Banking

This function is exclusive for Premium subscribers

DATABASE (13)

ARTICLES (28)

Using big data and predictive risk analysis, Pula is helping 4.4m farmers to boost yields, get insurance to protect their livelihoods against environmental hazards.

Using big data and predictive risk analysis, Pula is helping 4.4m farmers to boost yields, get insurance to protect their livelihoods against environmental hazards.

Micro-investing app, aimed at half of the world's millennials without retirement plans, rounds up users' card purchases to the nearest euro, saving the difference.

Micro-investing app, aimed at half of the world's millennials without retirement plans, rounds up users' card purchases to the nearest euro, saving the difference.

In two years, this social trends monitoring platform has launched over 30 projects worldwide, letting businesses and governments anticipate, detect and track behavior and movements.

In two years, this social trends monitoring platform has launched over 30 projects worldwide, letting businesses and governments anticipate, detect and track behavior and movements.

The first cryptocurrency project to be backed by a central bank, Coinffeine disrupted bitcoin exchanges with its decentralized P2P model.

The first cryptocurrency project to be backed by a central bank, Coinffeine disrupted bitcoin exchanges with its decentralized P2P model.

Galician startup uses blockchain technology to provide legal validity to formal legal meetings, saving up to 80% of related corporate and legal costs

Galician startup uses blockchain technology to provide legal validity to formal legal meetings, saving up to 80% of related corporate and legal costs

Mastercard, established in 1966, has made 12 acquisitions to date and has a special interest in secure payment systems and different technologies associated with their implementation. It has a special interest in secure payment systems and different technologies associated with their implementation. Since launch in early 2014, MasterCard Start Path, the company’s effort to support innovative early stage startups around the world, has partnered with over 40 startups across the globe in areas including biometrics, big data, wearable technology, beacons, B2B payments, and logistics.

Mastercard, established in 1966, has made 12 acquisitions to date and has a special interest in secure payment systems and different technologies associated with their implementation. It has a special interest in secure payment systems and different technologies associated with their implementation. Since launch in early 2014, MasterCard Start Path, the company’s effort to support innovative early stage startups around the world, has partnered with over 40 startups across the globe in areas including biometrics, big data, wearable technology, beacons, B2B payments, and logistics.

Shinhan is a Korea-based investment bank that provides commercial and consumer banking-related financial and investment services, aiming to help clients achieve their goals by providing financial products and services that meet the latest trends while delivering high returns. It seeks innovative new solutions using a methodology it calls "creative finance," which it believes will attract more clients, in turn increasing Shinhan’s corporate value and leading to a "virtuous cycle of shared prosperity."

Shinhan is a Korea-based investment bank that provides commercial and consumer banking-related financial and investment services, aiming to help clients achieve their goals by providing financial products and services that meet the latest trends while delivering high returns. It seeks innovative new solutions using a methodology it calls "creative finance," which it believes will attract more clients, in turn increasing Shinhan’s corporate value and leading to a "virtuous cycle of shared prosperity."

Mónica Delclaux has over 30 years of professional experience in the financial sector, specializing in stock markets. She is a member of the Spanish Institute of Financial Analysts and the Spanish Association of Accounting and Business Management (AECA).Delclaux is the CFO of Magallanes Value Investors SA SGIIC, a Spanish asset management company offering portfolio management, equity, financial planning, and advisory services.

Mónica Delclaux has over 30 years of professional experience in the financial sector, specializing in stock markets. She is a member of the Spanish Institute of Financial Analysts and the Spanish Association of Accounting and Business Management (AECA).Delclaux is the CFO of Magallanes Value Investors SA SGIIC, a Spanish asset management company offering portfolio management, equity, financial planning, and advisory services.

Blanca Hernández Rodriguez holds a Master's Degree in Finance from CUNEF, a private Spanish university specializing in banking and finance that is based in Madrid. She has over 20 years’ experience in value investing. Her career started in the Arcalia group. She later established and managed a family office fund.Today, Hernández Rodriguez is the CEO of Magallanes Value Investors SA SGIIC, a Spanish asset management company offering portfolio management, equity, financial planning and advisory services.

Blanca Hernández Rodriguez holds a Master's Degree in Finance from CUNEF, a private Spanish university specializing in banking and finance that is based in Madrid. She has over 20 years’ experience in value investing. Her career started in the Arcalia group. She later established and managed a family office fund.Today, Hernández Rodriguez is the CEO of Magallanes Value Investors SA SGIIC, a Spanish asset management company offering portfolio management, equity, financial planning and advisory services.

