Agriculture & Fishery

This function is exclusive for Premium subscribers

DATABASE (138)

ARTICLES (134)

Aqua-Spark is a Netherlands-based fund that supports aquaculture businesses around the world, with the vision to create profitable aquaculture ventures that can help to restore ocean ecosystems that have been damaged by overfishing. Its portfolio covers a wide range of enterprises, ranging from low-cost fish farms in Madagascar to biotechs and high tech aquaculture companies.

Aqua-Spark is a Netherlands-based fund that supports aquaculture businesses around the world, with the vision to create profitable aquaculture ventures that can help to restore ocean ecosystems that have been damaged by overfishing. Its portfolio covers a wide range of enterprises, ranging from low-cost fish farms in Madagascar to biotechs and high tech aquaculture companies.

Tianxing Capital is a venture capital management company that was founded in 2012. It has invested in over 500 enterprises so far. Its investment focuses are media, healthcare, energy conservation, environmental protection, high-end manufacturing, etc.

Tianxing Capital is a venture capital management company that was founded in 2012. It has invested in over 500 enterprises so far. Its investment focuses are media, healthcare, energy conservation, environmental protection, high-end manufacturing, etc.

Established by the Shenzhen Government in 1999, Shenzhen Capital Group invests mainly in small- and medium-sized enterprises as well as high-tech startups in the fields of information technology, internet, biomedicine, new energy, high-end equipment manufacturing, etc. As of June 2018, it had invested RMB 37.6 billion in 889 projects and startups, 140 of which have been listed on 16 stock exchanges around the world.

Established by the Shenzhen Government in 1999, Shenzhen Capital Group invests mainly in small- and medium-sized enterprises as well as high-tech startups in the fields of information technology, internet, biomedicine, new energy, high-end equipment manufacturing, etc. As of June 2018, it had invested RMB 37.6 billion in 889 projects and startups, 140 of which have been listed on 16 stock exchanges around the world.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

The Oslo-born venture capital company, Northzone VC, has offices in Norway, Sweden, London and New York, and was founded in 1996. It has invested in more than 130 companies globally, across a spectrum of sectors, and at different stages, and has around €1 billion under investment currently. It has seen nine IPOs from its portfolio and manages nine funds. It has been lead investor in almost 70 rounds and has seen 30 exits to date.

The Oslo-born venture capital company, Northzone VC, has offices in Norway, Sweden, London and New York, and was founded in 1996. It has invested in more than 130 companies globally, across a spectrum of sectors, and at different stages, and has around €1 billion under investment currently. It has seen nine IPOs from its portfolio and manages nine funds. It has been lead investor in almost 70 rounds and has seen 30 exits to date.

DFS168.com is a B2C e-commerce platform for agricultural materials. DFS168.com sells to major agricultural provinces in China such as Jiangxi, Heibei and Anhui. Upon noticing Chinese farmers' lack of agricultural expertise and technical knowledge, the team at DFS168.com came up with the idea of building an agricultural education platform. However, the company decided not to launch the business itself, worried farmers might misinterpret the platform as simply a means to sell more products. Instead, founder Yan Zitong co-founded Tiantian Xuenong, an independent company, with Zhao Guang, and DFS168.com assumed the role of angel investor.

DFS168.com is a B2C e-commerce platform for agricultural materials. DFS168.com sells to major agricultural provinces in China such as Jiangxi, Heibei and Anhui. Upon noticing Chinese farmers' lack of agricultural expertise and technical knowledge, the team at DFS168.com came up with the idea of building an agricultural education platform. However, the company decided not to launch the business itself, worried farmers might misinterpret the platform as simply a means to sell more products. Instead, founder Yan Zitong co-founded Tiantian Xuenong, an independent company, with Zhao Guang, and DFS168.com assumed the role of angel investor.

