Wei Venture Capital

-

DATABASE (844)

-

ARTICLES (435)

Led by angel investor João Brazão, BrainTrust invests in early-stage startups through capital and mentorship.

Led by angel investor João Brazão, BrainTrust invests in early-stage startups through capital and mentorship.

Charles Xue Biqun (b. 1953), alias Xue Manzi, is a popular Chinese-American billionaire venture capitalist and angel investor with over 10 million followers on Weibo. He studied foreign relations at the University of California, Berkeley. His most famous deal to date is his US$250,000 investment in Unitech in the early 1990s, which later became UTStarcom. The company went public in 2000, reaching a post-IPO value of over US$5 billion. He was also chairman of 8848.com (the earliest Chinese e-commerce network). Xue has invested in many internet startups in China, including PCPOP, Autohome, Xueqiu, CreatyChina, Community001 and 265.com (bought by Google).

Charles Xue Biqun (b. 1953), alias Xue Manzi, is a popular Chinese-American billionaire venture capitalist and angel investor with over 10 million followers on Weibo. He studied foreign relations at the University of California, Berkeley. His most famous deal to date is his US$250,000 investment in Unitech in the early 1990s, which later became UTStarcom. The company went public in 2000, reaching a post-IPO value of over US$5 billion. He was also chairman of 8848.com (the earliest Chinese e-commerce network). Xue has invested in many internet startups in China, including PCPOP, Autohome, Xueqiu, CreatyChina, Community001 and 265.com (bought by Google).

Innovation Nest is an early-stage venture capitalist firm based in Krakow, Poland. Founded in 2010, the VC has invested in more than 50 startups, with a special focus on European B2B SaaS companies. The firm was the lead investor in eight of the startups' funding rounds.The VC usually participates in seed rounds, with the most recent being a US$1-million investment in Poland's fraud detection company Netone and another seed investment in Portuguese facility management platform Infraspeak. The VC has also joined a Series A round for ICT SaaS company CallPage and Series B funding in sensor company Estimote.

Innovation Nest is an early-stage venture capitalist firm based in Krakow, Poland. Founded in 2010, the VC has invested in more than 50 startups, with a special focus on European B2B SaaS companies. The firm was the lead investor in eight of the startups' funding rounds.The VC usually participates in seed rounds, with the most recent being a US$1-million investment in Poland's fraud detection company Netone and another seed investment in Portuguese facility management platform Infraspeak. The VC has also joined a Series A round for ICT SaaS company CallPage and Series B funding in sensor company Estimote.

Miguel Arias received an MSc in Civil Engineering from Universidad Politécnica de Madrid in 2002 and an MBA from IE Business School in 2005. He has served as global entrepreneurship director at Telefónica since 2018.Arias began his career as an engineer. In 2003, he founded IMASTE (since acquired by US communications firm ON24), a virtual events startup, where he served as CTO for nine years.Arias is an active angel investor in the Spanish tech ecosystem. He co-founded Chamberí Valley, which promotes networking initiatives among tech entrepreneurs, and mentors at programs such as the IE Venture Lab and Wayra Academy.

Miguel Arias received an MSc in Civil Engineering from Universidad Politécnica de Madrid in 2002 and an MBA from IE Business School in 2005. He has served as global entrepreneurship director at Telefónica since 2018.Arias began his career as an engineer. In 2003, he founded IMASTE (since acquired by US communications firm ON24), a virtual events startup, where he served as CTO for nine years.Arias is an active angel investor in the Spanish tech ecosystem. He co-founded Chamberí Valley, which promotes networking initiatives among tech entrepreneurs, and mentors at programs such as the IE Venture Lab and Wayra Academy.

Laura González- Estéfani is best known as the co-founder of Venture City. Established in 2017, the tech accelerator has offices in Miami in the US and Madrid in Spain. The director of one of Spain’s largest banks CaixaBank is also a board member of the European Commission’s Innovation Council. She has also worked for Facebook as a country manager for Spain and Portugal.González- Estéfani has also been a prolific private investor and business angel since 2016. She invests across ecosystems and market verticals, including success stories like Cabify and Spotahome. In 2020, she participated in the seed round of Spanish femtech WOOM.

Laura González- Estéfani is best known as the co-founder of Venture City. Established in 2017, the tech accelerator has offices in Miami in the US and Madrid in Spain. The director of one of Spain’s largest banks CaixaBank is also a board member of the European Commission’s Innovation Council. She has also worked for Facebook as a country manager for Spain and Portugal.González- Estéfani has also been a prolific private investor and business angel since 2016. She invests across ecosystems and market verticals, including success stories like Cabify and Spotahome. In 2020, she participated in the seed round of Spanish femtech WOOM.

Ventech China is a unit of France’s Ventech Capital, based in Shanghai. Its focuses on mobile commerce, big data, communities and fintech.

