Wavemaker Partners

DATABASE (236)

ARTICLES (326)

Since 2003, US-based Wavemaker Partners have invested in more than 150 technology startups. The firm usually start with a US$100,000–$750,000 check and can follow on until US$1 million to US$1.25 million. Its investment portfolio in Asia-Pacific includes Luxola and TradeGecko. In 2016, it acquired Ardent Capital’s VC portfolio, which includes Sale Stock and Happyfresh.

Since 2003, US-based Wavemaker Partners have invested in more than 150 technology startups. The firm usually start with a US$100,000–$750,000 check and can follow on until US$1 million to US$1.25 million. Its investment portfolio in Asia-Pacific includes Luxola and TradeGecko. In 2016, it acquired Ardent Capital’s VC portfolio, which includes Sale Stock and Happyfresh.

Ardent Capital is a Thai venture capital fund focusing on e-commerce and fulfilment services. It ran a subsidiary company named Ardent Ventures. In 2016, Ardent Capital merged with Wavemaker Partners. Ardent Capital maintains its portfolio, including Moxy (now Orami) and Snapcart. Ardent Ventures companies include SaleStock that is now managed by Wavemaker.

Ardent Capital is a Thai venture capital fund focusing on e-commerce and fulfilment services. It ran a subsidiary company named Ardent Ventures. In 2016, Ardent Capital merged with Wavemaker Partners. Ardent Capital maintains its portfolio, including Moxy (now Orami) and Snapcart. Ardent Ventures companies include SaleStock that is now managed by Wavemaker.

Part of the Thai-headquartered venture capitalist firm Ardent Capital, Ardent Ventures invests in early-stage technology startups across Southeast Asia. In 2016, Ardent Capital announced its merger with US-based Wavemaker Partners.

Part of the Thai-headquartered venture capitalist firm Ardent Capital, Ardent Ventures invests in early-stage technology startups across Southeast Asia. In 2016, Ardent Capital announced its merger with US-based Wavemaker Partners.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

Mountain Partners is a global company builder that has managed more than 90 investments in IT-based startups. Mountain Partners supports companies from incubation to growth stages to go global.

Mountain Partners is a global company builder that has managed more than 90 investments in IT-based startups. Mountain Partners supports companies from incubation to growth stages to go global.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Established in 2016, Alphax Partners invests in rapidly growing internet companies. Founding partners include Thor Hongchuan, founder of Highland Capital China, Yao Yaping, an investment banker with 11 years of experience, and Yu Guangdong, former senior vice president of Chinese internet security company Qihoo 360. In May 2018, Alphax Partners raised RMB 2bn in total capital commitments for its debut fund.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Headquartered in London, Apax Partners was founded in 1969. It is one of the biggest private equity funds in Europe. Apax Partners has offices in New York, Hong Kong, Mumbai, Tel Aviv, Munich and Shanghai. The Shanghai office opened in 2008. Apax Partners currently manages over US$50 billion in assets and invests mainly in the sectors of technology & telecommunications, healthcare and consumer products.

Headquartered in London, Apax Partners was founded in 1969. It is one of the biggest private equity funds in Europe. Apax Partners has offices in New York, Hong Kong, Mumbai, Tel Aviv, Munich and Shanghai. The Shanghai office opened in 2008. Apax Partners currently manages over US$50 billion in assets and invests mainly in the sectors of technology & telecommunications, healthcare and consumer products.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Established in 2006, European private equity firm Vitruvian Partners focuses on asset-light companies in its targeted sectors. The firm has a successful track record with more than 85 transactions completed. Vitruvian Partners invests £25 million to over £150 million in companies typically valued at £50 million to over £500 million.

Established in 2006, European private equity firm Vitruvian Partners focuses on asset-light companies in its targeted sectors. The firm has a successful track record with more than 85 transactions completed. Vitruvian Partners invests £25 million to over £150 million in companies typically valued at £50 million to over £500 million.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

European venture capital firm Advent Venture Partners was established in 1981.

European venture capital firm Advent Venture Partners was established in 1981.

Asabys Partners is a VC firm based in Barcelona and invests mainly in the healthtech and biopharma industries. Backed by Sabadell Bank, the VC now has offices in Spain, UK, Switzerland and Israel. Asabys Partners aims to accelerate technology breakthroughs in the fields of science and medicine by supporting a network of industry experts and talent.Asabys started operations in 2019 and is currently fundraising its first fund, Sabadell Asabys Health Innovation Investments, with a target size of €70m and Banc Sabadell as anchor investor. Main areas of investment include Biopharma, MedTech and Digital Therapeutics.

Asabys Partners is a VC firm based in Barcelona and invests mainly in the healthtech and biopharma industries. Backed by Sabadell Bank, the VC now has offices in Spain, UK, Switzerland and Israel. Asabys Partners aims to accelerate technology breakthroughs in the fields of science and medicine by supporting a network of industry experts and talent.Asabys started operations in 2019 and is currently fundraising its first fund, Sabadell Asabys Health Innovation Investments, with a target size of €70m and Banc Sabadell as anchor investor. Main areas of investment include Biopharma, MedTech and Digital Therapeutics.

