social media

-

DATABASE (411)

-

ARTICLES (385)

CEO and co-founder of FROGS

After starting his career in Indonesian automotive conglomerate Astra, businessman Kiwi Aliwarga left the country in 1998 to establish United Machinery in Myanmar with business partner Daw Marlar Win. The United Machinery Group (UMG) is now one of Myanmar's biggest conglomerates. Its original core business, ranging from distribution of generators and other heavy machinery, has been transformed and expanded to include media, leisure and F&B.The venture capital arm UMG Idealab seeks and supports innovative business ideas from the region to bring back to Myanmar. Through UMG Idealab, Aliwarga is exploring various new technologies including passenger-carrying drone taxis. He recently co-founded FROGS in Indonesia with former aircraft engineer Asro Nasiri.

After starting his career in Indonesian automotive conglomerate Astra, businessman Kiwi Aliwarga left the country in 1998 to establish United Machinery in Myanmar with business partner Daw Marlar Win. The United Machinery Group (UMG) is now one of Myanmar's biggest conglomerates. Its original core business, ranging from distribution of generators and other heavy machinery, has been transformed and expanded to include media, leisure and F&B.The venture capital arm UMG Idealab seeks and supports innovative business ideas from the region to bring back to Myanmar. Through UMG Idealab, Aliwarga is exploring various new technologies including passenger-carrying drone taxis. He recently co-founded FROGS in Indonesia with former aircraft engineer Asro Nasiri.

The owner of WeChat, Tencent is China's biggest online entertainment and social network company. While the company is best known for QQ and WeChat (with 846m active users, and counting), online gaming is actually its biggest money-spinner. Within China, Tencent is the distributor of various international online game titles, such as League of Legends and Call of Duty Online. The company also publishes Honor of Kings, known as Arena of Valor outside China, which regularly tops the list of highest-grossing mobile games globally.Tencent has invested in various gaming-related companies, including Epic Games (creator of Fortnite and the Unreal Engine creation framework), PlatinumGames (Japanese game developer), and Riot Games (creator of League of Legends). Outside of video games, it has developed and invested in products related to video streaming, such as bilibili and Kuaishou, music (JOOX), and even healthcare.

The owner of WeChat, Tencent is China's biggest online entertainment and social network company. While the company is best known for QQ and WeChat (with 846m active users, and counting), online gaming is actually its biggest money-spinner. Within China, Tencent is the distributor of various international online game titles, such as League of Legends and Call of Duty Online. The company also publishes Honor of Kings, known as Arena of Valor outside China, which regularly tops the list of highest-grossing mobile games globally.Tencent has invested in various gaming-related companies, including Epic Games (creator of Fortnite and the Unreal Engine creation framework), PlatinumGames (Japanese game developer), and Riot Games (creator of League of Legends). Outside of video games, it has developed and invested in products related to video streaming, such as bilibili and Kuaishou, music (JOOX), and even healthcare.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Passion Capital is an early stage venture capital firm that has been involved in several large European technology exits, such as QXL/Tradus, Ricardo.de and Last.fm. The partners include Robert Dighero, Eileen Burbidge and Stefan Glaenzer who believe that the passion and ability of the founders are critical keys to success. Passion Capital has a hub for activities in White Bear Yard in London and invests in digital media and technology companies.

Passion Capital is an early stage venture capital firm that has been involved in several large European technology exits, such as QXL/Tradus, Ricardo.de and Last.fm. The partners include Robert Dighero, Eileen Burbidge and Stefan Glaenzer who believe that the passion and ability of the founders are critical keys to success. Passion Capital has a hub for activities in White Bear Yard in London and invests in digital media and technology companies.

Bojiang Capital was founded in Shanghai in September 2005. The investment management group has branches in Hong Kong, Beijing, Zhejiang and Shenzhen. It also has offices in Silicon Valley and Los Angeles in the US.Bojiang mainly invests in the primary equity market and focuses on high-tech young companies in the technology, media and telecoms (TMT) industry, big data, artificial intelligence, corporate services, fintech, new materials and culture.

Bojiang Capital was founded in Shanghai in September 2005. The investment management group has branches in Hong Kong, Beijing, Zhejiang and Shenzhen. It also has offices in Silicon Valley and Los Angeles in the US.Bojiang mainly invests in the primary equity market and focuses on high-tech young companies in the technology, media and telecoms (TMT) industry, big data, artificial intelligence, corporate services, fintech, new materials and culture.

