urban agriculture

DATABASE (74)

ARTICLES (169)

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

Triputra Group is an Indonesian conglomerate with businesses in agriculture, manufacturing, trading and mining. It also runs a pension fund and a charitable foundation. The conglomerate was founded in 1998 by Theodore Permadi Rachmat, the former CEO of the Astra Group. It is a recent entrant in the startup investing scene; in 2018, it invested in retail startup Warung Pintar and fishery automation company eFishery.

Triputra Group is an Indonesian conglomerate with businesses in agriculture, manufacturing, trading and mining. It also runs a pension fund and a charitable foundation. The conglomerate was founded in 1998 by Theodore Permadi Rachmat, the former CEO of the Astra Group. It is a recent entrant in the startup investing scene; in 2018, it invested in retail startup Warung Pintar and fishery automation company eFishery.

With New Hope Group, one of China’s biggest agriculture and food businesses, as its cornerstone investor, HosenCare Brothers had operated as a PE arm within the group for nearly a decade. In 2017, it began to operate under its current name. It currently manages assets worth more than RMB 3bn, and mainly invests in sectors of medtech, healthcare, biotechnology and smart manufacturing.

With New Hope Group, one of China’s biggest agriculture and food businesses, as its cornerstone investor, HosenCare Brothers had operated as a PE arm within the group for nearly a decade. In 2017, it began to operate under its current name. It currently manages assets worth more than RMB 3bn, and mainly invests in sectors of medtech, healthcare, biotechnology and smart manufacturing.

Chief Creative Officer and co-founder of Beyond Leather Materials / Leap

Hannah Michaud first started exploring ways to develop sustainable textiles in 2016 while completing her studies in sustainable fashion at Copenhagen’s KEA School of Design & Technology. She also studied fashion technology and design at the KEA academy from 2012 to 2015.Michaud worked as a fashion design intern at Danish company Barbara I Gongini in 2016 and also at Weekend CPH in 2014. After her graduation in 2017, she decided to continue her research work on sustainable fabrics as co-founder and chief creative officer of Danish alt-leather startup, Beyond Leather Materials ApS, in Copenhagen.Originally from Maine, US, Michaud also studied music as a classical flutist at the University of Maine, where she was first chair in its Symphony Orchestra, and Sustainable Agriculture in the university’s Natural Science and Forestry department.

Hannah Michaud first started exploring ways to develop sustainable textiles in 2016 while completing her studies in sustainable fashion at Copenhagen’s KEA School of Design & Technology. She also studied fashion technology and design at the KEA academy from 2012 to 2015.Michaud worked as a fashion design intern at Danish company Barbara I Gongini in 2016 and also at Weekend CPH in 2014. After her graduation in 2017, she decided to continue her research work on sustainable fabrics as co-founder and chief creative officer of Danish alt-leather startup, Beyond Leather Materials ApS, in Copenhagen.Originally from Maine, US, Michaud also studied music as a classical flutist at the University of Maine, where she was first chair in its Symphony Orchestra, and Sustainable Agriculture in the university’s Natural Science and Forestry department.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

Chief Project Manager and co-founder of IXON Food Technology

Elton Ho completed a master’s in food analysis and food safety management at Hong Kong Baptist University in 2015. Ho met Felix Cheung during the master’s program and they continued to develop the advanced sous-vide aseptic packaging (ASAP) technology after their graduation. They went on to co-found IXON Food Technology in January 2017, with funding from an angel investor.Ho had previously worked as a laboratory supervisor for nine years at the Vegetable Marketing Organization (VMO), monitoring the levels of pesticide chemical residues and heavy metals in domestic and imported fruits and vegetables. The VMO is a self-financing, non-profit organization established in 1946 to support local vegetable wholesalers and customers in Hong Kong. It also ensures food safety standards compliance and supports the sustainable development of local agriculture.

Elton Ho completed a master’s in food analysis and food safety management at Hong Kong Baptist University in 2015. Ho met Felix Cheung during the master’s program and they continued to develop the advanced sous-vide aseptic packaging (ASAP) technology after their graduation. They went on to co-found IXON Food Technology in January 2017, with funding from an angel investor.Ho had previously worked as a laboratory supervisor for nine years at the Vegetable Marketing Organization (VMO), monitoring the levels of pesticide chemical residues and heavy metals in domestic and imported fruits and vegetables. The VMO is a self-financing, non-profit organization established in 1946 to support local vegetable wholesalers and customers in Hong Kong. It also ensures food safety standards compliance and supports the sustainable development of local agriculture.

E²JDJ was founded in New Orleans in 2020 with an agtech and foodtech focus, including in the areas of cellular agriculture and synthetic biology. It has six startups in its portfolio and makes diverse investments. Its most recent disclosed investment was in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions.

E²JDJ was founded in New Orleans in 2020 with an agtech and foodtech focus, including in the areas of cellular agriculture and synthetic biology. It has six startups in its portfolio and makes diverse investments. Its most recent disclosed investment was in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions.

