Wind energy

-

DATABASE (153)

-

ARTICLES (139)

Co-founder, CEO of UTW (Unmanned Technical Works)

Julio Díaz Hernández worked as an electrical engineer for Spain's ITP group for two years before joining aerospace manufacturer ITD in 2001. He became ITD's head of systems design business unit based at Getafe before leaving in 2015 to become the co-founder and CEO of Unmanned Technical Works (UTW).The MBA postgrad, mechanical engineering and industrial electronics alumnus from Madrid's Polytechnic University also co-founded Aventix as CEO. Aventix provides personalized engineering services to UTW and other clients in the aerospace, ICT, railway, automotive and energy sectors.

Julio Díaz Hernández worked as an electrical engineer for Spain's ITP group for two years before joining aerospace manufacturer ITD in 2001. He became ITD's head of systems design business unit based at Getafe before leaving in 2015 to become the co-founder and CEO of Unmanned Technical Works (UTW).The MBA postgrad, mechanical engineering and industrial electronics alumnus from Madrid's Polytechnic University also co-founded Aventix as CEO. Aventix provides personalized engineering services to UTW and other clients in the aerospace, ICT, railway, automotive and energy sectors.

Director of Engineering and co-founder of AddVolt

Soares is co-founder and Director of Engineering at AddVolt, the first renewable energy tech to replace diesel engines for cold chain transport, where he has worked since 2013, when it was still a research project. Prior to that, he worked as both Assistant Professor and Research Engineer at the University of Porto's Faculty of Engineering, the birthplace of AddVolt. Soares holds a master's degree from the same institution in electronic and computer engineering and a Master of Science in management and innovation from the Technical University of Eindhoven, Netherlands.

Soares is co-founder and Director of Engineering at AddVolt, the first renewable energy tech to replace diesel engines for cold chain transport, where he has worked since 2013, when it was still a research project. Prior to that, he worked as both Assistant Professor and Research Engineer at the University of Porto's Faculty of Engineering, the birthplace of AddVolt. Soares holds a master's degree from the same institution in electronic and computer engineering and a Master of Science in management and innovation from the Technical University of Eindhoven, Netherlands.

CEO and founder of Omniflow

Pedro Ruão is the Portuguese founder and CEO of Omniflow. Prior to founding Omniflow, he had worked for seven years as a development engineer at Norcam and Protosys, the latter in the area of energy. Ruão won the EDP Richard Branson innovation prize in 2010 and had studied Materials Science at the Faculty of Engineering at Oporto University.

Pedro Ruão is the Portuguese founder and CEO of Omniflow. Prior to founding Omniflow, he had worked for seven years as a development engineer at Norcam and Protosys, the latter in the area of energy. Ruão won the EDP Richard Branson innovation prize in 2010 and had studied Materials Science at the Faculty of Engineering at Oporto University.

Huaxin Capital is a private equity fund management platform that was set up by Luxin Venture Capital Group in 2011. Huaxin Capital invests in the fields of biomedicine, medical equipment, internet, IoT, clean energy, high-end equipment manufacturing, among others.

Huaxin Capital is a private equity fund management platform that was set up by Luxin Venture Capital Group in 2011. Huaxin Capital invests in the fields of biomedicine, medical equipment, internet, IoT, clean energy, high-end equipment manufacturing, among others.

EDP Ventures is the VC arm of EDP, or Energias de Portugal, a global energy company based in Portugal. It invests in early-stage startups both Portuguese and from other nations across varied sectors and is a promoter of renewable energies.

EDP Ventures is the VC arm of EDP, or Energias de Portugal, a global energy company based in Portugal. It invests in early-stage startups both Portuguese and from other nations across varied sectors and is a promoter of renewable energies.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Horus Capital is a private equity firm founded at the end of 2012. It currently manages over RMB 10bn in assets and is focused on healthcare, AI, media, consumer goods, new materials and energy. The company has invested in about 100 companies.

Horus Capital is a private equity firm founded at the end of 2012. It currently manages over RMB 10bn in assets and is focused on healthcare, AI, media, consumer goods, new materials and energy. The company has invested in about 100 companies.

Co-founder and CEO of Conclave

Reynaldi Latief, also known as Rendy Latief, has a bachelor’s in Business Management from the Institut Teknologi Bandung (ITB) in Indonesia. After graduating in 2010, he worked as a general manager at PT Fullilaki Danprima, a mining company based in Jakarta. He left in 2013 to co-found Conclave with fellow ITB graduates Marshall Utoyo, Aditya Hadiputra and Akbar Brojosaputro. Since October 2013, he has been the CEO of PT Gudang Kapital Internasional that is linked to the coworking hub Conclave. In August 2015, he also became the CEO of Austral Energy, a subsidiary of logging company PT Austral Byna.

