Women in Tech

-

DATABASE (994)

-

ARTICLES (811)

Co-founder of Veniam

Winner of the 2016 EU Prize for Women Innovators, Portuguese national Susana Sargento has been a professor at the University of Aveiro for almost 16 years. She received her Ph.D. in Electrical Engineering from the same university. Her main research interests are self-organized networks, e.g., routing, mobility, delay-tolerant mechanisms and content distribution networks, in ad-hoc and vehicular mechanisms and protocols. In 2012, she co-founded Veniam, a tech startup for connected and autonomous vehicles, where she also worked in engineering and corporate research from 2012 until 2014. She advises the European Commission in her areas of expertise.

Winner of the 2016 EU Prize for Women Innovators, Portuguese national Susana Sargento has been a professor at the University of Aveiro for almost 16 years. She received her Ph.D. in Electrical Engineering from the same university. Her main research interests are self-organized networks, e.g., routing, mobility, delay-tolerant mechanisms and content distribution networks, in ad-hoc and vehicular mechanisms and protocols. In 2012, she co-founded Veniam, a tech startup for connected and autonomous vehicles, where she also worked in engineering and corporate research from 2012 until 2014. She advises the European Commission in her areas of expertise.

China's largest third-party online food delivery operator Shiheng Tech is gearing up to expand into traditional non-food sectors.

China's largest third-party online food delivery operator Shiheng Tech is gearing up to expand into traditional non-food sectors.

Founded in 2011, Kika Tech is an international mobile input software developer based in Beijing. Released in 2017 and powered by an AI engine, its core product Kika Keyboard supports more than 20 languages and helps users communicate authentically by predicting intent and context to enhance expressive communication. The company has 500m users worldwide and, as of the end of 2018, earned monthly revenue of RMB 20m. Kika CTO Yao Conglei is also co-founder and CTO of Bailian.ai.

Founded in 2011, Kika Tech is an international mobile input software developer based in Beijing. Released in 2017 and powered by an AI engine, its core product Kika Keyboard supports more than 20 languages and helps users communicate authentically by predicting intent and context to enhance expressive communication. The company has 500m users worldwide and, as of the end of 2018, earned monthly revenue of RMB 20m. Kika CTO Yao Conglei is also co-founder and CTO of Bailian.ai.

The first China-based company to mass-produce 3D food printers, Shiyin Tech plans to deploy 100,000 self-service models in the next three years.

The first China-based company to mass-produce 3D food printers, Shiyin Tech plans to deploy 100,000 self-service models in the next three years.

Co-founder and CMO of Muslimarket

Ben Soebiakto first became an entrepreneur in 2005 by founding the Octovate Group, a tech incubator for the creative industry. A graduate in Visual Communications from Universitas Trisakti in Indonesia, he also co-founded XM Gravity that later became part of the global advertising company WPP. Ben also founded a multichannel women content media Fimela and was also the CMO of KapanLagi Network, one of Indonesia’s major online content producers. He joined Muslimarket in February 2016.

Ben Soebiakto first became an entrepreneur in 2005 by founding the Octovate Group, a tech incubator for the creative industry. A graduate in Visual Communications from Universitas Trisakti in Indonesia, he also co-founded XM Gravity that later became part of the global advertising company WPP. Ben also founded a multichannel women content media Fimela and was also the CMO of KapanLagi Network, one of Indonesia’s major online content producers. He joined Muslimarket in February 2016.

Velos Partners brands itself as a Consumer Growth Capital Fund investing in companies at the intersection of consumer and technology. Based in Los Angeles, USA, its global portfolio includes women focused e-commerce site Orami, wearable tech firm Doppler Labs and property listing site 99.co.

Velos Partners brands itself as a Consumer Growth Capital Fund investing in companies at the intersection of consumer and technology. Based in Los Angeles, USA, its global portfolio includes women focused e-commerce site Orami, wearable tech firm Doppler Labs and property listing site 99.co.