BRI Ventures is the corporate VC arm of Indonesian state-owned bank BRI. It was established in 2019 and brought in Nicko Widjaja, who previously worked for MDI Ventures (another state-owned CVC linked to Telkom) as their CEO. They have a stake in the state-linked e-wallet company LinkAja as well as bill aggregator service AyoPop. Their investment activities began in earnest in 2020, with their participation in TaniGroup's Series A+ and Investree's Series C rounds.

BRI Ventures is the corporate VC arm of Indonesian state-owned bank BRI. It was established in 2019 and brought in Nicko Widjaja, who previously worked for MDI Ventures (another state-owned CVC linked to Telkom) as their CEO. They have a stake in the state-linked e-wallet company LinkAja as well as bill aggregator service AyoPop. Their investment activities began in earnest in 2020, with their participation in TaniGroup's Series A+ and Investree's Series C rounds.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Investisseurs & Partenaires (I&P)

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

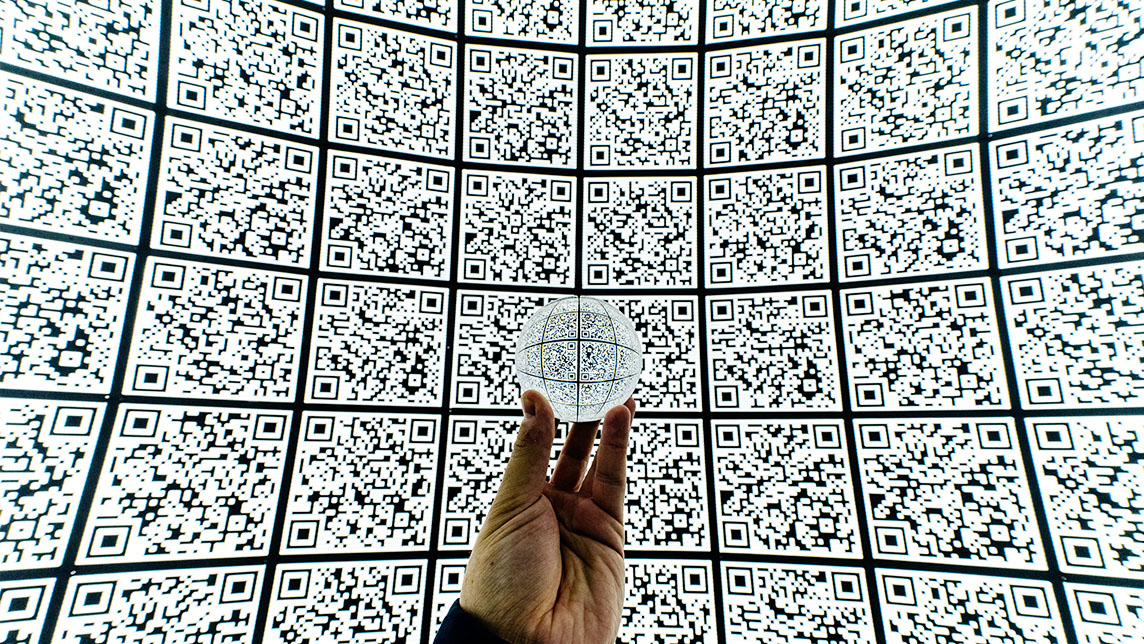

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

Coinscrap: Digital piggy banks for millennials

Smart savings app helps young consumers save and invest every cent of spare change by rounding up payments for purchases

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

Citibeats, a social trends monitoring tool for governments and businesses, wins €1.4m funding

Citibeats tracks and analyzes what the public is saying online in any language; wants to boost its presence in LatAm and Asia

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Bailian.ai: Using Internet big data, AI to help corporates acquire customers

Previously, a salesperson who got five or six customer leads was considered fortunate. Now, using Bailian.ai, thousands, or even millions, of leads can be found at once

ZendMoney: Putting cash back into the pockets of Indonesian migrant workers

ZendMoney's unique remittance concept has already helped 90,000 migrant workers send money back home

With universal QR code, Indonesia achieves e-payment harmony

The move to standardize Indonesia's QR code is expected to unify the country's cashless payments system and lift tens of thousands of small merchants into the payments mainstream

Analysing and leveraging data: Interview with Datanest co-founders

From credit scoring to demand forecasting, Datanest has built many machine-learning products and looks to raise new funding, expand beyond Indonesia

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

Kantox: Value for corporates, headache for banks

Moving beyond its initial remit of currency exchange, Europe's fourth-fastest growing fintech Kantox has garnered awards and financial sector hostility as it differentiates itself in a crowded marketplace

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

- 1

- 2