Wei Venture Capital

-

DATABASE (844)

-

ARTICLES (435)

Lenovo Accelerator was co-founded by Lenovo Capital and Incubator Group and Hong Kong-based business park Cyberport in Hong Kong in May 2016. It invests mainly in early-stage startups specialized in cutting-edge technologies and TMT. It is Lenovo Group's first startup accelerator in China. Each startup selected by Lenovo Accelerator receives RMB 500,000 to RMB 1m in funding from Lenovo Group.

Lenovo Accelerator was co-founded by Lenovo Capital and Incubator Group and Hong Kong-based business park Cyberport in Hong Kong in May 2016. It invests mainly in early-stage startups specialized in cutting-edge technologies and TMT. It is Lenovo Group's first startup accelerator in China. Each startup selected by Lenovo Accelerator receives RMB 500,000 to RMB 1m in funding from Lenovo Group.

Founded in 2007 by two US-educated and -trained returnees, David Zhang (Zhang Pin) and Shao Bo (Shao Yibo), Matrix Partners China has managed more than RMB 15.5 billion in capital and invested in over 320 companies, including Cheetah Mobile, Didi, Kuaidi, Ele.me, Koudai Shopping and Momo. Zhang has described the 100-strong firm’s investment style as “aggressive”, backing about 80 companies a year. An affiliate of Matrix Partners in the US, the firm focuses on internet & mobile internet, financial services, healthcare and SaaS companies in China.

Founded in 2007 by two US-educated and -trained returnees, David Zhang (Zhang Pin) and Shao Bo (Shao Yibo), Matrix Partners China has managed more than RMB 15.5 billion in capital and invested in over 320 companies, including Cheetah Mobile, Didi, Kuaidi, Ele.me, Koudai Shopping and Momo. Zhang has described the 100-strong firm’s investment style as “aggressive”, backing about 80 companies a year. An affiliate of Matrix Partners in the US, the firm focuses on internet & mobile internet, financial services, healthcare and SaaS companies in China.

Founded in 2011, the knowledge capital fund is an initiative from the InKemia IUCT Group to focus on innovation and the licensing of patents in the biotech sectors. InKemia supports the life science industry through R&D grant programs, technical consultancy and training. It specializes in areas such as chemical synthesis, biotech, bio-catalysis, quality control and EU releases of new products. InKemia also supports local entrepreneurs through the Manuel Arroyo Award for Young Entrepreneurs with the aim to promote local cooperative economic development.

Founded in 2011, the knowledge capital fund is an initiative from the InKemia IUCT Group to focus on innovation and the licensing of patents in the biotech sectors. InKemia supports the life science industry through R&D grant programs, technical consultancy and training. It specializes in areas such as chemical synthesis, biotech, bio-catalysis, quality control and EU releases of new products. InKemia also supports local entrepreneurs through the Manuel Arroyo Award for Young Entrepreneurs with the aim to promote local cooperative economic development.

Lei is co-founder, chairman and CEO of Xiaomi, one of the world’s largest smartphone companies. Born in December 1969, he holds a degree in Engineering from Wuhan University. With a personal net worth of US$11.2 billion, Lei has invested in 33 companies as a business angel, including Vancl.com, UCWeb, and YY Inc., a live streaming social media platform in China. He has also invested in 270 companies through Shunwei Capital, where he is a founding partner. Lei's investment focuses are e-commerce, mobile internet and social networking.

Lei is co-founder, chairman and CEO of Xiaomi, one of the world’s largest smartphone companies. Born in December 1969, he holds a degree in Engineering from Wuhan University. With a personal net worth of US$11.2 billion, Lei has invested in 33 companies as a business angel, including Vancl.com, UCWeb, and YY Inc., a live streaming social media platform in China. He has also invested in 270 companies through Shunwei Capital, where he is a founding partner. Lei's investment focuses are e-commerce, mobile internet and social networking.

Salvador García Andrés received his MSc in Telecommunications Engineering from Alfonso X el Sabio University in 2000. He also studied Finance at the London School of Economics in 2002.He has held several senior positions in the FX and trading desks of ABN Amro, Rabobank and Vega Capital. In 2009, he co-founded Ebury, a fintech company that offers a range of financial products to help SMEs expand internationally.García Andrés is an active angel investor in European tech startups.

