take

-

DATABASE (10)

-

ARTICLES (341)

Founder and CEO of Estay

Former child prodigy armed with chemistry, law, accounting and economics degrees. Shi graduated in Chemistry from Sichuan University at aged 20. He is also a qualified lawyer and accountant, and a doctor of Economics (PhD, Xiamen University). He founded RichWise Capital, investing in many startups that later went public; and 8jee.com, a lifestyle services website that did not take off.

Former child prodigy armed with chemistry, law, accounting and economics degrees. Shi graduated in Chemistry from Sichuan University at aged 20. He is also a qualified lawyer and accountant, and a doctor of Economics (PhD, Xiamen University). He founded RichWise Capital, investing in many startups that later went public; and 8jee.com, a lifestyle services website that did not take off.

Co-founder and ex-CEO of Gojek

Harvard-trained ex-McKinsey consultant Nadiem Makarim holds a Bachelor of Arts degree in International Relations and Affairs from Brown University and an MBA from Harvard Business School. Before launching Gojek, Nadiem worked at McKinsey, Zalora Indonesia and Kartuku. Makarim was born in 1984 in Singapore. In October 2019, Makarim left Gojek to take up the post of Minister of Education and Culture in the Indonesian cabinet of ministers.

Harvard-trained ex-McKinsey consultant Nadiem Makarim holds a Bachelor of Arts degree in International Relations and Affairs from Brown University and an MBA from Harvard Business School. Before launching Gojek, Nadiem worked at McKinsey, Zalora Indonesia and Kartuku. Makarim was born in 1984 in Singapore. In October 2019, Makarim left Gojek to take up the post of Minister of Education and Culture in the Indonesian cabinet of ministers.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

B'Smart to speed up adoption of AI-data technology in traditional sectors like transport and logistics, boosting profitability with IoT for fleet management.

B'Smart to speed up adoption of AI-data technology in traditional sectors like transport and logistics, boosting profitability with IoT for fleet management.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Spain’s Spotahome is the first European proptech to provide high quality digital tours of properties for virtual viewings by potential tenants.

Spain’s Spotahome is the first European proptech to provide high quality digital tours of properties for virtual viewings by potential tenants.

Award-winning social enterprise Kostoom aims to empower local tailors and fashion stakeholders to create a sustainable sharing economy across Indonesia.

Award-winning social enterprise Kostoom aims to empower local tailors and fashion stakeholders to create a sustainable sharing economy across Indonesia.

Roger Federer, the Swiss 20-times Grand Slam tennis champion, has turned into an angel investor while planning his professional life beyond and after his tennis sports career.In 2019, he invested in On, the Swiss running shoe manufacturer for an undisclosed funding amount. Federer currently has no formal role in the company but he’s actively involved in its R&D and product development. “I feel like I can give input on any of the lines, the shoes, anything moving forward. I can give my opinion on anything and On can either take it or leave it. I feel like [with] a major brand like Nike, that's literally impossible. It just wouldn't work,” he has said.More recently, Federer participated in a Series D funding round backing the first Chilean unicorn NotCo, which sells plant-based food and beverage products across Latin America and the US.

Roger Federer, the Swiss 20-times Grand Slam tennis champion, has turned into an angel investor while planning his professional life beyond and after his tennis sports career.In 2019, he invested in On, the Swiss running shoe manufacturer for an undisclosed funding amount. Federer currently has no formal role in the company but he’s actively involved in its R&D and product development. “I feel like I can give input on any of the lines, the shoes, anything moving forward. I can give my opinion on anything and On can either take it or leave it. I feel like [with] a major brand like Nike, that's literally impossible. It just wouldn't work,” he has said.More recently, Federer participated in a Series D funding round backing the first Chilean unicorn NotCo, which sells plant-based food and beverage products across Latin America and the US.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

Modern China Tea Shop: Cool hangout for yuppies in Chairman Mao's Hunan

The tea house in Changsha, the provincial capital of Hunan, is creating a storm in a teacup, serving tea lattes that go viral across China

Geetest provides an easy and fun way to secure websites and apps

This startup’s behavior-based verification process takes less than a second to finish, but that’s all the time it needs to distinguish a human from a robot

CraiditX gives banks and insurers AI tools for assessing consumer credit risk

Used by big lenders like Bank of China and Minsheng Bank, CraiditX's solutions can gauge consumer default risk even if a user has no credit history

Ruangguru cracks business model as it reaches 13 million student users

Holding pole position as Indonesia's popular tutoring services app, Ruangguru is revving up to expand into the lucrative corporate training sector

Marta Esteve: Talent, intuition and resolve – a winning formula for entrepreneurship

