brain health

-

DATABASE (149)

-

ARTICLES (210)

Angel investor Grace Tahir, daughter of Indonesian banker and real estate tycoon, has a passion for tech startups. Besides her self-made billionaire father, business is also in her blood from her mother’s Riady conglomerate family. Married to Ronald Kumalaputra, she finally realised her dream of becoming a techpreneur in her own right. In 2012, she founded an app BibbyCam that failed less than two years later. Building on her experience in healthcare, as the Tahir empire owns hospitals in Indonesia, she created an online health portal, www.doktor.id offering free health consultations.

Angel investor Grace Tahir, daughter of Indonesian banker and real estate tycoon, has a passion for tech startups. Besides her self-made billionaire father, business is also in her blood from her mother’s Riady conglomerate family. Married to Ronald Kumalaputra, she finally realised her dream of becoming a techpreneur in her own right. In 2012, she founded an app BibbyCam that failed less than two years later. Building on her experience in healthcare, as the Tahir empire owns hospitals in Indonesia, she created an online health portal, www.doktor.id offering free health consultations.

Founded in 2000 by Hans-Jurgen Schmitz and Mark Tluszcz, Mangrove Capital Partners is a Luxembourg-based fund. It has, as an early investor, backed four unicorns, namely, Skype, Wix, WalkMe and LetGo, as well as a multitude of other successful tech startups. It participates at all stages of investment and has made over 120 investments, including as lead investor in 40 of these. It has seen 15 exits to date, including Skype and, most recently, has invested in the Seed round of Attentive.us and in the Series B of K Health and Series A of Flo Health.

Founded in 2000 by Hans-Jurgen Schmitz and Mark Tluszcz, Mangrove Capital Partners is a Luxembourg-based fund. It has, as an early investor, backed four unicorns, namely, Skype, Wix, WalkMe and LetGo, as well as a multitude of other successful tech startups. It participates at all stages of investment and has made over 120 investments, including as lead investor in 40 of these. It has seen 15 exits to date, including Skype and, most recently, has invested in the Seed round of Attentive.us and in the Series B of K Health and Series A of Flo Health.

Founded in 2015, Hovione Capital is a VC firm from Portugal specializing in the health sector, with a focus on seed/early-stage investments in healthcare and medtech businesses. It currently manages €5 million in investment assets across its portfolio of three companies.

Founded in 2015, Hovione Capital is a VC firm from Portugal specializing in the health sector, with a focus on seed/early-stage investments in healthcare and medtech businesses. It currently manages €5 million in investment assets across its portfolio of three companies.

Co-founder and COO of ProSehat

After graduating as a doctor at Universitas Katolik Atma Jaya in Indonesia, Agnes Susanto joined Atoma Medical as operations manager in 2011. She completed a master’s in Public Health, Hospital and Healthcare Facilities at the Universitas Gadjah Mada (UGM) in 2016. She also co-founded ProSehat, a medical e-commerce startup as an offshoot of Atoma Medical.

After graduating as a doctor at Universitas Katolik Atma Jaya in Indonesia, Agnes Susanto joined Atoma Medical as operations manager in 2011. She completed a master’s in Public Health, Hospital and Healthcare Facilities at the Universitas Gadjah Mada (UGM) in 2016. She also co-founded ProSehat, a medical e-commerce startup as an offshoot of Atoma Medical.

Founded in Boston in 2019, Transformation is entirely dedicated to healthcare disruption, predominently focuses on US investments and typically invests $10-30m per startup. It currently has 22 companies in its portfolio. Its most recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and, the same month, in the $21m Series D round of Protenus, the US’ leading healthcare compliance analytics firm.

Founded in Boston in 2019, Transformation is entirely dedicated to healthcare disruption, predominently focuses on US investments and typically invests $10-30m per startup. It currently has 22 companies in its portfolio. Its most recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and, the same month, in the $21m Series D round of Protenus, the US’ leading healthcare compliance analytics firm.

Founder and CEO of TMiRob

After earning a master’s degree in Control Engineering from Shanghai Jiao Tong University in 2003, Pan joined the National Instruments Corporation (China), where he helped develop the Lego Mindstorms EV3 robot and MIT’s cheetah robot. In 2009, Pan founded Fingertip Health, which sells a self-developed HIS software. He founded TMiRob in January 2015.

After earning a master’s degree in Control Engineering from Shanghai Jiao Tong University in 2003, Pan joined the National Instruments Corporation (China), where he helped develop the Lego Mindstorms EV3 robot and MIT’s cheetah robot. In 2009, Pan founded Fingertip Health, which sells a self-developed HIS software. He founded TMiRob in January 2015.

