Agriculture & Fishery

This function is exclusive for Premium subscribers

DATABASE (138)

ARTICLES (134)

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

Founded in 2016 in Boulder, Colorado, Blackhorn specializes in startup investment in potential game-changers for industry, including construction – its top priority for investment – manufacturing, healthcare, agriculture, transportation, water and energy. It has no geographical bias and currently has 48 companies in its portfolio with two acquisitions to date. Its most recent investments include in the undisclosed $8m round of US medtech Cytovale in January 2021 and in the $20.5m December 2020 Series A round of employees compensation fintech Foresight Risk, based in Silicon Valley.

Founded in 2016 in Boulder, Colorado, Blackhorn specializes in startup investment in potential game-changers for industry, including construction – its top priority for investment – manufacturing, healthcare, agriculture, transportation, water and energy. It has no geographical bias and currently has 48 companies in its portfolio with two acquisitions to date. Its most recent investments include in the undisclosed $8m round of US medtech Cytovale in January 2021 and in the $20.5m December 2020 Series A round of employees compensation fintech Foresight Risk, based in Silicon Valley.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Based in San Francisco, the Mulago Foundation is a philanthropic foundation designed to carry on the life work of pediatrician Rainer Arnhold who died in 1993 while working in the mountains of Bolivia. He originally set up the Mulago Foundation in 1968, naming it after a hospital in Uganda. His Jewish family, bankers for generations, continued to support the foundation for impact investing across diverse sectors and geographies, with scalable solutions to alleviate poverty.It has invested in 61 companies to date. Successful ventures include: Kenya’s Komaza that raised $28m in its 2020 Series B and Myanmar’s Proximity Finance, a fintech for small-holder farmers that raised $14m in 2020. Komaza helps poor families turn dry land into small-scale, income-generating tree farms, benefiting more than 2m farmers in Sub-Saharan Africa.

Based in San Francisco, the Mulago Foundation is a philanthropic foundation designed to carry on the life work of pediatrician Rainer Arnhold who died in 1993 while working in the mountains of Bolivia. He originally set up the Mulago Foundation in 1968, naming it after a hospital in Uganda. His Jewish family, bankers for generations, continued to support the foundation for impact investing across diverse sectors and geographies, with scalable solutions to alleviate poverty.It has invested in 61 companies to date. Successful ventures include: Kenya’s Komaza that raised $28m in its 2020 Series B and Myanmar’s Proximity Finance, a fintech for small-holder farmers that raised $14m in 2020. Komaza helps poor families turn dry land into small-scale, income-generating tree farms, benefiting more than 2m farmers in Sub-Saharan Africa.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

DCVC (formerly Data Collective)

San Francisco-based DCVC, formerly named Data Collective, has made more than 400 investments in its 20 year history, with deep tech and science in general its key investment interests. It currently has 148 companies in its portfilio and has managed 48 exits to date, including acquisitions by Twitter and Amazon. Its most recent investments have included in the April 2021 £60m Series A round of British antibody medtech Alchemab Therapeutics and in the March 2021 $75m Series B round of Israeli blockchain development tool StarkWare Industries.

San Francisco-based DCVC, formerly named Data Collective, has made more than 400 investments in its 20 year history, with deep tech and science in general its key investment interests. It currently has 148 companies in its portfilio and has managed 48 exits to date, including acquisitions by Twitter and Amazon. Its most recent investments have included in the April 2021 £60m Series A round of British antibody medtech Alchemab Therapeutics and in the March 2021 $75m Series B round of Israeli blockchain development tool StarkWare Industries.

Founded in Berlin in 2016, Atlantic Food Labs’ mission is to support startups with the potential to feed 10bn people by 2050. It has supported 20 companies to date and its most recent investments include in the German healthy last-minute delivery service Gorillas’ $290m Series B round and in the €5.9m seed round of B2B German retail connection service Magaloop in March 2021.

