Women in Tech

DATABASE (994)

ARTICLES (811)

Co-founder of Veniam

Winner of the 2016 EU Prize for Women Innovators, Portuguese national Susana Sargento has been a professor at the University of Aveiro for almost 16 years. She received her Ph.D. in Electrical Engineering from the same university. Her main research interests are self-organized networks, e.g., routing, mobility, delay-tolerant mechanisms and content distribution networks, in ad-hoc and vehicular mechanisms and protocols. In 2012, she co-founded Veniam, a tech startup for connected and autonomous vehicles, where she also worked in engineering and corporate research from 2012 until 2014. She advises the European Commission in her areas of expertise.

Winner of the 2016 EU Prize for Women Innovators, Portuguese national Susana Sargento has been a professor at the University of Aveiro for almost 16 years. She received her Ph.D. in Electrical Engineering from the same university. Her main research interests are self-organized networks, e.g., routing, mobility, delay-tolerant mechanisms and content distribution networks, in ad-hoc and vehicular mechanisms and protocols. In 2012, she co-founded Veniam, a tech startup for connected and autonomous vehicles, where she also worked in engineering and corporate research from 2012 until 2014. She advises the European Commission in her areas of expertise.

China's largest third-party online food delivery operator Shiheng Tech is gearing up to expand into traditional non-food sectors.

China's largest third-party online food delivery operator Shiheng Tech is gearing up to expand into traditional non-food sectors.

Founded in 2011, Kika Tech is an international mobile input software developer based in Beijing. Released in 2017 and powered by an AI engine, its core product Kika Keyboard supports more than 20 languages and helps users communicate authentically by predicting intent and context to enhance expressive communication. The company has 500m users worldwide and, as of the end of 2018, earned monthly revenue of RMB 20m. Kika CTO Yao Conglei is also co-founder and CTO of Bailian.ai.

Founded in 2011, Kika Tech is an international mobile input software developer based in Beijing. Released in 2017 and powered by an AI engine, its core product Kika Keyboard supports more than 20 languages and helps users communicate authentically by predicting intent and context to enhance expressive communication. The company has 500m users worldwide and, as of the end of 2018, earned monthly revenue of RMB 20m. Kika CTO Yao Conglei is also co-founder and CTO of Bailian.ai.

The first China-based company to mass-produce 3D food printers, Shiyin Tech plans to deploy 100,000 self-service models in the next three years.

The first China-based company to mass-produce 3D food printers, Shiyin Tech plans to deploy 100,000 self-service models in the next three years.

Co-founder and CMO of Muslimarket

Ben Soebiakto first became an entrepreneur in 2005 by founding the Octovate Group, a tech incubator for the creative industry. A graduate in Visual Communications from Universitas Trisakti in Indonesia, he also co-founded XM Gravity that later became part of the global advertising company WPP. Ben also founded a multichannel women content media Fimela and was also the CMO of KapanLagi Network, one of Indonesia’s major online content producers. He joined Muslimarket in February 2016.

Ben Soebiakto first became an entrepreneur in 2005 by founding the Octovate Group, a tech incubator for the creative industry. A graduate in Visual Communications from Universitas Trisakti in Indonesia, he also co-founded XM Gravity that later became part of the global advertising company WPP. Ben also founded a multichannel women content media Fimela and was also the CMO of KapanLagi Network, one of Indonesia’s major online content producers. He joined Muslimarket in February 2016.

Velos Partners brands itself as a Consumer Growth Capital Fund investing in companies at the intersection of consumer and technology. Based in Los Angeles, USA, its global portfolio includes women focused e-commerce site Orami, wearable tech firm Doppler Labs and property listing site 99.co.

Velos Partners brands itself as a Consumer Growth Capital Fund investing in companies at the intersection of consumer and technology. Based in Los Angeles, USA, its global portfolio includes women focused e-commerce site Orami, wearable tech firm Doppler Labs and property listing site 99.co.

CEO and co-founder of RecyGlo

Shwe Yamin Oo graduated in computer science at the University of Computer Studies in Yangon in 2007. She has also completed a business management diploma in 2013.In March 2009, she established Shwe Bon Thar computer training center and became the COO and co-founder of its internet center and mart until 2013. In 2014, she founded an accounting tech startup Modern Boss mobile POS for local SMEs. She exited the fintech in 2017 to set up RecyGlo as CEO.In 2019, she was nominated for the Women of the Future awards for Southeast Asia in the Science, Technology and Digital categories. She is also a mentor at Yangon’s Founder Institute.