KEEN Growth Capital is an impact VC focusing on early-stage investments in companies that generate revenues of $200,000–$2m in the F&B, health or wellness sectors with an addressable market size above $300m. Investments in food segments include clean snacking, healthy eating and science tech-driven health products.Since 2017, the VC has been managing two capital funds. The KGC Fund I has yielded exits and late-stage valuations with returns of six to 75 times. The $40m KGC Fund II is directed at companies with a social and environmental impact in nutritional well-being, disease mitigation and life science technologies.

KEEN Growth Capital is an impact VC focusing on early-stage investments in companies that generate revenues of $200,000–$2m in the F&B, health or wellness sectors with an addressable market size above $300m. Investments in food segments include clean snacking, healthy eating and science tech-driven health products.Since 2017, the VC has been managing two capital funds. The KGC Fund I has yielded exits and late-stage valuations with returns of six to 75 times. The $40m KGC Fund II is directed at companies with a social and environmental impact in nutritional well-being, disease mitigation and life science technologies.

Co-founder of UpHill

Sequiera is a Portuguese co-founder at UpHill, whose SaaS helps healthcare professionals keep up-to-speed on the latest clinical treatments and protocols using AI. Despite being heavily involved in the development of the software Simulate, Sequiera continues to work in the medical field full-time.He works as a consultant at the SPMS – Shared Services of the Ministry of Health in Portugal – that centralizes, optimizes and rationalizes the procurement of goods and services in the state health service. He also lectures part-time in Leadership and Management in Healthcare at his former university, where UpHill was established.Sequiera has been President of ANEM, the Portuguese Medical Students’ International Committee and for two years helped develop the medical curriculum at the University of Luxembourg. He also holds a postgraduate qualification in Information Management and Business Intelligence in Healthcare from NOVA Information Management School in Lisbon.

Sequiera is a Portuguese co-founder at UpHill, whose SaaS helps healthcare professionals keep up-to-speed on the latest clinical treatments and protocols using AI. Despite being heavily involved in the development of the software Simulate, Sequiera continues to work in the medical field full-time.He works as a consultant at the SPMS – Shared Services of the Ministry of Health in Portugal – that centralizes, optimizes and rationalizes the procurement of goods and services in the state health service. He also lectures part-time in Leadership and Management in Healthcare at his former university, where UpHill was established.Sequiera has been President of ANEM, the Portuguese Medical Students’ International Committee and for two years helped develop the medical curriculum at the University of Luxembourg. He also holds a postgraduate qualification in Information Management and Business Intelligence in Healthcare from NOVA Information Management School in Lisbon.

Garden Impact Investments is an investment holding company based in Singapore. The company engages in impact investing, seeking startups that can create social and environmental benefits in their communities. Its portfolio includes companies in Indonesia, Thailand and Singapore, covering sectors ranging from agriculture, health and education.

Garden Impact Investments is an investment holding company based in Singapore. The company engages in impact investing, seeking startups that can create social and environmental benefits in their communities. Its portfolio includes companies in Indonesia, Thailand and Singapore, covering sectors ranging from agriculture, health and education.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Ataria Ventures is an early stage fund that offers predominantly Latin American investors and corporations access to technology startups in Israel and Silicon Valley. It has invested in more than 30 startups across a variety of industries and sectors, including Artificial Intelligence, Big Data, Virtual Reality, foodtech, agritech, consumer, and health.

Ataria Ventures is an early stage fund that offers predominantly Latin American investors and corporations access to technology startups in Israel and Silicon Valley. It has invested in more than 30 startups across a variety of industries and sectors, including Artificial Intelligence, Big Data, Virtual Reality, foodtech, agritech, consumer, and health.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

Co-founder and CTO of Qlapa

Fransiskus Xaverius is an experienced software engineer. He worked as an intern at RIM and Google during his Computer Science degree course at the University of Washington, USA. After graduating in 2011, he worked as a software engineer at various American tech companies, including the online game firm Zynga, Castlight Health and Homejoy. He returned to Indonesia after leaving Homejoy in 2015 to co-found Qlapa, an online marketplace for handmade products.

Fransiskus Xaverius is an experienced software engineer. He worked as an intern at RIM and Google during his Computer Science degree course at the University of Washington, USA. After graduating in 2011, he worked as a software engineer at various American tech companies, including the online game firm Zynga, Castlight Health and Homejoy. He returned to Indonesia after leaving Homejoy in 2015 to co-found Qlapa, an online marketplace for handmade products.

Co-founder and CEO of Gorry Holdings

Inspired by his own weight loss experience, former business consultant William Susilo founded the Gorry Holdings group of health and wellness startups: GorryGourmet, GorryWell and Helopt. Before becoming an entrepreneur, William worked for Accenture and Sinar Mas Land between 2012 and 2016, while also spending time at CT Corp, the holding company of a major Indonesian conglomerate. William graduated with a bachelor's in accounting from the University of Indonesia.

