B2C

This function is exclusive for Premium subscribers

DATABASE (212)

ARTICLES (221)

Plug and Play Spain is part of Silicon Valley’s Plug and Play Tech Center that runs 12 worldwide vertical acceleration programs. The Spanish accelerator program was launched in 2012 in Valencia. Plug and Play Spain has invested over €25 million in 45 companies with successful exits including Touristeye (Lonely Planet), Ducksboard (New Relic), Stream Hatchet (Millennial Esports) and Otogami (8Kdata).

Plug and Play Spain is part of Silicon Valley’s Plug and Play Tech Center that runs 12 worldwide vertical acceleration programs. The Spanish accelerator program was launched in 2012 in Valencia. Plug and Play Spain has invested over €25 million in 45 companies with successful exits including Touristeye (Lonely Planet), Ducksboard (New Relic), Stream Hatchet (Millennial Esports) and Otogami (8Kdata).

Daniel Romy is the CEO of Investments at Media Digital Ventures, the first media fund dedicated to Media for Equity in Spain. With assets valued at €35 million, MDV supports startups through powerful marketing campaigns in return for equity. Romy is experienced in venture capital and crowdfunding, having worked as COO for three years at The Crowd Angel, a leading equity crowdfunding platform. He is also a member of the investment committee of Inveready First II SCR that manages assets worth €20 million.

Daniel Romy is the CEO of Investments at Media Digital Ventures, the first media fund dedicated to Media for Equity in Spain. With assets valued at €35 million, MDV supports startups through powerful marketing campaigns in return for equity. Romy is experienced in venture capital and crowdfunding, having worked as COO for three years at The Crowd Angel, a leading equity crowdfunding platform. He is also a member of the investment committee of Inveready First II SCR that manages assets worth €20 million.

Well-known for co-founding JobsCentral in Singapore, Lim Der Shing has been an angel investor since 2009. JobsCentral was acquired by CareerBuilder USA in 2011 and Der Shing became its Asia-Pacific MD. He left the new role after six months in 2014 to become a full-time investor and partner at Singapore-based VC Jungle Ventures. The electrical and electronic engineer graduated in 1999 with a Summa cum Laude from the University of Michigan, USA. As a scholar, he returned to work at Sembcorp before co-founding JobsCentral’s predecessor JobsFactory in 2000 with co-founder and wife Huang Shao-Ning.

Well-known for co-founding JobsCentral in Singapore, Lim Der Shing has been an angel investor since 2009. JobsCentral was acquired by CareerBuilder USA in 2011 and Der Shing became its Asia-Pacific MD. He left the new role after six months in 2014 to become a full-time investor and partner at Singapore-based VC Jungle Ventures. The electrical and electronic engineer graduated in 1999 with a Summa cum Laude from the University of Michigan, USA. As a scholar, he returned to work at Sembcorp before co-founding JobsCentral’s predecessor JobsFactory in 2000 with co-founder and wife Huang Shao-Ning.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

The Oslo-born venture capital company, Northzone VC, has offices in Norway, Sweden, London and New York, and was founded in 1996. It has invested in more than 130 companies globally, across a spectrum of sectors, and at different stages, and has around €1 billion under investment currently. It has seen nine IPOs from its portfolio and manages nine funds. It has been lead investor in almost 70 rounds and has seen 30 exits to date.

The Oslo-born venture capital company, Northzone VC, has offices in Norway, Sweden, London and New York, and was founded in 1996. It has invested in more than 130 companies globally, across a spectrum of sectors, and at different stages, and has around €1 billion under investment currently. It has seen nine IPOs from its portfolio and manages nine funds. It has been lead investor in almost 70 rounds and has seen 30 exits to date.

Charlotte Street Capital is a London-based venture capital firm focused on early stage investments. It invests from £150,000 to £1 million in innovative technology businesses, ranging from hardware products, software and services in the B2C and B2B sectors.

