Manufacturing

This function is exclusive for Premium subscribers

-

DATABASE (39)

-

ARTICLES (41)

Bygen’s energy-efficient process for manufacturing activated carbon helps agribusinesses turn their biomass waste into a valuable industrial commodity.

Bygen’s energy-efficient process for manufacturing activated carbon helps agribusinesses turn their biomass waste into a valuable industrial commodity.

With Allozymes technology, designing industrial enzymes takes months instead of years, helping industries from pharmaceuticals to foodtech get the chemicals they need much faster.

With Allozymes technology, designing industrial enzymes takes months instead of years, helping industries from pharmaceuticals to foodtech get the chemicals they need much faster.

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

Organic waste-management circular tech producing raw bioplastic for versatile processing uses via its automated waste-processing hardware with garbage-eating cultivated bacteria.

Organic waste-management circular tech producing raw bioplastic for versatile processing uses via its automated waste-processing hardware with garbage-eating cultivated bacteria.

Computer vision-based SaaS platform auto reads, selects and converts relevant text, symbols and codes into big data to help digitize industries and supply chains.

Computer vision-based SaaS platform auto reads, selects and converts relevant text, symbols and codes into big data to help digitize industries and supply chains.

Oimo’s bioplastic products degrade in water within a month and are compatible with existing manufacturing machinery, allowing rapid replacement of single-use plastics.

Oimo’s bioplastic products degrade in water within a month and are compatible with existing manufacturing machinery, allowing rapid replacement of single-use plastics.

Triditive's AMCELL is the first automated additive manufacturing technology to enable round-the-clock mass production, empowering SME manufacturers to access Industry 4.0.

Triditive's AMCELL is the first automated additive manufacturing technology to enable round-the-clock mass production, empowering SME manufacturers to access Industry 4.0.

Besides helping shoemakers cut product development costs by 80%, 4D ShoeTech is now expanding its 3D modeling services to make prototypes for luggage manufacturers.

Besides helping shoemakers cut product development costs by 80%, 4D ShoeTech is now expanding its 3D modeling services to make prototypes for luggage manufacturers.

A government-backed firm, Portugal Ventures is the country's most active VC. It invests exclusively in Portugal-based or initiated startups. There are currently over 100 companies in its portfolio, predominantly from the engineering, tourism, manufacturing and life sciences sectors. Established in 2012, Portugal Ventures focuses on MVP-ready projects and invests from €300,000 to €1.5m in the projects it selects for funding. The firm has managed eight exits to date. It most recently invested in the €1m seed round of conversational games developer Doppio Games and in the €2m seed round of remote access security company Fyde.

A government-backed firm, Portugal Ventures is the country's most active VC. It invests exclusively in Portugal-based or initiated startups. There are currently over 100 companies in its portfolio, predominantly from the engineering, tourism, manufacturing and life sciences sectors. Established in 2012, Portugal Ventures focuses on MVP-ready projects and invests from €300,000 to €1.5m in the projects it selects for funding. The firm has managed eight exits to date. It most recently invested in the €1m seed round of conversational games developer Doppio Games and in the €2m seed round of remote access security company Fyde.

Yamaha Motor Ventures & Laboratory Silicon Valley

The investment arm of Yamaha Motor Group (Japan) was founded in 2015 and is headquartered in Palo Alto, California. It focuses on industrial automation and transportation technology, and on smart and automated solutions in particular. Recent investments include automated strawberry picker Advanced Farm Technologies' US$7.5m Series A round and drone and robotics startup Exyn Technology's US$16m Series A round.

The investment arm of Yamaha Motor Group (Japan) was founded in 2015 and is headquartered in Palo Alto, California. It focuses on industrial automation and transportation technology, and on smart and automated solutions in particular. Recent investments include automated strawberry picker Advanced Farm Technologies' US$7.5m Series A round and drone and robotics startup Exyn Technology's US$16m Series A round.

Grand China Capital is a Beijing-based venture capital firm. It invests mainly in media, entertainment, sports, tourism, and smart manufacturing sectors. It provides businesses with services such as financial investment, strategic consulting and data-based marketing. Grand China Capital co-launched a RMB 2 billion fund with Japan's SBI Group (previously known as Softbank Investment Co., Ltd) in September 2018 to drive tech development in the Asia Pacific region.