Established in Shanghai in 2013, Galileo Venture focuses on the application of new technologies - e.g., mobile internet, artificial intelligence and big data - in the fields of education, healthcare, agriculture and consumer products. It has invested in dozens of early-stage startups.

Established in Shanghai in 2013, Galileo Venture focuses on the application of new technologies - e.g., mobile internet, artificial intelligence and big data - in the fields of education, healthcare, agriculture and consumer products. It has invested in dozens of early-stage startups.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

Established in 2014, WOW Aceleradora is a startup accelerator based in Porto Alegre, Brazil. It has invested over BR$8 million (US$2.1 million) through its network of 170 angel investors, specializing in tech companies.

Established in 2014, WOW Aceleradora is a startup accelerator based in Porto Alegre, Brazil. It has invested over BR$8 million (US$2.1 million) through its network of 170 angel investors, specializing in tech companies.

Established in 2018, Robot Union is a pan-European robotics association that is funded by the European Union. It is an EU initiative under the Horizon 2020 program for investment in research and innovation across sectors and countries. Through various competitions, robotics startups can win equity-free awards of up to €223,000 each. Robot Union selected its first batch of 20 startups in September 2018.

Established in 2018, Robot Union is a pan-European robotics association that is funded by the European Union. It is an EU initiative under the Horizon 2020 program for investment in research and innovation across sectors and countries. Through various competitions, robotics startups can win equity-free awards of up to €223,000 each. Robot Union selected its first batch of 20 startups in September 2018.

Fosun RZ Capital (Fosun Kinzon Capital)

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Ataria Ventures is an early stage fund that offers predominantly Latin American investors and corporations access to technology startups in Israel and Silicon Valley. It has invested in more than 30 startups across a variety of industries and sectors, including Artificial Intelligence, Big Data, Virtual Reality, foodtech, agritech, consumer, and health.

Ataria Ventures is an early stage fund that offers predominantly Latin American investors and corporations access to technology startups in Israel and Silicon Valley. It has invested in more than 30 startups across a variety of industries and sectors, including Artificial Intelligence, Big Data, Virtual Reality, foodtech, agritech, consumer, and health.

Climate-KIC is an initiative supported by the European Institute of Innovation and Technology (EIT), whose focus is to create and support a community of entrepreneurs and mentors that jointly develop and produce innovative ideas facilitating the transition to a zero-carbon economy. Climate-KIC has launched various initiatives and acceleration programs across Europe targeted at growing startups that are tackling climate change, providing them with structure, assistance, mentoring and seed funding to develop low-carbon products and services.

Climate-KIC is an initiative supported by the European Institute of Innovation and Technology (EIT), whose focus is to create and support a community of entrepreneurs and mentors that jointly develop and produce innovative ideas facilitating the transition to a zero-carbon economy. Climate-KIC has launched various initiatives and acceleration programs across Europe targeted at growing startups that are tackling climate change, providing them with structure, assistance, mentoring and seed funding to develop low-carbon products and services.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