Reynaldi Latief, also known as Rendy Latief, has a bachelor’s in Business Management from the Institut Teknologi Bandung (ITB) in Indonesia. After graduating in 2010, he worked as a general manager at PT Fullilaki Danprima, a mining company based in Jakarta. He left in 2013 to co-found Conclave with fellow ITB graduates Marshall Utoyo, Aditya Hadiputra and Akbar Brojosaputro. Since October 2013, he has been the CEO of PT Gudang Kapital Internasional that is linked to the coworking hub Conclave. In August 2015, he also became the CEO of Austral Energy, a subsidiary of logging company PT Austral Byna.

Founder and CEO of Sennotech

Li Qin earned a bachelor’s degree in Economics from Zhejiang University in 2006 and an M.Sc. from Utrecht University in 2007. Upon graduation, he worked briefly on B2B market analysis at the Vilnius office of Euromonitor International, an independent strategic market research provider. After returning to China in 2007, Li became head of R&D on cryogenics at Shanxi Energy Industries Group Co., Ltd. From November 2009 until early 2015, he served as a lecturer at Shanxi University of Finance and Economics. In February 2015, Li founded Sennotech in Shenzhen.

Li Qin earned a bachelor’s degree in Economics from Zhejiang University in 2006 and an M.Sc. from Utrecht University in 2007. Upon graduation, he worked briefly on B2B market analysis at the Vilnius office of Euromonitor International, an independent strategic market research provider. After returning to China in 2007, Li became head of R&D on cryogenics at Shanxi Energy Industries Group Co., Ltd. From November 2009 until early 2015, he served as a lecturer at Shanxi University of Finance and Economics. In February 2015, Li founded Sennotech in Shenzhen.

Director of Operations and co-founder of AddVolt

Sousa is the Portuguese co-founder and Director of Operations at AddVolt, the first renewable energy tech to replace diesel engines for cold chain transport, where he has worked since 2014, when the company was founded. Prior to that, he worked on its technology, when it was still a research project, in his capacity as R&D Engineer at the University of Porto's Faculty of Engineering. Sousa has a master's in electrical and electronics engineering from the University of Porto and a Master of Science in electrical and electronics engineering from Padova University in Italy.

Sousa is the Portuguese co-founder and Director of Operations at AddVolt, the first renewable energy tech to replace diesel engines for cold chain transport, where he has worked since 2014, when the company was founded. Prior to that, he worked on its technology, when it was still a research project, in his capacity as R&D Engineer at the University of Porto's Faculty of Engineering. Sousa has a master's in electrical and electronics engineering from the University of Porto and a Master of Science in electrical and electronics engineering from Padova University in Italy.

Co-founder and Director of Technology of Xurya

Edwin Widjonarko spent almost 6 years working as a research assistant at the USA’s National Renewable Energy Laboratory and at University of Colorado Boulder. In some of the projects he worked on, Widjonarko contributed to the development of new generation solar panels. In 2015, he left the research sphere to join Intel Corporation as a technology development process engineer. He stayed on until 2018, when he left Intel and returned to Indonesia to establish Xurya, a solar power company. Working with longtime friend Gusmantara Himawan and former East Ventures associate Philip Effendy, Widjonarko now works as Xurya’s director of technology.

Edwin Widjonarko spent almost 6 years working as a research assistant at the USA’s National Renewable Energy Laboratory and at University of Colorado Boulder. In some of the projects he worked on, Widjonarko contributed to the development of new generation solar panels. In 2015, he left the research sphere to join Intel Corporation as a technology development process engineer. He stayed on until 2018, when he left Intel and returned to Indonesia to establish Xurya, a solar power company. Working with longtime friend Gusmantara Himawan and former East Ventures associate Philip Effendy, Widjonarko now works as Xurya’s director of technology.

Founded in 2008 in Shanghai, Stone Capital managed assets over RMB 10 billion in 2017. It focuses on high-growth private enterprises and state-owned companies with special resources in industries such as new material, new energy, high-tech, IT, environmental protection and healthcare.