Ventech China is a unit of France’s Ventech Capital, based in Shanghai. Its focuses on mobile commerce, big data, communities and fintech.

Yuan Tou VC was founded as a private equity firm with a registered capital of RMB 10m in Beijing in December 2015.

Yuan Tou VC was founded as a private equity firm with a registered capital of RMB 10m in Beijing in December 2015.

Caris LeVert is a professional basketball player in the USA’s National Basketball Association league, playing for the Brooklyn Nets. A graduate of the University of Michigan, he joined the Nets in 2016, after the Indiana Pacers swapped him for Thaddeus Young in that year’s draft. In 2019, the Nets signed a three year-extension for LeVert’s contract, worth $52.5m.LeVert is managed by Roc Nation, the entertainment and sports management firm founded by musician Jay-Z. He took part in Roc Nation’s investment (via venture arm Arrive) in Indonesian coffee brand Kopi Kenangan. LeVert is also the founder of the 22 Initiative, a youth mentorship program in New York.

Caris LeVert is a professional basketball player in the USA’s National Basketball Association league, playing for the Brooklyn Nets. A graduate of the University of Michigan, he joined the Nets in 2016, after the Indiana Pacers swapped him for Thaddeus Young in that year’s draft. In 2019, the Nets signed a three year-extension for LeVert’s contract, worth $52.5m.LeVert is managed by Roc Nation, the entertainment and sports management firm founded by musician Jay-Z. He took part in Roc Nation’s investment (via venture arm Arrive) in Indonesian coffee brand Kopi Kenangan. LeVert is also the founder of the 22 Initiative, a youth mentorship program in New York.

CICC Alpha is a subsidiary of China International Capital Corporation Limited (CICC), managing a RMB 2 billion fund focusing on internet and financial innovation.

CICC Alpha is a subsidiary of China International Capital Corporation Limited (CICC), managing a RMB 2 billion fund focusing on internet and financial innovation.

Xia Zuoquan (b. 1963) co-founded BYD in 1996, which makes cars as well as batteries for electric vehicles. BYD is about 10% owned by Warren Buffett's Berkshire Hathaway. Xia founded Zhengxuan Capital in 2004, an investment firm having over RMB 10 billion in assets under management. Zhengxuan Capital has invested in more than 30 companies in gene sequencing, robotics, smart hardware, chip design, supply chain finance and talent assessment sectors. Xia was placed no. 256 in the 2015 Forbes China Rich List, with an estimated net worth US$1.2 billion.

Xia Zuoquan (b. 1963) co-founded BYD in 1996, which makes cars as well as batteries for electric vehicles. BYD is about 10% owned by Warren Buffett's Berkshire Hathaway. Xia founded Zhengxuan Capital in 2004, an investment firm having over RMB 10 billion in assets under management. Zhengxuan Capital has invested in more than 30 companies in gene sequencing, robotics, smart hardware, chip design, supply chain finance and talent assessment sectors. Xia was placed no. 256 in the 2015 Forbes China Rich List, with an estimated net worth US$1.2 billion.

Big Sur Ventures is a Spanish VC based in Madrid. It was co-founded by Jose Miguel Herrero and Manuel Matés both with extensive international experience in leading technology products and services companies and M&A. The fund invests in companies focused on SaaS, online marketplace and platforms, IT and digital media. Investments range from seed to later growth stage. The VC usually represents the first institutional capital in a company, leading or co-leading the round with capital injection of between €100,000 and €400.000 per round.

Big Sur Ventures is a Spanish VC based in Madrid. It was co-founded by Jose Miguel Herrero and Manuel Matés both with extensive international experience in leading technology products and services companies and M&A. The fund invests in companies focused on SaaS, online marketplace and platforms, IT and digital media. Investments range from seed to later growth stage. The VC usually represents the first institutional capital in a company, leading or co-leading the round with capital injection of between €100,000 and €400.000 per round.

Founder of Fenghou Capital and Secretary-General of China Young Angel Investor Leader Association (founded in 2013 by China’s leading angel investors such as Bob Xu and Yang Ning).

Founder of Fenghou Capital and Secretary-General of China Young Angel Investor Leader Association (founded in 2013 by China’s leading angel investors such as Bob Xu and Yang Ning).

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

Founder of Xiongxin Capital, Wang Guanxiong used to work in Alibaba, Wanda, 360 and Linekong. He is one of the top 10 We Media and a KOL in tech business in China.

Founder of Xiongxin Capital, Wang Guanxiong used to work in Alibaba, Wanda, 360 and Linekong. He is one of the top 10 We Media and a KOL in tech business in China.

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

Have you ever bought expensive equipment but seldom used it? Do you want to try the latest electronic gadgets at low cost? Try this online sharing and rental platform

Duozhuayu: This platform sells pre-owned books after repairing them to look like new

Duozhuayu also uses its own algorithm to predict demand, selling about 2,000 used books daily

Dai Wei and his Ofo: Fighting till the last act?

