brain health

-

DATABASE (149)

-

ARTICLES (210)

Founded in 2020 in Boulder, Colorado, Trailhead Capital is a specialist agtech and foodtech investor that focuses on startups in the US, Canada, Australia and Israel. The VC’s regenerative agriculture portfolio includes investments in food ingredients traceability, food supply chains, reducing food waste and soil health environmental management.Recent investments include in the $12m Series A round of Vence, a US-based producer of virtual fencing wearables for livestock management in May 2021. In February 2021, it also participated in the $6m funding round of foodtech HowGood that specializes in rating the sustainability of grocery products.

Founded in 2020 in Boulder, Colorado, Trailhead Capital is a specialist agtech and foodtech investor that focuses on startups in the US, Canada, Australia and Israel. The VC’s regenerative agriculture portfolio includes investments in food ingredients traceability, food supply chains, reducing food waste and soil health environmental management.Recent investments include in the $12m Series A round of Vence, a US-based producer of virtual fencing wearables for livestock management in May 2021. In February 2021, it also participated in the $6m funding round of foodtech HowGood that specializes in rating the sustainability of grocery products.

Co-founder of Waterdrop and general manager of Shuidi Chou of Waterdrop (Shuidi)

Xu Hanhan graduated from the Guanghua School of Management, Peking University, in 2008. She then worked at the VC, China Renaissance Capital Investment, and later became personal assistant to ByteDance CEO and founder Zhang Yiming during the startup's early years. She co-founded Waterdrop in 2016 and is now in charge of Waterdrop Crowdfunding. She also started another of Waterdrop's platforms, Waterdrop Public Wellness, which helps charitable organizations fundraise as well as report on the usage of the funds received.

Xu Hanhan graduated from the Guanghua School of Management, Peking University, in 2008. She then worked at the VC, China Renaissance Capital Investment, and later became personal assistant to ByteDance CEO and founder Zhang Yiming during the startup's early years. She co-founded Waterdrop in 2016 and is now in charge of Waterdrop Crowdfunding. She also started another of Waterdrop's platforms, Waterdrop Public Wellness, which helps charitable organizations fundraise as well as report on the usage of the funds received.

CTO and co-founder of HumanITcare

Sanchez is a computer and data science expert with a master’s degree in innovation and research in informatics with specialization in advanced computing from the Polytechnic University of Barcelona (UPC). He also holds multiple certifications from the John Hopkins University School of Education. Sanchez is currently CTO and co-founder of HumanITcare, a telemedicine platform for remote patient monitoring using real-world data and AI to treat patients affected by chronic diseases and also to accelerate drug development and clinical trials. Prior to HumanITcare, Sanchez worked as Data Scientist in a joint-project between the Spanish insurance company Catalana Occidente and technology consultancy Raona to develop a sales collaborative platform. He has also worked on projects in software development, mobile apps, server and hardware as well as prototyping for IoT devices in the fields of education, health and wellness.

Sanchez is a computer and data science expert with a master’s degree in innovation and research in informatics with specialization in advanced computing from the Polytechnic University of Barcelona (UPC). He also holds multiple certifications from the John Hopkins University School of Education. Sanchez is currently CTO and co-founder of HumanITcare, a telemedicine platform for remote patient monitoring using real-world data and AI to treat patients affected by chronic diseases and also to accelerate drug development and clinical trials. Prior to HumanITcare, Sanchez worked as Data Scientist in a joint-project between the Spanish insurance company Catalana Occidente and technology consultancy Raona to develop a sales collaborative platform. He has also worked on projects in software development, mobile apps, server and hardware as well as prototyping for IoT devices in the fields of education, health and wellness.

Castel Capital is a privately-owned Dutch venture capital and equity platform. The company also works with co-investors and private family offices to build bespoke investment portfolios. Castel focuses on both tech and non-tech business opportunities across Europe. Seed funding of €100,000–€500,000 and Series A rounds of €500,000–€1 million are generally available for tech deals. Castel has a hands-on management approach and seeks to add value to the portfolio companies. The firm has invested in 10 startups in diverse sectors like digital health, fintech and transportation.

Castel Capital is a privately-owned Dutch venture capital and equity platform. The company also works with co-investors and private family offices to build bespoke investment portfolios. Castel focuses on both tech and non-tech business opportunities across Europe. Seed funding of €100,000–€500,000 and Series A rounds of €500,000–€1 million are generally available for tech deals. Castel has a hands-on management approach and seeks to add value to the portfolio companies. The firm has invested in 10 startups in diverse sectors like digital health, fintech and transportation.