Founded in Berlin in 2016, Atlantic Food Labs’ mission is to support startups with the potential to feed 10bn people by 2050. It has supported 20 companies to date and its most recent investments include in the German healthy last-minute delivery service Gorillas’ $290m Series B round and in the €5.9m seed round of B2B German retail connection service Magaloop in March 2021.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Founded in Washington DC in 2016, AV Ventures is co-founded by US not-for-profit organizations, the Agricultural Cooperative Development International and Volunteers in Overseas Cooperative Assistance.AV Ventures focuses on supporting SMEs that facilitate financing for farmers to improve sustainable supply chain management and boost social impact in Africa and Central Asia. Investments in tech startups include the $790,000 seed round of AgroCenta in January 2021. Through AV Frontiers in Bishkek, the VC also recently participated in April’s investment round of Kyrgyzstan-based ololoAkJol Resort, a hub for digital nomads, or independent remote workers.

Founded in Washington DC in 2016, AV Ventures is co-founded by US not-for-profit organizations, the Agricultural Cooperative Development International and Volunteers in Overseas Cooperative Assistance.AV Ventures focuses on supporting SMEs that facilitate financing for farmers to improve sustainable supply chain management and boost social impact in Africa and Central Asia. Investments in tech startups include the $790,000 seed round of AgroCenta in January 2021. Through AV Frontiers in Bishkek, the VC also recently participated in April’s investment round of Kyrgyzstan-based ololoAkJol Resort, a hub for digital nomads, or independent remote workers.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Orkla ASA is an Oslo-based supplier of branded consumer products to major markets in the Nordic and Baltic regions and Central Europe. Selected product categories are also available in India, known as MTR Foods brand. Popular brands include Felix, Toro, Panda and Abba.Originally founded in 1654, Orkla is one of Norway’s oldest business conglomerates and became public-listed on the Oslo Stock Exchange (ORKLY) in 1929. Orkla Foods accounts for 39% of the group’s operating revenues. Two other subsidiaries, Orkla Care and Orkla Food Ingredients generate about 43% of the group’s operating revenues. The Orkla Confectionery & Snacks division contributes about 15%.

Orkla ASA is an Oslo-based supplier of branded consumer products to major markets in the Nordic and Baltic regions and Central Europe. Selected product categories are also available in India, known as MTR Foods brand. Popular brands include Felix, Toro, Panda and Abba.Originally founded in 1654, Orkla is one of Norway’s oldest business conglomerates and became public-listed on the Oslo Stock Exchange (ORKLY) in 1929. Orkla Foods accounts for 39% of the group’s operating revenues. Two other subsidiaries, Orkla Care and Orkla Food Ingredients generate about 43% of the group’s operating revenues. The Orkla Confectionery & Snacks division contributes about 15%.

Founded in 2002, Galia Gestion is an investment fund based in Bordeaux and operating principally in southwest France. To date, it has supported some 150 companies and currently has €100m of investments under management.

Founded in 2002, Galia Gestion is an investment fund based in Bordeaux and operating principally in southwest France. To date, it has supported some 150 companies and currently has €100m of investments under management.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Forward Fooding: Ranking the world's agrifood startups on success and sustainability

The collaborative platform has opened applications for its FoodTech500 global ranking of agrifood startups; counts over 7,000 startups and scaleups mapped so far

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

NovoNutrients: Tackling the dual problems of CO2 emissions and over-fishing

The first to transform CO2 to fish food, NovoNutrients is trialing with industry giants Skretting and Chevron, and will soon raise Series A funding

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Want to cut plastic packaging? Notpla's edible seaweed sachets are an option

From its edible whiskey “bubbles” to biodegradable Teflon-free container liners, Notpla seeks to replace single-use plastic and help food companies boost their green credentials

Demand Side Instruments: Using small data to solve big problems

Following a €3.6m Series A round, the French startup is growing its workforce to commercialize its precision irrigation technology in new markets in Europe and North America