Inspired by his own weight loss experience, former business consultant William Susilo founded the Gorry Holdings group of health and wellness startups: GorryGourmet, GorryWell and Helopt. Before becoming an entrepreneur, William worked for Accenture and Sinar Mas Land between 2012 and 2016, while also spending time at CT Corp, the holding company of a major Indonesian conglomerate. William graduated with a bachelor's in accounting from the University of Indonesia.

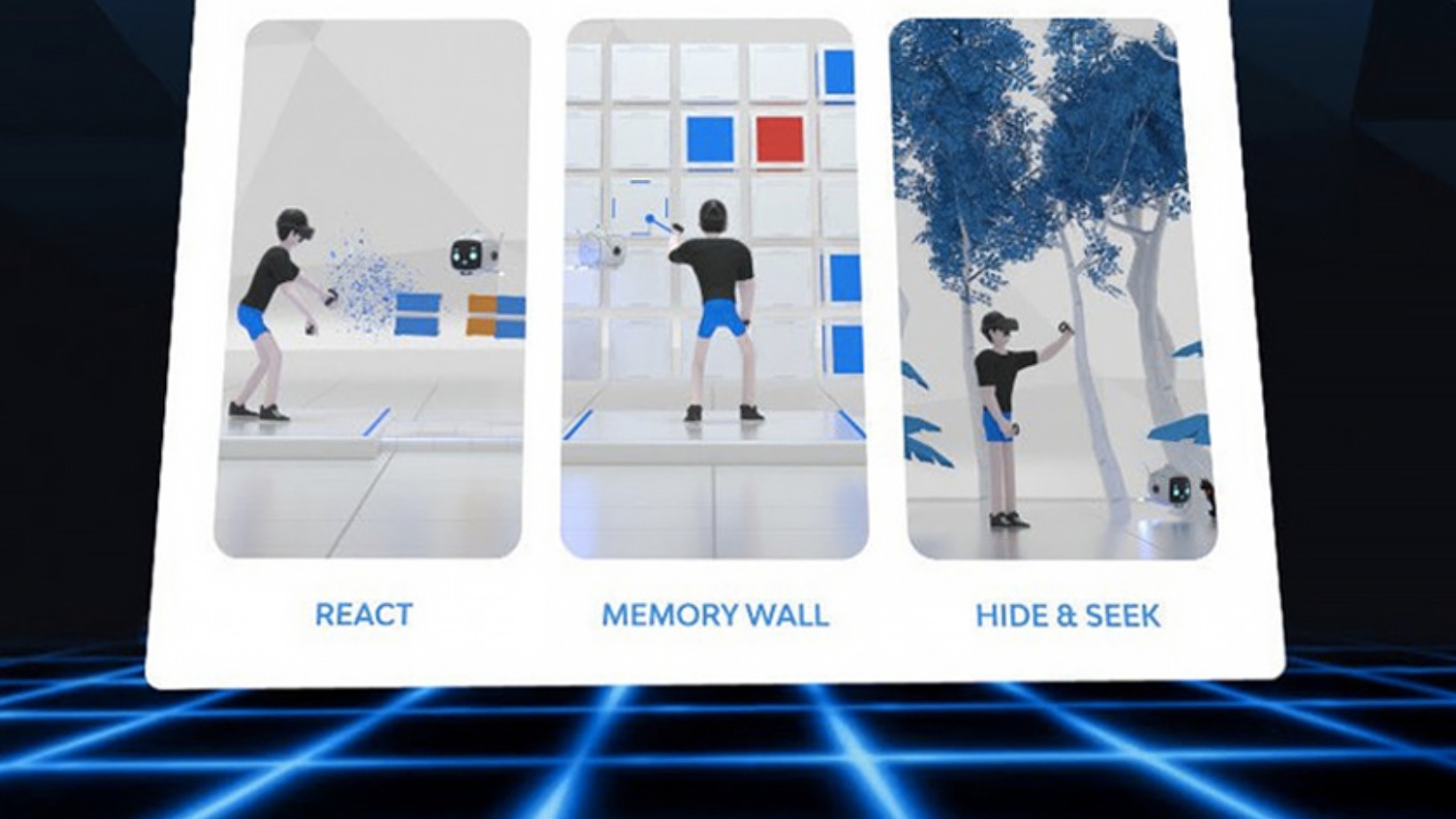

Virtuleap's VR games provide a mental workout, boosting brain health

Used by the AARP and Veteran's Health Administration in the US, Virtuleap’s games with AI-enabled assessment work to improve cognition and to counter degenerative diseases such as Alzheimer's

