Yozma Program

-

DATABASE (157)

-

ARTICLES (273)

Entrepreneur First is a global entrepreneur incubator program and early-startup investor. The incubator is an intensive six-month program for founders and aspiring entrepreneurs to help them develop ideas that can go into building their own companies. The program is held in six cities around the world: Bangalore; Berlin, London, Paris, Singapore and Toronto (Canada).Participants do not need to have a startup or a specific business idea to participate, and those who have established their own companies can seek partners or co-founders at the program. Roughly 40-50% of the cohort reach the “Launch” phase, where the participants have established their own companies and received investments from Entrepreneur First and potentially other VCs. Entrepreneur First can invest in a startup built by program participants in exchange for 10% equity. The exact amount invested varies: £80,000 for the European programs; S$75,000 for the Singapore and Bangalore programs; and C$100,000 for the Canada program.

Entrepreneur First is a global entrepreneur incubator program and early-startup investor. The incubator is an intensive six-month program for founders and aspiring entrepreneurs to help them develop ideas that can go into building their own companies. The program is held in six cities around the world: Bangalore; Berlin, London, Paris, Singapore and Toronto (Canada).Participants do not need to have a startup or a specific business idea to participate, and those who have established their own companies can seek partners or co-founders at the program. Roughly 40-50% of the cohort reach the “Launch” phase, where the participants have established their own companies and received investments from Entrepreneur First and potentially other VCs. Entrepreneur First can invest in a startup built by program participants in exchange for 10% equity. The exact amount invested varies: £80,000 for the European programs; S$75,000 for the Singapore and Bangalore programs; and C$100,000 for the Canada program.

Shanshui Investment (Born For Maker Fund)

Founded in 2015 by Beijing News, Beijing Culture Investment Development Group, among other funds, the Born For Maker program was renamed Shanshui Investment in April 2018 by Chairman of the Board Dai Zigeng, former publisher of Beijing News and CEO of Beijing Culture Investment Development Group. Wang Yuechun, former editor-in-chief of Beijing News, was named founder of Shanshui Investment. Born For Maker, an incubator program, holds an annual startup competition. In 2016, the program set up an investment fund.

Founded in 2015 by Beijing News, Beijing Culture Investment Development Group, among other funds, the Born For Maker program was renamed Shanshui Investment in April 2018 by Chairman of the Board Dai Zigeng, former publisher of Beijing News and CEO of Beijing Culture Investment Development Group. Wang Yuechun, former editor-in-chief of Beijing News, was named founder of Shanshui Investment. Born For Maker, an incubator program, holds an annual startup competition. In 2016, the program set up an investment fund.

Based in Singapore, Antler is a venture capital firm that runs a global five-month venture building program. Aside from funding and company building, Antler matches founders and the talent they need prior to the start of the program. Antler's programs are run in Singapore, Stockholm, Sydney, Amsterdam and London. Antler was founded by former managing director of Zalora, Magnus Grimeland.

Based in Singapore, Antler is a venture capital firm that runs a global five-month venture building program. Aside from funding and company building, Antler matches founders and the talent they need prior to the start of the program. Antler's programs are run in Singapore, Stockholm, Sydney, Amsterdam and London. Antler was founded by former managing director of Zalora, Magnus Grimeland.

AngelPad is a New York and San Francisco-based accelerator program for seed-stage companies. Established in 2010, AngelPad has been ranked by MIT and others as the number one acceleration program in the US. It has invested in more than 150 companies, with recent investments in HypeLabs from Portugal and the US$4.5m seed round of local autonomous logistics vehicle maker Gatik.

AngelPad is a New York and San Francisco-based accelerator program for seed-stage companies. Established in 2010, AngelPad has been ranked by MIT and others as the number one acceleration program in the US. It has invested in more than 150 companies, with recent investments in HypeLabs from Portugal and the US$4.5m seed round of local autonomous logistics vehicle maker Gatik.