Vesalius Biocapital III is a €70 million fund that invests in medtech, e-health initiatives and drug development in Europe. It was launched in 2017 by Luxembourg-based Vesalius Biocapital, a life sciences venture capital firm founded in 2007. Preceding Vesalius Biocapital III were Vesalius Biocapital I, with €76 million under management and Vesalius Biocapital II, which has €78 million invested; both funds have 11 portfolio companies each.Its recent investments include in Portuguese home physiotherapy tech solution SWORD Health's 2021 $25m Series B and in the 2020 $9m second phase of its Series A round as well as in the 2020 €22m Series B round of German biotech Topas Therapeutics.

Vesalius Biocapital III is a €70 million fund that invests in medtech, e-health initiatives and drug development in Europe. It was launched in 2017 by Luxembourg-based Vesalius Biocapital, a life sciences venture capital firm founded in 2007. Preceding Vesalius Biocapital III were Vesalius Biocapital I, with €76 million under management and Vesalius Biocapital II, which has €78 million invested; both funds have 11 portfolio companies each.Its recent investments include in Portuguese home physiotherapy tech solution SWORD Health's 2021 $25m Series B and in the 2020 $9m second phase of its Series A round as well as in the 2020 €22m Series B round of German biotech Topas Therapeutics.

Founder and CEO of PesanLab

Dimas Prasetyo is the founder and CEO of PesanLab. He graduated with a degree in Medical Technology and Laboratory Science from Yogyakarta Health Polytechnic. He has over eight years of work experience in marketing, operations and management in the clinical laboratory diagnostics industry. He was also a product specialist at Non-invasive Genetic Abnormalities Test in Your Clinic and at Natera Inc. He co-founded Lab Panorama Bandung in 2009 and left in 2013 to become the founder of LabConX that was later rebranded as PesanLab.

Dimas Prasetyo is the founder and CEO of PesanLab. He graduated with a degree in Medical Technology and Laboratory Science from Yogyakarta Health Polytechnic. He has over eight years of work experience in marketing, operations and management in the clinical laboratory diagnostics industry. He was also a product specialist at Non-invasive Genetic Abnormalities Test in Your Clinic and at Natera Inc. He co-founded Lab Panorama Bandung in 2009 and left in 2013 to become the founder of LabConX that was later rebranded as PesanLab.

CEO and co-founder of String Bio

Ezhil Subbian studied industrial biotechnology at Anna University in India. She then went to the US to complete two PhDs in biochemistry, biophysics and molecular biology at the Oregon Health & Science University and from Rutgers, the State University of New Jersey-New Brunswick. She was a research assistant at both universities.While in the US, she was also a research scientist at Gevo Inc and at Vollum Institute. In 2008, she became a scientist and technical lead at pharma Codexis in California. In 2011, she worked at San Francisco-based Kumar Investments as an entrepreneur and biotech consultant.In 2012, she founded biotech startup String Inc while on a nine-month Startup Leadership Program in Silicon Valley. In June 2013, she and husband returned to India and formed a new company String Bio to continue working on the alternative protein powder project for animal feed production.

Ezhil Subbian studied industrial biotechnology at Anna University in India. She then went to the US to complete two PhDs in biochemistry, biophysics and molecular biology at the Oregon Health & Science University and from Rutgers, the State University of New Jersey-New Brunswick. She was a research assistant at both universities.While in the US, she was also a research scientist at Gevo Inc and at Vollum Institute. In 2008, she became a scientist and technical lead at pharma Codexis in California. In 2011, she worked at San Francisco-based Kumar Investments as an entrepreneur and biotech consultant.In 2012, she founded biotech startup String Inc while on a nine-month Startup Leadership Program in Silicon Valley. In June 2013, she and husband returned to India and formed a new company String Bio to continue working on the alternative protein powder project for animal feed production.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

C4 Ventures was founded by Pascal Cagni, former VP and GM of Apple EMEIA. With offices in Paris and London, the firm invests in early-stage startups across market segments in Europe. The VC also supports later-stage companies interested in expanding into Europe. It currently has 33 startups in its portfolio with principal interests in sectors like hardware, digital media and the future of commerce and work.Recent investments in 2021 include the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and the $5m seed round in June of Norbert Health, the French producers of the first ambient scanner that can measure vital signs.