Founded in 2005, Fortune Link focuses on private equity investment. Its founder, Kan Zhidong was also the founder of Shenzhen Capital Group, one of the first few venture capitalists in China. As at March 2018, it had set up a number of funds and managed over 20 investment teams.With over RMB 30bn worth of assets under its management, Fortune Link mainly invests in sectors including TMT, environmental protection, advanced material, healthcare, high tech industries, culture and media.

Founded in 2005, Fortune Link focuses on private equity investment. Its founder, Kan Zhidong was also the founder of Shenzhen Capital Group, one of the first few venture capitalists in China. As at March 2018, it had set up a number of funds and managed over 20 investment teams.With over RMB 30bn worth of assets under its management, Fortune Link mainly invests in sectors including TMT, environmental protection, advanced material, healthcare, high tech industries, culture and media.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Furnished workplaces providing flexibility for post-Covid hybrid working arrangements, purpose-designed for early-stage startups requiring short-term rental and investment-free commitments.

Furnished workplaces providing flexibility for post-Covid hybrid working arrangements, purpose-designed for early-stage startups requiring short-term rental and investment-free commitments.

Being the first investment group in Zhejiang province to list on the NEEQ market, ZSVC has over 30 funds under its management today, amounting to nearly RMB 40 billion. Founded in 2007, it is the major investor for more than 130 Chinese startups across healthcare, media & entertainment, logistic and advanced manufacturing sectors, with more than 30 successful exits. Headquartered in Hangzhou, it has taken its widely acclaimed “Zhejiang Entrepreneur Experience” to a broader world with subsidiaries in Beijing, Shanghai, Shenzhen, Shenyang and the Silicon Valley.

Being the first investment group in Zhejiang province to list on the NEEQ market, ZSVC has over 30 funds under its management today, amounting to nearly RMB 40 billion. Founded in 2007, it is the major investor for more than 130 Chinese startups across healthcare, media & entertainment, logistic and advanced manufacturing sectors, with more than 30 successful exits. Headquartered in Hangzhou, it has taken its widely acclaimed “Zhejiang Entrepreneur Experience” to a broader world with subsidiaries in Beijing, Shanghai, Shenzhen, Shenyang and the Silicon Valley.

B4Motion is a Spanish venture capital fund led by Sebastian Canadell and supported by a board of advisors who have varied expertise in visual media production, mobile strategy, product design and law. B4Motion is focused on mobility-related technologies, including autonomous driving systems, Internet-of-Things (IoT) applications for transport as well as on-demand logistics, car sharing, parking and valet services. B4Motion invests across all funding stages from seed through Series D and IPO in the Spanish and Latin American markets.

B4Motion is a Spanish venture capital fund led by Sebastian Canadell and supported by a board of advisors who have varied expertise in visual media production, mobile strategy, product design and law. B4Motion is focused on mobility-related technologies, including autonomous driving systems, Internet-of-Things (IoT) applications for transport as well as on-demand logistics, car sharing, parking and valet services. B4Motion invests across all funding stages from seed through Series D and IPO in the Spanish and Latin American markets.

Genesia Ventures is a Japanese VC firm founded and led by former CyberAgent Ventures executive Soichi Tajima. The company's name is a portmanteau word combining "genesis" and "Asia" and the fund focuses on seed and pre-Series A rounds. It has backed startups in new media and those implementing new technology to traditional sectors. Its portfolio includes Japanese companies Sukedachi and Linc Corporation as well as Southeast Asian startups Homedy and Bobobox.

Genesia Ventures is a Japanese VC firm founded and led by former CyberAgent Ventures executive Soichi Tajima. The company's name is a portmanteau word combining "genesis" and "Asia" and the fund focuses on seed and pre-Series A rounds. It has backed startups in new media and those implementing new technology to traditional sectors. Its portfolio includes Japanese companies Sukedachi and Linc Corporation as well as Southeast Asian startups Homedy and Bobobox.

Founded in 1993, WI Harper Group is a venture capital firm investing in early to growth stage companies across the US, Greater China and Asia Pacific. The group has invested in more than 400 companies in the fields of healthcare, biotech, artificial intelligence, robotics, fintech, sustainability and new media. It manages seven venture capital funds with over 100 successful IPO and M&A exits. With three strategic offices in San Francisco, Beijing and Taipei, the group seeks investment opportunities both in the US and Asia.

Founded in 1993, WI Harper Group is a venture capital firm investing in early to growth stage companies across the US, Greater China and Asia Pacific. The group has invested in more than 400 companies in the fields of healthcare, biotech, artificial intelligence, robotics, fintech, sustainability and new media. It manages seven venture capital funds with over 100 successful IPO and M&A exits. With three strategic offices in San Francisco, Beijing and Taipei, the group seeks investment opportunities both in the US and Asia.