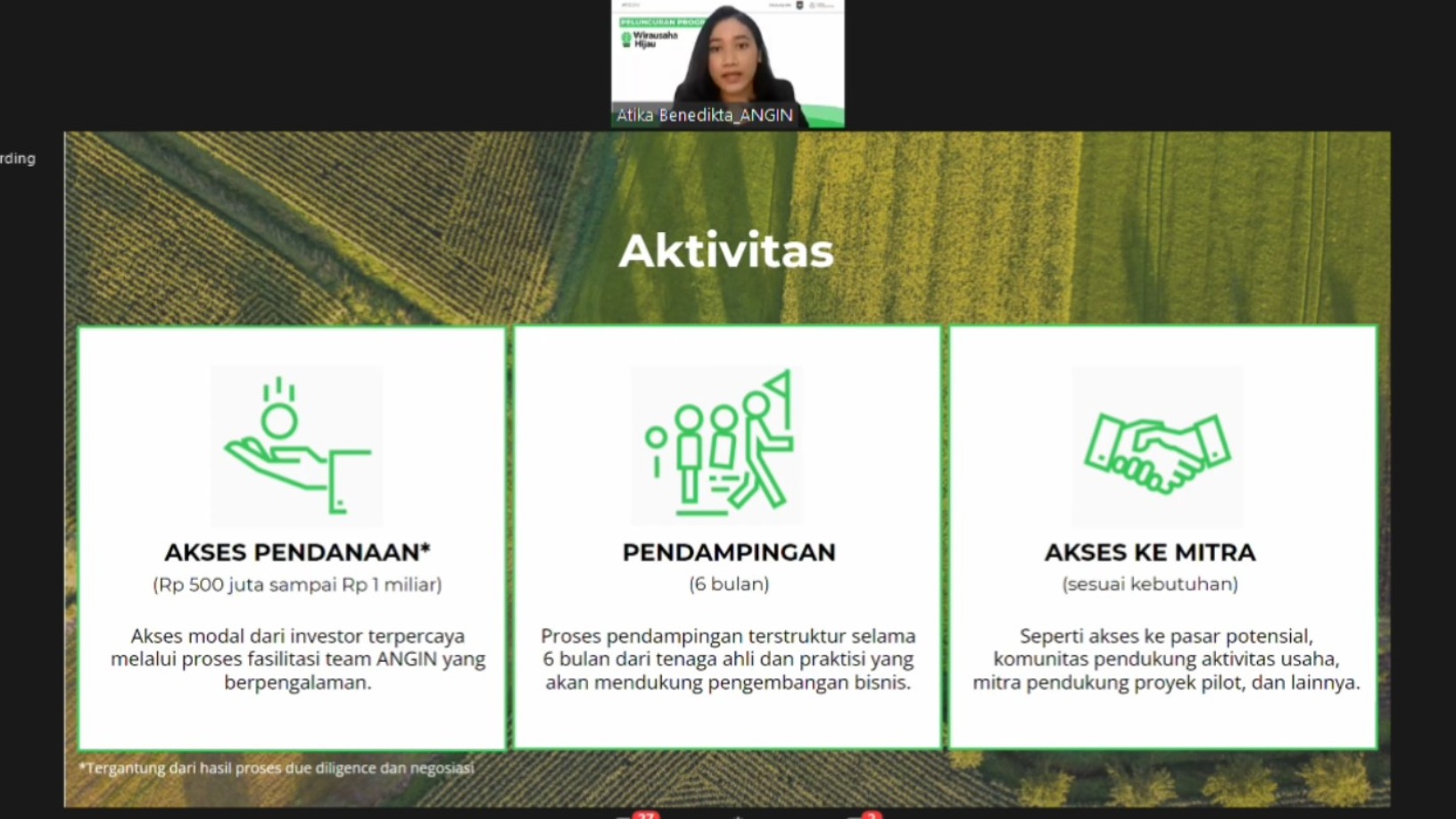

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Forward Fooding: Ranking the world's agrifood startups on success and sustainability

The collaborative platform has opened applications for its FoodTech500 global ranking of agrifood startups; counts over 7,000 startups and scaleups mapped so far

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

NovoNutrients: Tackling the dual problems of CO2 emissions and over-fishing

The first to transform CO2 to fish food, NovoNutrients is trialing with industry giants Skretting and Chevron, and will soon raise Series A funding

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Want to cut plastic packaging? Notpla's edible seaweed sachets are an option

From its edible whiskey “bubbles” to biodegradable Teflon-free container liners, Notpla seeks to replace single-use plastic and help food companies boost their green credentials

Demand Side Instruments: Using small data to solve big problems

Following a €3.6m Series A round, the French startup is growing its workforce to commercialize its precision irrigation technology in new markets in Europe and North America

