Wei Venture Capital

-

DATABASE (844)

-

ARTICLES (435)

Albert Domingo is a Spanish entrepreneur and investor. He is the founder and CEO NexTReT, which was established in 1992 to provide IT systems and infrastructure services. Domingo is also an active business angel, backing startups as a partner investor in Barcelona-based venture builder Itnig's network, which has seen two exits, Gym For Less and Playfulbet. He studied computer engineering and also management development at the IESE Business School in Barcelona.

Albert Domingo is a Spanish entrepreneur and investor. He is the founder and CEO NexTReT, which was established in 1992 to provide IT systems and infrastructure services. Domingo is also an active business angel, backing startups as a partner investor in Barcelona-based venture builder Itnig's network, which has seen two exits, Gym For Less and Playfulbet. He studied computer engineering and also management development at the IESE Business School in Barcelona.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Chenshan Asset Management was founded in 2016 by Jiang Jian, Edward Tian (Tian Suning) and Chen Haofei. Jiang is also the partner of China Broadband Capital and has led its investments in Dianping, Tujia, Babytree, etc. Tian is the board chairman of China Broadband Capital, founder of Nasdaq-listed AsiaInfo and former CEO of China Netcom Corporation. Chen is the managing director of China International Capital Corp (CICC).

Chenshan Asset Management was founded in 2016 by Jiang Jian, Edward Tian (Tian Suning) and Chen Haofei. Jiang is also the partner of China Broadband Capital and has led its investments in Dianping, Tujia, Babytree, etc. Tian is the board chairman of China Broadband Capital, founder of Nasdaq-listed AsiaInfo and former CEO of China Netcom Corporation. Chen is the managing director of China International Capital Corp (CICC).

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

Ignacio Martín de Andrés has over eight years of experience working at consultancies such as KPMG, PwC and Grant Thornton.He made an angel investment in Reclamador.es, a web platform that manages and automates consumer claims, and has also helped define the company's strategy and service-level agreement.Since 2019, he's been a partner at Venture Partnership, supporting the company by defining growth strategy, KPIs and process optimization for startups in the company’s investment portfolio.

Ignacio Martín de Andrés has over eight years of experience working at consultancies such as KPMG, PwC and Grant Thornton.He made an angel investment in Reclamador.es, a web platform that manages and automates consumer claims, and has also helped define the company's strategy and service-level agreement.Since 2019, he's been a partner at Venture Partnership, supporting the company by defining growth strategy, KPIs and process optimization for startups in the company’s investment portfolio.

bp ventures is an investment arm of the energy group BP with an annual venture investment budget between $150m and $200m. The group invests in new energy solutions, with over 30 startups’ investments in its portfolio supporting BP’s core business in oil and gas.bp ventures has increasingly invested over the past years in carbon-management technologies, low-carbon products, and advanced mobility through EV charging companies like the Chinese Shanghai PowerShare Tech and the California-based FreeWire Technologies.

bp ventures is an investment arm of the energy group BP with an annual venture investment budget between $150m and $200m. The group invests in new energy solutions, with over 30 startups’ investments in its portfolio supporting BP’s core business in oil and gas.bp ventures has increasingly invested over the past years in carbon-management technologies, low-carbon products, and advanced mobility through EV charging companies like the Chinese Shanghai PowerShare Tech and the California-based FreeWire Technologies.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Archipelago Next is an investor based in Spain’s Canary Islands and owned by prominent local companies. It has a non-sectorial focus on startups based in the archipelago and in Africa and is the Canary Islands’ only venture builder. It currently has 20 startups in its portfolio. Its most recent investments were €520,000 in a seed funding round in 2021 of Valencian accessibility hardware and app for the deaf, Visualfy and €260,000 in the 2021 seed round of AI-powered crop prediction agtech RawData.