Salvador García Andrés received his MSc in Telecommunications Engineering from Alfonso X el Sabio University in 2000. He also studied Finance at the London School of Economics in 2002.He has held several senior positions in the FX and trading desks of ABN Amro, Rabobank and Vega Capital. In 2009, he co-founded Ebury, a fintech company that offers a range of financial products to help SMEs expand internationally.García Andrés is an active angel investor in European tech startups.

Spain's first social impact investment fund Creas Foundation invests in business projects which prioritize the creation of social and environmental value. It acts as an investor and partner in financial, management and strategic decisions. Its goal is to facilitate access to funding and accelerate growth of social businesses which have an innovative approach and sustainable income model. It has fixed a target of €30m to invest in social enterprise startups. The fund offers participatory loans or capital injections ranging from €5,000 to €25,000.

Spain's first social impact investment fund Creas Foundation invests in business projects which prioritize the creation of social and environmental value. It acts as an investor and partner in financial, management and strategic decisions. Its goal is to facilitate access to funding and accelerate growth of social businesses which have an innovative approach and sustainable income model. It has fixed a target of €30m to invest in social enterprise startups. The fund offers participatory loans or capital injections ranging from €5,000 to €25,000.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Nigerian investment bank and investor CardinalStone Partners was founded in 2008. It invests in enterprises with the potential to transform diverse sectors deemed to be strategic to the development of the economies in Nigeria, Ghana and other West African countries.The VC also reviews potential investments in relation to their ESG impact. CardinalStone currently has six companies in its portfolio including Nigerian gym chain i-Fitness and Nigerian fintech Appzone. In 2020, it raised $50m for a new private equity fund, CardinalStone Capital Advisers Growth Fund.

Nigerian investment bank and investor CardinalStone Partners was founded in 2008. It invests in enterprises with the potential to transform diverse sectors deemed to be strategic to the development of the economies in Nigeria, Ghana and other West African countries.The VC also reviews potential investments in relation to their ESG impact. CardinalStone currently has six companies in its portfolio including Nigerian gym chain i-Fitness and Nigerian fintech Appzone. In 2020, it raised $50m for a new private equity fund, CardinalStone Capital Advisers Growth Fund.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Khosla Ventures is a Silicon Valley-based VC, founded in 2004 by Indian-born founder of tech pioneer Sun Microsystems Vinod Khosla. The company has no specific interest in terms of sector but heavily favors “large problems that are amenable to technology solutions” and invests in so-called high potential 'black swans´. Healthcare is a strong focus and its most recent investments include in the Portuguese home physiotherapy tech solution SWORD Health's 2021 $85m Series C and $25m Series B rounds besides its 2020 $17m Series A round which it led. Khosla has over $5bn under management and more than 70 staff, with investments in more than 700 startups, leading more than one-third. Other recent investments include in the July 2021 $75m Series C round of Indian personal health and fitness app HealthifyMe and, the same month, in the $12.5m Series A round of US commercial real estate app for tenants and property managers Jones.

Khosla Ventures is a Silicon Valley-based VC, founded in 2004 by Indian-born founder of tech pioneer Sun Microsystems Vinod Khosla. The company has no specific interest in terms of sector but heavily favors “large problems that are amenable to technology solutions” and invests in so-called high potential 'black swans´. Healthcare is a strong focus and its most recent investments include in the Portuguese home physiotherapy tech solution SWORD Health's 2021 $85m Series C and $25m Series B rounds besides its 2020 $17m Series A round which it led. Khosla has over $5bn under management and more than 70 staff, with investments in more than 700 startups, leading more than one-third. Other recent investments include in the July 2021 $75m Series C round of Indian personal health and fitness app HealthifyMe and, the same month, in the $12.5m Series A round of US commercial real estate app for tenants and property managers Jones.

China- and Asia Pacific-focused SAIF Partners is one of China's largest homegrown PE firms, managing about $4 billion in capital. Led by former World Bank economist Andy Yan, it has invested in more than 200 companies. Taking a value-based investment approach, it says: "We generally make individual equity investments of between $10 million and $100 million, in one or more rounds of financing, and generally seek to obtain a significant minority equity ownership position in the range of 15% to 40% of a portfolio company." SAIF also has a strong presence in India.