CEO and co-founder of RecyGlo

Shwe Yamin Oo graduated in computer science at the University of Computer Studies in Yangon in 2007. She has also completed a business management diploma in 2013.In March 2009, she established Shwe Bon Thar computer training center and became the COO and co-founder of its internet center and mart until 2013. In 2014, she founded an accounting tech startup Modern Boss mobile POS for local SMEs. She exited the fintech in 2017 to set up RecyGlo as CEO.In 2019, she was nominated for the Women of the Future awards for Southeast Asia in the Science, Technology and Digital categories. She is also a mentor at Yangon’s Founder Institute.

Shwe Yamin Oo graduated in computer science at the University of Computer Studies in Yangon in 2007. She has also completed a business management diploma in 2013.In March 2009, she established Shwe Bon Thar computer training center and became the COO and co-founder of its internet center and mart until 2013. In 2014, she founded an accounting tech startup Modern Boss mobile POS for local SMEs. She exited the fintech in 2017 to set up RecyGlo as CEO.In 2019, she was nominated for the Women of the Future awards for Southeast Asia in the Science, Technology and Digital categories. She is also a mentor at Yangon’s Founder Institute.

Ladies Investment Club (LIC) is a group of self-funded women investors, put together with a mission to find, support and nurture female founders on their journey to business ownership. Driven by a desire to see more women-led startups, LIC touts its extensive experience across multiple industries and disciplines, and offers not just capital, but guidance and mentoring to increase female founders' likelihood of success.

Ladies Investment Club (LIC) is a group of self-funded women investors, put together with a mission to find, support and nurture female founders on their journey to business ownership. Driven by a desire to see more women-led startups, LIC touts its extensive experience across multiple industries and disciplines, and offers not just capital, but guidance and mentoring to increase female founders' likelihood of success.

Pegasus Tech Ventures (Fenox Venture Capital)

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Indonesia’s fashion industry is concentrated in large cities in Java. For those living elsewhere, Sale Stock’s low prices and free shipping are especially attractive.

Indonesia’s fashion industry is concentrated in large cities in Java. For those living elsewhere, Sale Stock’s low prices and free shipping are especially attractive.

Incubator for Chinese female entrepreneurs run by successful young career women who understand the strengths and weaknesses of women, offering support and a valuable network.

Incubator for Chinese female entrepreneurs run by successful young career women who understand the strengths and weaknesses of women, offering support and a valuable network.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Beijing Kunlun Tech Co., Ltd. (Kunlun) is a Beijing-based gaming, fintech and software company founded in 2008. It went public on the Shenzhen Stock Exchange in 2015. In 2016, Kunlun acquired a 60% stake in Grindr. It now invests primarily in sectors such as social networking, live streaming, IoT and AI. Four of the companies in which it invested - Qudian, Yinke, Opera and Ruhan - have gone public as of April 2019.

Beijing Kunlun Tech Co., Ltd. (Kunlun) is a Beijing-based gaming, fintech and software company founded in 2008. It went public on the Shenzhen Stock Exchange in 2015. In 2016, Kunlun acquired a 60% stake in Grindr. It now invests primarily in sectors such as social networking, live streaming, IoT and AI. Four of the companies in which it invested - Qudian, Yinke, Opera and Ruhan - have gone public as of April 2019.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

