Weston Energy

-

DATABASE (152)

-

ARTICLES (131)

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

CEO, co-founder of Xampla

Simon Hombersley is the CEO and co-founder of Britain’s Xampla, producer of plant-based biodegradable plastics made from protein, where he has worked full-time since 2018. Prior to Xampla, Hombersley worked in various UK-based engineering roles that included almost three years at Oxford Flow, an Oxford University spin-off, reducing water leakage and improving industrial efficiency.Earlier, between 2012 and 2015, he worked in the industrial entrepreneurial agency Puntios, which he founded. From 2004–2012 he was Chairman and founder at TwentyNinety, developers of a wireless monitoring system for photovoltaics. From 2004 to March 2021, he was the founder and non-executive director at Lontra, an engineering firm developing and commercializing energy-saving industrial compressors. Hombersley began his professional life as a public affairs consultant providing advice on regulatory and political affairs mainly to water companies.

Simon Hombersley is the CEO and co-founder of Britain’s Xampla, producer of plant-based biodegradable plastics made from protein, where he has worked full-time since 2018. Prior to Xampla, Hombersley worked in various UK-based engineering roles that included almost three years at Oxford Flow, an Oxford University spin-off, reducing water leakage and improving industrial efficiency.Earlier, between 2012 and 2015, he worked in the industrial entrepreneurial agency Puntios, which he founded. From 2004–2012 he was Chairman and founder at TwentyNinety, developers of a wireless monitoring system for photovoltaics. From 2004 to March 2021, he was the founder and non-executive director at Lontra, an engineering firm developing and commercializing energy-saving industrial compressors. Hombersley began his professional life as a public affairs consultant providing advice on regulatory and political affairs mainly to water companies.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Founded in 2016, SDICVC is a fund management company under State Development & Investment Corp, dedicating itself to promoting the industrialization of advanced technology and innovation in China, with key focus in Clean Technology, New Energy, Advanced Biotechnology, Advanced IT & Electronic Science. SDICVC currently manages 3 major funds, namely, National Science and Technology Major Project Fund, JingJinJi (Beijing, Tianjin, Hebei) Special Fund and High-Tech (Shenzhen) Startup Fund, backing up 30 Chinese startups in the related fields.

Founded in 2016, SDICVC is a fund management company under State Development & Investment Corp, dedicating itself to promoting the industrialization of advanced technology and innovation in China, with key focus in Clean Technology, New Energy, Advanced Biotechnology, Advanced IT & Electronic Science. SDICVC currently manages 3 major funds, namely, National Science and Technology Major Project Fund, JingJinJi (Beijing, Tianjin, Hebei) Special Fund and High-Tech (Shenzhen) Startup Fund, backing up 30 Chinese startups in the related fields.

Changxing Angel was founded in 2015 by the local government of Changxing county in Jiaxing city, Zhejiang province. In 2016, it set up an incubator in Hangzhou called UNI Tech-Forest . Startups in Uni Tech-Forest could enjoy the policy support of Changxing county and the tech ecosystems in Hangzhou. As at October 2019, it had more than 60 companies in its incubator, most of which are from new energy, new material, electronics and smart manufacturing sectors.

Changxing Angel was founded in 2015 by the local government of Changxing county in Jiaxing city, Zhejiang province. In 2016, it set up an incubator in Hangzhou called UNI Tech-Forest . Startups in Uni Tech-Forest could enjoy the policy support of Changxing county and the tech ecosystems in Hangzhou. As at October 2019, it had more than 60 companies in its incubator, most of which are from new energy, new material, electronics and smart manufacturing sectors.

Gin Venture Capital, also commonly known as GVC, is a Madrid-based investment management firm that has a multidisciplinary team with expertise and experience in strategic consulting, finance, marketing, sales, engineering, IT and logistics. Its investment commitment is for a maximum of five years. The firm usually co-invests through minimum investment tickets of €25,000. Its investment focus is on tech startups and SMEs and has developed proprietary technology companies in the clean-energy sector and IoT.