BStartup is an initiative of Sabadell Bank that supports innovation and entrepreneurship in Spain. It focuses mainly on tech and digital ecosystems and has recently launched a new program BStartup Health to invest in the healthtech sector. The BStartup10 program allocates €1 million annually to support the seed and early-stage of development of 10 startups. The Sabadell Venture Capital provides Series A and Series B funding.

BStartup is an initiative of Sabadell Bank that supports innovation and entrepreneurship in Spain. It focuses mainly on tech and digital ecosystems and has recently launched a new program BStartup Health to invest in the healthtech sector. The BStartup10 program allocates €1 million annually to support the seed and early-stage of development of 10 startups. The Sabadell Venture Capital provides Series A and Series B funding.

Startmate is an accelerator program for tech-enabled Australian and New Zealand start-ups. It also operates a seed fund backed by venture capitalists and established entrepreneurs. The organisation was established in 2011 by Niki Scevak, founder of Blackbird Ventures, and a team that included the founders of Australian enterprise software company Atlassian. Since its inception in 2011, Startmate has invested in more than 150 startups with a combined valuation of more than A$1 billion. Startmate runs two accelerator cohorts a year, usually from January–April and July–October. This accelerator program is open to a wide range of entrepreneurs, from idea-stage groups and pre-Series A startups, to solo founders and complete teams. Companies participating in Startmate’s accelerator program each receive A$75,000 from Startmate’s community of mentors, in exchange for 7.5% equity. In 2019 Startmate launched a dedicated Climate Cohort, which runs parallel with the standard program and focuses on startups in cleantech and climate-tech. Startmate also runs a First Believers program twice a year, which trains future or aspiring angel investors from Australia and New Zealand by building their confidence and networks and refining their investment strategies. In addition, the organization runs a coaching and mentorship program and holds other networking programs, like a Founders’ Fellowship, Women Fellowship, and Student Fellowship, at various dates throughout the year.

Startmate is an accelerator program for tech-enabled Australian and New Zealand start-ups. It also operates a seed fund backed by venture capitalists and established entrepreneurs. The organisation was established in 2011 by Niki Scevak, founder of Blackbird Ventures, and a team that included the founders of Australian enterprise software company Atlassian. Since its inception in 2011, Startmate has invested in more than 150 startups with a combined valuation of more than A$1 billion. Startmate runs two accelerator cohorts a year, usually from January–April and July–October. This accelerator program is open to a wide range of entrepreneurs, from idea-stage groups and pre-Series A startups, to solo founders and complete teams. Companies participating in Startmate’s accelerator program each receive A$75,000 from Startmate’s community of mentors, in exchange for 7.5% equity. In 2019 Startmate launched a dedicated Climate Cohort, which runs parallel with the standard program and focuses on startups in cleantech and climate-tech. Startmate also runs a First Believers program twice a year, which trains future or aspiring angel investors from Australia and New Zealand by building their confidence and networks and refining their investment strategies. In addition, the organization runs a coaching and mentorship program and holds other networking programs, like a Founders’ Fellowship, Women Fellowship, and Student Fellowship, at various dates throughout the year.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

Founded in 2013, Telstra’s muru-D accelerator has so far worked with 44 startups, with total revenue generated of over AUD 7.8 million. Telstra also has another venture capital arm that connects with technology businesses at a much later stage in their life cycles and looks to build strategic alliances. muru-D companies receive AUD 20,000 at the start of the program and if they achieve specific milestones by the midpoint of the program they unlock a further AUD 20,000. The accelerator has also dropped the requirement that companies raise AUD15,000 from mentors and investors.

Founded in 2013, Telstra’s muru-D accelerator has so far worked with 44 startups, with total revenue generated of over AUD 7.8 million. Telstra also has another venture capital arm that connects with technology businesses at a much later stage in their life cycles and looks to build strategic alliances. muru-D companies receive AUD 20,000 at the start of the program and if they achieve specific milestones by the midpoint of the program they unlock a further AUD 20,000. The accelerator has also dropped the requirement that companies raise AUD15,000 from mentors and investors.