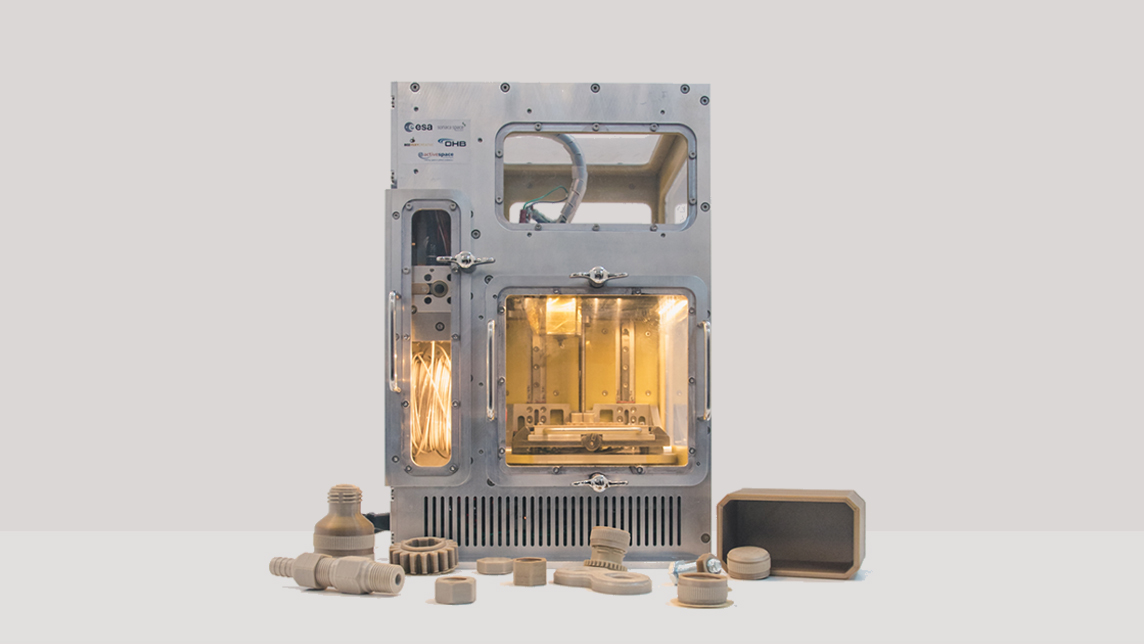

BEEVERYCREATIVE: Taking 3D printing from classrooms into Outer Space

Innovative 3D printing for daily use from a picturesque fishing village in Portugal.