Archipelago Next is an investor based in Spain’s Canary Islands and owned by prominent local companies. It has a non-sectorial focus on startups based in the archipelago and in Africa and is the Canary Islands’ only venture builder. It currently has 20 startups in its portfolio. Its most recent investments were €520,000 in a seed funding round in 2021 of Valencian accessibility hardware and app for the deaf, Visualfy and €260,000 in the 2021 seed round of AI-powered crop prediction agtech RawData.

Media Digital Ventures is the first Spanish Cross-Media fund focusing on Media for Equity. It holds multichannel advertising assets across major media sectors. Based in Barcelona, MDV also creates multimedia and advertising campaigns for scaling high-growth startups in return for equity.MDV is co-founded by Gerard Olivé and Miguel Vicente. Both are serial entrepreneurs, investors and co-founders of Antai Venture Builder, Wallapop, Deliberry and Chicplace. Vicente, who exited LetsBonus which he founded in 2009, is also the president of Barcelona Tech City.

Media Digital Ventures is the first Spanish Cross-Media fund focusing on Media for Equity. It holds multichannel advertising assets across major media sectors. Based in Barcelona, MDV also creates multimedia and advertising campaigns for scaling high-growth startups in return for equity.MDV is co-founded by Gerard Olivé and Miguel Vicente. Both are serial entrepreneurs, investors and co-founders of Antai Venture Builder, Wallapop, Deliberry and Chicplace. Vicente, who exited LetsBonus which he founded in 2009, is also the president of Barcelona Tech City.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Shanghai Alliance Investment Ltd

Shanghai Alliance Investment Ltd is a state-owned company founded in September 1994 under the State-owned Assets Supervision and Administration Commission of Shanghai. It mainly engages in equity investment in hi-tech and modern services industry.It has invested over RMB 10bn in diverse sectors including information technology, biomedicine, new energy, environmental protection, new materials and financial services. In 2004, the company and Microsoft set up the joint venture Shanghai MSN Network Communications Technology Co Ltd that operates MSN China's website: msn.com.cn.

Shanghai Alliance Investment Ltd is a state-owned company founded in September 1994 under the State-owned Assets Supervision and Administration Commission of Shanghai. It mainly engages in equity investment in hi-tech and modern services industry.It has invested over RMB 10bn in diverse sectors including information technology, biomedicine, new energy, environmental protection, new materials and financial services. In 2004, the company and Microsoft set up the joint venture Shanghai MSN Network Communications Technology Co Ltd that operates MSN China's website: msn.com.cn.

Li is a TV presenter, entrepreneur and investor. Born in June 1970, she joined Beijing TV in 1993 as a news anchor. From 1995 to 1999, Li worked at CCTV as a TV show host. In 1999, she left CCTV and co-founded Fleet Entertainment with fellow TV host Dai Jun. The two co-hosted Super Talk Show from 2000 to 2016, one of the most highly viewed shows in China. Li founded cosmetics e-retailer Lefeng.com in 2008, skincare brand JPlus in 2009 and Star Venture Fund in 2015.

Li is a TV presenter, entrepreneur and investor. Born in June 1970, she joined Beijing TV in 1993 as a news anchor. From 1995 to 1999, Li worked at CCTV as a TV show host. In 1999, she left CCTV and co-founded Fleet Entertainment with fellow TV host Dai Jun. The two co-hosted Super Talk Show from 2000 to 2016, one of the most highly viewed shows in China. Li founded cosmetics e-retailer Lefeng.com in 2008, skincare brand JPlus in 2009 and Star Venture Fund in 2015.

Founded in October 2013, JD Finance was renamed as JD Digits in November 2018. The fintech arm of Chinese e-commerce giant JD.com focuses on applying digital technology, artificial intelligence and IoT in five sectors: finance, smart cities, agriculture, campus development and marketing.The company manages five sub-brands: JD Finance, JD iCity, JD Agriculture, JD Shaodongjia, and JD MO Media. In September 2017, a joint venture was established with Central Group, one of Thailand’s biggest retailers. In December 2017, JD Digits also started operating an AI lab in Silicon Valley.