New Food Invest: Challenges of growing an alt-protein startup

Founders of three alt-protein startups in the US share what motivated them to start, their personal experiences growing the businesses, getting funding and finding strategic partners

Spanish startups and investors rethink strategies as Covid-19 hits funding, valuations

Investors and startups in Spain say most funding has stalled, and share their strategies and advice for coping with the downturn

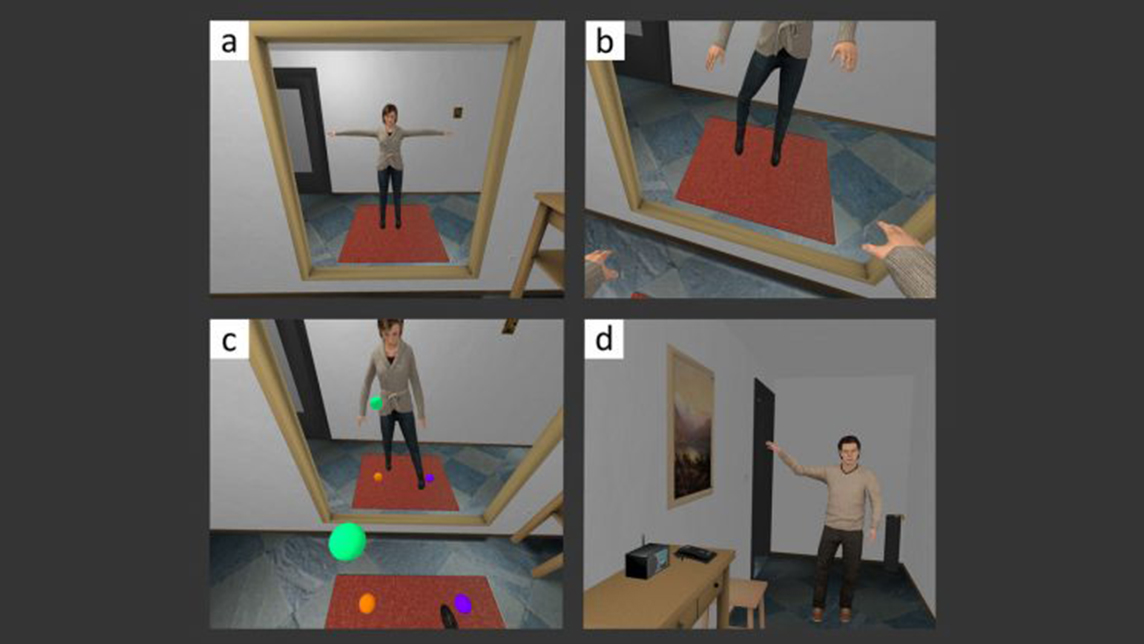

Virtual Bodyworks: VR psychotherapy to reduce crime and health issues

Applications created by the Barcelona-based startup could be used to track and influence human behavior

Billin offers unlimited free e-invoicing services to SMEs and freelancers

Offering automated online invoice generating, sharing, tracking and payments, the Spanish fintech wants to become the billing Dropbox for businesses worldwide

