carbon footprint

DATABASE (42)

ARTICLES (102)

Developed by ex-UN experts, Everimpact provides real-time GHG data using satellites, sensors and IoT to help cities and companies manage and monetize emissions reduction.

Developed by ex-UN experts, Everimpact provides real-time GHG data using satellites, sensors and IoT to help cities and companies manage and monetize emissions reduction.

Operation & finance lead and co-founder of Graviky Labs

Nikhil Kaushik is one of the three co-founders of a startup company and MIT spin-off, Graviky Labs, which he began together with Anirudh Sharma and Nitesh Kadyan. The company developed AIR-INK, an industrial and customer-grade ink made of upcycled carbon emissions that are captured and purified through patented proprietary technology. At Graviky Labs, Kaushik heads its operations and finance, and formerly oversaw its supply chain and business relations.Kaushik is a qualified chartered accountant. Prior to Graviky Labs, he worked in Ernst & Young managing tax advisory and compliance work for large Indian and international corporates. Kaushik was named one of Foreign Policy magazine's 100 Global Thinkers in 2016 along with the other Graviky Labs co-founders.

Nikhil Kaushik is one of the three co-founders of a startup company and MIT spin-off, Graviky Labs, which he began together with Anirudh Sharma and Nitesh Kadyan. The company developed AIR-INK, an industrial and customer-grade ink made of upcycled carbon emissions that are captured and purified through patented proprietary technology. At Graviky Labs, Kaushik heads its operations and finance, and formerly oversaw its supply chain and business relations.Kaushik is a qualified chartered accountant. Prior to Graviky Labs, he worked in Ernst & Young managing tax advisory and compliance work for large Indian and international corporates. Kaushik was named one of Foreign Policy magazine's 100 Global Thinkers in 2016 along with the other Graviky Labs co-founders.

Structure Capital is San Francisco-based VC, established in 2013, that only invests in carbon-neutral startups. It has a special interest in A.I. and Big Data-based entities and currently manages a portfolio with 76 international startups. It has managed 13 exits to date, including Jobr and Guest Driven. ts recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$225m Series D round of accommodation platform and unicorn, Sonder.

Structure Capital is San Francisco-based VC, established in 2013, that only invests in carbon-neutral startups. It has a special interest in A.I. and Big Data-based entities and currently manages a portfolio with 76 international startups. It has managed 13 exits to date, including Jobr and Guest Driven. ts recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$225m Series D round of accommodation platform and unicorn, Sonder.

CTO and co-founder of Bygen

Ben Morton is an Australian entrepreneur and a chemical engineer by training. While serving in the Royal Australian Infantry, he attended Flinders University, pursuing a double honours degree in physics and organic chemistry. After graduating in 2013, Morton briefly worked as a chemist at fertilizer company SprayGro. In 2016, he enrolled at the University of Adelaide to pursue a PhD in Chemical Engineering. There, he joined Philip Kwong’s research group and met fellow PhD student Lewis Dunnigan. Using technology they developed at the research group, in 2017 Morton, and Dunnigan established Bygen, a startup offering a low-cost, novel way process of making activated carbon using various forms of agricultural waste, with Kwong as a technical adviser and fellow co-founder. Morton is now CTO of Bygen.

Ben Morton is an Australian entrepreneur and a chemical engineer by training. While serving in the Royal Australian Infantry, he attended Flinders University, pursuing a double honours degree in physics and organic chemistry. After graduating in 2013, Morton briefly worked as a chemist at fertilizer company SprayGro. In 2016, he enrolled at the University of Adelaide to pursue a PhD in Chemical Engineering. There, he joined Philip Kwong’s research group and met fellow PhD student Lewis Dunnigan. Using technology they developed at the research group, in 2017 Morton, and Dunnigan established Bygen, a startup offering a low-cost, novel way process of making activated carbon using various forms of agricultural waste, with Kwong as a technical adviser and fellow co-founder. Morton is now CTO of Bygen.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Founder, CEO of Satelligence