Founded in October 2013, JD Finance was renamed as JD Digits in November 2018. The fintech arm of Chinese e-commerce giant JD.com focuses on applying digital technology, artificial intelligence and IoT in five sectors: finance, smart cities, agriculture, campus development and marketing.The company manages five sub-brands: JD Finance, JD iCity, JD Agriculture, JD Shaodongjia, and JD MO Media. In September 2017, a joint venture was established with Central Group, one of Thailand’s biggest retailers. In December 2017, JD Digits also started operating an AI lab in Silicon Valley.

Founded in 2013 by Ramanan Raghavendran and John Kim, Amasia is a venture capital investment firm based in San Francisco and Singapore. The VC promotes environmental and sustainable innovations that help to reduce consumption, boost recycling and upcycling. Eco-investments include Finch, Treedots and Joro. Finch provides information about a product’s environmental impact to consumers while TreeDots connects grocery suppliers directly with businesses and households. Joro advises users on actionable steps to reduce their carbon footprints.Amasia primarily invests in startups from seed stage up to Series B, but it has also participated in later-stage investments. The VC also aims to encourage conventional offline businesses to go online and optimize supply chain activities. In October 2020, Amasia participated in a $100m Series E round raised by Dialpad, a remote working communication software firm. In September 2021, the VC took a stake in Indonesian fintech Xendit’s $150m Series C round. Tokopedia also joined the Amasia stable in 2016 when the e-commerce platform became Indonesia’s first tech unicorn after the $147m funding round.Other investments include Super, a social commerce platform that improves FMCG distribution to tier-2 and tier-3 cities in Indonesia, online education firm SkillShare and Rainforest Life that acquires and aggregates direct-to-consumer e-commerce brands.

Founded in 2013 by Ramanan Raghavendran and John Kim, Amasia is a venture capital investment firm based in San Francisco and Singapore. The VC promotes environmental and sustainable innovations that help to reduce consumption, boost recycling and upcycling. Eco-investments include Finch, Treedots and Joro. Finch provides information about a product’s environmental impact to consumers while TreeDots connects grocery suppliers directly with businesses and households. Joro advises users on actionable steps to reduce their carbon footprints.Amasia primarily invests in startups from seed stage up to Series B, but it has also participated in later-stage investments. The VC also aims to encourage conventional offline businesses to go online and optimize supply chain activities. In October 2020, Amasia participated in a $100m Series E round raised by Dialpad, a remote working communication software firm. In September 2021, the VC took a stake in Indonesian fintech Xendit’s $150m Series C round. Tokopedia also joined the Amasia stable in 2016 when the e-commerce platform became Indonesia’s first tech unicorn after the $147m funding round.Other investments include Super, a social commerce platform that improves FMCG distribution to tier-2 and tier-3 cities in Indonesia, online education firm SkillShare and Rainforest Life that acquires and aggregates direct-to-consumer e-commerce brands.

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

Have you ever bought expensive equipment but seldom used it? Do you want to try the latest electronic gadgets at low cost? Try this online sharing and rental platform

Duozhuayu: This platform sells pre-owned books after repairing them to look like new

Duozhuayu also uses its own algorithm to predict demand, selling about 2,000 used books daily

Dai Wei and his Ofo: Fighting till the last act?

How the college student who founded a global bike-sharing sensation also led it to the verge of bankruptcy through a string of mistakes

Covid-19 has renewed investors' interest in China's online education sector

Will skyrocketing demand for online education during Covid-19 give China's edtechs that long-awaited push to profitability?