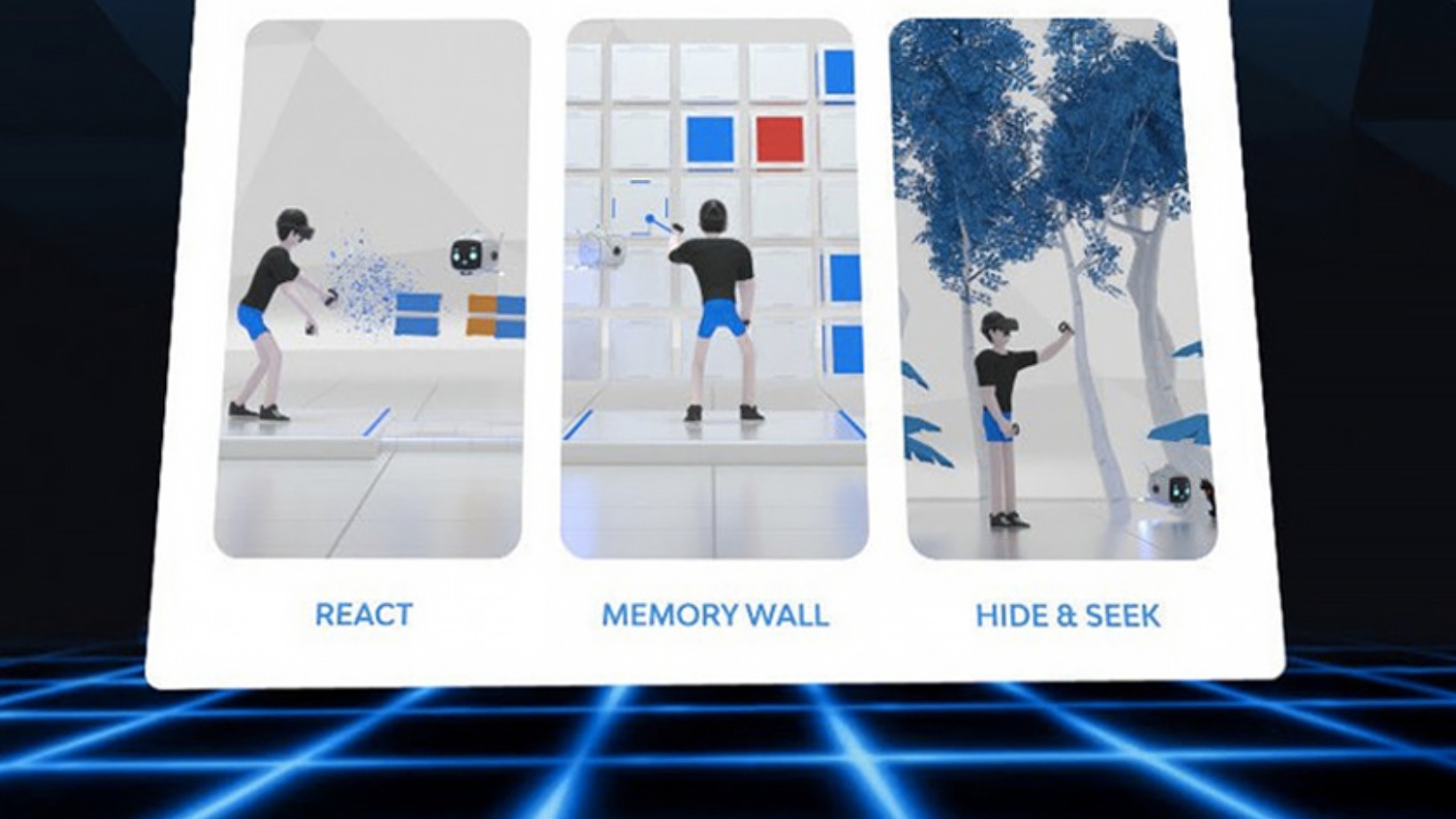

Virtuleap's VR games provide a mental workout, boosting brain health

Used by the AARP and Veteran's Health Administration in the US, Virtuleap’s games with AI-enabled assessment work to improve cognition and to counter degenerative diseases such as Alzheimer's

SWITCH Singapore: VCs urge startups to think beyond Covid-19

VCs also discuss prospects of a current tech bubble, and whether new working and hiring practices sparked by the pandemic could end Silicon Valley dominance

Tigerobo: Building the next-generation search engine with natural language processing

With the success of Tigerobo Search, its flagship AI-based finance industry search engine, the startup is also diversifying into government, energy and media sectors

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

TuSimple: When robo-trucks meet the road

After switching focus from adtech to robo-trucks, TuSimple aims to be king of the road in China and the US

Zhongzheng Information: Big data and fully integrated services for smart office buildings

Joining the Microsoft for Startups program will boost Zhongzheng's R&D and business expansion in China