C4 Ventures was founded by Pascal Cagni, former VP and GM of Apple EMEIA. With offices in Paris and London, the firm invests in early-stage startups across market segments in Europe. The VC also supports later-stage companies interested in expanding into Europe. It currently has 33 startups in its portfolio with principal interests in sectors like hardware, digital media and the future of commerce and work.Recent investments in 2021 include the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and the $5m seed round in June of Norbert Health, the French producers of the first ambient scanner that can measure vital signs.

A mobile platform that combines online medical counseling with offline clinical services to address mother-and-child healthcare concerns.

A mobile platform that combines online medical counseling with offline clinical services to address mother-and-child healthcare concerns.

Co-founder and Advisor of Shotl

Igor Martret dedicated 15 years of his life to professional sports. The former athlete, from the University of Barcelona, is passionate about ultra trails, marathons and triathlons. The sports performance advocate also worked for five years as club manager at Virgin Health and Holmes Place.In 2006, he joined the family business as COO of Drivania Chauffeurs that was started by his brothers in 2001. Today, he's co-owner and CEO of Drivania International, the family-run chauffeur services enterprise that has grown to become a leading chauffeur company in Europe. In 2016, the Martrets established on-demand shuttle services company Shotl.

Igor Martret dedicated 15 years of his life to professional sports. The former athlete, from the University of Barcelona, is passionate about ultra trails, marathons and triathlons. The sports performance advocate also worked for five years as club manager at Virgin Health and Holmes Place.In 2006, he joined the family business as COO of Drivania Chauffeurs that was started by his brothers in 2001. Today, he's co-owner and CEO of Drivania International, the family-run chauffeur services enterprise that has grown to become a leading chauffeur company in Europe. In 2016, the Martrets established on-demand shuttle services company Shotl.

Speedinvest is a pan-European, early-stage venture capital firm with offices in Vienna, Munich, San Francisco, Berlin, London and Paris. The firm helps startups grow internationally. Its raised its third and latest fund of €190m in Feburary 2020, bringing total AUM to over €400m. Each investment ticket size starts from €50,000 and goes up to €1.5m. Founded by Austrian Oliver Holle, a former entrepreneur who founded his business in the 2000s and went on to work another tech startup in Silicon Valley. With conviction that "European founders can win big in the Valley and beyond,” Rolle started Speedinvest with a €10m fund in 2011.The firm mainly invests in pan-European fintech startups, digital health, consumer tech, B2B SaaS and deep tech startups.

Speedinvest is a pan-European, early-stage venture capital firm with offices in Vienna, Munich, San Francisco, Berlin, London and Paris. The firm helps startups grow internationally. Its raised its third and latest fund of €190m in Feburary 2020, bringing total AUM to over €400m. Each investment ticket size starts from €50,000 and goes up to €1.5m. Founded by Austrian Oliver Holle, a former entrepreneur who founded his business in the 2000s and went on to work another tech startup in Silicon Valley. With conviction that "European founders can win big in the Valley and beyond,” Rolle started Speedinvest with a €10m fund in 2011.The firm mainly invests in pan-European fintech startups, digital health, consumer tech, B2B SaaS and deep tech startups.

Founded in 2013, Visionnaire Ventures is based in San Francisco and invests globally in innovative technologies in diverse sectors like AI and ML, digital health, Big Data, IoT, mobile and agriculture. The firm is managed by a team of serial entrepreneurs and executives involved in global internet, game and online media companies.The VC is co-founded by managing partners Taizo Son, Keith Nilsson and Susan Choe who also founded Katalyst Ventures. Son is the brother of SoftBank’s Masayoshi Son based in Japan. Taizo founded Gungho Online in 2002, a major online gaming company that became public-listed in 2005. With a vision to create a Silicon Valley-like venture eco-system in East Asia, he also founded MOVIDA JAPAN in 2009. He also founded Mistletoe Inc as CEO in 2013 to support entrepreneurs and provide startup ecosystem development activities.