Niels Wielaard is the Dutch CEO, founder and co-owner of Satelligence, a SaaS platform using satellite data and AI to help corporates improve their supply chain sustainability and track environmental risks. Before founding Satelligence in 2016, he spent 14 years at earth-monitoring company SarVision, which is a spin-off of Wageningen University in Utrecht, where he was a senior project manager and, previously, a remote sensing and geo-information specialist. Wielaard holds a master’s in Forestry from Wageningen University and has always been passionate about forest sustainability. His other work experience includes one year as a GIS research analyst at another Utrecht-based initiative, the Copernicus Institute of Sustainable Development, as part of a post-master’s research project developing a new mapping methodology for the design of biological corridors. He also completed stints during his studies working on pilot forestry-based carbon offset projects at an NGO and in forest certification research for the Dutch space agency, Space Netherlands.

Niels Wielaard is the Dutch CEO, founder and co-owner of Satelligence, a SaaS platform using satellite data and AI to help corporates improve their supply chain sustainability and track environmental risks. Before founding Satelligence in 2016, he spent 14 years at earth-monitoring company SarVision, which is a spin-off of Wageningen University in Utrecht, where he was a senior project manager and, previously, a remote sensing and geo-information specialist. Wielaard holds a master’s in Forestry from Wageningen University and has always been passionate about forest sustainability. His other work experience includes one year as a GIS research analyst at another Utrecht-based initiative, the Copernicus Institute of Sustainable Development, as part of a post-master’s research project developing a new mapping methodology for the design of biological corridors. He also completed stints during his studies working on pilot forestry-based carbon offset projects at an NGO and in forest certification research for the Dutch space agency, Space Netherlands.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

CTO and co-founder of Diamond Foundry

Jeremy Scholz is CTO and co-founder at US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. He has worked there since 2012, leading up to the company’s official establishment. Prior to this, Scholz co-founded startup consultancy Alicanto in 2011 and briefly worked at startup YottaQ as director of engineering. From 2006–2011, Scholz worked as an engineer and manager at the $640m solar power startup Nanosolar. Silicon Valley's first solar power technology startup financed by American venture capital, the firm was the highest-valued firm in the industry at the time. When Nanosolar closed due to cheaper competition from China, much of its technical expertise and experience were diverted to set up Diamond Foundry. Scholz graduated from the Massachusetts Institute of Technology in mechanical engineering and started his career working at Boeing as a mechanical engineer from 2005–2006.

Jeremy Scholz is CTO and co-founder at US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. He has worked there since 2012, leading up to the company’s official establishment. Prior to this, Scholz co-founded startup consultancy Alicanto in 2011 and briefly worked at startup YottaQ as director of engineering. From 2006–2011, Scholz worked as an engineer and manager at the $640m solar power startup Nanosolar. Silicon Valley's first solar power technology startup financed by American venture capital, the firm was the highest-valued firm in the industry at the time. When Nanosolar closed due to cheaper competition from China, much of its technical expertise and experience were diverted to set up Diamond Foundry. Scholz graduated from the Massachusetts Institute of Technology in mechanical engineering and started his career working at Boeing as a mechanical engineer from 2005–2006.

CEO and co-founder of Bygen

Lewis Dunnigan is a researcher turned entrepreneur based in Australia. After earning a master’s degree in Chemical Engineering and working as a researcher at the University of Edinburgh in the UK, Dunnigan returned to Australia. He had a brief stint as a visiting researcher and earned his PhD in Chemical Engineering at the University of Adelaide.During his PhD, Dunnigan was a part of Philip Kwong’s research laboratory. His PhD project involved developing a system to generate activated charcoal and renewable energy from biomass. In 2017, Dunnigan, Kwong, and fellow PhD student Ben Morton decided to commercialize this technology and established a spin-off company called Bygen, which developed a low-cost, novel way to make activated carbon more sustainably using various forms of agricultural waste. Dunnigan is now the CEO of Bygen.

