World Bank

-

DATABASE (254)

-

ARTICLES (469)

Resorts World is the hospitality-focused subsidiary of the Genting Group, a Malaysian diversified conglomerate with business interests in hospitality and leisure, plantations, property, and biotechnology. Resorts World operates luxury accommodations in various tourist destinations within Malaysia and abroad, such as Singapore, Las Vegas, and Birmingham.

Resorts World is the hospitality-focused subsidiary of the Genting Group, a Malaysian diversified conglomerate with business interests in hospitality and leisure, plantations, property, and biotechnology. Resorts World operates luxury accommodations in various tourist destinations within Malaysia and abroad, such as Singapore, Las Vegas, and Birmingham.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

Co-founder and President of TaniHub Group

Trained in mathematics and economics, Pamitra Wineka has worked as an analyst for mutual funds distributor Danareksa, JP Morgan and the World Bank. After four years with the World Bank, he joined TaniHub as co-founder and president in 2016.Pamitra graduated in Mathematics at Institut Teknologi Bandung in 2010 and obtained a master's in Economics in 2011 from the University of Illinois at Urbana-Champaign, USA. He is also a partner and senior advisor at P2P lending firm Perdana and microloan app Akulaku.

Trained in mathematics and economics, Pamitra Wineka has worked as an analyst for mutual funds distributor Danareksa, JP Morgan and the World Bank. After four years with the World Bank, he joined TaniHub as co-founder and president in 2016.Pamitra graduated in Mathematics at Institut Teknologi Bandung in 2010 and obtained a master's in Economics in 2011 from the University of Illinois at Urbana-Champaign, USA. He is also a partner and senior advisor at P2P lending firm Perdana and microloan app Akulaku.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

Established in Beijing on January 12, 1996, China Minsheng Banking Corporation Limited was China’s first national joint-stock commercial bank established mainly by non-state-owned enterprises. As of June 2017, it had total assets worth RMB 5767.2 billion. The firm now employs around 57,000 people at nearly 3,000 branches, sub-branches and outlets. It was listed on the Shanghai Stock Exchange in 2000 and the Hong Kong Stock Exchange in 2009.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

Co-founder and CEO of Seekmi

University of British Columbia alumna Clarissa Leung had worked as a software engineer at ATR Humanoid Robotics Computational Neuroscience, Panasonic and Barclays Investment bank before dipping her toes into the entrepreneurial world in Canada. After her MBA at Queen’s University in Ontario, Clarissa moved to Indonesia in 2014 to join venture capital fund AccelerAsia as managing director. However, she left a year later to become a co-founder of on-demand household services startup Seekmi and was appointed its CEO in 2016.

University of British Columbia alumna Clarissa Leung had worked as a software engineer at ATR Humanoid Robotics Computational Neuroscience, Panasonic and Barclays Investment bank before dipping her toes into the entrepreneurial world in Canada. After her MBA at Queen’s University in Ontario, Clarissa moved to Indonesia in 2014 to join venture capital fund AccelerAsia as managing director. However, she left a year later to become a co-founder of on-demand household services startup Seekmi and was appointed its CEO in 2016.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

Co-founder of Mapan by Ruma

After graduating with an Industrial Engineering degree from Purdue University in the US, Sean DeWitt became a management consultant at PricewaterhouseCoopers. He later worked at the US Department of State and the Fund for New York City.In 2007, he joined the nonprofit Grameen Foundation that was established by Grameen Bank founder Muhammad Yunus. As part of the nonprofit, he helped Aldi Haryopratomo establish the social enterprise Ruma. DeWitt currently works for the World Resource Institute. He also holds master’s degrees in Development Finance and Environmental Economics from the University of London.

After graduating with an Industrial Engineering degree from Purdue University in the US, Sean DeWitt became a management consultant at PricewaterhouseCoopers. He later worked at the US Department of State and the Fund for New York City.In 2007, he joined the nonprofit Grameen Foundation that was established by Grameen Bank founder Muhammad Yunus. As part of the nonprofit, he helped Aldi Haryopratomo establish the social enterprise Ruma. DeWitt currently works for the World Resource Institute. He also holds master’s degrees in Development Finance and Environmental Economics from the University of London.

Co-founder of Uniplaces, Co-founder of StudentFinance

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a focus on Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a focus on Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

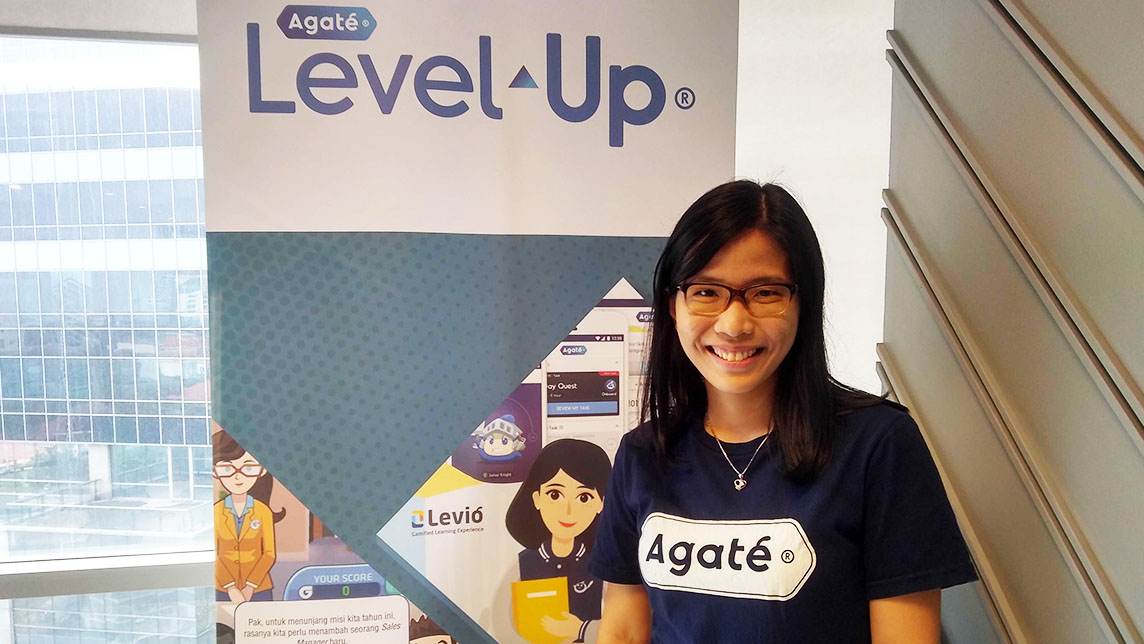

Agate learns it's not all about the games – it's about the fun

Agate has evolved into one of the biggest game development companies in Indonesia over the past decade. We learned how it got there from Shieny Aprilia, Agate's Vice President of Enterprise Business

Zen Video: Using AI to automate video editing

Founded by a Carnegie Mellon roboticist, the Zen Video app reduces the time required to edit video clips to only a few minutes, meeting growing demand for short videos

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

Using sensors and machine learning, Jejak.in wants to make conservation programs count

Launched this year, Jejak.in is helping big corporates like Danone-Aqua in environmental projects and a major B2C carbon-offsetting partnership is next

4D ShoeTech: Digital design platform helps shoemakers to slash production time by over 60%

Armed with new funding, 4D ShoeTech is scaling its Ideation platform to offer digital modelling services to cover other popular products like suitcases

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

East Ventures raises funds, teams up with state agency to produce Covid-19 tests for Indonesia

East Ventures investee Nusantics has been working with state researchers to produce the prototype; expects mass production of the test kits soon

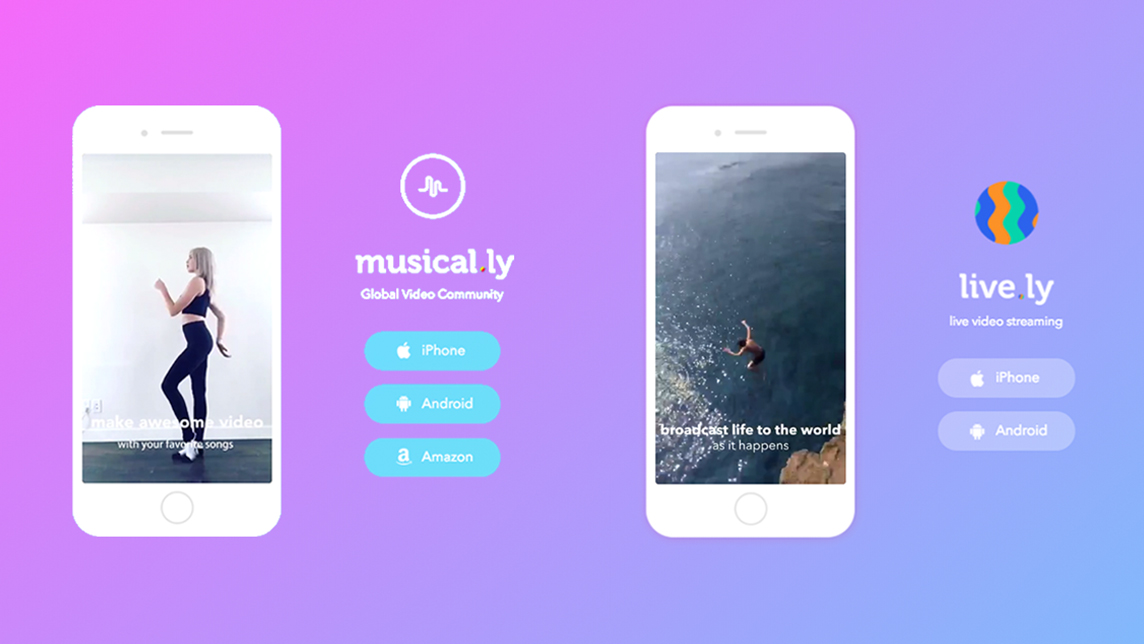

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

FluroSat: Combining satellite imagery and farm data to predict crop issues

This year’s Future of Food Asia winner offers a crop management software that can be used with existing agritech platforms, adding value with machine learning, and is even used for sustainability reporting

Koinpack tackles Indonesia's sachet waste problem with refillable bottles

Partnering with FMCG companies, Koinpack is making small amounts of household consumables available to lower-income groups without using traditional sachet packaging

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

MenteLista: Empowering small children to learn English with 10 minutes daily practice

Designed for infants and children, ranging in age from just 6 months to 7 years old, this platform could revolutionize language study during the critical learning period

Will this one-year-old startup revolutionize traditional industries?

Targeting retail and tourism first, Aibee aims to help traditional businesses keep up with their online counterparts using its all-in-one AI solutions

From China, Clever Home to build “Home Depot” marts in Africa

Combining B2B2C and O2O models, Clever Home is turning its 40,000sqm trade center in Nigeria into the "Yiwu marketplace" for Chinese companies looking to set up shop in Africa

Sorry, we couldn’t find any matches for“World Bank”.