Founded in 2013, Visionnaire Ventures is based in San Francisco and invests globally in innovative technologies in diverse sectors like AI and ML, digital health, Big Data, IoT, mobile and agriculture. The firm is managed by a team of serial entrepreneurs and executives involved in global internet, game and online media companies.The VC is co-founded by managing partners Taizo Son, Keith Nilsson and Susan Choe who also founded Katalyst Ventures. Son is the brother of SoftBank’s Masayoshi Son based in Japan. Taizo founded Gungho Online in 2002, a major online gaming company that became public-listed in 2005. With a vision to create a Silicon Valley-like venture eco-system in East Asia, he also founded MOVIDA JAPAN in 2009. He also founded Mistletoe Inc as CEO in 2013 to support entrepreneurs and provide startup ecosystem development activities.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

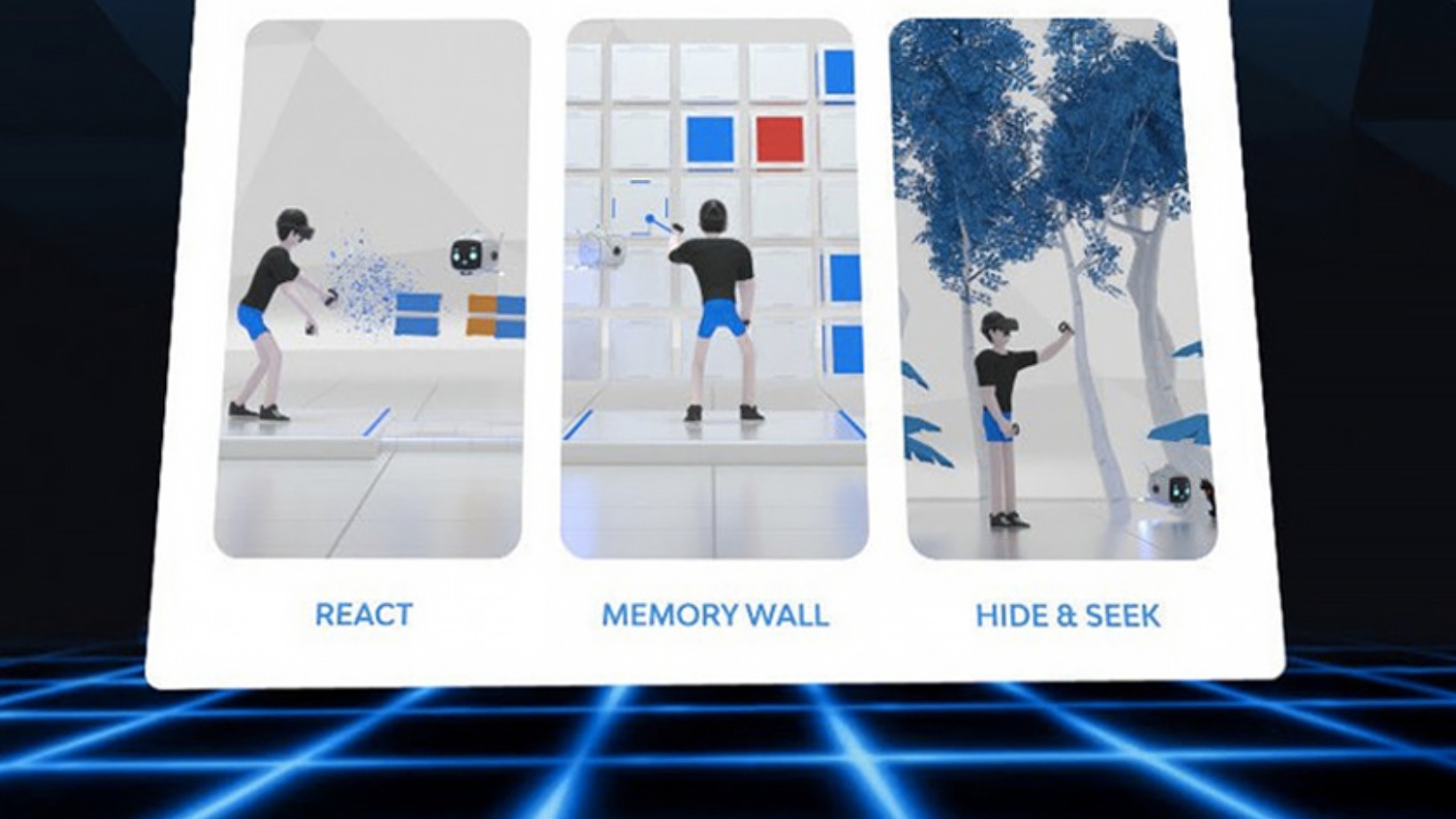

Virtuleap's VR games provide a mental workout, boosting brain health

Used by the AARP and Veteran's Health Administration in the US, Virtuleap’s games with AI-enabled assessment work to improve cognition and to counter degenerative diseases such as Alzheimer's

Benergy: A new app to track gut health with smart data

The Benergy app allows results to be shared with doctors to facilitate diagnosis and includes swap tests