Founded in 2008 in Shanghai, Stone Capital managed assets over RMB 10 billion in 2017. It focuses on high-growth private enterprises and state-owned companies with special resources in industries such as new material, new energy, high-tech, IT, environmental protection and healthcare.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

Beijing Zhongguancun Development Qihang Industrial Investment Fund

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

X1 Wind's PivotBuoy: Innovative floating platform to help scale offshore wind energy

With a downwind turbine on its patented single point mooring system, Spanish startup X1 Wind aims to disrupt the market with light, cheaper and easy to install offshore platforms

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

Jungle.ai: Tapping data and AI to prevent outages and breakdowns

Forewarned is forearmed. Performance predictions by Jungle.ai can help save billions of dollars and hours of frustration caused by sudden power failures

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

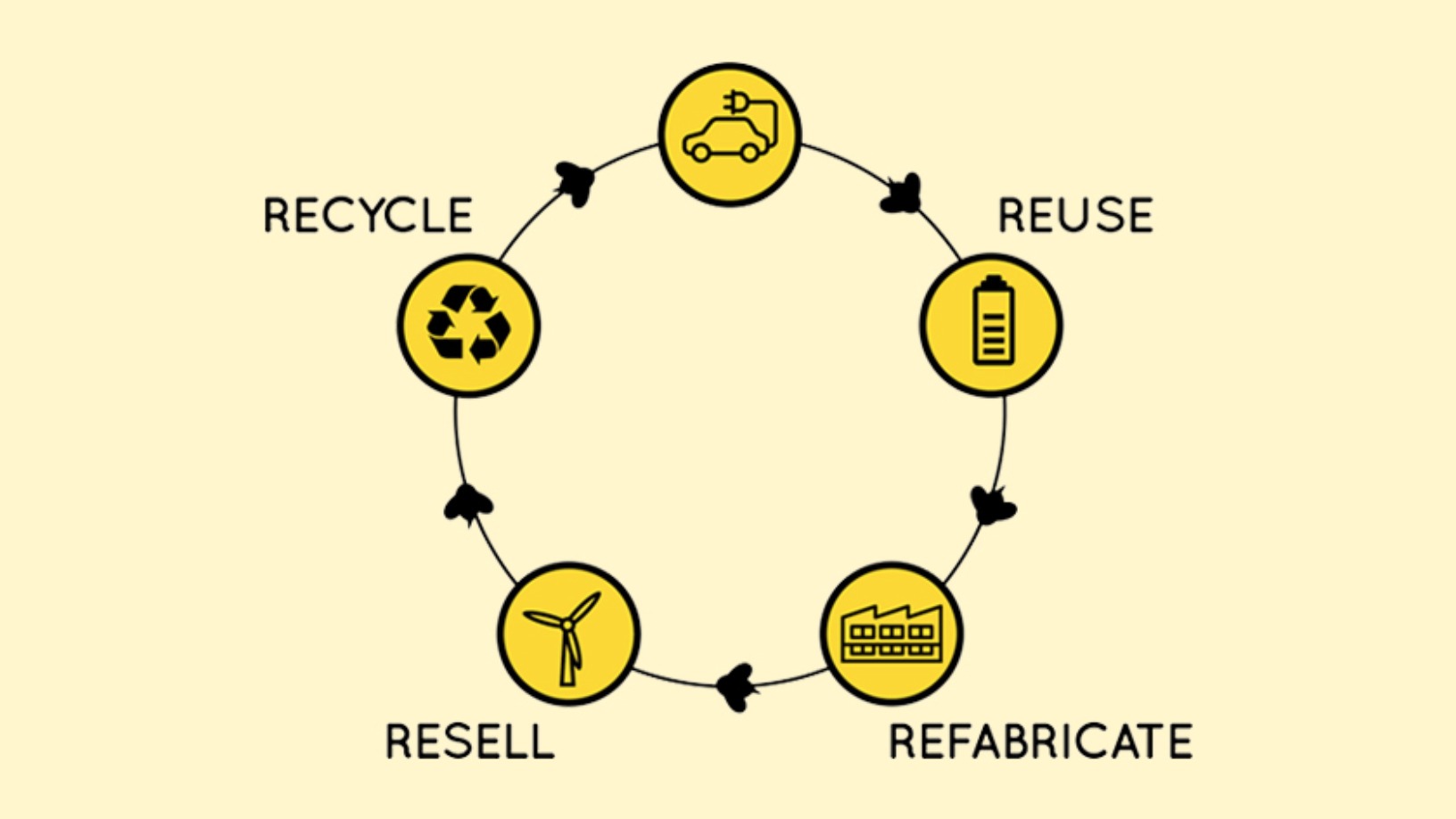

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Portugal looks to its marine heritage to create an oceantech leader

Portugal is tapping oceantech disruption to create new value out of its blue economy, with strong government push

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Bound4Blue’s aeronautical tech propels first sustainable shipping vessel in the Pacific