CEO and co-founder of Singrow

With a PhD in molecular biology from NUS, Bao Shengjie, CEO and co-founder of Singrow, is a plant physiology expert who has been focusing his research for more than six years on expediting growth and improving yields. He grew up in Ningbo, a coastal city of China’s eastern Zhejiang Province. In 2011, he graduated from esteemed Zhejiang University with a bachelor's degree. He also studied bioinformatics at North Carolina State University, followed by studies at NUS. Since 2017, he has been an NUS research fellow. Strawberry has his favourite fruit since childhood. After moving to Singapore, he found that strawberries from the local supermarket were nothing close to those he had been eating for years. That sparked his study into the problem of Singapore’s local strawberry market, which in turn caused him to explore the urban farming industry with his plant physiology and molecular biology knowledge. Besides founding Singrow, he is the breeder of the company’s signature White Crystal Strawberry and invented the Fast Cultivation Method.

With a PhD in molecular biology from NUS, Bao Shengjie, CEO and co-founder of Singrow, is a plant physiology expert who has been focusing his research for more than six years on expediting growth and improving yields. He grew up in Ningbo, a coastal city of China’s eastern Zhejiang Province. In 2011, he graduated from esteemed Zhejiang University with a bachelor's degree. He also studied bioinformatics at North Carolina State University, followed by studies at NUS. Since 2017, he has been an NUS research fellow. Strawberry has his favourite fruit since childhood. After moving to Singapore, he found that strawberries from the local supermarket were nothing close to those he had been eating for years. That sparked his study into the problem of Singapore’s local strawberry market, which in turn caused him to explore the urban farming industry with his plant physiology and molecular biology knowledge. Besides founding Singrow, he is the breeder of the company’s signature White Crystal Strawberry and invented the Fast Cultivation Method.

Established in 2000. With RMB 15 billion under management, Fortune Capital focuses on companies in the TMT, consumer goods & services, modern agriculture and cleantech sectors. It has invested in about 300 startups including Qingke, Hammerhead Sharks, StoreMax and NTS Technology.

Established in 2000. With RMB 15 billion under management, Fortune Capital focuses on companies in the TMT, consumer goods & services, modern agriculture and cleantech sectors. It has invested in about 300 startups including Qingke, Hammerhead Sharks, StoreMax and NTS Technology.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Founded in 2016 in Boulder, Colorado, Blackhorn specializes in startup investment in potential game-changers for industry, including construction – its top priority for investment – manufacturing, healthcare, agriculture, transportation, water and energy. It has no geographical bias and currently has 48 companies in its portfolio with two acquisitions to date. Its most recent investments include in the undisclosed $8m round of US medtech Cytovale in January 2021 and in the $20.5m December 2020 Series A round of employees compensation fintech Foresight Risk, based in Silicon Valley.

Founded in 2016 in Boulder, Colorado, Blackhorn specializes in startup investment in potential game-changers for industry, including construction – its top priority for investment – manufacturing, healthcare, agriculture, transportation, water and energy. It has no geographical bias and currently has 48 companies in its portfolio with two acquisitions to date. Its most recent investments include in the undisclosed $8m round of US medtech Cytovale in January 2021 and in the $20.5m December 2020 Series A round of employees compensation fintech Foresight Risk, based in Silicon Valley.

CEO and co-founder of Scoobic Urban Mobility

Jose María Gómez Marquez started his business career as CEO at Roder Spain from 1986–1994, manufacturing materials used in Expo 1992 in Seville. From 1998–2005, Gómez worked in business development for Climocubierta indoor swimming pool materials company in Seville. Since 1998, Gómez has also been running F1/MotoGP equipment supply company AMG Services as CEO and founder.He completed a master’s in business management in 2006 at San Telmo International Institute in Seville and became the managing partner of Seville-based engineering design company Arquingenia.In 2015, he co-founded Spanish mobility startup Scoobic Urban Mobility and became the CEO of the country’s first three-wheeled EV last-mile delivery logistics provider. He is also CEO of Passion Motorbike Factory.Between 2011 and 2015, Gómez was a director at Morocco-based EURoma Network, a transnational EU organization contributing to the promotion of social inclusion, equal opportunities and the fight against discrimination of the Roma community.

Jose María Gómez Marquez started his business career as CEO at Roder Spain from 1986–1994, manufacturing materials used in Expo 1992 in Seville. From 1998–2005, Gómez worked in business development for Climocubierta indoor swimming pool materials company in Seville. Since 1998, Gómez has also been running F1/MotoGP equipment supply company AMG Services as CEO and founder.He completed a master’s in business management in 2006 at San Telmo International Institute in Seville and became the managing partner of Seville-based engineering design company Arquingenia.In 2015, he co-founded Spanish mobility startup Scoobic Urban Mobility and became the CEO of the country’s first three-wheeled EV last-mile delivery logistics provider. He is also CEO of Passion Motorbike Factory.Between 2011 and 2015, Gómez was a director at Morocco-based EURoma Network, a transnational EU organization contributing to the promotion of social inclusion, equal opportunities and the fight against discrimination of the Roma community.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Agricool: Growing fresh strawberries in shipping containers