Charlotte Street Capital is a London-based venture capital firm focused on early stage investments. It invests from £150,000 to £1 million in innovative technology businesses, ranging from hardware products, software and services in the B2C and B2B sectors.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

Partech Ventures is a global venture capital firm established in San Francisco in 1982 as Paribas Technologies, a subsidiary of French bank Paribas that currently holds €1.3 billion in assets under its management. In addition to San Francisco, Partech also has offices in Paris, Berlin and Dakar, Senegal, with the latter focused exclusively on African startups. The company is now based in Paris and has invested in over 300 companies across different funding stages with 48 exits to date.

Partech Ventures is a global venture capital firm established in San Francisco in 1982 as Paribas Technologies, a subsidiary of French bank Paribas that currently holds €1.3 billion in assets under its management. In addition to San Francisco, Partech also has offices in Paris, Berlin and Dakar, Senegal, with the latter focused exclusively on African startups. The company is now based in Paris and has invested in over 300 companies across different funding stages with 48 exits to date.

Fosun RZ Capital (Fosun Kinzon Capital)

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

Ataria Ventures is an early stage fund that offers predominantly Latin American investors and corporations access to technology startups in Israel and Silicon Valley. It has invested in more than 30 startups across a variety of industries and sectors, including Artificial Intelligence, Big Data, Virtual Reality, foodtech, agritech, consumer, and health.

Ataria Ventures is an early stage fund that offers predominantly Latin American investors and corporations access to technology startups in Israel and Silicon Valley. It has invested in more than 30 startups across a variety of industries and sectors, including Artificial Intelligence, Big Data, Virtual Reality, foodtech, agritech, consumer, and health.

Pinama Investments is a Madrid-based club of investors that has invested across a range of sectors and technologies. It has conducted two selection rounds to date, in 2013 and 2017. The group looks for scaleable opportunities that help its portfolio companies derive synergies among themselves so that they potentially collaborate with, and become customers of, one another. The firm has seen one exit to date.

Pinama Investments is a Madrid-based club of investors that has invested across a range of sectors and technologies. It has conducted two selection rounds to date, in 2013 and 2017. The group looks for scaleable opportunities that help its portfolio companies derive synergies among themselves so that they potentially collaborate with, and become customers of, one another. The firm has seen one exit to date.

Genesia Ventures is a Japanese VC firm founded and led by former CyberAgent Ventures executive Soichi Tajima. The company's name is a portmanteau word combining "genesis" and "Asia" and the fund focuses on seed and pre-Series A rounds. It has backed startups in new media and those implementing new technology to traditional sectors. Its portfolio includes Japanese companies Sukedachi and Linc Corporation as well as Southeast Asian startups Homedy and Bobobox.

Genesia Ventures is a Japanese VC firm founded and led by former CyberAgent Ventures executive Soichi Tajima. The company's name is a portmanteau word combining "genesis" and "Asia" and the fund focuses on seed and pre-Series A rounds. It has backed startups in new media and those implementing new technology to traditional sectors. Its portfolio includes Japanese companies Sukedachi and Linc Corporation as well as Southeast Asian startups Homedy and Bobobox.