Winning €5m fresh funding, Bound4Blue also scores with its EC-backed pilot, the first of its kind, offering new possibilities to cargo vessels seeking sustainable transportation

Botree Cycling: Recovering critical metals from end-of-life batteries

The Beijing-based startup helps clients dismantle and recycle spent lithium batteries on-site, recovering over 90% of rare metals and reducing demand for mineral resources

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

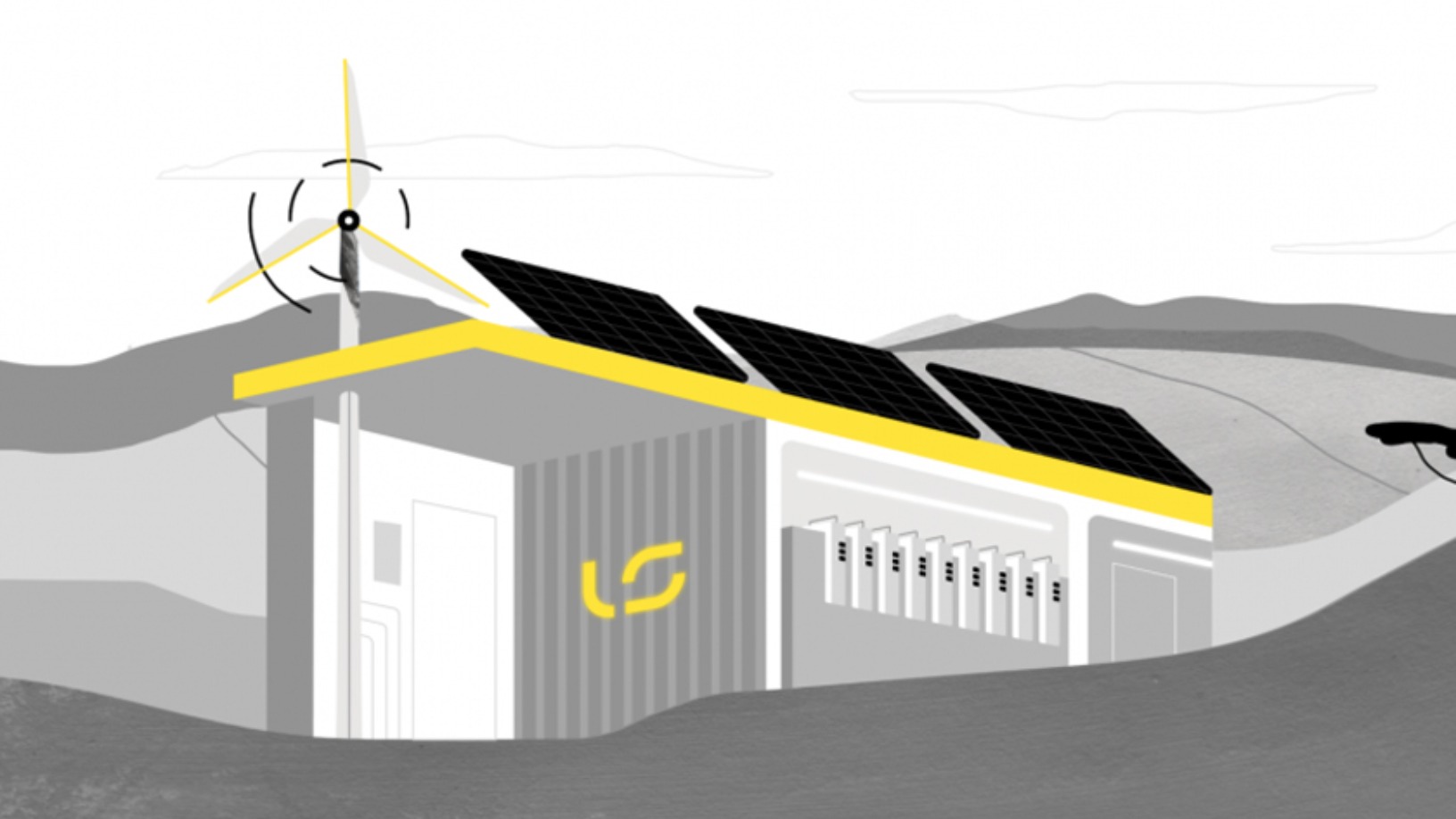

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Tigerobo: Building the next-generation search engine with natural language processing

With the success of Tigerobo Search, its flagship AI-based finance industry search engine, the startup is also diversifying into government, energy and media sectors

Sorry, we couldn’t find any matches for“Wind energy”.