take

-

DATABASE (10)

-

ARTICLES (341)

Founder and CEO of Estay

Former child prodigy armed with chemistry, law, accounting and economics degrees. Shi graduated in Chemistry from Sichuan University at aged 20. He is also a qualified lawyer and accountant, and a doctor of Economics (PhD, Xiamen University). He founded RichWise Capital, investing in many startups that later went public; and 8jee.com, a lifestyle services website that did not take off.

Former child prodigy armed with chemistry, law, accounting and economics degrees. Shi graduated in Chemistry from Sichuan University at aged 20. He is also a qualified lawyer and accountant, and a doctor of Economics (PhD, Xiamen University). He founded RichWise Capital, investing in many startups that later went public; and 8jee.com, a lifestyle services website that did not take off.

Co-founder and ex-CEO of Gojek

Harvard-trained ex-McKinsey consultant Nadiem Makarim holds a Bachelor of Arts degree in International Relations and Affairs from Brown University and an MBA from Harvard Business School. Before launching Gojek, Nadiem worked at McKinsey, Zalora Indonesia and Kartuku. Makarim was born in 1984 in Singapore. In October 2019, Makarim left Gojek to take up the post of Minister of Education and Culture in the Indonesian cabinet of ministers.

Harvard-trained ex-McKinsey consultant Nadiem Makarim holds a Bachelor of Arts degree in International Relations and Affairs from Brown University and an MBA from Harvard Business School. Before launching Gojek, Nadiem worked at McKinsey, Zalora Indonesia and Kartuku. Makarim was born in 1984 in Singapore. In October 2019, Makarim left Gojek to take up the post of Minister of Education and Culture in the Indonesian cabinet of ministers.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

IGF is a crowdfunding platform for impact investing in Asia. It aims to partner with innovative, high-impact enterprises in need of capital to scale their businesses and, as a result, be of value to society and the environment. The fund seeks to mobilize its US$50m in investment capital to deliver affordable healthcare, cut CO2 emissions, help more than 2m people gain access to clean energy and empower women. IGF's investments range in size from US$250,000 to US$5m, and primarily take the form of equity or quasi-equity. All its investments include pre-agreed social or environmental impact targets.

B'Smart to speed up adoption of AI-data technology in traditional sectors like transport and logistics, boosting profitability with IoT for fleet management.

B'Smart to speed up adoption of AI-data technology in traditional sectors like transport and logistics, boosting profitability with IoT for fleet management.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Spain’s Spotahome is the first European proptech to provide high quality digital tours of properties for virtual viewings by potential tenants.

Spain’s Spotahome is the first European proptech to provide high quality digital tours of properties for virtual viewings by potential tenants.

Award-winning social enterprise Kostoom aims to empower local tailors and fashion stakeholders to create a sustainable sharing economy across Indonesia.

Award-winning social enterprise Kostoom aims to empower local tailors and fashion stakeholders to create a sustainable sharing economy across Indonesia.

Roger Federer, the Swiss 20-times Grand Slam tennis champion, has turned into an angel investor while planning his professional life beyond and after his tennis sports career.In 2019, he invested in On, the Swiss running shoe manufacturer for an undisclosed funding amount. Federer currently has no formal role in the company but he’s actively involved in its R&D and product development. “I feel like I can give input on any of the lines, the shoes, anything moving forward. I can give my opinion on anything and On can either take it or leave it. I feel like [with] a major brand like Nike, that's literally impossible. It just wouldn't work,” he has said.More recently, Federer participated in a Series D funding round backing the first Chilean unicorn NotCo, which sells plant-based food and beverage products across Latin America and the US.

Roger Federer, the Swiss 20-times Grand Slam tennis champion, has turned into an angel investor while planning his professional life beyond and after his tennis sports career.In 2019, he invested in On, the Swiss running shoe manufacturer for an undisclosed funding amount. Federer currently has no formal role in the company but he’s actively involved in its R&D and product development. “I feel like I can give input on any of the lines, the shoes, anything moving forward. I can give my opinion on anything and On can either take it or leave it. I feel like [with] a major brand like Nike, that's literally impossible. It just wouldn't work,” he has said.More recently, Federer participated in a Series D funding round backing the first Chilean unicorn NotCo, which sells plant-based food and beverage products across Latin America and the US.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

2gether: The world's first crypto-collaborative financial platform

Banking on the opportunities afforded by blockchain, 2gether is owned by its customers who get commission-free financial services in euros and cryptocurrency

Indonesian B2B e-procurement platforms: Disrupting long-standing practices

Indonesia’s B2B e-commerce players are winning over corporate clients with education and government support, growing a market forecast to be worth $13.4bn by 2023

