Werner Enterprises

-

DATABASE (68)

-

ARTICLES (77)

Tianxing Capital is a venture capital management company that was founded in 2012. It has invested in over 500 enterprises so far. Its investment focuses are media, healthcare, energy conservation, environmental protection, high-end manufacturing, etc.

Tianxing Capital is a venture capital management company that was founded in 2012. It has invested in over 500 enterprises so far. Its investment focuses are media, healthcare, energy conservation, environmental protection, high-end manufacturing, etc.

Centro para el Desarollo Tecnológico Industrial (CDTI) is a Spanish government startup accelerator under the Ministry of Science, Education and Universities. Based in Madrid, it has invested in 13 startups since 2015, predominantly focusing on scientific enterprises.

Centro para el Desarollo Tecnológico Industrial (CDTI) is a Spanish government startup accelerator under the Ministry of Science, Education and Universities. Based in Madrid, it has invested in 13 startups since 2015, predominantly focusing on scientific enterprises.

Guangdong China Science & Merchants Capital Management

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Guangzhou Yuexiu Industrial Investment Fund Management

Founded by the conglomerate Yuexiu Enterprises (Holdings) Limited in 2011, Guangzhou Yuexiu Industrial Investment Fund Management is mainly engaged in equity investment, mezzanine investment and FOF investment. The firm managed total of assets worth over RMB 60bn by the end of 2018.

Founded by the conglomerate Yuexiu Enterprises (Holdings) Limited in 2011, Guangzhou Yuexiu Industrial Investment Fund Management is mainly engaged in equity investment, mezzanine investment and FOF investment. The firm managed total of assets worth over RMB 60bn by the end of 2018.

Co-founder of Glovo

Of mixed Canadian-British heritage, Sacha Michaud (b.1970) is an entrepreneur with over 15 years of experience in managing and setting up successful companies such as Latin Red in 1997. In 1999, StarMedia Networks Inc acquired Latin Red, one of the most successful acquisitions of Spanish startups to this day.Michaud has also founded companies like Inlander, Transword and OZU. In 2014, he left Betfair Iberia to establish Glovo with Oscar Pierre. Michaud is still with Binaria that he co-founded in 1997 in Barcelona. He is also an advisor and investor in diverse enterprises likes Exoticca and Playfulbet.

Of mixed Canadian-British heritage, Sacha Michaud (b.1970) is an entrepreneur with over 15 years of experience in managing and setting up successful companies such as Latin Red in 1997. In 1999, StarMedia Networks Inc acquired Latin Red, one of the most successful acquisitions of Spanish startups to this day.Michaud has also founded companies like Inlander, Transword and OZU. In 2014, he left Betfair Iberia to establish Glovo with Oscar Pierre. Michaud is still with Binaria that he co-founded in 1997 in Barcelona. He is also an advisor and investor in diverse enterprises likes Exoticca and Playfulbet.

Founded in 2008 in Shanghai, Stone Capital managed assets over RMB 10 billion in 2017. It focuses on high-growth private enterprises and state-owned companies with special resources in industries such as new material, new energy, high-tech, IT, environmental protection and healthcare.

Founded in 2008 in Shanghai, Stone Capital managed assets over RMB 10 billion in 2017. It focuses on high-growth private enterprises and state-owned companies with special resources in industries such as new material, new energy, high-tech, IT, environmental protection and healthcare.

Oriental Fortune Capital is an entrepreneur-oriented investment management company that was founded in 2006. It manages 26 funds with capital over RMB 10 billion. It has invested in over 220 projects, 20% of which are early stage startups and 80% growing or mature enterprises.

Oriental Fortune Capital is an entrepreneur-oriented investment management company that was founded in 2006. It manages 26 funds with capital over RMB 10 billion. It has invested in over 220 projects, 20% of which are early stage startups and 80% growing or mature enterprises.

Chief Strategist, CTO and co-founder of TurtleTree Labs

Max Rye graduated in computer science at the University of California, Davis, in 2001. Currently based in Berkeley, Rye has worked in the IT industry for over 15 years. He was the CEO of Royal IT from 2003 to 2018 in California. He was also a senior information technology specialist at Mahler Enterprises from 2011 to 2018.In 2019, he set up TurtleTree Labs in Singapore with Lin Fengru whom he had previously met at a Google conference. He became the CTO of TurtleTree Labs with Lin as CEO. In January 2020, he was appointed chief strategist based at the company’s office in San Francisco. In December 2020, he and Lin also co-founded TurtleTree Scientific in Singapore.

Max Rye graduated in computer science at the University of California, Davis, in 2001. Currently based in Berkeley, Rye has worked in the IT industry for over 15 years. He was the CEO of Royal IT from 2003 to 2018 in California. He was also a senior information technology specialist at Mahler Enterprises from 2011 to 2018.In 2019, he set up TurtleTree Labs in Singapore with Lin Fengru whom he had previously met at a Google conference. He became the CTO of TurtleTree Labs with Lin as CEO. In January 2020, he was appointed chief strategist based at the company’s office in San Francisco. In December 2020, he and Lin also co-founded TurtleTree Scientific in Singapore.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

Shenzhen Guozhong Venture Capital Management Co., Ltd. (GZVCM)

Shenzhen Guozhong Venture Capital Management Co., Ltd. (GZVCM) was founded in December 2015. Chief Partner and CEO Shi Anping previously served as vice president at Shenzhen Venture Capital Group. GZVCM is currently entrusted to operate the state-backed Small Medium Enterprises Development Fund, which has RMB 60bn under management.