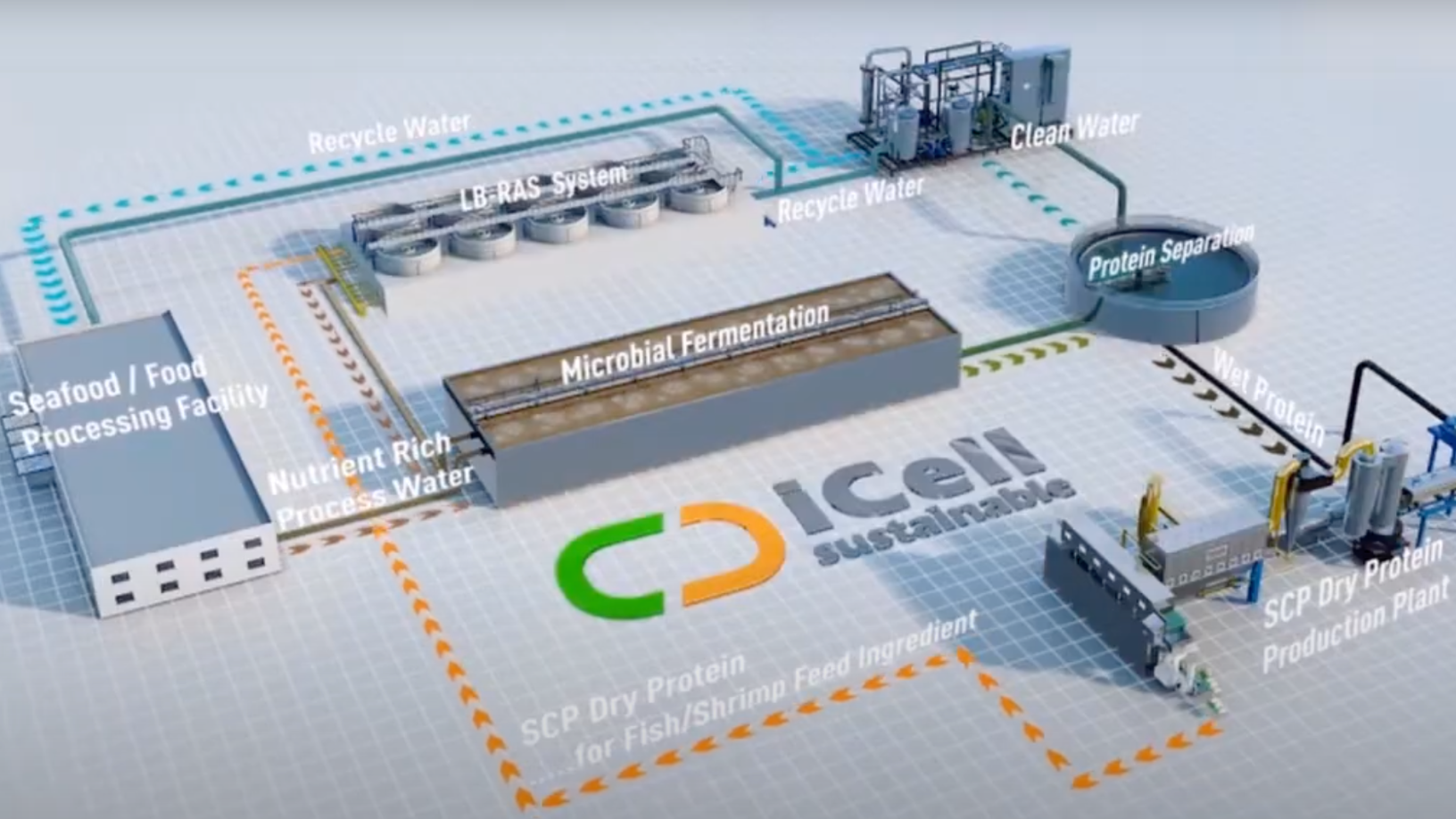

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon