worth over RMB 20bn. It’s also the limited partner of some renowned VC funds including Source Code Capital, Legend Capital, Kinzon Capital and Oriza Holdings. As of May 2021, three of its portfolio companies and 27 of its sub-funds had gone public.While making investments in companies, the investor is more focused on attracting investment firms in Wujiang to offer support to them. Beyond that, it’s also committed to supporting small-sized early-stage startups, so as to bring new blood for industrial development in the region.

Suzhou Wujiang Orient State-Owned Capital Investment Management is a state-owned company established in 2001 in Suzhou with the mission to facilitate industrial development in Wujiang District, Suzhou. It currently manages assets worth over RMB 20bn. It’s also the limited partner of some renowned VC funds including Source Code Capital, Legend Capital, Kinzon Capital and Oriza Holdings. As of May 2021, three of its portfolio companies and 27 of its sub-funds had gone public.While making investments in companies, the investor is more focused on attracting investment firms in Wujiang to offer support to them. Beyond that, it’s also committed to supporting small-sized early-stage startups, so as to bring new blood for industrial development in the region.

This all-in-one collaborative tool makes it easy to delegate tasks, prioritize to-do lists, work together on projects and communicate among team members.

This all-in-one collaborative tool makes it easy to delegate tasks, prioritize to-do lists, work together on projects and communicate among team members.

Proptech Zhongzheng will focus on AI-powered data analytics to optimize performance of smart buildings in China.

Proptech Zhongzheng will focus on AI-powered data analytics to optimize performance of smart buildings in China.

Loket aims to join the big league in the region’s events management industry by developing innovative hi-tech ticketing software and Big Data services.

Loket aims to join the big league in the region’s events management industry by developing innovative hi-tech ticketing software and Big Data services.

Hong Kong-based Jeneration Capital was founded in 2015 by Jimmy Chang, a former banker at Morgan Stanley. It now manages approximately US$2bn in capital, utilizing a multi-strategy investment approach with an emphasis on direct investment and dynamic asset allocation across private equity, public equity and diversified fund investments. In terms of direct investment, Jeneration Capital mainly invests in growth-stage technology-enabled companies in the Asia-Pacific region, with a focus on Greater China.

Hong Kong-based Jeneration Capital was founded in 2015 by Jimmy Chang, a former banker at Morgan Stanley. It now manages approximately US$2bn in capital, utilizing a multi-strategy investment approach with an emphasis on direct investment and dynamic asset allocation across private equity, public equity and diversified fund investments. In terms of direct investment, Jeneration Capital mainly invests in growth-stage technology-enabled companies in the Asia-Pacific region, with a focus on Greater China.

FSI is an independent private equity firm based in Milan. It currently manages the mid-market Fund FSI I. Before its launch in 2017, the FSI investment team had already made PE investments in the Italian mid-market for several years at Fondo Strategico Italiano.The FSI investors include some of Italy’s largest institutional investors, primary sovereign funds from the Middle East, Far East and Central Asia. The firm also has a network of asset managers, insurance companies, European banks, family offices and foundations.

FSI is an independent private equity firm based in Milan. It currently manages the mid-market Fund FSI I. Before its launch in 2017, the FSI investment team had already made PE investments in the Italian mid-market for several years at Fondo Strategico Italiano.The FSI investors include some of Italy’s largest institutional investors, primary sovereign funds from the Middle East, Far East and Central Asia. The firm also has a network of asset managers, insurance companies, European banks, family offices and foundations.

Formerly the Suzhou Venture Group (which was reconstructed from the former venture capital entity China-Singapore Suzhou Industrial Park Ventures), state investment firm Oriza Holdings manages about RMB 29.7 billion. As of 1Q2016, its investments comprised 253 seed/early-stage companies, 81 growth-stage entities and 48 mature ones.

Formerly the Suzhou Venture Group (which was reconstructed from the former venture capital entity China-Singapore Suzhou Industrial Park Ventures), state investment firm Oriza Holdings manages about RMB 29.7 billion. As of 1Q2016, its investments comprised 253 seed/early-stage companies, 81 growth-stage entities and 48 mature ones.

A one-stop booking platform for personal grooming services in Indonesia, Minutes Apps is fast becoming a cool lifestyle brand for busy urbanites and salons.

A one-stop booking platform for personal grooming services in Indonesia, Minutes Apps is fast becoming a cool lifestyle brand for busy urbanites and salons.

Sleekr is poised to become Indonesia’s leading HR management and accounting software startup, offering comprehensive yet affordable solutions for the growing tech-savvy small-and-medium enterprise market.

Sleekr is poised to become Indonesia’s leading HR management and accounting software startup, offering comprehensive yet affordable solutions for the growing tech-savvy small-and-medium enterprise market.

Advertisers can reach out to over 347m residents daily through QinLin Technology’s AI-powered community services platform for gated neighborhoods in 130 cities.

Advertisers can reach out to over 347m residents daily through QinLin Technology’s AI-powered community services platform for gated neighborhoods in 130 cities.