Lewis Dunnigan is a researcher turned entrepreneur based in Australia. After earning a master’s degree in Chemical Engineering and working as a researcher at the University of Edinburgh in the UK, Dunnigan returned to Australia. He had a brief stint as a visiting researcher and earned his PhD in Chemical Engineering at the University of Adelaide.During his PhD, Dunnigan was a part of Philip Kwong’s research laboratory. His PhD project involved developing a system to generate activated charcoal and renewable energy from biomass. In 2017, Dunnigan, Kwong, and fellow PhD student Ben Morton decided to commercialize this technology and established a spin-off company called Bygen, which developed a low-cost, novel way to make activated carbon more sustainably using various forms of agricultural waste. Dunnigan is now the CEO of Bygen.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Jason Stockwood is the chairman and co-owner of Grimsby Town Football Club. The Grimsby working-class lad managed to get a scholarship to study in the US, worked at Trailfinders and Lastminute.com in the 1990s. He was a non-executive director of Skyscanner and international MD at Travelocity Business and also at Match.com. In 2010, he became the CEO and vice-chair of online insurance company, Simply Business, that was sold for £400m in 2017.The co-founder of VC 53° has also invested in British startups across market segments, including the Series B investment round of food-sharing app OLIO in September 2021 and August 2020 financing of carbon tracking platform for banks and investors CoGo UK.

Jason Stockwood is the chairman and co-owner of Grimsby Town Football Club. The Grimsby working-class lad managed to get a scholarship to study in the US, worked at Trailfinders and Lastminute.com in the 1990s. He was a non-executive director of Skyscanner and international MD at Travelocity Business and also at Match.com. In 2010, he became the CEO and vice-chair of online insurance company, Simply Business, that was sold for £400m in 2017.The co-founder of VC 53° has also invested in British startups across market segments, including the Series B investment round of food-sharing app OLIO in September 2021 and August 2020 financing of carbon tracking platform for banks and investors CoGo UK.

Owen van Natta was formerly COO of Facebook and CEO of MySpace, and also previously held senior positions in Amazon and Zynga. He is an angel investor, founder of 415 LLC as well as a founding partner of tech-focused VC firm Prefix Capital, and has invested in a number of startups to date. His disclosed investments include participation in the March 2017 $800,000 seed round of Irish water regulatory platform SwiftComply and the November 2015 undisclosed funding round of US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. No pic on SM

Owen van Natta was formerly COO of Facebook and CEO of MySpace, and also previously held senior positions in Amazon and Zynga. He is an angel investor, founder of 415 LLC as well as a founding partner of tech-focused VC firm Prefix Capital, and has invested in a number of startups to date. His disclosed investments include participation in the March 2017 $800,000 seed round of Irish water regulatory platform SwiftComply and the November 2015 undisclosed funding round of US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. No pic on SM

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

Already helping over 1,000 corporates like Alibaba and JD.com manage and lower their carbon emissions, Carbonstop is ready to do more when China’s carbon trading starts next year

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Demand Side Instruments: Using small data to solve big problems

Following a €3.6m Series A round, the French startup is growing its workforce to commercialize its precision irrigation technology in new markets in Europe and North America

Auara: Social enterprise and environmental sustainability in a bottle

Auara, with its 100% recycled-plastic mineral water bottles, aims to reduce its manufacturing carbon footprint while helping the most water-stressed citizens