Paris-based Agricool grows fresh produce in urban aeroponics farms within shipping containers for sale at downtown supermarkets, aims to supply more large cities by 2030

Future Food Asia: Temasek, Continental Grain on investing in agrifood in Singapore and China

The two heavyweight investors discuss opportunities, needs and how agrifood startups can scale in Asian markets

Neurafarm: Putting an AI plant doctor in farmers' hands

This startup is riding on Indonesia’s urban farming trend with its planting kit and an AI-powered app that identifies plant diseases from photos of unhealthy leaves

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

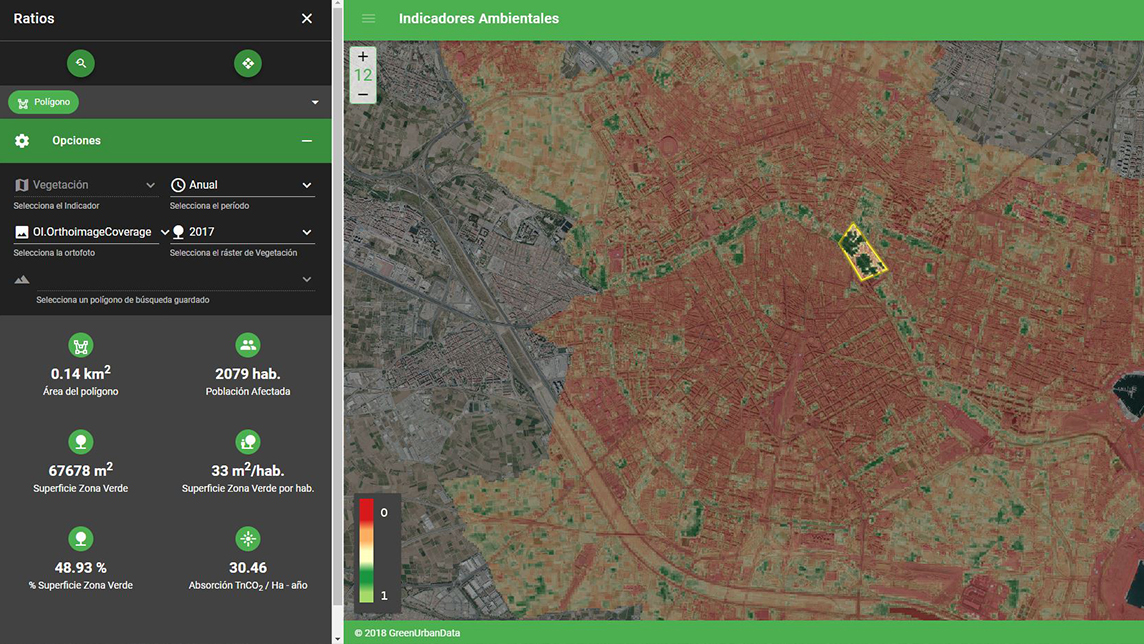

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Tiantian Xuenong: China's first pay-for-knowledge agricultural platform

Capitalizing on a deep understanding of Chinese agriculture, this startup is building an online school where farmers can learn agricultural and business skills

Yimutian: China agriculture e-commerce's comeback kid

As the world’s most populous country faces potential food supply shortages, Yimutian, China’s No. 1 agro trading marketplace, is seeing more opportunities

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

Circular economy: Discarded goods get a new lease of life in Spain

From e-chargers inside phone booths, recycling chatbots to refurbished stadium seats from Atlético Madrid, the offbeat magic of the circular economy is fast becoming a lucrative business in Spain

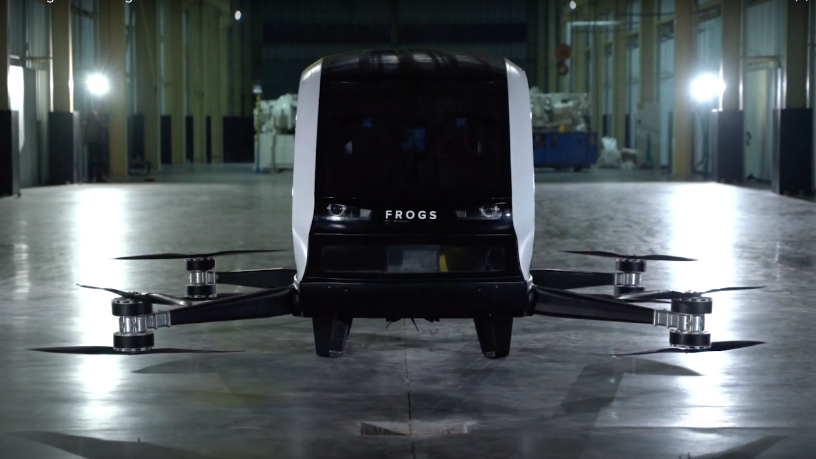

FROGS: Overcoming challenges to launch Indonesia's first drone-taxi for daily commutes

The Yogyakarta-based startup backed by UMG Idealab seeks more technical resources to launch Indonesia's first homegrown “flying taxi,” after the success of its agritech drones

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Sorry, we couldn’t find any matches for“urban agriculture”.