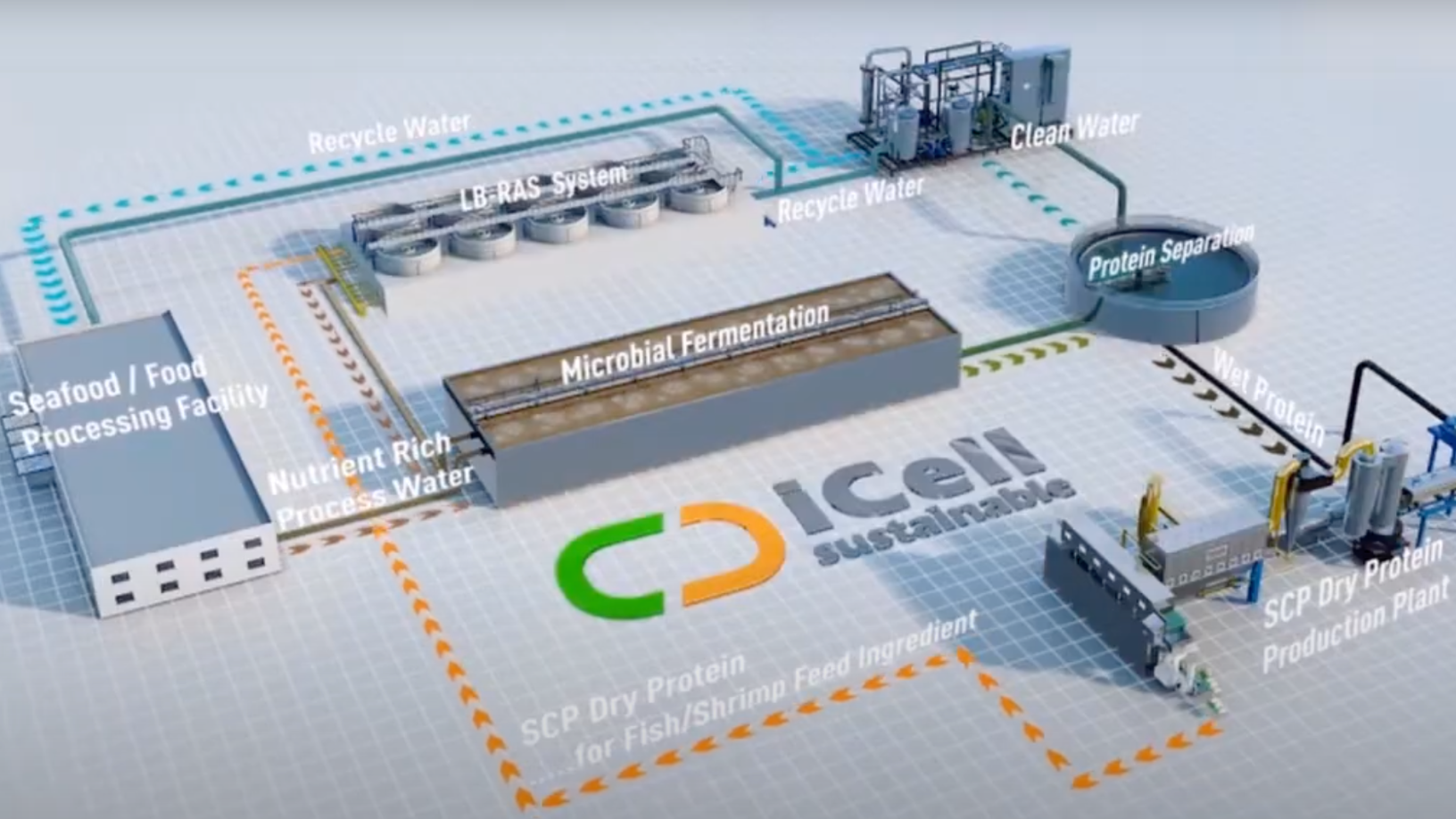

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon