Yamaha Motor Company

-

DATABASE (830)

-

ARTICLES (723)

One of China’s most famous angel investors and a prolific speaker, Xu Xiaoping (b.1960) is the managing partner of ZhenFund, a TMT-focused seed fund he founded with close friend and business partner Wang Qiang, in collaboration with Sequoia Capital China, in 2011. Xu began investing in 2006, after the New Oriental Education & Technology Group he co-founded became the first Chinese education company to list on NYSE. Trained as a professional musician, Xu plays the piano, violin, and oboe, and composes music as a hobby. He is also the author of more than 10 books. He studied at the Beijing Central Conservatory of Music and holds a master's in Music from the University of Saskatchewan.

One of China’s most famous angel investors and a prolific speaker, Xu Xiaoping (b.1960) is the managing partner of ZhenFund, a TMT-focused seed fund he founded with close friend and business partner Wang Qiang, in collaboration with Sequoia Capital China, in 2011. Xu began investing in 2006, after the New Oriental Education & Technology Group he co-founded became the first Chinese education company to list on NYSE. Trained as a professional musician, Xu plays the piano, violin, and oboe, and composes music as a hobby. He is also the author of more than 10 books. He studied at the Beijing Central Conservatory of Music and holds a master's in Music from the University of Saskatchewan.

Currently based in the UK, Carlos González-Cadenas is a serial entrepreneur and business angel. In 2017, he became the CPO and CTO of GoCardless, one of the fintech partners of Billin. He founded Fogg in Barcelona in 2008 to build an advanced semantic search platform for the travel industry that was acquired by Scotland's Skyscanner in 2013. As CPO of Skyscanner in UK, he was able to scale the product development organization globally before the company was acquired by the Ctrip group for US$1.75 billion in November 2016. He was also part of Oberlo that was acquired by Shopify.

Currently based in the UK, Carlos González-Cadenas is a serial entrepreneur and business angel. In 2017, he became the CPO and CTO of GoCardless, one of the fintech partners of Billin. He founded Fogg in Barcelona in 2008 to build an advanced semantic search platform for the travel industry that was acquired by Scotland's Skyscanner in 2013. As CPO of Skyscanner in UK, he was able to scale the product development organization globally before the company was acquired by the Ctrip group for US$1.75 billion in November 2016. He was also part of Oberlo that was acquired by Shopify.

Creandum invests in early-stage technology firms in the consumer internet, software and hardware sectors. The firm has grown from having 10 startups in its portfolio and an advisory team scattered across Sweden in 2007, to being headquartered in Stockholm with offices in Berlin, San Francisco and Guernsey and a total five funds raised worth over €700m. It's most recent fund raised €265m in 2019 and will ofcus on European startups. The company was the lead investor in more than a third of its almost 150 investments to date and was Spotify's first institutional investor. The most recent investments include in Spanish HR SaaS Factorial's €15m Series A round and in German tax assistant app Taxfix's US$65m Series C round.

Creandum invests in early-stage technology firms in the consumer internet, software and hardware sectors. The firm has grown from having 10 startups in its portfolio and an advisory team scattered across Sweden in 2007, to being headquartered in Stockholm with offices in Berlin, San Francisco and Guernsey and a total five funds raised worth over €700m. It's most recent fund raised €265m in 2019 and will ofcus on European startups. The company was the lead investor in more than a third of its almost 150 investments to date and was Spotify's first institutional investor. The most recent investments include in Spanish HR SaaS Factorial's €15m Series A round and in German tax assistant app Taxfix's US$65m Series C round.

Founded in 2009, Andreessen Horowitz is based in Menlo Park in California. The numeronym is the first and last letter of the firm’s brand with the characters count in-between. Starting with initial capital of $300m, the VC quickly raised a second venture fund of $650m in 2010 and another worth $1.5bn in 2014. In 2019, a new office was set up in San Francisco.Founded by Marc Andreessen and Ben Horowitz, the firm has invested in tech pioneers like Skype, Facebook, Groupon and Twitter. Andreessen is the software engineer who pioneered web browser Mosaic and co-founded Netscape. In 1995, Horowitz joined Andreessen as product manager at Netscape that was sold to AOL for $4.2bn in 2016. He also co-founded Opsware (Loudcloud), an automation software company that was sold to Hewlett Packard for $1.6bn in 2007.

Founded in 2009, Andreessen Horowitz is based in Menlo Park in California. The numeronym is the first and last letter of the firm’s brand with the characters count in-between. Starting with initial capital of $300m, the VC quickly raised a second venture fund of $650m in 2010 and another worth $1.5bn in 2014. In 2019, a new office was set up in San Francisco.Founded by Marc Andreessen and Ben Horowitz, the firm has invested in tech pioneers like Skype, Facebook, Groupon and Twitter. Andreessen is the software engineer who pioneered web browser Mosaic and co-founded Netscape. In 1995, Horowitz joined Andreessen as product manager at Netscape that was sold to AOL for $4.2bn in 2016. He also co-founded Opsware (Loudcloud), an automation software company that was sold to Hewlett Packard for $1.6bn in 2007.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

German-born Andreas “Andy” Bechtolsheim is chairman and co-founder of Arista Networks and was a co-founder at Sun Microsystems, which was acquired by Oracle in 2010 for $7.4bn. His main interest is in productivity software across market segments, as well as cybersecurity. He is also a billionaire investor, with much of his wealth coming from being the first angel investor in Google. Since then, he has been an occasional investor in startups, with his most recent disclosed investments occurring in 2020 when he invested in two companies. He has also participated in the $22m Series A round of US email security company Material Security and in the $21m Series A round of AI customer service platform Cresta.

German-born Andreas “Andy” Bechtolsheim is chairman and co-founder of Arista Networks and was a co-founder at Sun Microsystems, which was acquired by Oracle in 2010 for $7.4bn. His main interest is in productivity software across market segments, as well as cybersecurity. He is also a billionaire investor, with much of his wealth coming from being the first angel investor in Google. Since then, he has been an occasional investor in startups, with his most recent disclosed investments occurring in 2020 when he invested in two companies. He has also participated in the $22m Series A round of US email security company Material Security and in the $21m Series A round of AI customer service platform Cresta.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Chairman and Business Development Manager of AEInnova

Raúl Aragonés Ortiz is AEInnova’s chairman, former CEO, principal founder and originator of the idea behind the company. He is currently AEInnova's business development manager and holds a PhD in Microelectronics. He is also a professor at the IESE Business School and Salesians School Sarrià in Barcelona. Before founding AEInnova, Aragonés was an R&D investigator in chip systems, ASIC design, energy harvesting and smart cities at the Autonomous University of Barcelona. He holds memberships in the Astronomical Association of Terrassa and the Institute of Electrical and Electronics Engineers (IEEE). Since 2018, he has also been a business advisor to the startup Happy Customer Box.

Raúl Aragonés Ortiz is AEInnova’s chairman, former CEO, principal founder and originator of the idea behind the company. He is currently AEInnova's business development manager and holds a PhD in Microelectronics. He is also a professor at the IESE Business School and Salesians School Sarrià in Barcelona. Before founding AEInnova, Aragonés was an R&D investigator in chip systems, ASIC design, energy harvesting and smart cities at the Autonomous University of Barcelona. He holds memberships in the Astronomical Association of Terrassa and the Institute of Electrical and Electronics Engineers (IEEE). Since 2018, he has also been a business advisor to the startup Happy Customer Box.

Chief Growth Officer and co-founder of Kobo360

After graduating in business administration at the University of Michigan-Dearborn in 2013, Ife Oyedele II stayed on at the university to obtain a master’s in information technology in 2016.While studying in Michigan, Oyedele met up with Obi Ozor and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor later moved to Philadelphia to continue his studies at Wharton School.Still at university, he gained work experience in business intelligence at Michigan consultancy firm CFI Group for about three years. He has also conducted some research for pharma group iLabs and completed stints in business analysis and quality assurance at various companies. In May 2014, he joined General Fuels company in Detroit and worked as a business manager for almost two years.In 2016, Ozor and Oyedele co-founded Uber-style logistics platform Kobo360 in Nigeria. Oyedele was CTO at Kobo360 until 2020 when he became the company’s Chief Growth Officer.

After graduating in business administration at the University of Michigan-Dearborn in 2013, Ife Oyedele II stayed on at the university to obtain a master’s in information technology in 2016.While studying in Michigan, Oyedele met up with Obi Ozor and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor later moved to Philadelphia to continue his studies at Wharton School.Still at university, he gained work experience in business intelligence at Michigan consultancy firm CFI Group for about three years. He has also conducted some research for pharma group iLabs and completed stints in business analysis and quality assurance at various companies. In May 2014, he joined General Fuels company in Detroit and worked as a business manager for almost two years.In 2016, Ozor and Oyedele co-founded Uber-style logistics platform Kobo360 in Nigeria. Oyedele was CTO at Kobo360 until 2020 when he became the company’s Chief Growth Officer.

