sustainable development goals

-

DATABASE (447)

-

ARTICLES (486)

GU Ventures is the Swedish venture capital agency of University of Gothenburg. The VC also runs incubator programs to support tech and science-related projects within the university and its alumni network.Founded in 1995, GU has backed more than 150 companies and projects, including 30 exits and 11 filed IPOs. According to the firm, 87% of its portfolio companies are contributing to the sustainable development goals set by the UN.

GU Ventures is the Swedish venture capital agency of University of Gothenburg. The VC also runs incubator programs to support tech and science-related projects within the university and its alumni network.Founded in 1995, GU has backed more than 150 companies and projects, including 30 exits and 11 filed IPOs. According to the firm, 87% of its portfolio companies are contributing to the sustainable development goals set by the UN.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

LGT Venture Philanthropy is an independent charitable foundation that supports organizations and companies which implement solutions that contribute to the achievement of sustainable development goals. It strives to improve the quality of life of disadvantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. LGT supports the growth of innovative social organizations by providing them with a tailored combination of growth capital, access to business skills, management know-how and strategic advice.

LGT Venture Philanthropy is an independent charitable foundation that supports organizations and companies which implement solutions that contribute to the achievement of sustainable development goals. It strives to improve the quality of life of disadvantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. LGT supports the growth of innovative social organizations by providing them with a tailored combination of growth capital, access to business skills, management know-how and strategic advice.

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

H&M Foundation is a non-profit foundation established in 2013. It is privately funded by the Stefan Persson family, the founders and major shareholders of the H&M Group, who have donated SEK 1.5 billion to it to date. The foundation aims to help accelerate progress towards the UN Sustainable Development Goals 2030, by developing, funding and sharing solutions to address the world’s most urgent issues. It has a particular focus on promoting a planet-positive fashion industry and on building inclusive societies.Tackling mostly challenges associated with the fast fashion industry and its supply chain, H&M Foundation advocates for more sustainable practices across the fashion value chain and more inclusive business practices. The foundation is also actively involved in providing emergency relief for natural disasters or pandemics. It also aims to encourage innovation that promotes social change and sustainability. To this end, it provides startups support in accelerating and scale new technologies. It also runs the Global Change Award. Dubbed the Nobel Prize of fashion, this aims to recognise disruptive innovations that have the potential to make fashion more sustainable, and transform the way garments are designed, produced, shipped, bought, used and recycled.

H&M Foundation is a non-profit foundation established in 2013. It is privately funded by the Stefan Persson family, the founders and major shareholders of the H&M Group, who have donated SEK 1.5 billion to it to date. The foundation aims to help accelerate progress towards the UN Sustainable Development Goals 2030, by developing, funding and sharing solutions to address the world’s most urgent issues. It has a particular focus on promoting a planet-positive fashion industry and on building inclusive societies.Tackling mostly challenges associated with the fast fashion industry and its supply chain, H&M Foundation advocates for more sustainable practices across the fashion value chain and more inclusive business practices. The foundation is also actively involved in providing emergency relief for natural disasters or pandemics. It also aims to encourage innovation that promotes social change and sustainability. To this end, it provides startups support in accelerating and scale new technologies. It also runs the Global Change Award. Dubbed the Nobel Prize of fashion, this aims to recognise disruptive innovations that have the potential to make fashion more sustainable, and transform the way garments are designed, produced, shipped, bought, used and recycled.

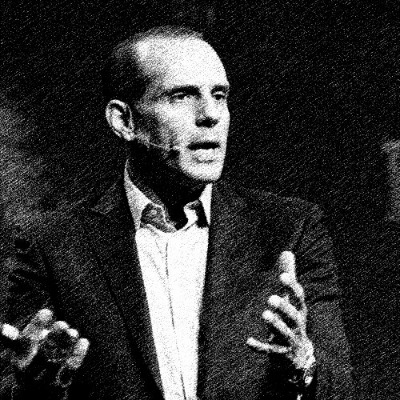

Spanish-born Juan Verde Suárez is an internationally-renowned strategist for both the public and private sectors, focusing on sustainable economic development. Based in the US, he was the Deputy Assistant Secretary for Europe and Eurasia at the US Department of Commerce during the Obama presidency. He was also the campaign fundraising manager during the 2020 US elections for President Joe Biden.As an angel investor, Verde’s only disclosed investment is his participation in the €10m Series A funding round of Scoobic Urban Mobility in 2021. Besides joining as a board director of the Spanish e-scooter startup, Verde is also head of the Madrid-based Álamo Solutions, a sustainable business development consulting firm.

Spanish-born Juan Verde Suárez is an internationally-renowned strategist for both the public and private sectors, focusing on sustainable economic development. Based in the US, he was the Deputy Assistant Secretary for Europe and Eurasia at the US Department of Commerce during the Obama presidency. He was also the campaign fundraising manager during the 2020 US elections for President Joe Biden.As an angel investor, Verde’s only disclosed investment is his participation in the €10m Series A funding round of Scoobic Urban Mobility in 2021. Besides joining as a board director of the Spanish e-scooter startup, Verde is also head of the Madrid-based Álamo Solutions, a sustainable business development consulting firm.

Beijing Zhongguancun Development Qihang Industrial Investment Fund

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Beijing Weijing Culture Development Co., Ltd.

Beijing Weijing Culture Development Co., Ltd., was founded on November 13, 2014.

Beijing Weijing Culture Development Co., Ltd., was founded on November 13, 2014.