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

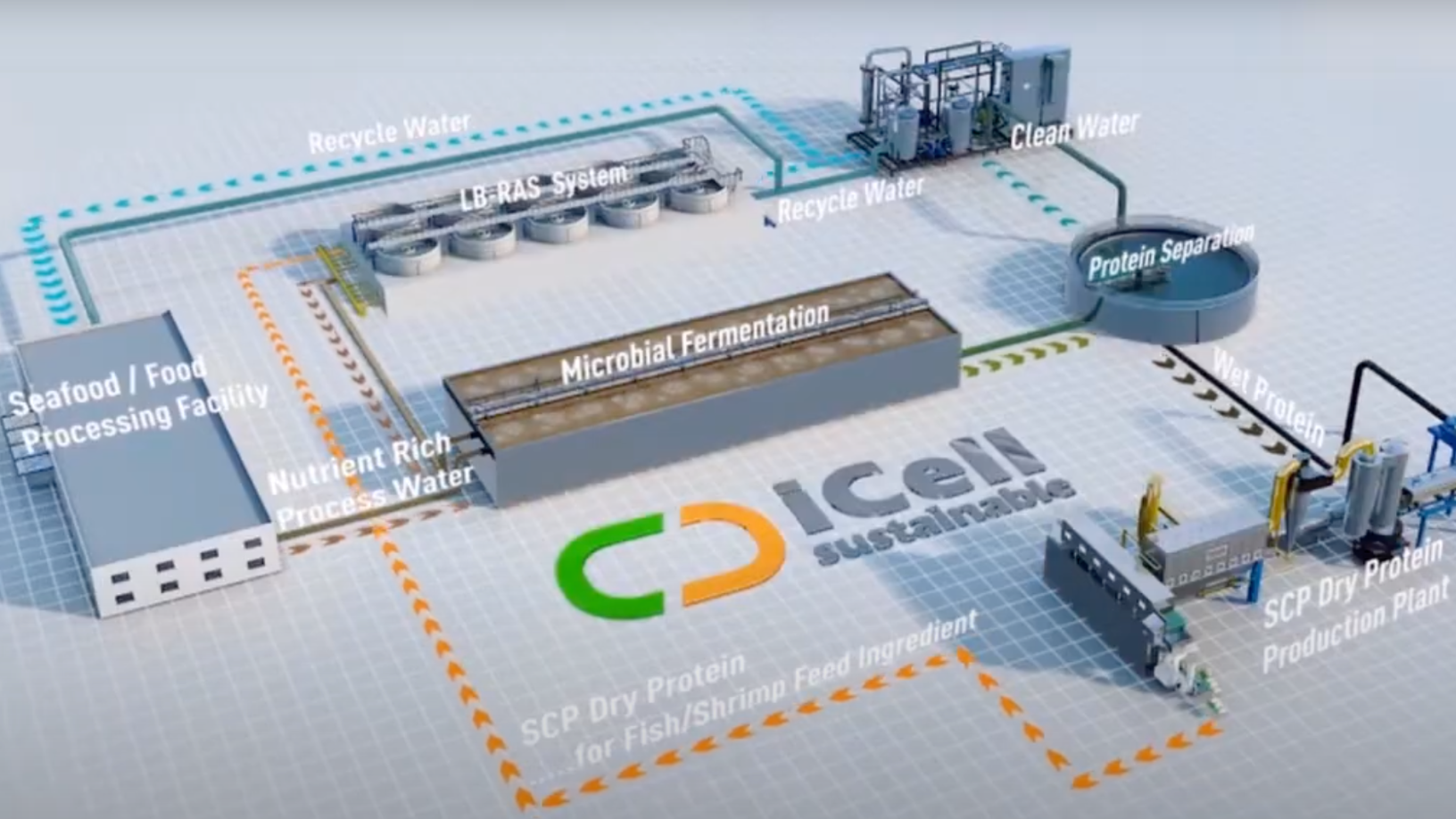

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon

AddVolt: Taking the diesel out of cold-chain transport to make it cleaner, more efficient

The Porto-based startup is winning over the refrigerated goods transportation industry in Europe with the world's first renewable energy plug-in electrical system for the sector

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

Indonesian startup Traval goes virtual to stay afloat during pandemic

The startup is also trying to set itself apart from mainstream tourism with tours like Zero Waste Journey where travelers do not bring plastic items and even plant trees