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

Previously known as Incubate Capital Partners, Incubate Fund was founded in 1999 by Tohru Akaura and partners. Focusing on providing early stage funding, its portfolio includes more than 120 companies. It also hosts Incubate Camp, a seed-stage startup acceleration program.

Previously known as Incubate Capital Partners, Incubate Fund was founded in 1999 by Tohru Akaura and partners. Focusing on providing early stage funding, its portfolio includes more than 120 companies. It also hosts Incubate Camp, a seed-stage startup acceleration program.

MDI Ventures is the venture capital arm of Telkom, Indonesia’s state-owned telco. It aims to invest in disruptive and innovative companies in the online, media, and mobile internet space. It also supports fledgling startups through Indigo, an incubator and accelerator program.

MDI Ventures is the venture capital arm of Telkom, Indonesia’s state-owned telco. It aims to invest in disruptive and innovative companies in the online, media, and mobile internet space. It also supports fledgling startups through Indigo, an incubator and accelerator program.

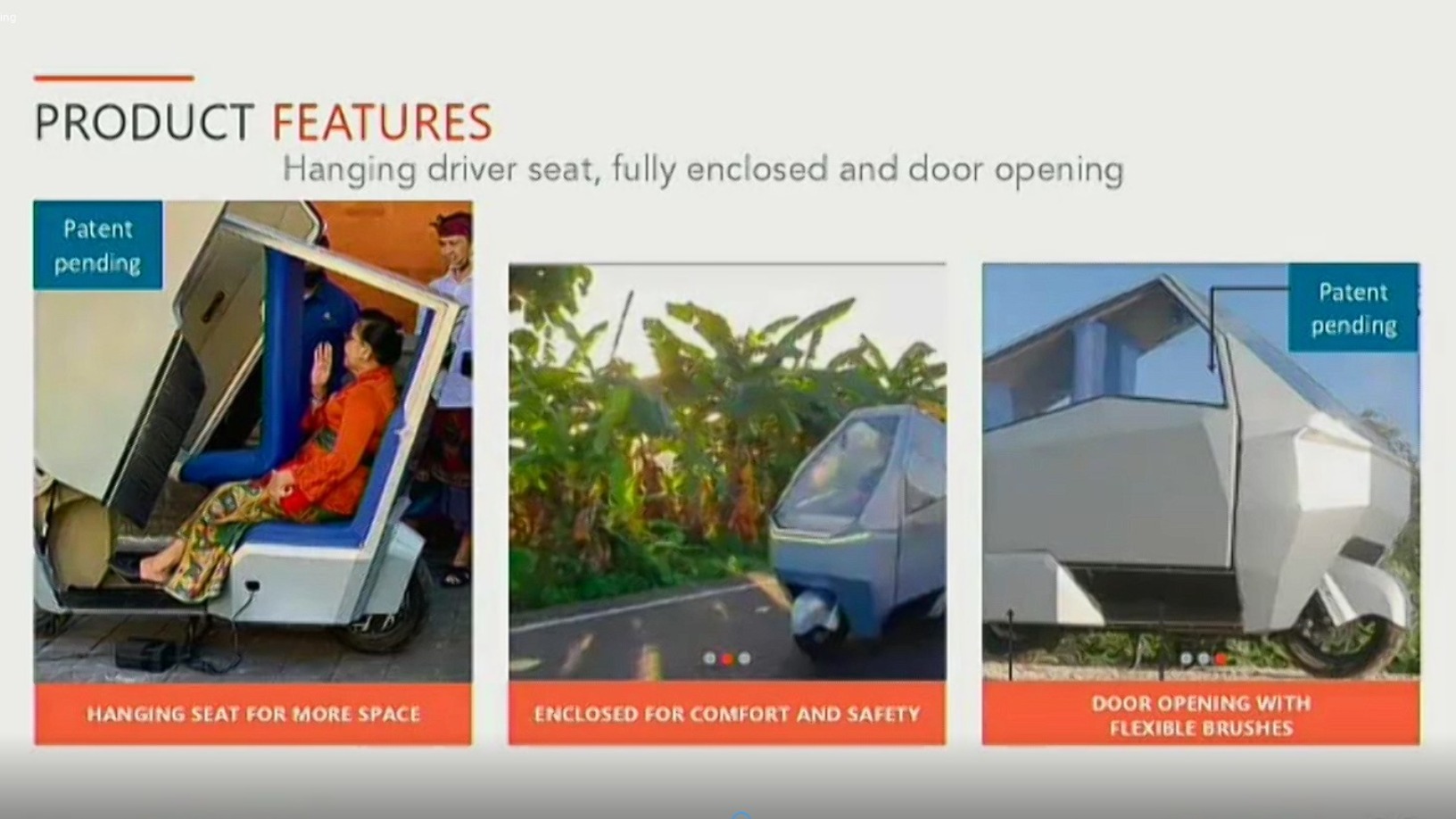

On-demand chauffeur services is the launchpad for Oper's ambition to become a one-stop “online helper” for meeting the daily needs of Indonesian urbanites.

On-demand chauffeur services is the launchpad for Oper's ambition to become a one-stop “online helper” for meeting the daily needs of Indonesian urbanites.

China’s largest fresh-food aggregator app buys directly from farmers, disrupting the traditionally long supply chain, to offer eateries cheaper, better-quality produce, with speedy delivery.

China’s largest fresh-food aggregator app buys directly from farmers, disrupting the traditionally long supply chain, to offer eateries cheaper, better-quality produce, with speedy delivery.

Canika: A new app offering more budget-friendly weddings

Canika woos young couples with more flexible prices and options in Indonesia's $7bn wedding planning market

Medigo, a long-awaited solution for Indonesia healthcare to go digital

Winning seed funding from Venturra Capital, Medigo seeks to help Indonesian hospitals make the transition into digital administration. We spoke to co-founders Harya Bimo and Faizal Rahman to find out more