Greater Bay Area Homeland Development Fund

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

NewMargin Ventures is a venture capital management firm in China focused on the IT, sustainable growth technology, biomedicine and high margin manufacturing sectors. Its Chinese investors include China Foundation of Science & Technology for Development (a joint venture between the National Development and Reform Commission, the Ministry of Commerce and Chinese Academy of Sciences) and Shanghai Alliance Investment Co. (an investment firm founded by Jiang Mianheng, son of the former Chinese President Jiang Zemin); and its foreign investors include GIC, Kerry Group, K.Wah Group, SUNeVision, JAFCO, Motorola and Alcatel. NewMargin Ventures has invested more than US$1.7 billion in 160 companies, including 40 IPOs.

NewMargin Ventures is a venture capital management firm in China focused on the IT, sustainable growth technology, biomedicine and high margin manufacturing sectors. Its Chinese investors include China Foundation of Science & Technology for Development (a joint venture between the National Development and Reform Commission, the Ministry of Commerce and Chinese Academy of Sciences) and Shanghai Alliance Investment Co. (an investment firm founded by Jiang Mianheng, son of the former Chinese President Jiang Zemin); and its foreign investors include GIC, Kerry Group, K.Wah Group, SUNeVision, JAFCO, Motorola and Alcatel. NewMargin Ventures has invested more than US$1.7 billion in 160 companies, including 40 IPOs.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

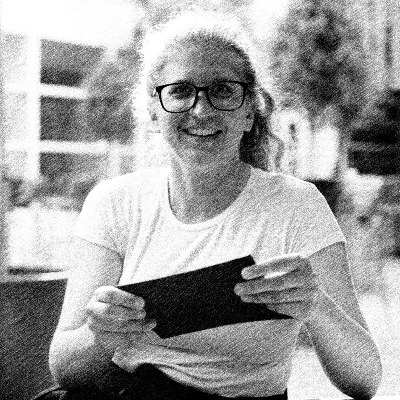

Chief Creative Officer and co-founder of Beyond Leather Materials / Leap

Hannah Michaud first started exploring ways to develop sustainable textiles in 2016 while completing her studies in sustainable fashion at Copenhagen’s KEA School of Design & Technology. She also studied fashion technology and design at the KEA academy from 2012 to 2015.Michaud worked as a fashion design intern at Danish company Barbara I Gongini in 2016 and also at Weekend CPH in 2014. After her graduation in 2017, she decided to continue her research work on sustainable fabrics as co-founder and chief creative officer of Danish alt-leather startup, Beyond Leather Materials ApS, in Copenhagen.Originally from Maine, US, Michaud also studied music as a classical flutist at the University of Maine, where she was first chair in its Symphony Orchestra, and Sustainable Agriculture in the university’s Natural Science and Forestry department.

Hannah Michaud first started exploring ways to develop sustainable textiles in 2016 while completing her studies in sustainable fashion at Copenhagen’s KEA School of Design & Technology. She also studied fashion technology and design at the KEA academy from 2012 to 2015.Michaud worked as a fashion design intern at Danish company Barbara I Gongini in 2016 and also at Weekend CPH in 2014. After her graduation in 2017, she decided to continue her research work on sustainable fabrics as co-founder and chief creative officer of Danish alt-leather startup, Beyond Leather Materials ApS, in Copenhagen.Originally from Maine, US, Michaud also studied music as a classical flutist at the University of Maine, where she was first chair in its Symphony Orchestra, and Sustainable Agriculture in the university’s Natural Science and Forestry department.

Guangzhou Emerging Industry Development Fund

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Worktile sells an easier, more efficient approach to teamwork

Employees no longer have to switch between different apps to complete projects, thanks to this collaborative SaaS for enterprises

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

Logisly challenges the Indonesian on-demand freight sector with managed marketplace

In less than a year of launching, Logisly has facilitated more than a thousand shipments and raised seed funding from three investors

Consumers Trust: The company that gives consumers a voice

Consumers Trust has become Portugal's go-to company for customer complaint resolution; it is seeking funding to enable it to replicate its success in new markets

CloudGuide: Bringing museum tourism into the 21st century

CloudGuide, an app hosting official multimedia content from museums and tourist attractions, seeks post-seed funding to scale in Europe

Event ticketing veterans create Tracer to fight touts, improve market transparency and fairness

Tracer is the first to combine dynamic QR codes and blockchain to challenge ticketing's $12bn secondary sales market

Science4you cancels IPO amid market jitters, foresees slower growth

Portugal's largest toymaker will continue to focus on international markets, digital boost

iOLAND: Farm management technology created for and by farmers

Precision farming startup iOLAND provides farmers recommendations based on data collected by its IoT devices and refined by machine learning

China reverses ban on street vendors to boost economy, sparking new demand for digital solutions

Alibaba, Tencent, Meituan and other tech giants give roadside vendors digital makeover, so they can compete with fast-food chains like McDonald’s, KFC and Pizza Hut

How Aptoide gained 150 million users – without paid promotion

With legions of online businesses competing for a slice of the pie, many resort to shelling out cash to get noticed. Aptoide cuts through the noise with a simple concept: create value, keep it open and people will come to you

Data integration platform Onna accelerates growth with Covid-19 boost

Corporates use up to 80 different apps in their workflows. Slack- and Dropbox-backed Onna is a central platform integrating all that fragmented data, giving companies greater control

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Sorry, we couldn’t find any matches for“sustainable development goals”.