Shenzhen Guozhong Venture Capital Management Co., Ltd. (GZVCM) was founded in December 2015. Chief Partner and CEO Shi Anping previously served as vice president at Shenzhen Venture Capital Group. GZVCM is currently entrusted to operate the state-backed Small Medium Enterprises Development Fund, which has RMB 60bn under management.

Co-founder of Santara

Mardigu Wowiek Prasantyo is a serial entrepreneur who has over 30 years of experience in various oil and gas businesses and other enterprises. Prasantyo is the founder of oil and gas services companies Titis Sampurna and Laksel EPS, which have been part of various energy projects in Indonesia. He claims to be the only civilian to have worked as special advisor for Indonesia's Ministry of Defense. Armed with a degree in criminal psychology, he has said he has taken part in interrogations and has provided opinions on terrorist movements. Prior to becoming involved with equity crowdfunding platform, Santara, he also started a gold-backed cryptocurrency called Cyronium, which purportedly supports SMEs through blockchain-based investments.

Mardigu Wowiek Prasantyo is a serial entrepreneur who has over 30 years of experience in various oil and gas businesses and other enterprises. Prasantyo is the founder of oil and gas services companies Titis Sampurna and Laksel EPS, which have been part of various energy projects in Indonesia. He claims to be the only civilian to have worked as special advisor for Indonesia's Ministry of Defense. Armed with a degree in criminal psychology, he has said he has taken part in interrogations and has provided opinions on terrorist movements. Prior to becoming involved with equity crowdfunding platform, Santara, he also started a gold-backed cryptocurrency called Cyronium, which purportedly supports SMEs through blockchain-based investments.

Aqua-Spark is a Netherlands-based fund that supports aquaculture businesses around the world, with the vision to create profitable aquaculture ventures that can help to restore ocean ecosystems that have been damaged by overfishing. Its portfolio covers a wide range of enterprises, ranging from low-cost fish farms in Madagascar to biotechs and high tech aquaculture companies.

Aqua-Spark is a Netherlands-based fund that supports aquaculture businesses around the world, with the vision to create profitable aquaculture ventures that can help to restore ocean ecosystems that have been damaged by overfishing. Its portfolio covers a wide range of enterprises, ranging from low-cost fish farms in Madagascar to biotechs and high tech aquaculture companies.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

The Repsol Foundation, part of the Repsol Group, is committed to improving social and environmental outcomes.Repsol has launched a €50m social investment fund to be used in developing a portfolio of social enterprises focused on energy transition and social inclusion of vulnerable groups in Spain. The firm invested €9,5m during 2018.

The Repsol Foundation, part of the Repsol Group, is committed to improving social and environmental outcomes.Repsol has launched a €50m social investment fund to be used in developing a portfolio of social enterprises focused on energy transition and social inclusion of vulnerable groups in Spain. The firm invested €9,5m during 2018.

Aavishkaar (‘invention’ in Hindi) was founded in 2001 as an early stage investor to help build sustainable enterprises in India’s underserved regions. Its VC portfolio, valued at over US$ 155 million, covers key industry sectors including sanitation, healthcare, agriculture and technology. Its Aavishkaar Frontier Fund was created in 2015 to invest in South and Southeast Asian countries like Indonesia, Pakistan and Bangladesh.

Aavishkaar (‘invention’ in Hindi) was founded in 2001 as an early stage investor to help build sustainable enterprises in India’s underserved regions. Its VC portfolio, valued at over US$ 155 million, covers key industry sectors including sanitation, healthcare, agriculture and technology. Its Aavishkaar Frontier Fund was created in 2015 to invest in South and Southeast Asian countries like Indonesia, Pakistan and Bangladesh.