How the college student who founded a global bike-sharing sensation also led it to the verge of bankruptcy through a string of mistakes

Covid-19 has renewed investors' interest in China's online education sector

Will skyrocketing demand for online education during Covid-19 give China's edtechs that long-awaited push to profitability?

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

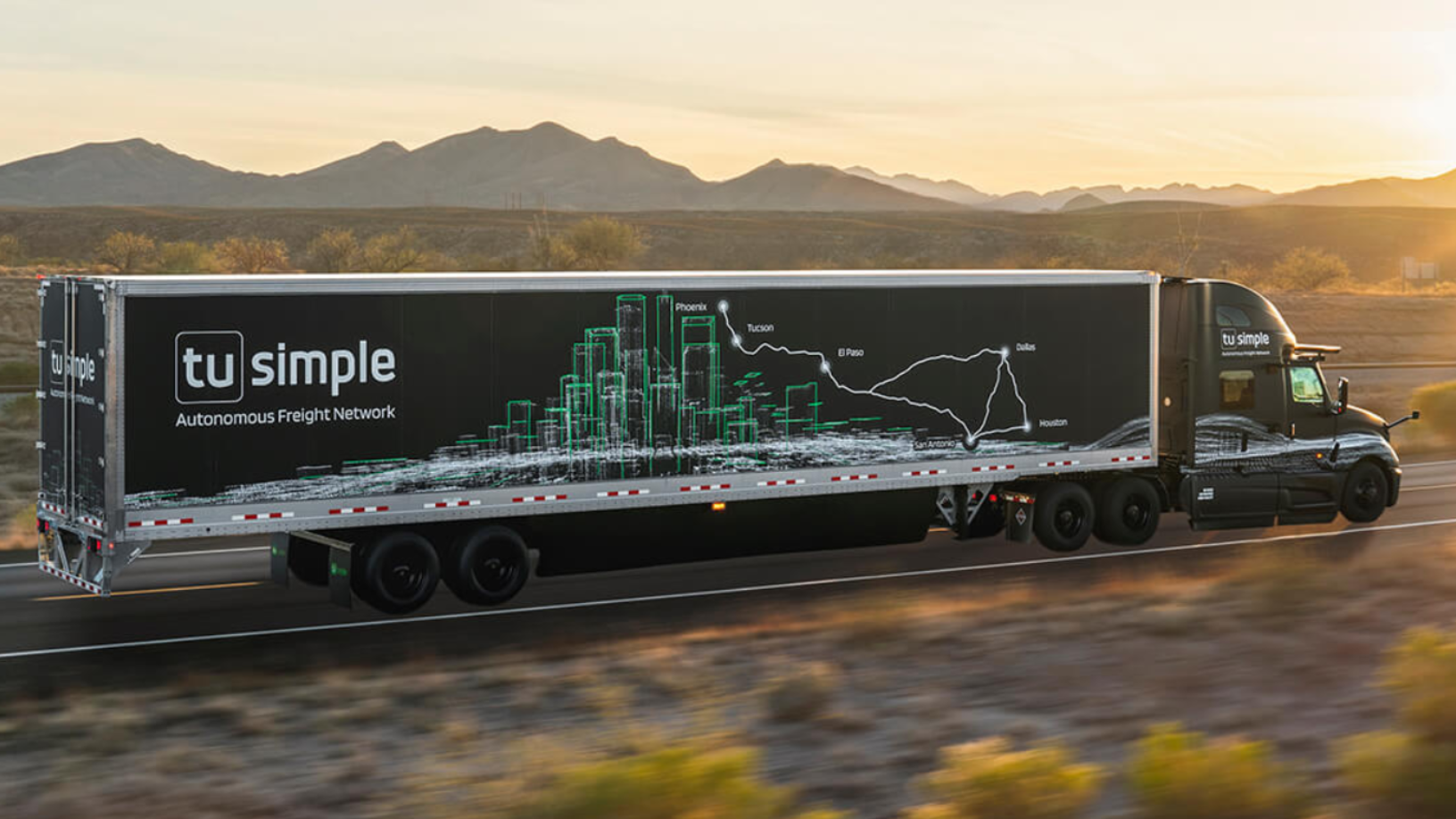

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

SWITCH Singapore: Sustainability startups see growing demand from corporates

Sophie’s BioNutrients, Ubiik and Intello Labs also note new trends in technology and supply chain arising from the Covid-19 pandemic, across the food, manufacturing and e-commerce sectors

Li Zexiang and his game-changing plans to take Chinese robotics global

An early supporter of drone giant DJI, Professor Li Zexiang is building robotics hubs across China to pivot homegrown enterprises into global players

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Sorry, we couldn’t find any matches for“Wei Venture Capital”.