Gin Venture Capital, also commonly known as GVC, is a Madrid-based investment management firm that has a multidisciplinary team with expertise and experience in strategic consulting, finance, marketing, sales, engineering, IT and logistics. Its investment commitment is for a maximum of five years. The firm usually co-invests through minimum investment tickets of €25,000. Its investment focus is on tech startups and SMEs and has developed proprietary technology companies in the clean-energy sector and IoT.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Stanford Graduate School of Business

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

Shanghai Alliance Investment Ltd

Shanghai Alliance Investment Ltd is a state-owned company founded in September 1994 under the State-owned Assets Supervision and Administration Commission of Shanghai. It mainly engages in equity investment in hi-tech and modern services industry.It has invested over RMB 10bn in diverse sectors including information technology, biomedicine, new energy, environmental protection, new materials and financial services. In 2004, the company and Microsoft set up the joint venture Shanghai MSN Network Communications Technology Co Ltd that operates MSN China's website: msn.com.cn.

Shanghai Alliance Investment Ltd is a state-owned company founded in September 1994 under the State-owned Assets Supervision and Administration Commission of Shanghai. It mainly engages in equity investment in hi-tech and modern services industry.It has invested over RMB 10bn in diverse sectors including information technology, biomedicine, new energy, environmental protection, new materials and financial services. In 2004, the company and Microsoft set up the joint venture Shanghai MSN Network Communications Technology Co Ltd that operates MSN China's website: msn.com.cn.

Founded in 2006, Abacus Alpha is a German VC that has invested in water or industry service companies instead of the typical tech startups. Based in Frankenthal, Rheinland-Pfalz, it is the investment arm of German multinational, KSB Group, a pump and valve producer. Its most recent investments were the 2019 undisclosed seed funding of industrial tech company Applied Nano Services, the 2018 undisclosed seed round in desalination innovator Salinova and the 2017 undisclosed seed investment in AddVolt, pioneer of renewable energy generation technology to replace diesel engines for cold chain transport.

Founded in 2006, Abacus Alpha is a German VC that has invested in water or industry service companies instead of the typical tech startups. Based in Frankenthal, Rheinland-Pfalz, it is the investment arm of German multinational, KSB Group, a pump and valve producer. Its most recent investments were the 2019 undisclosed seed funding of industrial tech company Applied Nano Services, the 2018 undisclosed seed round in desalination innovator Salinova and the 2017 undisclosed seed investment in AddVolt, pioneer of renewable energy generation technology to replace diesel engines for cold chain transport.

Founded in 2016 in Boulder, Colorado, Blackhorn specializes in startup investment in potential game-changers for industry, including construction – its top priority for investment – manufacturing, healthcare, agriculture, transportation, water and energy. It has no geographical bias and currently has 48 companies in its portfolio with two acquisitions to date. Its most recent investments include in the undisclosed $8m round of US medtech Cytovale in January 2021 and in the $20.5m December 2020 Series A round of employees compensation fintech Foresight Risk, based in Silicon Valley.

Founded in 2016 in Boulder, Colorado, Blackhorn specializes in startup investment in potential game-changers for industry, including construction – its top priority for investment – manufacturing, healthcare, agriculture, transportation, water and energy. It has no geographical bias and currently has 48 companies in its portfolio with two acquisitions to date. Its most recent investments include in the undisclosed $8m round of US medtech Cytovale in January 2021 and in the $20.5m December 2020 Series A round of employees compensation fintech Foresight Risk, based in Silicon Valley.

Established in 1996, SBI Investment is a venture capital firm that focuses on growth sectors such as information technology, biotechnology, life science, mobile, environment and energy. The VC arm of the SBI Group is developed to quickly find new, emerging technologies and investing in those technologies to further the development of the group. SBI Group then introduces the new technologies to existing businesses in order to help them stay ahead in the market, as well as to revitalize local industries in Japan, particularly in the financial and banking sectors.