Big Sur Ventures is a Spanish VC based in Madrid. It was co-founded by Jose Miguel Herrero and Manuel Matés both with extensive international experience in leading technology products and services companies and M&A. The fund invests in companies focused on SaaS, online marketplace and platforms, IT and digital media. Investments range from seed to later growth stage. The VC usually represents the first institutional capital in a company, leading or co-leading the round with capital injection of between €100,000 and €400.000 per round.

Big Sur Ventures is a Spanish VC based in Madrid. It was co-founded by Jose Miguel Herrero and Manuel Matés both with extensive international experience in leading technology products and services companies and M&A. The fund invests in companies focused on SaaS, online marketplace and platforms, IT and digital media. Investments range from seed to later growth stage. The VC usually represents the first institutional capital in a company, leading or co-leading the round with capital injection of between €100,000 and €400.000 per round.

Founded in October 2013, JD Finance was renamed as JD Digits in November 2018. The fintech arm of Chinese e-commerce giant JD.com focuses on applying digital technology, artificial intelligence and IoT in five sectors: finance, smart cities, agriculture, campus development and marketing.The company manages five sub-brands: JD Finance, JD iCity, JD Agriculture, JD Shaodongjia, and JD MO Media. In September 2017, a joint venture was established with Central Group, one of Thailand’s biggest retailers. In December 2017, JD Digits also started operating an AI lab in Silicon Valley.

Founded in October 2013, JD Finance was renamed as JD Digits in November 2018. The fintech arm of Chinese e-commerce giant JD.com focuses on applying digital technology, artificial intelligence and IoT in five sectors: finance, smart cities, agriculture, campus development and marketing.The company manages five sub-brands: JD Finance, JD iCity, JD Agriculture, JD Shaodongjia, and JD MO Media. In September 2017, a joint venture was established with Central Group, one of Thailand’s biggest retailers. In December 2017, JD Digits also started operating an AI lab in Silicon Valley.

Next-generation social media app YouClap targets engagement over reach

Already valued at €5m one year after launching, the YouClap platform for online challenges will seek Series A investment before the end of 2019

Waterdrop: Using crowdfunding and social media to disrupt health insurance

Insurtech startup Waterdrop helps families in China who cannot afford medical treatment to raise money via online mutual aid and crowdfunding, while selling insurance plans too

This app lets you show off your cat on social media

Is Meowcard the next big thing or a flash in the pan?

Narasi TV: Creating a better media experience for Indonesia

Spearheaded by a popular talkshow host, this new media startup seeks to cultivate a more positive online media environment

SFTC: Riding on the rise of independent music and alternative media

From recording music sessions for its YouTube channel, Sounds From The Corner has expanded into content production, reflecting Indonesia’s fast-evolving media landscape

Tutellus.io: Creating social change by tokenizing education

Tutellus.io has built an incentive-based tokenized education system to boost students’ motivation and teachers’ commitment while facilitating global access to education

Get.AI: Using artificial intelligence to help humans write more efficiently

Writing productivity tool Get.AI automates mundane tasks, such as tracking the latest trending topics and speeding up research, improving writers' efficiency by as much as 70%

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

How influential is your influencer? This startup has the metrics to turn buzz into gold

Influencity is a new way for companies and brands to win in social media marketing

Koiki: Delivering social advancement, one parcel at a time

Social enterprise startup Koiki seeks to reduce the carbon footprint of e-commerce deliveries and provide jobs for Spain's most vulnerable people

Auara: Social enterprise and environmental sustainability in a bottle

Auara, with its 100% recycled-plastic mineral water bottles, aims to reduce its manufacturing carbon footprint while helping the most water-stressed citizens

Jakarta Aman uses social networking to improve neighborhood security

Backed by Jakarta's provincial government and MDI Ventures, neighborhood security app Jakarta Aman seeks to reignite the “gotong royong” spirit to keep communities safe