Catapa: Putting AI into HR to help SMEs put their best people forward

Powered by AI and offering affordable subscription rates, Catapa is aiming to lift Indonesian SMEs – especially startups – into the HR mainstream

Indonesia's Rata offers customized aligners for quicker teeth straightening

Founded by two dentists, Alpha JWC Ventures-backed Rata seeks to offer an affordable alternative to conventional braces by tapping AI in orthodontics

Billin offers unlimited free e-invoicing services to SMEs and freelancers

Offering automated online invoice generating, sharing, tracking and payments, the Spanish fintech wants to become the billing Dropbox for businesses worldwide

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Councilbox: Lawtech that helps cut corporate meeting costs by up to 80%

The startup behind legally validated meeting software is one of the first market movers, targeting some 3m companies in Spain

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Arkademi wants people "to finish the course, pass the test and get the certificate they need"

Adopting a mobile-first focus, Indonesian MOOC Arkademi sets out to meet the needs of professionals and graduates for affordable courses that have ready applicability

As AI assistant market heats up, Sherpa zooms in on smart autos, smart homes

Spanish AI assistant startup Sherpa launches Sherpa Platform, a new set of APIs for smart cars, phones and home devices

Forget Instacart. Now you can get groceries from the vending machine downstairs

A Beijing startup has created a faster way for customers to purchase milk and eggs – just pop downstairs, buy from its smart vending machine and pay by smartphone

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Edpuzzle waives fees for video learning platform during coronavirus pandemic

Spanish edtech startup Edpuzzle lets teachers create engaging remote-learning tools from easily accessible online videos

Indonesian edtechs attract funding even as students head back to school

With services that complement and support conventional schools at a fraction of offline tuition cost, edtech companies are likely to continue growing

Sorry, we couldn’t find any matches for“Yozma Program”.