She founded her first two internet startups during the dot-com era. Today, Marta Esteve is considered one of the most influential and successful women entrepreneurs in the Spanish startup ecosystem

Francisco Polo: The former entrepreneur heading Spain's Digital Advancement

He's been charged to transform Spain into an entrepreneurial nation, and a technological and innovation frontrunner

Bernardo Hernández: Celebrity investor and Google's former marketing whiz

The angel investor behind some of the most successful Spanish internet startups also has an unusual honor for techies – GQ’s Man of the Year

Covid-19: Indonesia's P2P lenders ready for slower business, default risk

P2P lending startups set up stricter scrutiny, budget reserves; playing key role in helping Indonesian businesses survive the Covid-19 crisis

The edtech startup formerly named Squiline hopes greater fluency in English can boost Indonesia's creative and tourism sectors

CloudYoung: Smart agritech for every process, from farm to table

CloudYoung covers the entire production chain, from cutting costs and pesticide use in its smart greenhouses to connecting farmers with buyers in e-commerce

From real estate to rearing insects for food: Magalarva's way to a sustainable future

The Indonesian agritech startup is already using insects to replace fishmeal and has new funding to grow further

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Zymvol Biomodeling: In the footsteps of Chemistry Nobel Prize winner Frances H. Arnold

Startup founded by scientists helps industries discover and develop enzymes cheaply through computer-driven innovation

