climate change

-

DATABASE (35)

-

ARTICLES (270)

Climate-KIC is an initiative supported by the European Institute of Innovation and Technology (EIT), whose focus is to create and support a community of entrepreneurs and mentors that jointly develop and produce innovative ideas facilitating the transition to a zero-carbon economy. Climate-KIC has launched various initiatives and acceleration programs across Europe targeted at growing startups that are tackling climate change, providing them with structure, assistance, mentoring and seed funding to develop low-carbon products and services.

Climate-KIC is an initiative supported by the European Institute of Innovation and Technology (EIT), whose focus is to create and support a community of entrepreneurs and mentors that jointly develop and produce innovative ideas facilitating the transition to a zero-carbon economy. Climate-KIC has launched various initiatives and acceleration programs across Europe targeted at growing startups that are tackling climate change, providing them with structure, assistance, mentoring and seed funding to develop low-carbon products and services.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

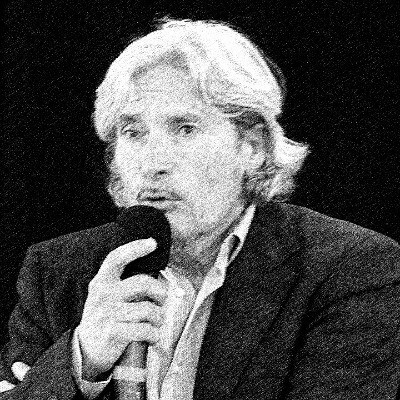

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Zurich-based Übermorgen Ventures was founded in 2019 to invest in climate-change startups that focus on reducing greenhouse gas emissions. The VC has invested in five startups including recent participation in the €500,000 seed investment of German low-cost solar provider Sunvigo in January 2021 and the $6.2m seed round of Finnish biocarbon startup Carbo Culture in April.

Zurich-based Übermorgen Ventures was founded in 2019 to invest in climate-change startups that focus on reducing greenhouse gas emissions. The VC has invested in five startups including recent participation in the €500,000 seed investment of German low-cost solar provider Sunvigo in January 2021 and the $6.2m seed round of Finnish biocarbon startup Carbo Culture in April.

CEO and Founder of Carbonstop

Yan graduated from Oxford University in 2009 with an MSc in Computer Science. Before that, he had worked at the IT company YTEC as a software engineer and project manager from 2006–2008. After graduation, he joined Best Foot Forward, one of the earliest global carbon footprint consulting companies as a senior software engineer, and worked there until March 2011 when he left to found Carbonstop.He is an expert reviewer of the UN IPCC Fifth Assessment Report (AR5) and a member of the Carbon Disclosure Project Technical Experts. He used to be a member of the China Youth Delegate for UNFCCC 2012 Doha Climate Change Conference.

Yan graduated from Oxford University in 2009 with an MSc in Computer Science. Before that, he had worked at the IT company YTEC as a software engineer and project manager from 2006–2008. After graduation, he joined Best Foot Forward, one of the earliest global carbon footprint consulting companies as a senior software engineer, and worked there until March 2011 when he left to found Carbonstop.He is an expert reviewer of the UN IPCC Fifth Assessment Report (AR5) and a member of the Carbon Disclosure Project Technical Experts. He used to be a member of the China Youth Delegate for UNFCCC 2012 Doha Climate Change Conference.

CTO and co-founder of Everimpact

Alain Retière is CTO and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more accurate carbon emissions data to public bodies, municipalities, and businesses.Retière has rich experience in sustainable development, climate change, as well as satellite technology. He was previously an agro-economist and senior scientific advisor at sustainable development organizations, public bodies, and international organisations, with three decades of field experience across 120 countries. In the course of his career, Retière spent a total of 13 years as director of two satellite-related agencies under the UN. This included three years managing CLIMSAT, a specialized center under the UNDP helping local government bodies assess the impact of climate change by using satellite and geo-spatial data, as well as 10 years at the helm of UNOSAT, the UN emergency satellite service. For his service at UNOSAT, he received the UN21 Award from UN Secretary-General Kofi Annan in 2005.Retière graduated from Groupe Ecole supérieure d'Agriculture d'Angers and holds a postgraduate degree from Université Pierre et Marie Curie, which is now part of Sorbonne University.

Alain Retière is CTO and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more accurate carbon emissions data to public bodies, municipalities, and businesses.Retière has rich experience in sustainable development, climate change, as well as satellite technology. He was previously an agro-economist and senior scientific advisor at sustainable development organizations, public bodies, and international organisations, with three decades of field experience across 120 countries. In the course of his career, Retière spent a total of 13 years as director of two satellite-related agencies under the UN. This included three years managing CLIMSAT, a specialized center under the UNDP helping local government bodies assess the impact of climate change by using satellite and geo-spatial data, as well as 10 years at the helm of UNOSAT, the UN emergency satellite service. For his service at UNOSAT, he received the UN21 Award from UN Secretary-General Kofi Annan in 2005.Retière graduated from Groupe Ecole supérieure d'Agriculture d'Angers and holds a postgraduate degree from Université Pierre et Marie Curie, which is now part of Sorbonne University.

The Boston-based Grantham Environmental Trust is part of the Grantham Foundation for the Protection of the Environment. The philanthropic organization was founded in 1997 by entrepreneurs Jeremy Grantham and his wife Hannelore as a private foundation controlled by family members. Grantham is chairman and co-founder of investment management firm GMO. The charitable trust has independent trustees like the CEOs of World Wildlife Fund US and the Rocky Mountain Institute. The trust’s Neglected Climate Opportunities LLC invests in little-funded yet promising climate change prevention technologies. Recent investments include the $12m Series A round of Vence, a US-based producer of a virtual fencing wearable for livestock management in May 2021 and the January 2021 investment round of US sustainable electrofuels producer Infinium.

The Boston-based Grantham Environmental Trust is part of the Grantham Foundation for the Protection of the Environment. The philanthropic organization was founded in 1997 by entrepreneurs Jeremy Grantham and his wife Hannelore as a private foundation controlled by family members. Grantham is chairman and co-founder of investment management firm GMO. The charitable trust has independent trustees like the CEOs of World Wildlife Fund US and the Rocky Mountain Institute. The trust’s Neglected Climate Opportunities LLC invests in little-funded yet promising climate change prevention technologies. Recent investments include the $12m Series A round of Vence, a US-based producer of a virtual fencing wearable for livestock management in May 2021 and the January 2021 investment round of US sustainable electrofuels producer Infinium.

CEO of Krakakoa

Sabrina Mustopo is the founder and CEO of Krakakoa Chocolate, a "farmer-to-bar" social enterprise that works directly with smallholder cocoa farmers to produce chocolate. She is also an independent consultant with experience in strategy, project management, agriculture and sustainable development. Mustopo previously worked in Singapore as an associate and research analyst for international consultancy McKinsey & Co., where she focused on climate change and agricultural topics and served public sector clients in the Asia-Pacific region and East Africa. She graduated magna cum laude from Cornell University in Ithaca, New York, with a Bachelor of Science degree in International Agriculture and Rural Development.

Sabrina Mustopo is the founder and CEO of Krakakoa Chocolate, a "farmer-to-bar" social enterprise that works directly with smallholder cocoa farmers to produce chocolate. She is also an independent consultant with experience in strategy, project management, agriculture and sustainable development. Mustopo previously worked in Singapore as an associate and research analyst for international consultancy McKinsey & Co., where she focused on climate change and agricultural topics and served public sector clients in the Asia-Pacific region and East Africa. She graduated magna cum laude from Cornell University in Ithaca, New York, with a Bachelor of Science degree in International Agriculture and Rural Development.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Co-founder and COO of PeekMed

“I want to change the world!” says Sara Silva in her LinkedIn profile. She might just do that, as co-founder of PeekMed, a 3D imaging software that is potentially revolutionizing orthopedic surgery. Silva holds a master’s in Biomedical/Medical Engineering from the University of Minho.

“I want to change the world!” says Sara Silva in her LinkedIn profile. She might just do that, as co-founder of PeekMed, a 3D imaging software that is potentially revolutionizing orthopedic surgery. Silva holds a master’s in Biomedical/Medical Engineering from the University of Minho.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

Using big data and predictive risk analysis, Pula is helping 4.4m farmers to boost yields, get insurance to protect their livelihoods against environmental hazards.

Using big data and predictive risk analysis, Pula is helping 4.4m farmers to boost yields, get insurance to protect their livelihoods against environmental hazards.

Oper Indonesia: On-demand drivers give car owners a break from endless traffic jams

Oper offers on-demand chauffeurs and car valets for stressed-out drivers and busy vehicle-owners

Shiyin Tech's self-service 3D food printers let you create your own desserts

Anyone with a smartphone can use one of 200 Shiyin Tech 3D printers to produce a chocolate dessert in under five minutes

Cristina Fonseca: On a one-woman mission to make Portugal more innovative

The co-founder of Portugal's third unicorn, Talkdesk, is now an influential investor and AI authority

Alex Deans, youth creator of wearable tech for the blind, discusses the inventing process

He started with just CA$100 worth of GPS shields and wires at aged 12. Now the 20-year-old student is readying to take his iAid navigation device for the visually impaired to market

Indonesian online basic food startups like Sayurbox and Wahyoo have had as much as a fivefold jump in orders and are working to sustain strong sales post-social distancing

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

SWITCH Singapore: Xpeng expects strong China EV growth after 3Q rebound, launches overseas expansion

Welcoming foreign player entry as potential boost to EV adoption, Xpeng President Brian Gu also notes attractiveness of overseas markets, especially Europe

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

GOI Travel: From collaborative economy to professional transporter

Optimizing last-mile delivery to guarantee the cheapest service

Pony.ai repurposes its robotaxi fleet for last-mile delivery amid the Covid-19 pandemic

Pony.ai is seeking more ways to commercialize its versatile autonomous driving technology, transforming mobility and logistics

Marta Esteve: Talent, intuition and resolve – a winning formula for entrepreneurship

She founded her first two internet startups during the dot-com era. Today, Marta Esteve is considered one of the most influential and successful women entrepreneurs in the Spanish startup ecosystem

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

Nuuk, the cooler box poised to disrupt cold chain logistics

Barcelona-based startup Groenlandia Tech has developed a smart cooler box to track and monitor biological samples, providing an extra layer of security and control during transport

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Sorry, we couldn’t find any matches for“climate change”.