China- and Asia Pacific-focused SAIF Partners is one of China's largest homegrown PE firms, managing about $4 billion in capital. Led by former World Bank economist Andy Yan, it has invested in more than 200 companies. Taking a value-based investment approach, it says: "We generally make individual equity investments of between $10 million and $100 million, in one or more rounds of financing, and generally seek to obtain a significant minority equity ownership position in the range of 15% to 40% of a portfolio company." SAIF also has a strong presence in India.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Veteran Portuguese investor Diamantino Costa, aka Dino, is the founder and managing partner of DCVentures and Ganexa Capital. He is also the chairman and CEO of Intelligent Sensing Anywhere (ISA), an IoT firm in energy, oil and gas. He is a former chairman of the Portuguese Aerospace Industry Association (PEMAS).Costa has a master’s in Computer Science from the University of Coimbra. He co-founded and exited Critical Software, one of Portugal’s first startups. The business application development company has its roots at the University of Coimbra and secured NASA as its first client.

Veteran Portuguese investor Diamantino Costa, aka Dino, is the founder and managing partner of DCVentures and Ganexa Capital. He is also the chairman and CEO of Intelligent Sensing Anywhere (ISA), an IoT firm in energy, oil and gas. He is a former chairman of the Portuguese Aerospace Industry Association (PEMAS).Costa has a master’s in Computer Science from the University of Coimbra. He co-founded and exited Critical Software, one of Portugal’s first startups. The business application development company has its roots at the University of Coimbra and secured NASA as its first client.

Founding partner of China Bridge Capital, Zeng Qiang used to be nominated the Most Influential Chinese IT Leader by TIME in 1998. He founded Sparkice, one of the first B2B e-commerce platforms in China, in 1996. He co-founded LeTV CBC Buyout Fund, Wumei CBC Buyout Fund, iCarbonX CBC Buyout Fund, E-China Alliance, and Yabuli China Entrepreneurs Forum. Zeng Qiang received his Master of Economic Management in Tsinghua University and Master of Financial Economics in The University of Toronto. He also serves as the guest professor at the Business School of Tsinghua.

Founding partner of China Bridge Capital, Zeng Qiang used to be nominated the Most Influential Chinese IT Leader by TIME in 1998. He founded Sparkice, one of the first B2B e-commerce platforms in China, in 1996. He co-founded LeTV CBC Buyout Fund, Wumei CBC Buyout Fund, iCarbonX CBC Buyout Fund, E-China Alliance, and Yabuli China Entrepreneurs Forum. Zeng Qiang received his Master of Economic Management in Tsinghua University and Master of Financial Economics in The University of Toronto. He also serves as the guest professor at the Business School of Tsinghua.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

With the State Council’s approval, the China State-Owned VC Fund was established and financed by China Construction Bank Corporation, China Reform Holdings Corporation, Ltd. (CRHC), the Postal Savings Bank of China and Shenzhen Investment Holding Co., Ltd. in 2016. The fund had initial capital of RMB 100 billion, 34 billion of which came from state-owned CRHC, which is also the fund’s main sponsor and controlling shareholder. The China State-Owned VC Fund is committed to helping centrally-administered state companies develop by investing in technological upgrades in the fields of robotics, AI, big data, mobile finance, electric vehicles, new energy, etc.

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

Have you ever bought expensive equipment but seldom used it? Do you want to try the latest electronic gadgets at low cost? Try this online sharing and rental platform

Duozhuayu: This platform sells pre-owned books after repairing them to look like new

Duozhuayu also uses its own algorithm to predict demand, selling about 2,000 used books daily

Dai Wei and his Ofo: Fighting till the last act?

How the college student who founded a global bike-sharing sensation also led it to the verge of bankruptcy through a string of mistakes

Covid-19 has renewed investors' interest in China's online education sector

Will skyrocketing demand for online education during Covid-19 give China's edtechs that long-awaited push to profitability?