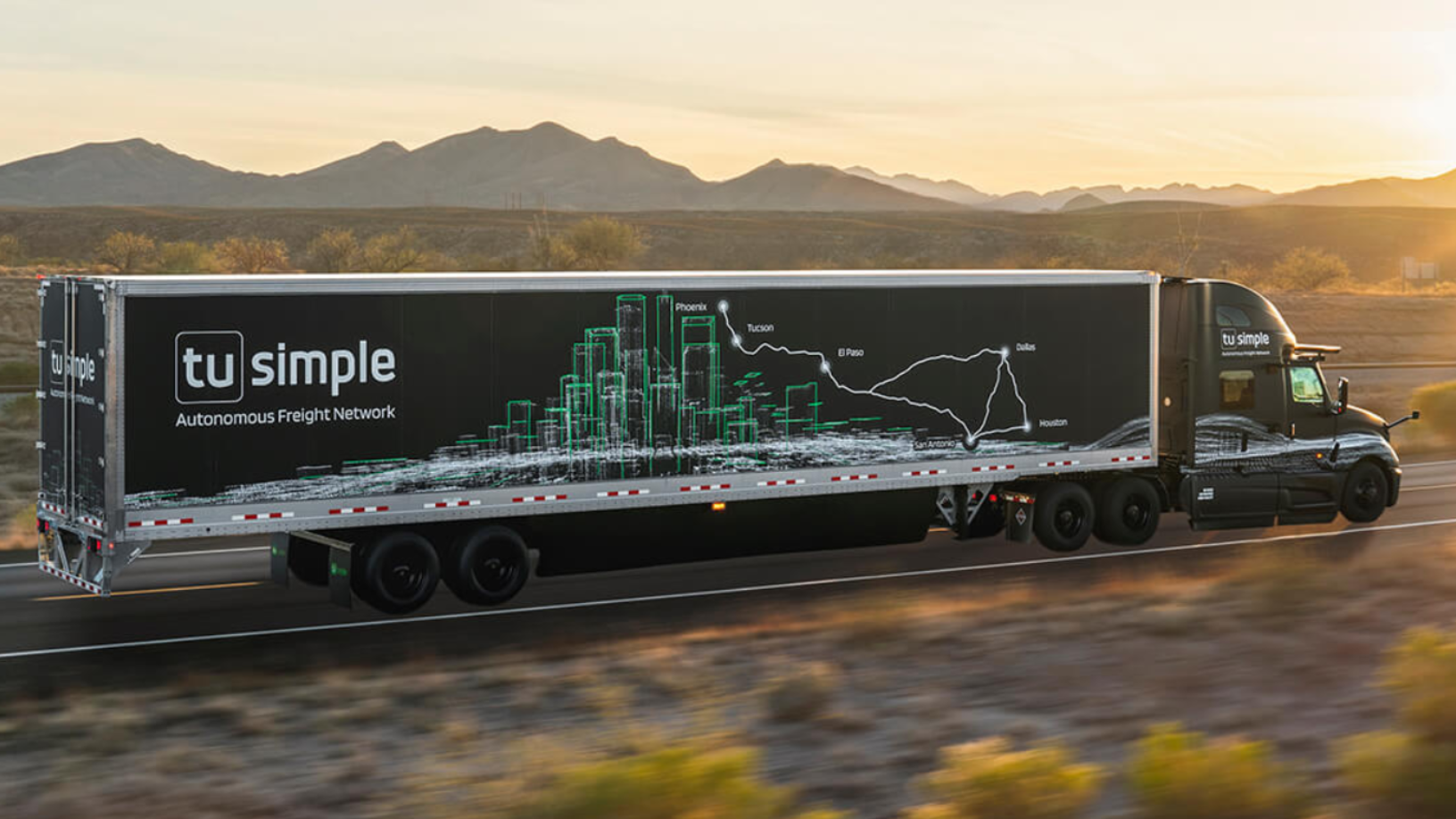

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Delman helps enterprises wrangle data for machine learning and automation

With fresh $1.6m seed funding and high-profile partners, Delman’s data services are helping Indonesian clients achieve digital transformation

Neosentec: Open source SaaS helping enterprises create customized AR experiences

Neosentec has created an open source SaaS for businesses to offer customized AR experiences

Indonesian state enterprises launch e-wallet LinkAja, competing with Go-Pay and OVO

Even with a wider range of services and extensive state backing, LinkAja faces a tough battle

MENA and Du’Anyam: How two Indonesian social enterprises are tackling Covid-19 challenges

The call to help women in rural communities has become more urgent as social enterprises struggle to survive the current crisis

Volantis Technology: Guiding Indonesian enterprises into "Industry 4.0" with end-to-end AI platform

Volantis Technology helps Indonesian companies incorporate digital transformation and make the best use of their data; eyes Singapore office for overseas markets

Already helping over 1,000 corporates like Alibaba and JD.com manage and lower their carbon emissions, Carbonstop is ready to do more when China’s carbon trading starts next year

Ciweishixi: HR startup helps Chinese youth pursue rewarding careers

Ciweishixi uses the Western internship model to help young people discover their true passion, online and offline

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

China B2B startups still have much room to grow in a trillion-RMB market

Investors favor enterprise tech startups amid slowing deal flow, still foresee strong growth despite competition from tech giants

China’s startups have much to gain from the US-China trade war

The prolonged trade conflict may be exactly what Chinese startups need to strengthen their technological capabilities

Bailian.ai: Using Internet big data, AI to help corporates acquire customers

Previously, a salesperson who got five or six customer leads was considered fortunate. Now, using Bailian.ai, thousands, or even millions, of leads can be found at once

Ambitious startup Kuaidiniao aims to be the Alipay of logistics

Kuaidiniao carves out a niche for itself in the logistics market by targeting small- and medium-sized businesses

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

Auara: Social enterprise and environmental sustainability in a bottle

Auara, with its 100% recycled-plastic mineral water bottles, aims to reduce its manufacturing carbon footprint while helping the most water-stressed citizens

Sorry, we couldn’t find any matches for“Werner Enterprises”.