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

Portugal's health & medtech startups: Taking innovation and disruption to heart

Backed by local and foreign money, Portugal’s healthcare and medical technology startups are hungry to go global

BioMind: AI medical diagnostics with over 90% accuracy for 100 diseases

BioMind helps doctors save lives by providing more accurate diagnosis of life-threatening diseases like Covid-19 and brain tumors

SWORD Health nabs Portugal's second biggest Series A round within one year

SWORD Health's AI-based physiotherapy solution has just clinched $9m from Khosla Ventures and Founders Fund, ringing in a total of $17m in Series A funding

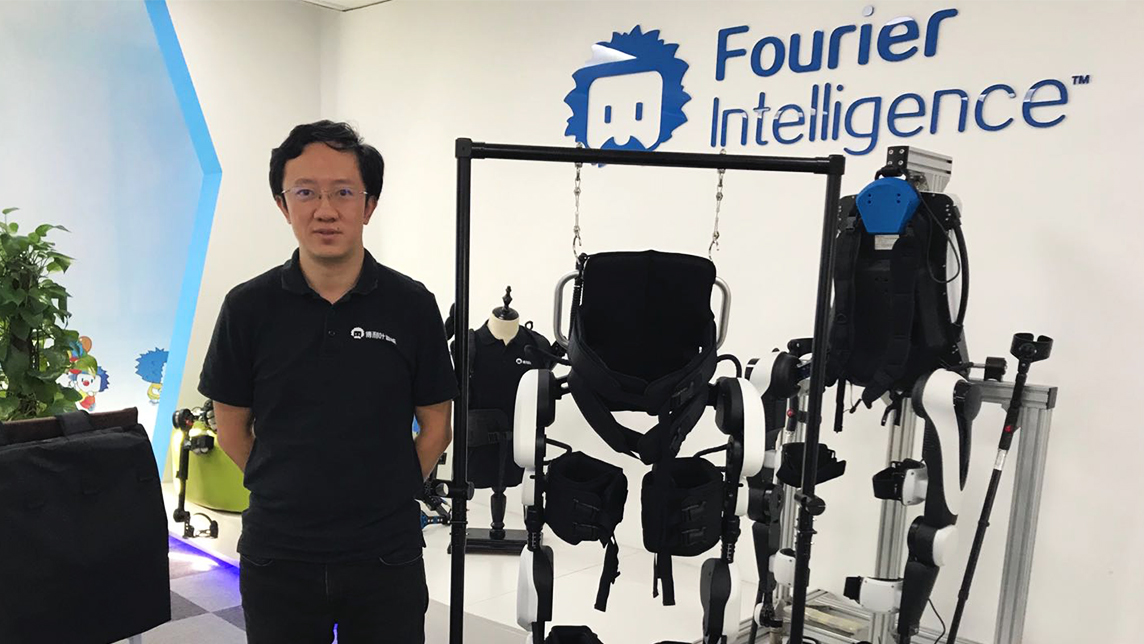

Fourier Intelligence: Quality rehabilitation robots at affordable prices

The startup has also launched an open-source platform to boost rehabilitation robotics and exoskeleton R&D and collaboration

Medigo, a long-awaited solution for Indonesia healthcare to go digital

Winning seed funding from Venturra Capital, Medigo seeks to help Indonesian hospitals make the transition into digital administration. We spoke to co-founders Harya Bimo and Faizal Rahman to find out more

Mental health services platform Ibunda wants to keep expanding its reach

Since its founding in 2015, the Indonesian startup Ibunda has provided psychological consultations to over 200,000 clients

Waterdrop: Using crowdfunding and social media to disrupt health insurance

Insurtech startup Waterdrop helps families in China who cannot afford medical treatment to raise money via online mutual aid and crowdfunding, while selling insurance plans too

MenteLista: Empowering small children to learn English with 10 minutes daily practice

Designed for infants and children, ranging in age from just 6 months to 7 years old, this platform could revolutionize language study during the critical learning period

Atomian: The powerful cognitive software that thinks, works like the human brain

Combining natural language processing with big data, Atomian enables easy, quick and real-time access to information in databases and documents

Biel Glasses: A pioneering solution for low vision sufferers

Biel Glasses offers a life-changing technology for people with low vision, a condition that is seven times more common than blindness

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

The Watertree Project: Eliminating single-use plastic water bottles in Malaysia

With high-profile Malaysian corporate clients under its belt, the startup is in no hurry to raise funds, preferring to focus on raising public awareness and winning mindshare

Sorry, we couldn’t find any matches for“brain health”.