Benergy: A new app to track gut health with smart data

The Benergy app allows results to be shared with doctors to facilitate diagnosis and includes swap tests

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

Portugal's health & medtech startups: Taking innovation and disruption to heart

Backed by local and foreign money, Portugal’s healthcare and medical technology startups are hungry to go global

BioMind: AI medical diagnostics with over 90% accuracy for 100 diseases

BioMind helps doctors save lives by providing more accurate diagnosis of life-threatening diseases like Covid-19 and brain tumors

SWORD Health nabs Portugal's second biggest Series A round within one year

SWORD Health's AI-based physiotherapy solution has just clinched $9m from Khosla Ventures and Founders Fund, ringing in a total of $17m in Series A funding

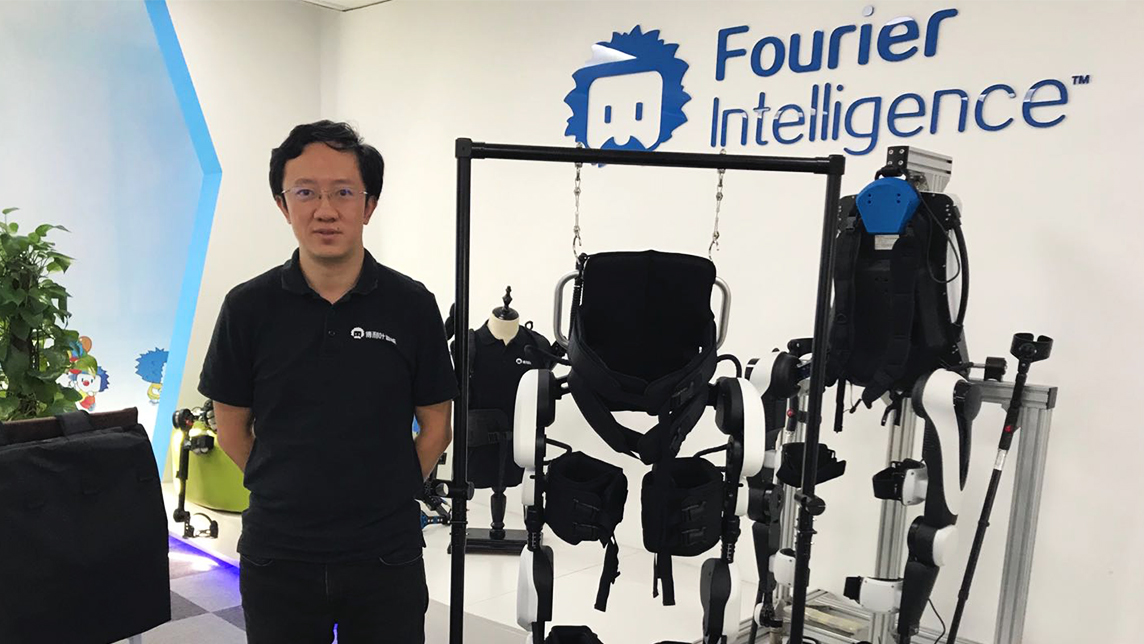

Fourier Intelligence: Quality rehabilitation robots at affordable prices

The startup has also launched an open-source platform to boost rehabilitation robotics and exoskeleton R&D and collaboration

Medigo, a long-awaited solution for Indonesia healthcare to go digital

Winning seed funding from Venturra Capital, Medigo seeks to help Indonesian hospitals make the transition into digital administration. We spoke to co-founders Harya Bimo and Faizal Rahman to find out more

Mental health services platform Ibunda wants to keep expanding its reach

Since its founding in 2015, the Indonesian startup Ibunda has provided psychological consultations to over 200,000 clients

Waterdrop: Using crowdfunding and social media to disrupt health insurance

Insurtech startup Waterdrop helps families in China who cannot afford medical treatment to raise money via online mutual aid and crowdfunding, while selling insurance plans too

MenteLista: Empowering small children to learn English with 10 minutes daily practice

Designed for infants and children, ranging in age from just 6 months to 7 years old, this platform could revolutionize language study during the critical learning period

Atomian: The powerful cognitive software that thinks, works like the human brain

Combining natural language processing with big data, Atomian enables easy, quick and real-time access to information in databases and documents

Biel Glasses: A pioneering solution for low vision sufferers

Biel Glasses offers a life-changing technology for people with low vision, a condition that is seven times more common than blindness

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

The Watertree Project: Eliminating single-use plastic water bottles in Malaysia

With high-profile Malaysian corporate clients under its belt, the startup is in no hurry to raise funds, preferring to focus on raising public awareness and winning mindshare

Sorry, we couldn’t find any matches for“brain health”.