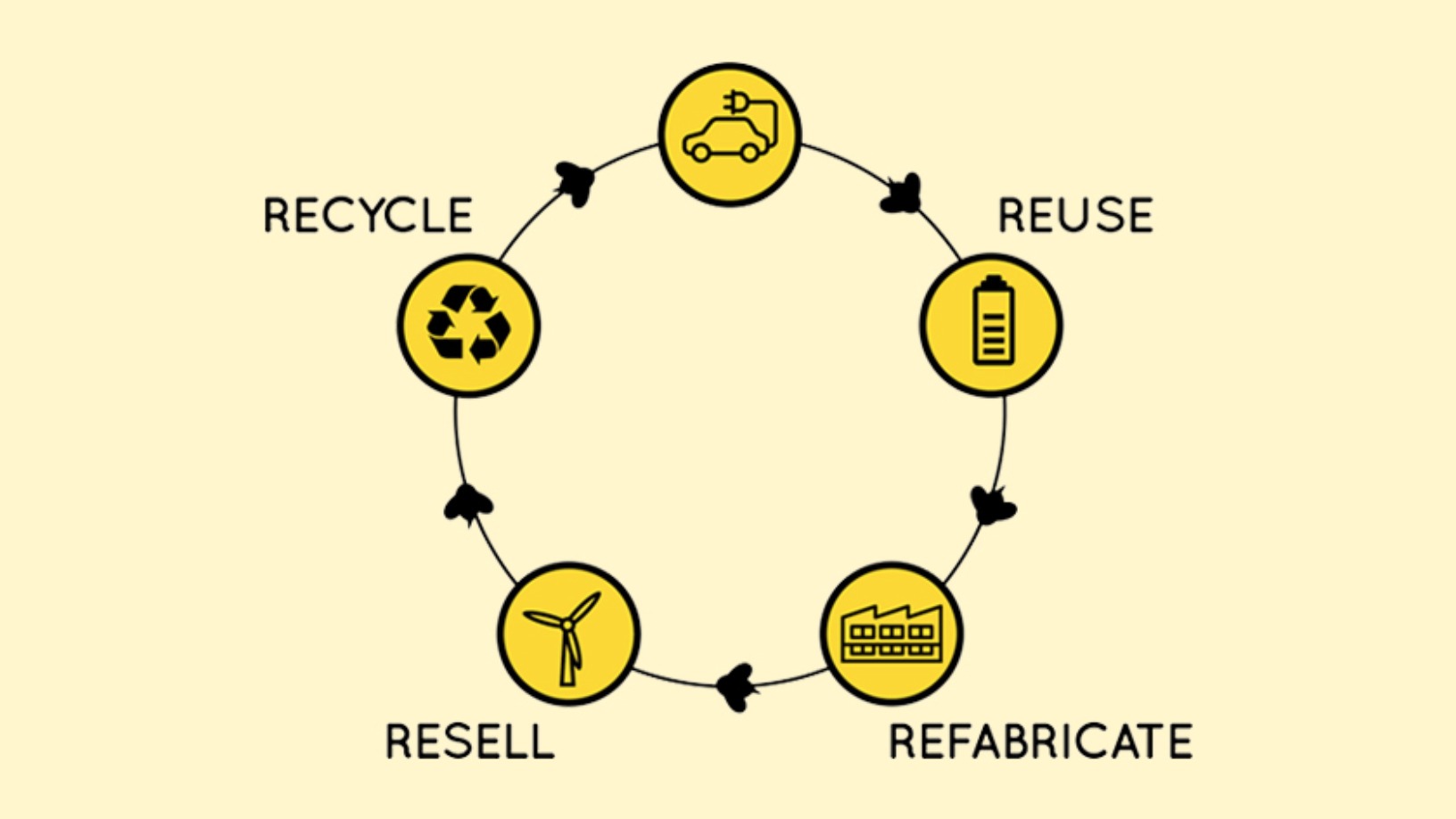

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Mi Terro turns milk waste into eco-friendly clothing and packaging

With food giants like Danone, Arla and Dole as partners, US-Sino startup Mi Terro plans to extend its technology to plant-based food waste like soy to get plastic and fiber alternatives

Sorry, we couldn’t find any matches for“carbon footprint”.