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

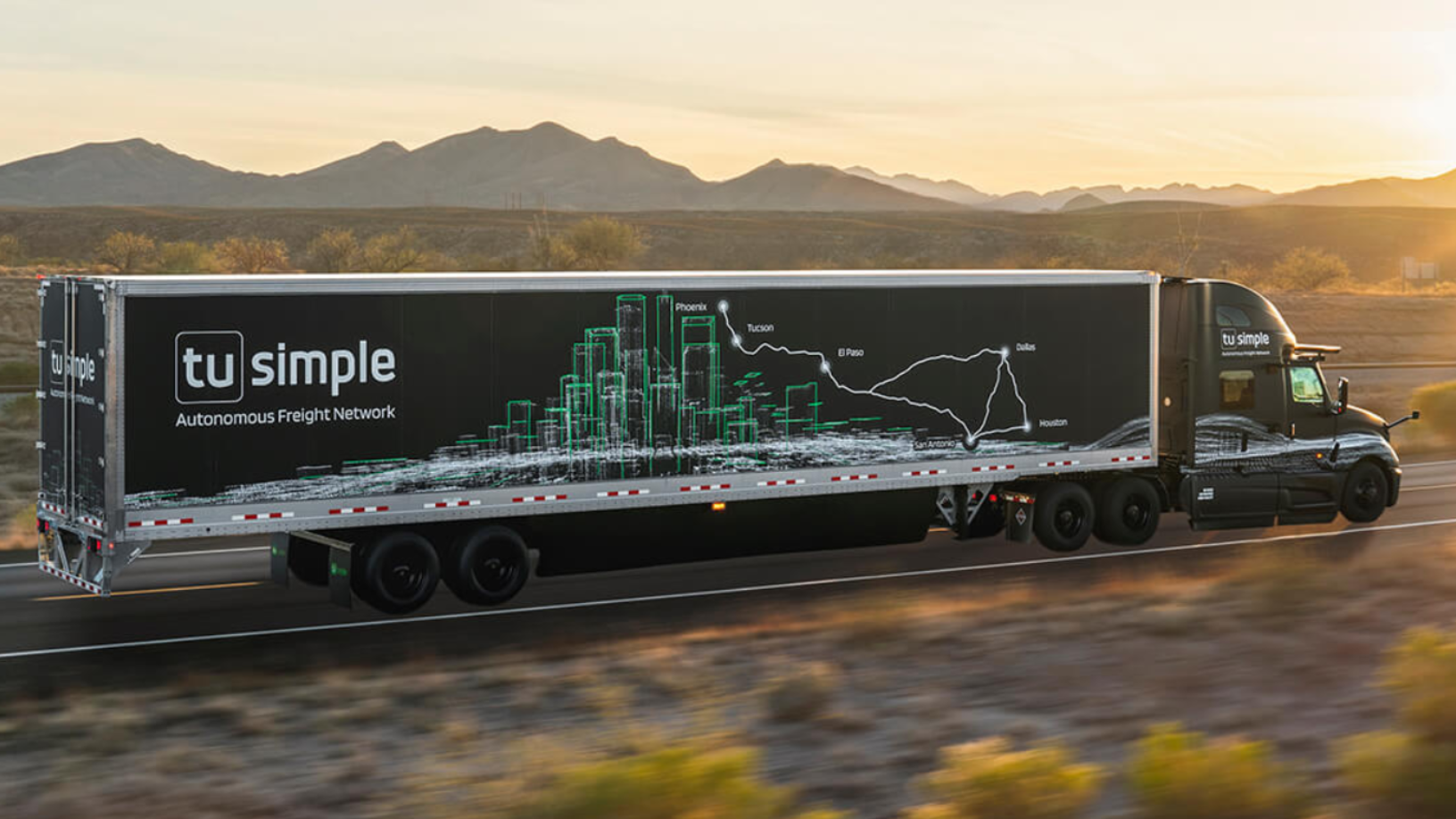

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

SWITCH Singapore: Sustainability startups see growing demand from corporates

Sophie’s BioNutrients, Ubiik and Intello Labs also note new trends in technology and supply chain arising from the Covid-19 pandemic, across the food, manufacturing and e-commerce sectors

Li Zexiang and his game-changing plans to take Chinese robotics global

An early supporter of drone giant DJI, Professor Li Zexiang is building robotics hubs across China to pivot homegrown enterprises into global players

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Sorry, we couldn’t find any matches for“Wei Venture Capital”.