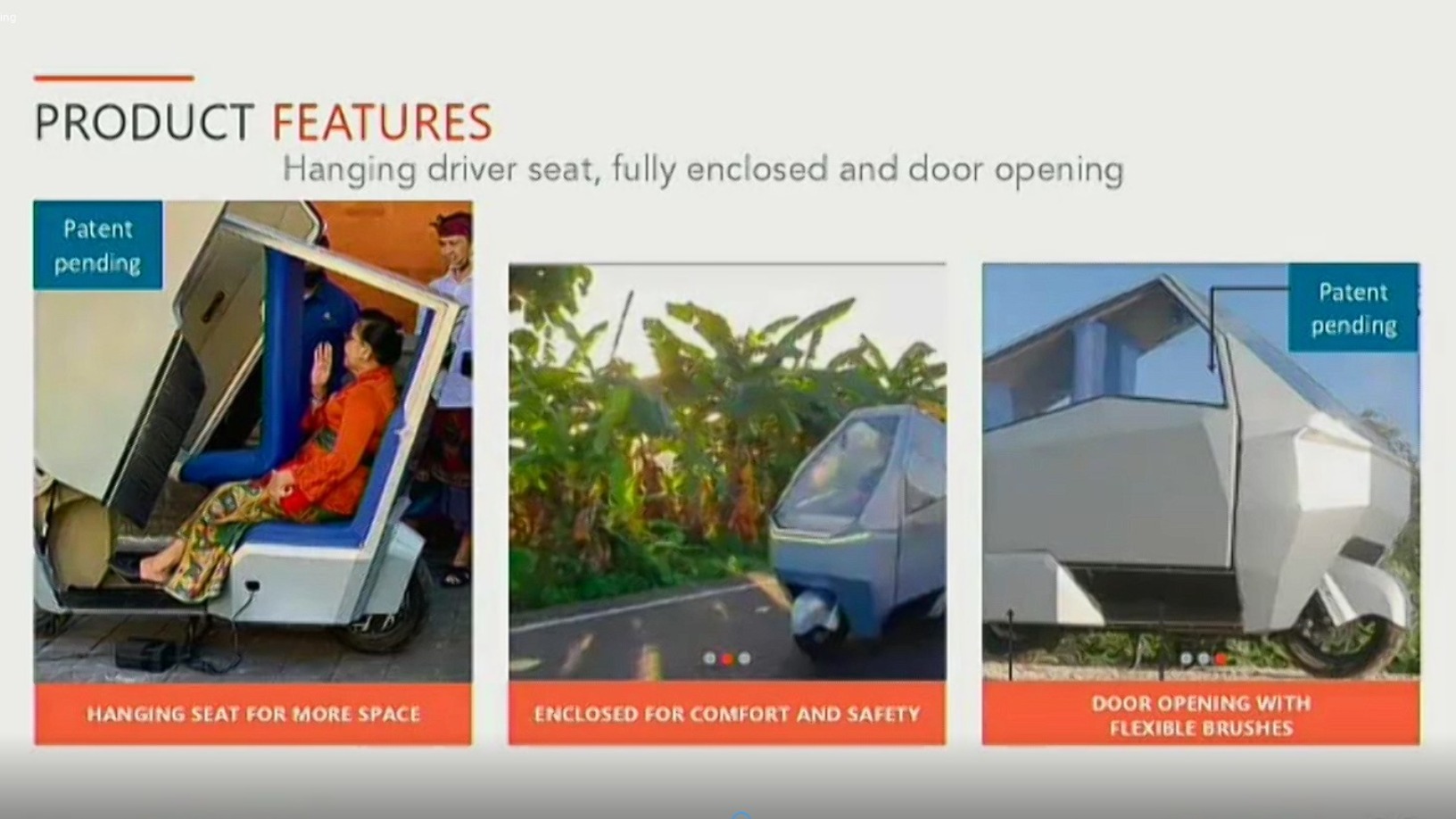

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Knokcare: Telemedicine app connects you to doctors in 30 minutes

Seeking funding of over €1m, Portugal’s digital healthcare pioneer is expanding its SaaS to tap new markets in Europe, Africa and Latin America

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Bound4Blue’s aeronautical tech propels first sustainable shipping vessel in the Pacific

Winning €5m fresh funding, Bound4Blue also scores with its EC-backed pilot, the first of its kind, offering new possibilities to cargo vessels seeking sustainable transportation

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Ajaib targets millennials with easy-to-use investment app

Y Combinator alumnus Ajaib recently acquired a local brokerage to add stock trading to its products

As AI assistant market heats up, Sherpa zooms in on smart autos, smart homes

Spanish AI assistant startup Sherpa launches Sherpa Platform, a new set of APIs for smart cars, phones and home devices

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

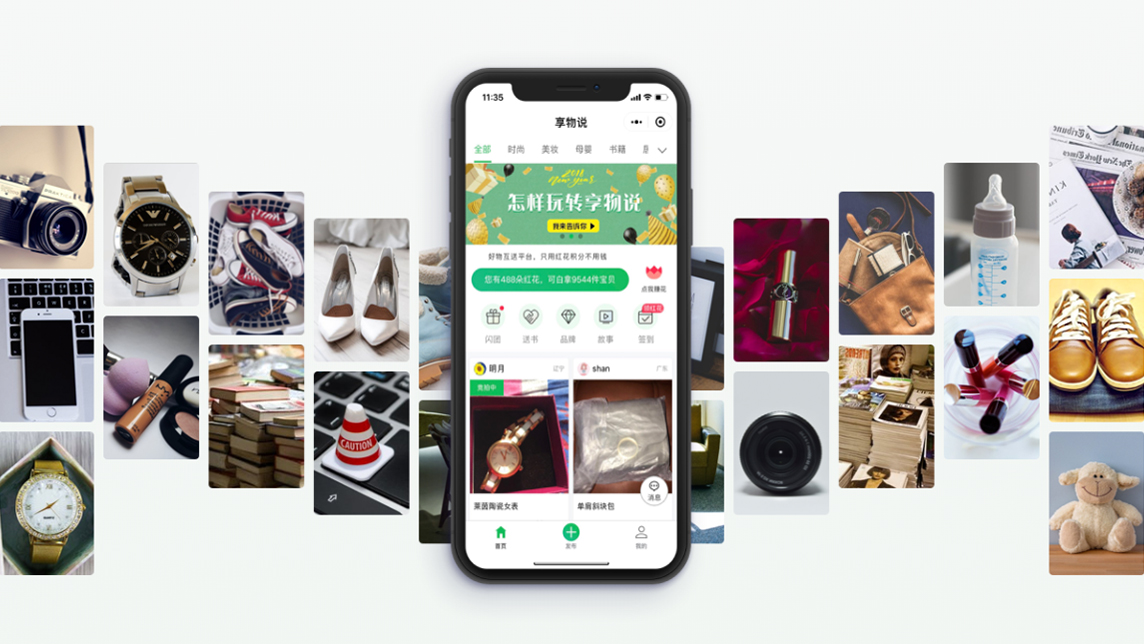

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Sorry, we couldn’t find any matches for“Wavemaker Partners”.