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

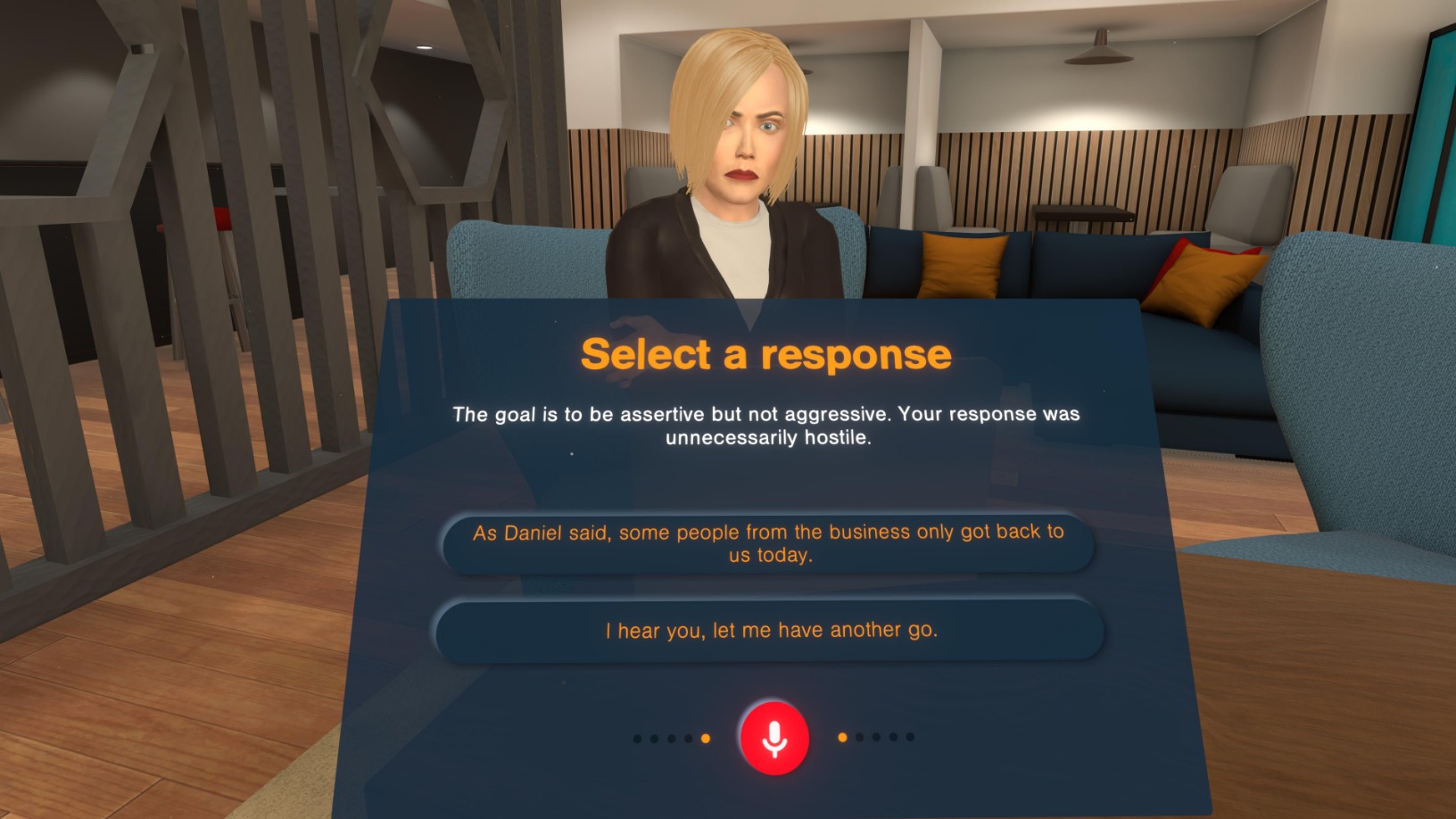

Bodyswaps: Using VR to train workplace communication soft skills at scale

UK-based Bodyswaps taps VR's simulation powers for job-based soft skills training to improve management skills and employability

Lalibela Global-Networks: A mission to digitalize, move Africa's healthcare system to the cloud

This year’s Web Summit winner, Lalibela Global-Networks, is digitalizing Africa’s paper-based healthcare system in a low-cost, low-code way to save lives and make healthcare affordable

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

This Tencent-backed startup helps content creators make real money with their own e-shops in WeChat

Despite a lack of infrastructure and threats from middlemen, Aruna continues to help Indonesian fishing communities find buyers for their catch and manage their money better.

Chinese EV startups feel the heat as Tesla slashes prices, market subsidies ending

Tesla's recent price cuts and upcoming Shanghai plant for producing cheaper cars are increasing pressure on its Chinese rivals

Ontruck CTO: How to build, scale technology in the road freight sector

Iterate fast and understand your clients, explains Samuel Fuentes, co-founder and CTO of Ontruck, because "for us, innovation is business as usual”

The B2B platform for greater route efficiency and sustainability in trucking raised €17m despite supply chain disruptions, economic uncertainties during Covid-19

Kobo360: Nigeria's Uber-style logistics startup turns pan-African dream into reality

Riding on Africa’s new free trade deal, Kobo360 aims to be the continent’s next unicorn by digitalizing logistics ops to transport goods quickly, reliably and more cheaply

Cubiq Foods: Bioreactor farms producing the food of tomorrow

Growing appetite for meat alternatives expected to fuel demand for Cubiq’s low calorie, Omega 3-enriched lab-grown fats

Chinese startups join the race to address chip shortage amid funding boom

Would an overheated semiconductor startup scene and the ability to design cutting-edge chips be enough to help China achieve chip self-sufficiency?

Sorry, we couldn’t find any matches for“take”.