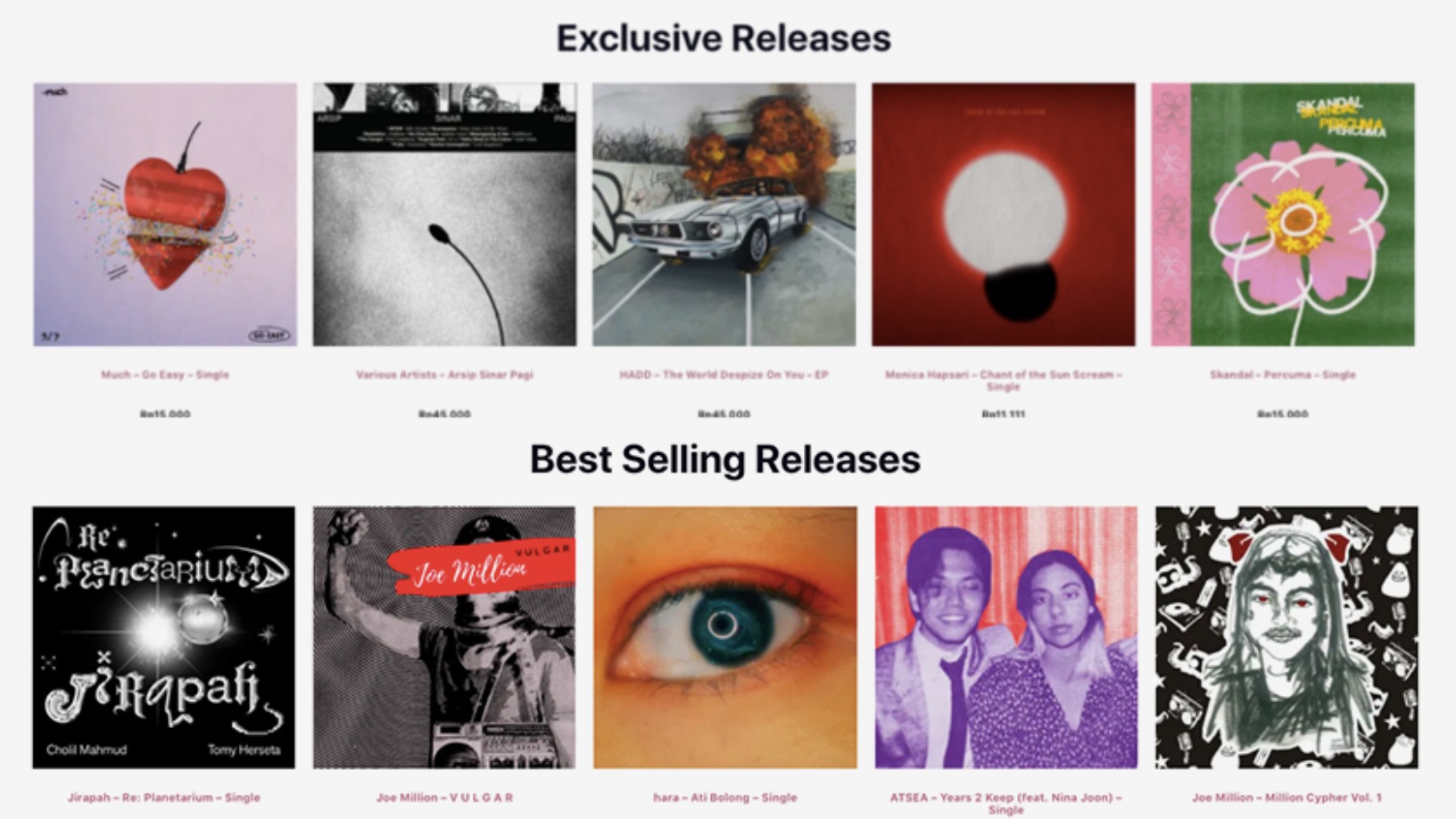

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

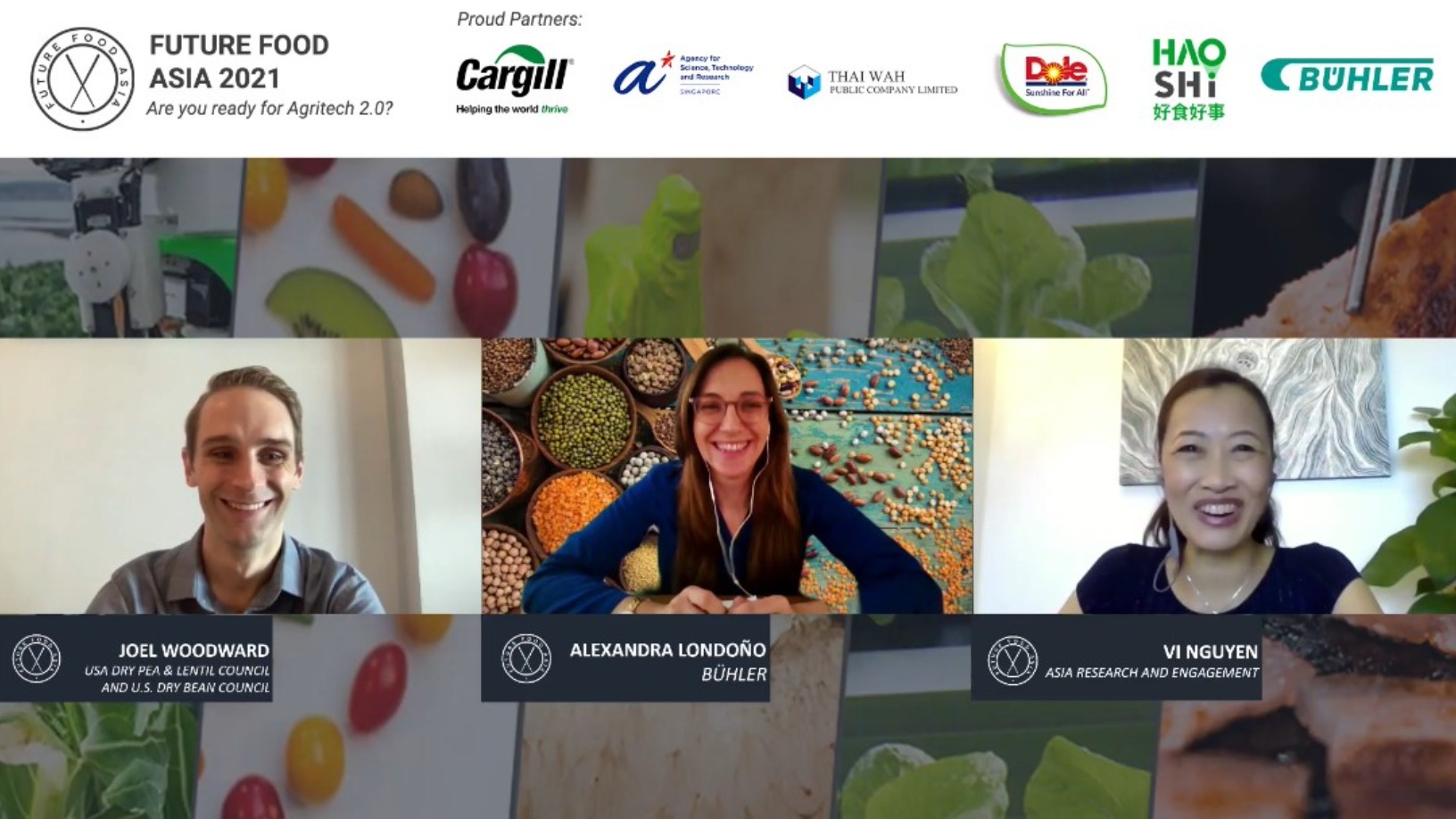

Future Food Asia 2021: Potential of pulses in the alt-protein space

Asia presents a unique opportunity for pulses as people in the region, who traditionally fractionated pulses for starch, now see protein as a useful byproduct

Sorry, we couldn’t find any matches for“take”.