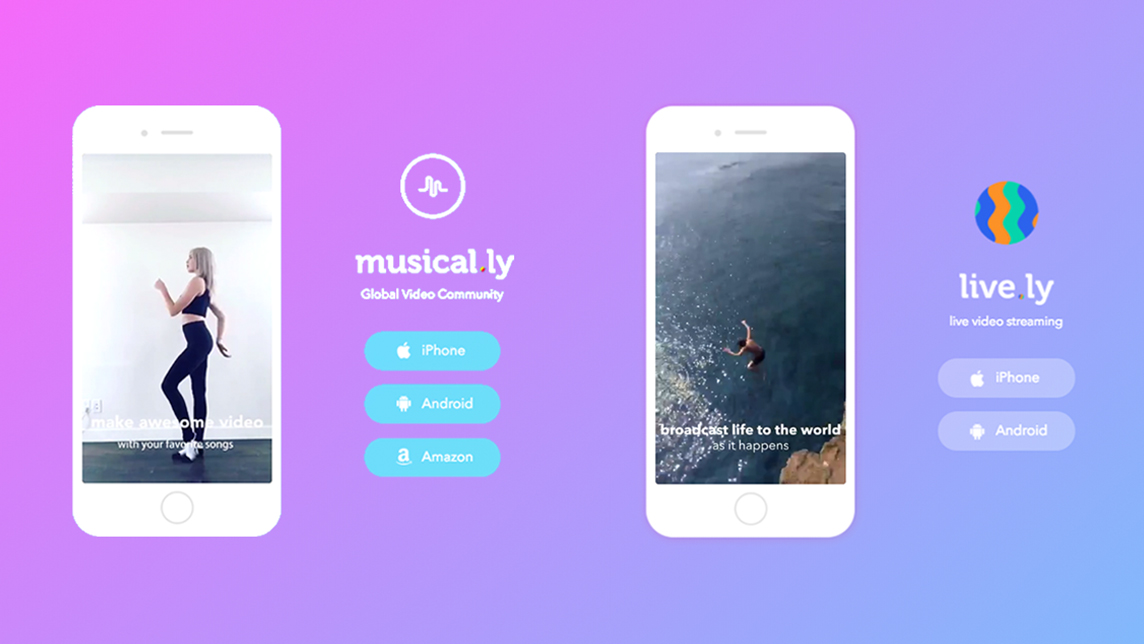

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Zen Video: Using AI to automate video editing

Founded by a Carnegie Mellon roboticist, the Zen Video app reduces the time required to edit video clips to only a few minutes, meeting growing demand for short videos

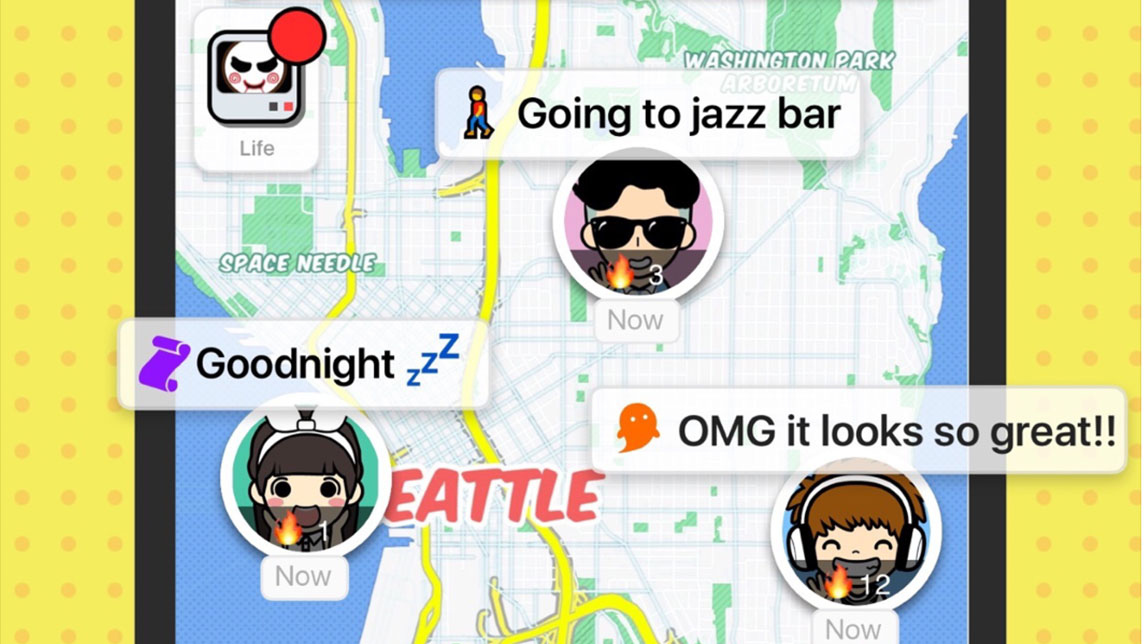

"Spot" your friends, live chat and share music with this social mapping app

Spot, a new challenger to China's WeChat, is using pop-up song lyrics to entice youths to live chat and play games

Sorry, we couldn’t find any matches for“social media”.