Established in 1996, SBI Investment is a venture capital firm that focuses on growth sectors such as information technology, biotechnology, life science, mobile, environment and energy. The VC arm of the SBI Group is developed to quickly find new, emerging technologies and investing in those technologies to further the development of the group. SBI Group then introduces the new technologies to existing businesses in order to help them stay ahead in the market, as well as to revitalize local industries in Japan, particularly in the financial and banking sectors.

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

Solatom: Cost-effective flatpack mobile solar energy units for SMEs

Solatom's turnkey solar thermal solutions can cut energy costs by 37%. Its real-time data analytics can also be used to ensure that the industrial processing units are operating at optimal conditions

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

Dipole Tech: Using blockchain to democratize access to renewable energy in Asia

Having established key markets in the Philippines and Thailand, China’s Dipole Tech is next gaining ground at home for its energy trading app

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

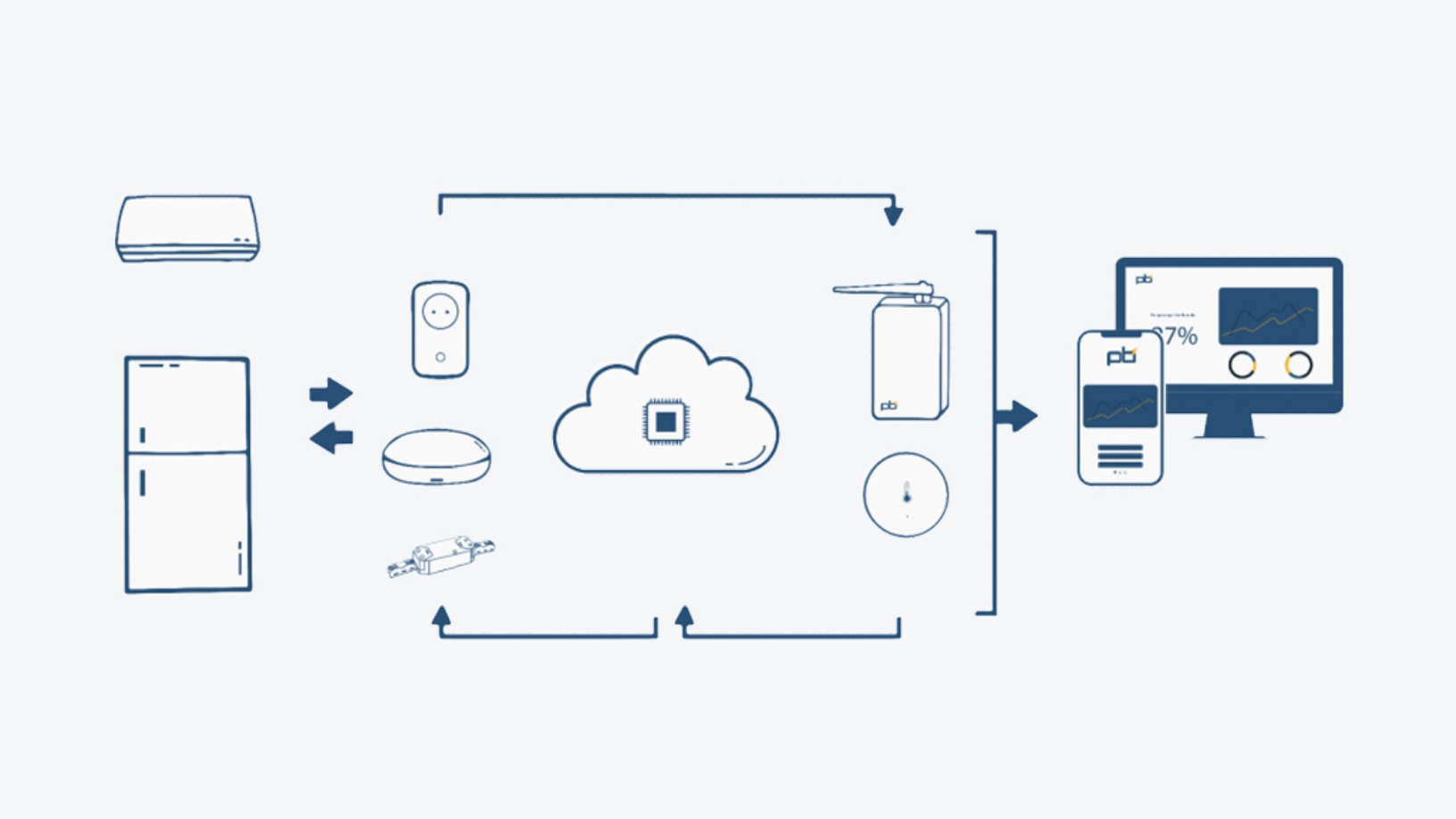

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

SWITCH Singapore 2021: Driving renewable energy impact through better business models

Startups need to communicate the business benefits of green solutions to their customers, rather than just pitching the hi-tech

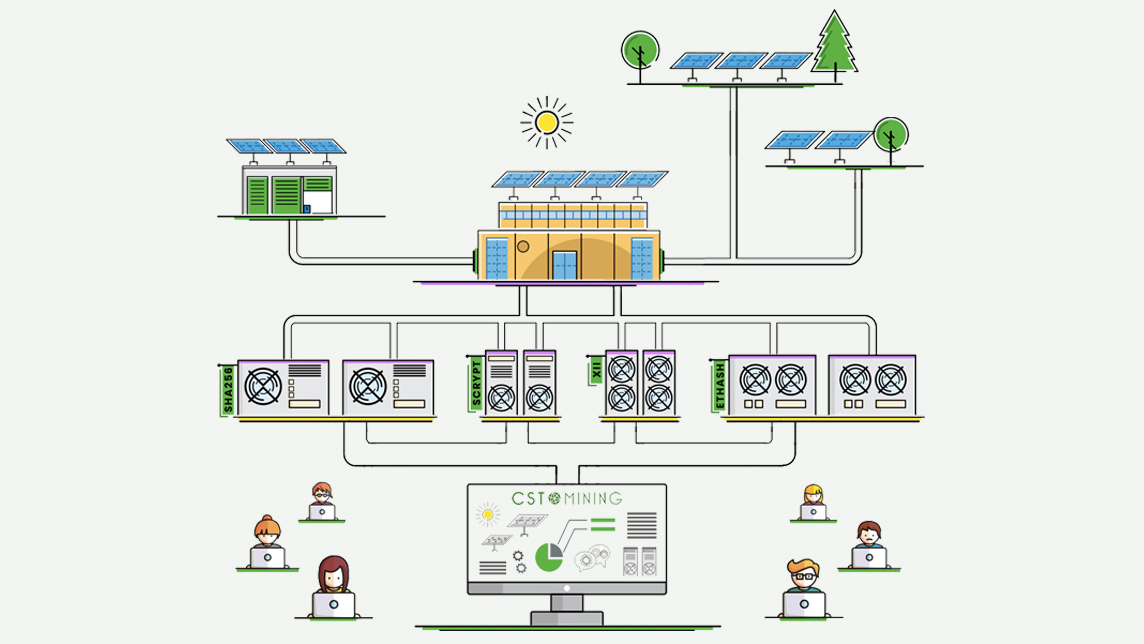

Cryptosolartech: Harnessing solar power to make cryptomining less environmentally harmful

The Spanish startup also sources cheaper electricity for cryptomining. It recently raised €8.85m in a pre-ICO, enabling it to build the world's first solar-powered cryptomining farm

Sorry, we couldn’t find any matches for“Weston Energy”.