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

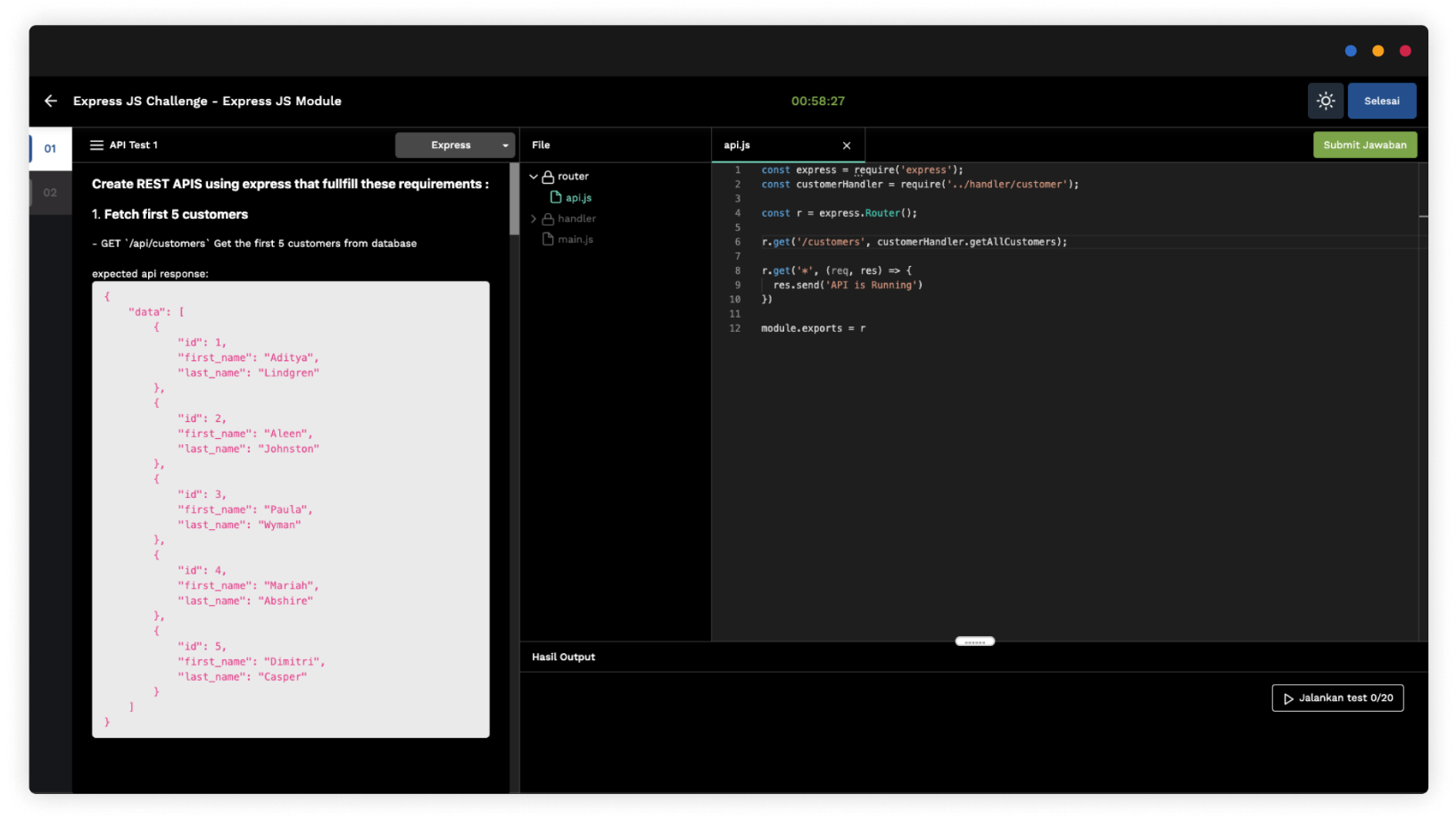

Algobash: SaaS for more effective IT hiring in Indonesia

With its remote assessment and automated interview platform, Algobash seeks faster, fairer and more inclusive recruitment and training of coders, to support tech growth in Indonesia