Shwe Yamin Oo graduated in computer science at the University of Computer Studies in Yangon in 2007. She has also completed a business management diploma in 2013.In March 2009, she established Shwe Bon Thar computer training center and became the COO and co-founder of its internet center and mart until 2013. In 2014, she founded an accounting tech startup Modern Boss mobile POS for local SMEs. She exited the fintech in 2017 to set up RecyGlo as CEO.In 2019, she was nominated for the Women of the Future awards for Southeast Asia in the Science, Technology and Digital categories. She is also a mentor at Yangon’s Founder Institute.

Ladies Investment Club (LIC) is a group of self-funded women investors, put together with a mission to find, support and nurture female founders on their journey to business ownership. Driven by a desire to see more women-led startups, LIC touts its extensive experience across multiple industries and disciplines, and offers not just capital, but guidance and mentoring to increase female founders' likelihood of success.

Ladies Investment Club (LIC) is a group of self-funded women investors, put together with a mission to find, support and nurture female founders on their journey to business ownership. Driven by a desire to see more women-led startups, LIC touts its extensive experience across multiple industries and disciplines, and offers not just capital, but guidance and mentoring to increase female founders' likelihood of success.

Pegasus Tech Ventures (Fenox Venture Capital)

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Indonesia’s fashion industry is concentrated in large cities in Java. For those living elsewhere, Sale Stock’s low prices and free shipping are especially attractive.

Indonesia’s fashion industry is concentrated in large cities in Java. For those living elsewhere, Sale Stock’s low prices and free shipping are especially attractive.

Incubator for Chinese female entrepreneurs run by successful young career women who understand the strengths and weaknesses of women, offering support and a valuable network.

Incubator for Chinese female entrepreneurs run by successful young career women who understand the strengths and weaknesses of women, offering support and a valuable network.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Beijing Kunlun Tech Co., Ltd. (Kunlun) is a Beijing-based gaming, fintech and software company founded in 2008. It went public on the Shenzhen Stock Exchange in 2015. In 2016, Kunlun acquired a 60% stake in Grindr. It now invests primarily in sectors such as social networking, live streaming, IoT and AI. Four of the companies in which it invested - Qudian, Yinke, Opera and Ruhan - have gone public as of April 2019.

Beijing Kunlun Tech Co., Ltd. (Kunlun) is a Beijing-based gaming, fintech and software company founded in 2008. It went public on the Shenzhen Stock Exchange in 2015. In 2016, Kunlun acquired a 60% stake in Grindr. It now invests primarily in sectors such as social networking, live streaming, IoT and AI. Four of the companies in which it invested - Qudian, Yinke, Opera and Ruhan - have gone public as of April 2019.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