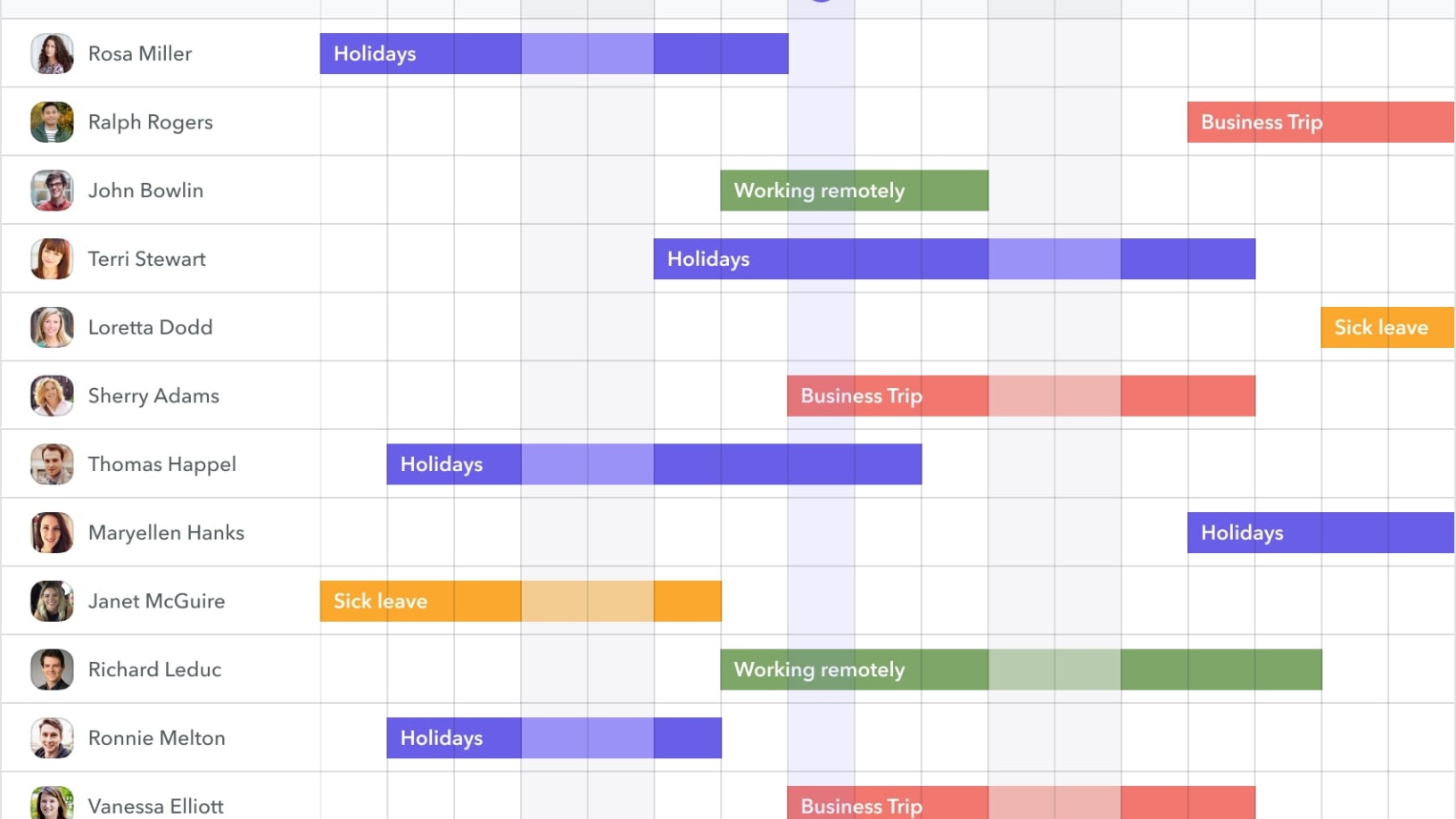

Calling Factorial “the Zendesk of HR," Silicon Valley heavyweight CRV led the round, in its first-ever investment in Spain

Backed by Kleiner Perkins, Spotahome clinches Spain’s first Silicon Valley-led funding

Now in Europe’s US$500 billion home rental market, the Spanish proptech will soon expand to LatAm, the US and Asia

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

“From a record year to a tragic year” – Investor Eneko Knorr on Spain’s 2020 startup funding

Startups should focus on profitability but for investors with leeway, there are still great opportunities, says Spanish angel investor Eneko Knorr. He shares his outlook, top picks and advice on riding out the Covid-19 crisis

Glovo’s 2018 rollercoaster ride

The year saw the delivery giant dealing with labor unions, diversification and international expansion

Spanish AI startups unleash the power of virtual assistants

More Spanish deep technology firms are shifting the paradigms in human-machine interactions, overhauling customer experience

Sorry, we couldn’t find any matches for“Women in Tech”.