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

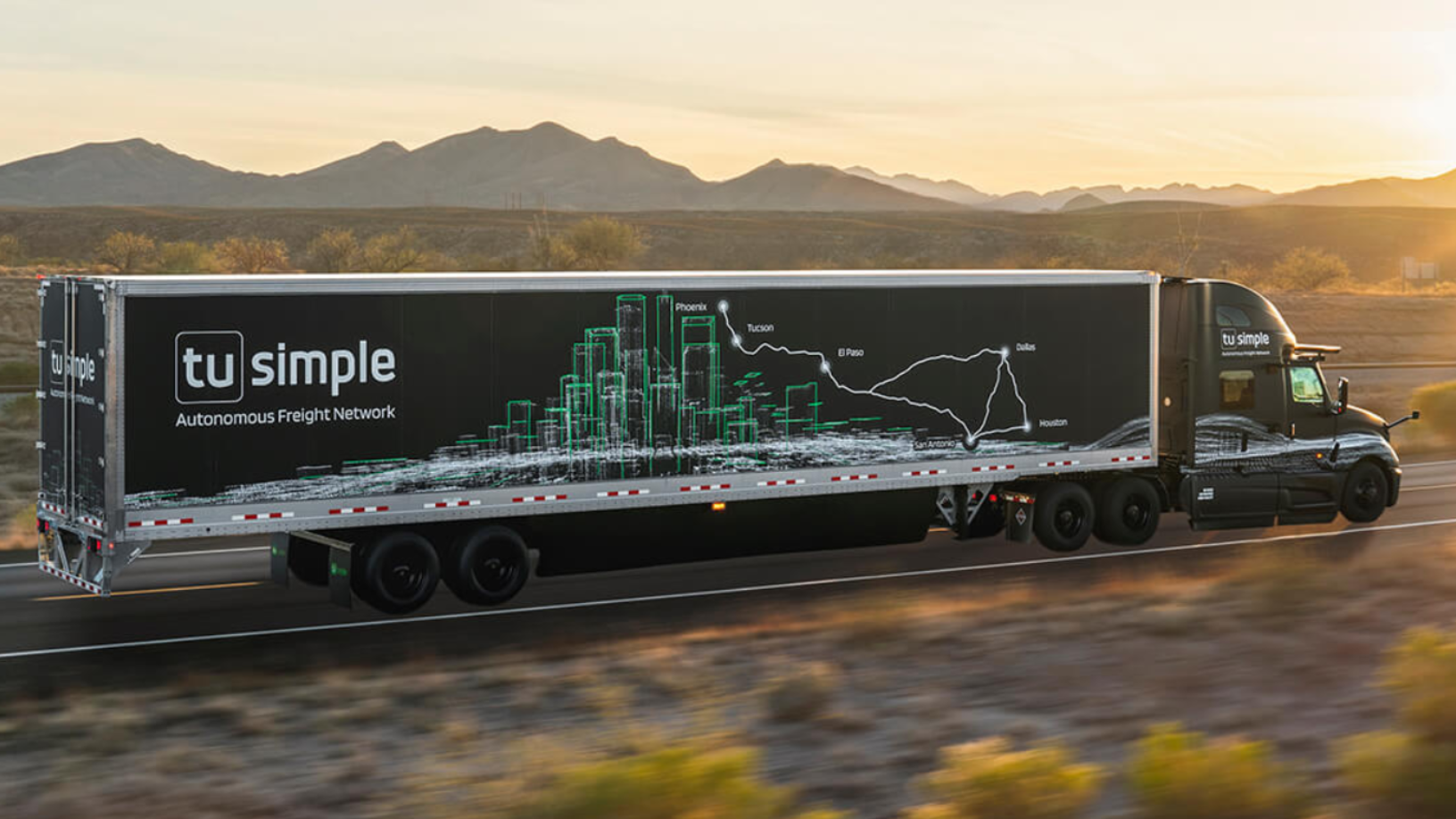

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

SWITCH Singapore: Sustainability startups see growing demand from corporates

Sophie’s BioNutrients, Ubiik and Intello Labs also note new trends in technology and supply chain arising from the Covid-19 pandemic, across the food, manufacturing and e-commerce sectors

Li Zexiang and his game-changing plans to take Chinese robotics global

An early supporter of drone giant DJI, Professor Li Zexiang is building robotics hubs across China to pivot homegrown enterprises into global players

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Sorry, we couldn’t find any matches for“Wei Venture Capital”.