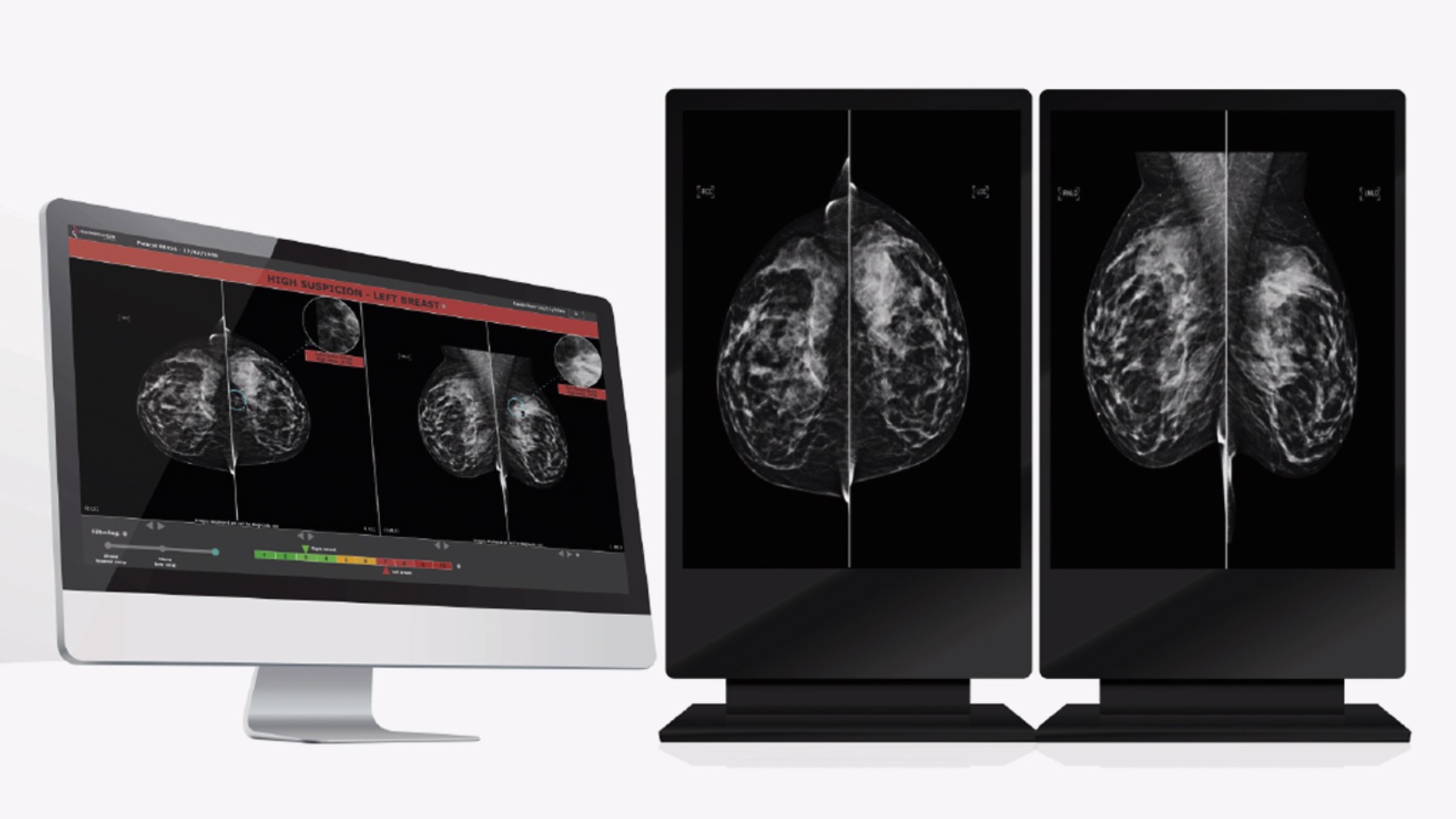

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

Francisco Polo: The former entrepreneur heading Spain's Digital Advancement

He's been charged to transform Spain into an entrepreneurial nation, and a technological and innovation frontrunner

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

Modoo: Reducing stillbirth risk with fetal heart monitoring wearable

Weighing just 15g, the world’s smallest wearable “patch” with passive fetal monitoring technology by Modoo seeks to offer a safer alternative to ultrasound devices

Evermos is Indonesia's version of social commerce – and it's Sharia-compliant, too

Evermos targets the resale market, encouraging students and housewives to earn extra income by promoting products on their social media and WhatsApp networks

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

“Good thing about my style. Some like it, some hate it but everybody recognizes it.” @sofíabenjumea

Outspoken with a hands-on management style, Sofía Benjumea is a force to reckon with at Google’s Campus Madrid

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

Start with the little things: 5 Indonesian social impact startups

From providing student loans to empowering marginalized groups and farmers, these Indonesian startups are revitalizing local communities

Insights on tech and the Indonesian diaspora in Silicon Valley

Navigating the different diaspora communities, one tech event at a time

Haishen Tech: Scan image and find your product in one second

Haishen Tech's AI vending machines will revive unmanned retail economy and tap into growing on-demand consumerism worldwide

Capaball: Empowering employees to upskill in tech as more businesses digitalize

The Spanish edtech platform for Fortune 500 clients and professionals is focused on developing new markets in Latin America

In depth: The business ecosystems China’s tech giants and unicorns build

Startups could accept to join Alibaba, Tencent or other tech giants in their ecosystems and scale quickly. Or they could say no and keep their independence. But do they really have a choice?

Shiheng Tech: The brains behind Starbucks' online delivery success in China

Using real-time data analytics to optimize last-mile delivery, Shiheng Tech offers the perfect on-demand recipe for F&B businesses

Sorry, we couldn’t find any matches for“Women in Tech”.