Grand China Capital is a Beijing-based venture capital firm. It invests mainly in media, entertainment, sports, tourism, and smart manufacturing sectors. It provides businesses with services such as financial investment, strategic consulting and data-based marketing. Grand China Capital co-launched a RMB 2 billion fund with Japan's SBI Group (previously known as Softbank Investment Co., Ltd) in September 2018 to drive tech development in the Asia Pacific region.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

SWITCH Singapore: Sustainability startups see growing demand from corporates

Sophie’s BioNutrients, Ubiik and Intello Labs also note new trends in technology and supply chain arising from the Covid-19 pandemic, across the food, manufacturing and e-commerce sectors

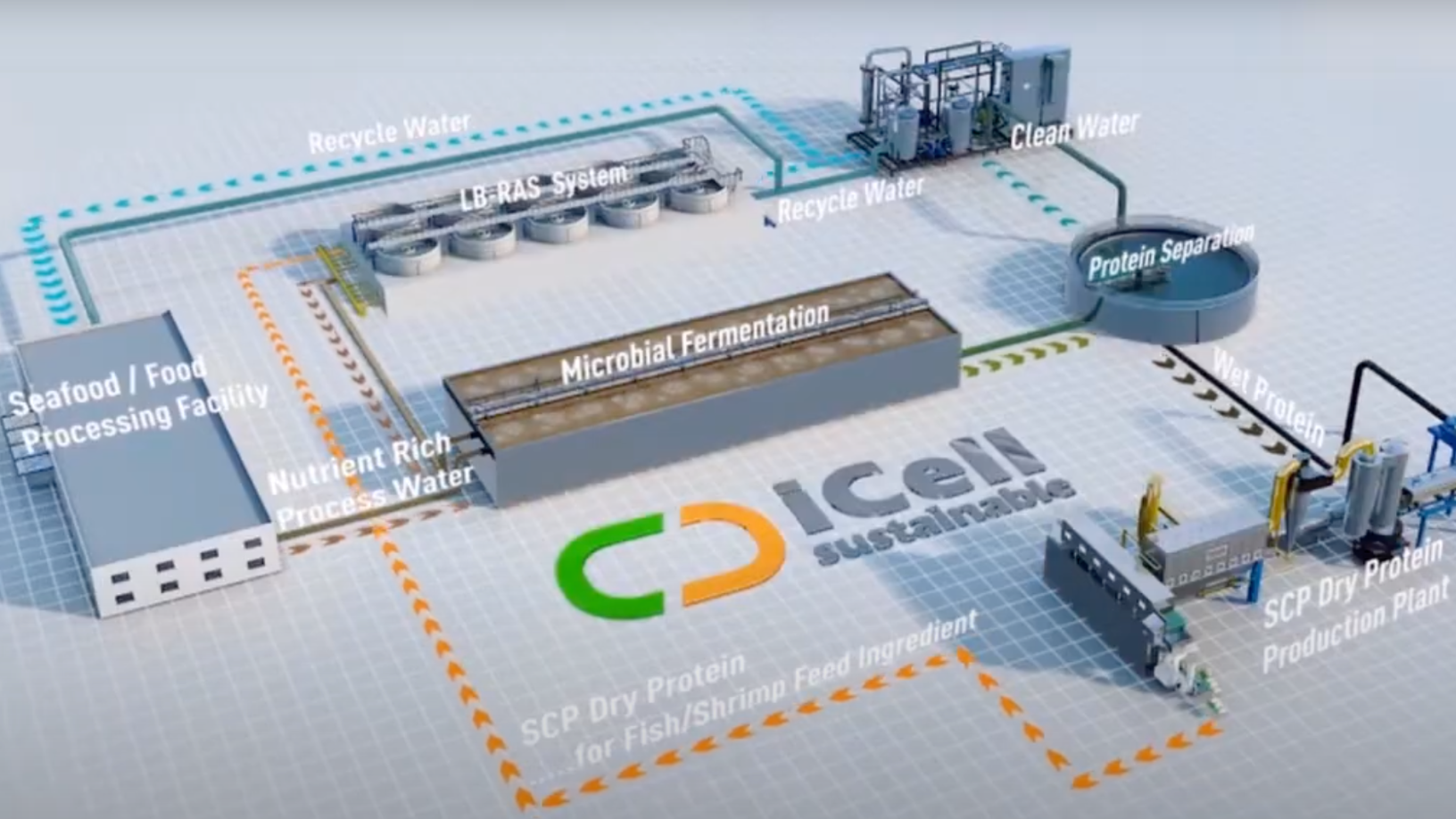

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

IXON: Preserving food without canning or freezing

Chinese foodtech IXON aims to disrupt global cold chain logistics with its novel food preparation and packaging solution that keeps food fresh at room temperature for years

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon

Allozymes wants to supercharge manufacturing with engineered enzymes

The Future Food Asia 2021 award winner speeds up enzyme engineering from years to months, is already attracting clients and has just raised $5m seed funding

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change