Kuaidiniao streamlines logistics and express services with its free API platform with which users can access services from 418 logistics service providers.

Kuaidiniao streamlines logistics and express services with its free API platform with which users can access services from 418 logistics service providers.

Everbright New Economy USD Fund

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Zaihui’s SaaS services help retailers boost customer loyalty and sales. It achieved the same growth in five months as US peer Fivestars in two years.

Zaihui’s SaaS services help retailers boost customer loyalty and sales. It achieved the same growth in five months as US peer Fivestars in two years.

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Indonesian rental and asset management platform Travelio bags US$18m funding

The four-year-old proptech startup recently raised Series B funding as it gains ground in Indonesia’s growing real estate investment market

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Fumi Technology: Getting ahead of human wealth managers with its Webull robo-advisors

Fumi's AI-based fintech platform offers real-time quotes and free trading to over 10m punters in 100 countries

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

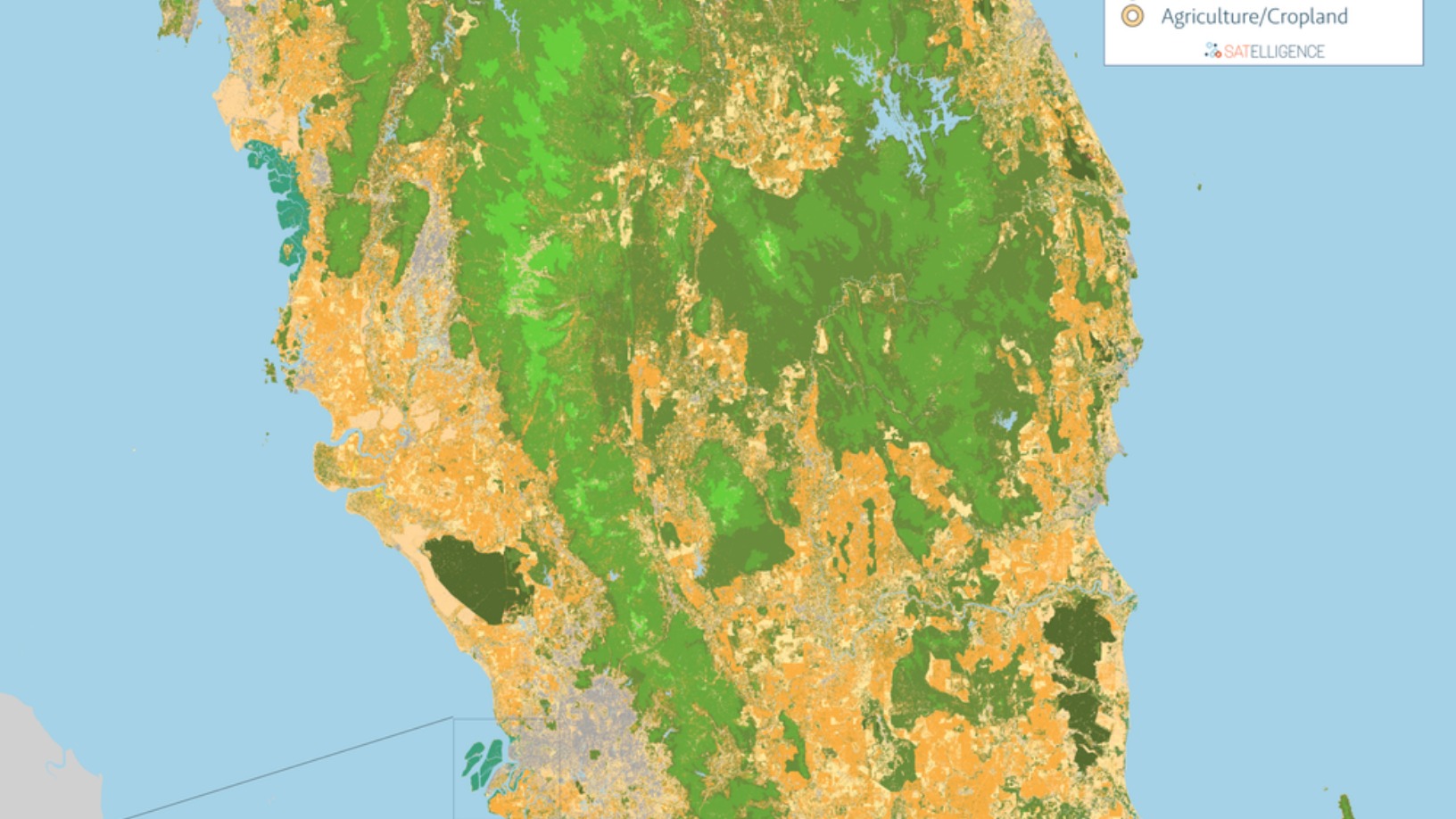

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Sorry, we couldn’t find any matches for“Unovis Asset Management”.