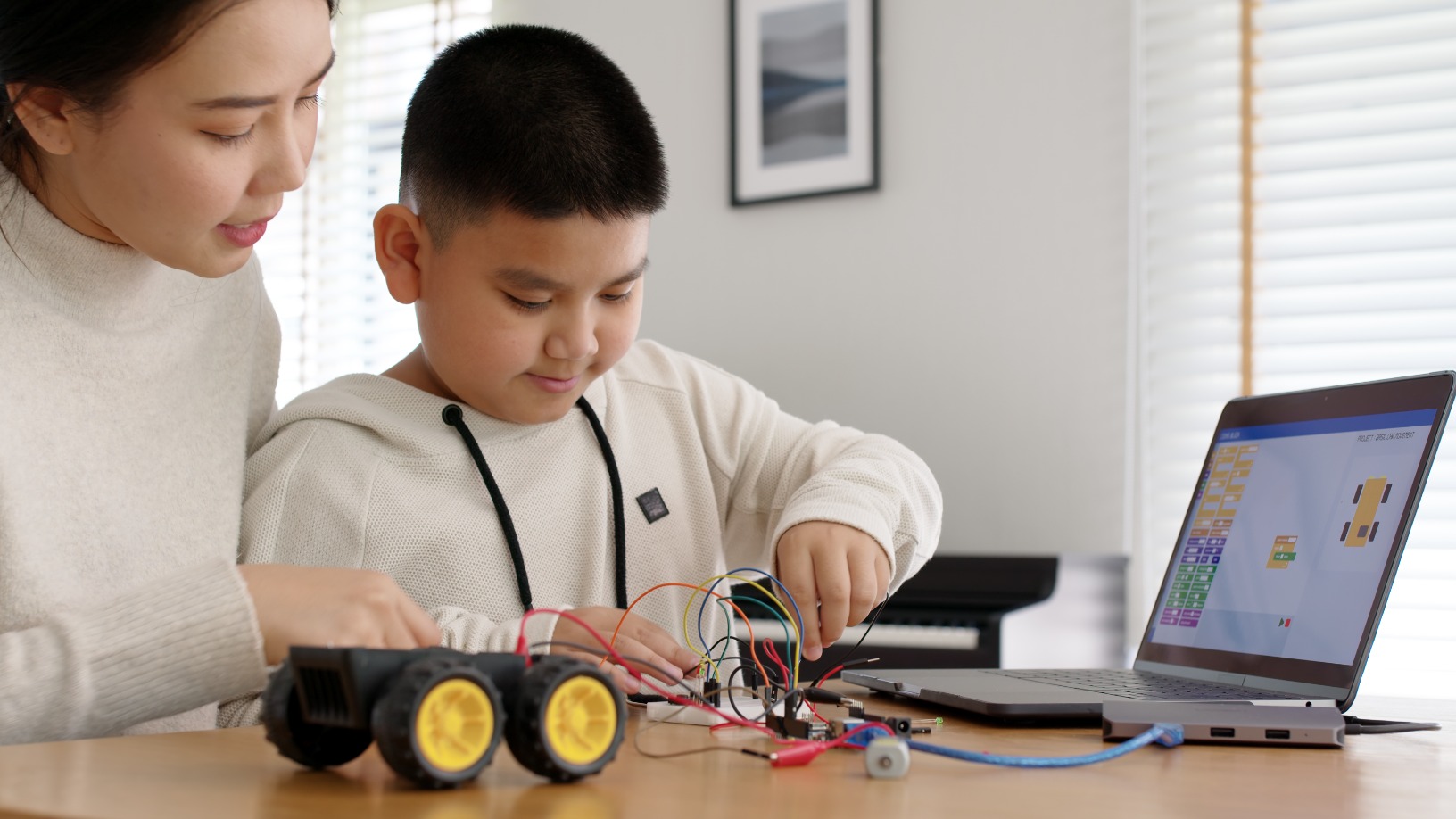

China edtech companies pivot to survive private tutoring crackdown

AI adaptive personalized learning is the bright star, attracting investors and corporates

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

South Summit 2021: Key insights on going from startup to scaleup in Spain

Company culture, talent acquisition and ecosystem support are top-of-mind for Voicemod’s Jaime Bosch and Jobandtalent’s Juan Urdiales in scaling startups up from zero to hero

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

TherapyChat: Using AI to scale and improve accuracy in mental health treatment

Business for the Spanish startup has surged ninefold since Covid-19, with the company expanding to the UK and Italy

Stockeld Dreamery: Vegan cheese created together with chefs

Backed by €16.5m in new funding, Stockeld Dreamery sets to expand into Europe and North America, and double its team to 50 a year on

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Mindtera: Building mental resilience through bite-sized lessons

Mindtera wants to nip mental health issues in the bud by equipping working adults with skills to navigate work challenges and personal relationships, using their phones

Senior Deli: Creating easy-to-swallow, appealing food for dysphagia sufferers

Already supplying to over 200 senior homes and hospitals, the Future Food Asia 2021 co-winner uses proprietary tech to make nutritious, affordable texture-modified foods for people with swallowing difficulties