Co-founder of Diamond Foundry

Kyle Gazay is a co-founder of Diamond Foundry, the US-based unicorn that makes lab-grown diamonds and which is also the world’s first diamond producer to be certified carbon neutral. He has worked at Diamond Foundry since its launch, and held several roles there, including being COO as well as president of productionCurrently, Gazay oversees all diamond production at the company. Gazay’s expertise is in engineering and production. He has a decade’s track record in working with any equipment to obtain a robust and repeatable baseline output.Like the other co-founders of Diamond Foundry, Gazay previously worked at Nanosolar, a $640m US-based solar power technology provider, which later folded due to pressure from cheaper competition in China. At Nanosolar, Gazay led the development of its production line, and oversaw the translation of the company’s research into development and baseline production output. Upon the closure of Nanosolar, Gazay joined former Nanosolar CEO Martin Roscheisen and former Nanosolar engineer Jeremy Scholz in pivoting to work on lab-grown diamonds, and in establishing Diamond Foundry.

Kyle Gazay is a co-founder of Diamond Foundry, the US-based unicorn that makes lab-grown diamonds and which is also the world’s first diamond producer to be certified carbon neutral. He has worked at Diamond Foundry since its launch, and held several roles there, including being COO as well as president of productionCurrently, Gazay oversees all diamond production at the company. Gazay’s expertise is in engineering and production. He has a decade’s track record in working with any equipment to obtain a robust and repeatable baseline output.Like the other co-founders of Diamond Foundry, Gazay previously worked at Nanosolar, a $640m US-based solar power technology provider, which later folded due to pressure from cheaper competition in China. At Nanosolar, Gazay led the development of its production line, and oversaw the translation of the company’s research into development and baseline production output. Upon the closure of Nanosolar, Gazay joined former Nanosolar CEO Martin Roscheisen and former Nanosolar engineer Jeremy Scholz in pivoting to work on lab-grown diamonds, and in establishing Diamond Foundry.

CEO and founder of Swan Daojia (formerly 58 Daojia)

Chen received a bachelor’s degree in material formation from Xiangtan University in 2004. While in college, he co-founded 0755.org.cn, one of the earliest online classifieds providers in China. He is also a co-founder of dunsh.org, a nonprofit search engine optimization website in China. After graduation, he served as senior project manager and chief editor at Xiamen Haowei Network Technology. From June–December 2007, Chen served as head of the product department at ganji.com, an online classified site, responsible for product management and customer experience. He then joined 58.com the same year, serving as senior VP of product management and website operation from December 2007 to August 2014.In November 2014, he founded 58 Daojia and has served as CEO since then. In August 2017, 58 Daojia announced a merger with 58 Su Yun and Gogovan, a logistics platform in Southeast Asia, and he became Chairman of the new company. The merger created Asia's largest city-to-city cargo delivery platform. In 2018, 58 Daojia was rebranded as Daojia Group. The group’s 58 Su Yun received $250m funding and was relaunched as Kuaigou Express.

Chen received a bachelor’s degree in material formation from Xiangtan University in 2004. While in college, he co-founded 0755.org.cn, one of the earliest online classifieds providers in China. He is also a co-founder of dunsh.org, a nonprofit search engine optimization website in China. After graduation, he served as senior project manager and chief editor at Xiamen Haowei Network Technology. From June–December 2007, Chen served as head of the product department at ganji.com, an online classified site, responsible for product management and customer experience. He then joined 58.com the same year, serving as senior VP of product management and website operation from December 2007 to August 2014.In November 2014, he founded 58 Daojia and has served as CEO since then. In August 2017, 58 Daojia announced a merger with 58 Su Yun and Gogovan, a logistics platform in Southeast Asia, and he became Chairman of the new company. The merger created Asia's largest city-to-city cargo delivery platform. In 2018, 58 Daojia was rebranded as Daojia Group. The group’s 58 Su Yun received $250m funding and was relaunched as Kuaigou Express.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

British Oxford-educated engineer William Reeve is a serial investor and entrepreneur who built two successful businesses Fletcher Research and LOVEFiLM.com from scratch and led them to successful exits. He is currently Chairman of online investment management platform Nutmeg.com, CEO of proptech accelerator Goodlord and Non-Executive Director of Dunhelm Soft Furnishings. He was also Co-CEO and Chairman at grocery delivery company Hubbub.co.uk and was Non-Executive Chairman at healthy snack startup Graze.com. He was Head of Operations at Paddy Power betting agency, Managing Director of Oxalyst Systems and has been a non-executive director at a host of online platforms including Secret Escapes, Zoopla! and DealChecker.co.uk.

British Oxford-educated engineer William Reeve is a serial investor and entrepreneur who built two successful businesses Fletcher Research and LOVEFiLM.com from scratch and led them to successful exits. He is currently Chairman of online investment management platform Nutmeg.com, CEO of proptech accelerator Goodlord and Non-Executive Director of Dunhelm Soft Furnishings. He was also Co-CEO and Chairman at grocery delivery company Hubbub.co.uk and was Non-Executive Chairman at healthy snack startup Graze.com. He was Head of Operations at Paddy Power betting agency, Managing Director of Oxalyst Systems and has been a non-executive director at a host of online platforms including Secret Escapes, Zoopla! and DealChecker.co.uk.

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Mass production and delivery delays – common challenges facing China EV startups

As Tesla postponed delivery yet again, its Chinese rivals are scrambling too

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

This EV maker caters to young consumers by making driving easier and more fun

Amongst all the players in China’s EV market, Xpeng Motors still stands out

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Pony.ai repurposes its robotaxi fleet for last-mile delivery amid the Covid-19 pandemic

Pony.ai is seeking more ways to commercialize its versatile autonomous driving technology, transforming mobility and logistics

China bets on road-vehicle coordination for the mass adoption of autonomous driving cars by 2025

Money pours in as China pushes sector to be the next growth engine, and both self-driving startups and their investors are optimistic about their commercialization attempts

Consumers Trust: The company that gives consumers a voice

Consumers Trust has become Portugal's go-to company for customer complaint resolution; it is seeking funding to enable it to replicate its success in new markets

Bdeo: Using video intelligence to automate, speed up insurance claims handling and payouts

Insurtech SaaS Bdeo lets insurers process 70% of motor and property claims without human staff; targets Series A close by year-end

Payfazz aims to be Indonesia's first on-demand financial services company

Handling transactions averaging over IDR 1tn monthly, Payfazz hopes to bring the benefits of banking to all Indonesians

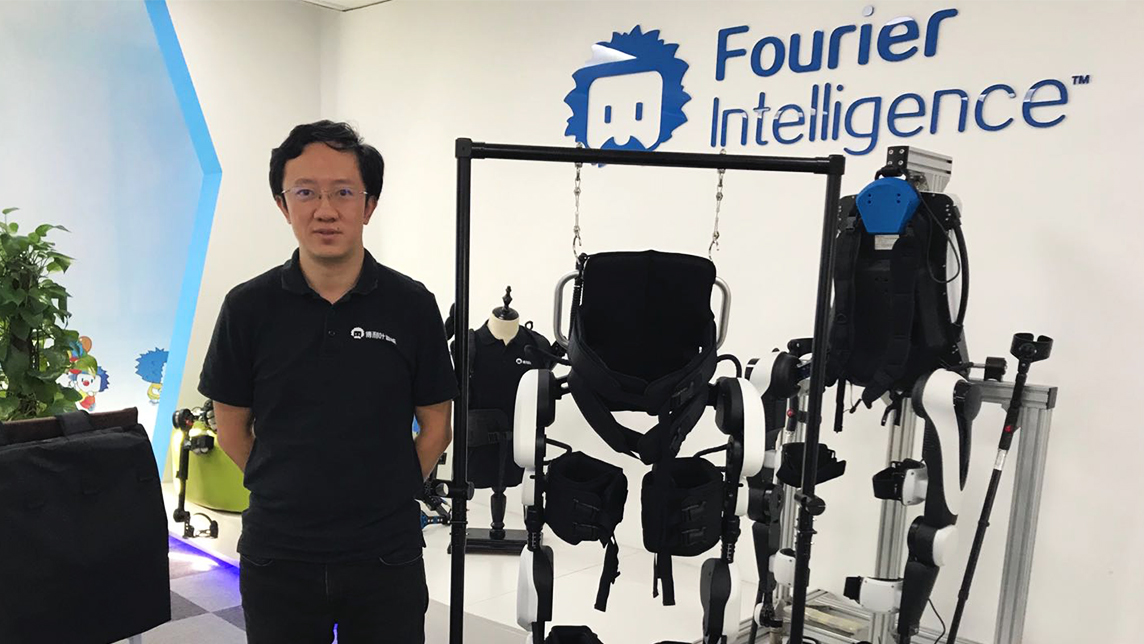

Fourier Intelligence: Quality rehabilitation robots at affordable prices

The startup has also launched an open-source platform to boost rehabilitation robotics and exoskeleton R&D and collaboration

Alén Space: Nanosatellite company targets contracts of over €2 million by 2020

Alén Space seeks funding of €1.5 million to accelerate plans to win a share of the global market of 2,600 small satellites to be launched by 2023

Oper Indonesia: On-demand drivers give car owners a break from endless traffic jams

Oper offers on-demand chauffeurs and car valets for stressed-out drivers and busy vehicle-owners

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Chinese EV startups feel the heat as Tesla slashes prices, market subsidies ending

Tesla's recent price cuts and upcoming Shanghai plant for producing cheaper cars are increasing pressure on its Chinese rivals

Sorry, we couldn’t find any matches for“Yamaha Motor Company”.