E-commerce

This function is exclusive for Premium subscribers

-

DATABASE (251)

-

ARTICLES (146)

K11 is a shopping mall brand based in Hong Kong. It was founded in 2008 by entrepreneur Adrian Cheng. Cheng’s family owns and controls Hong Kong conglomerate New World Development, which deals mainly in property, infrastructure and services, department stores and hotels, and jewelry group Chow Tai Fook.

K11 is a shopping mall brand based in Hong Kong. It was founded in 2008 by entrepreneur Adrian Cheng. Cheng’s family owns and controls Hong Kong conglomerate New World Development, which deals mainly in property, infrastructure and services, department stores and hotels, and jewelry group Chow Tai Fook.

After earning his MBA at the Wharton School of the University of Pennsylvania, Zhang worked as an advisor at American Management Systems, an IT consulting firm based in the US. In 2003, he founded Dianping.com, one of China’s biggest online lifestyle services providers, and served as CEO and chairman until 2015. After Dianping.com merged with group-buying giant Meituan in 2015, Zhang became chairman of Meituan-Dianping.

After earning his MBA at the Wharton School of the University of Pennsylvania, Zhang worked as an advisor at American Management Systems, an IT consulting firm based in the US. In 2003, he founded Dianping.com, one of China’s biggest online lifestyle services providers, and served as CEO and chairman until 2015. After Dianping.com merged with group-buying giant Meituan in 2015, Zhang became chairman of Meituan-Dianping.

Born in Shanghai in 1973, Zhang and his parents immigrated to the US in 1987. He received his bachelor’s in Neurobiology from the University of California, San Francisco in 1995 and his master’s in Biotechnology and Business from Northwestern University in 1999. Zhang worked at Salomon Smith Barney and ABN AMRO Capital from 1999–2001. He then served as managing director and head of China operations at venture capital firm WI Harper Group from 2002–2008. Zhang has since served as founding managing partner at Matrix Partners China.

Born in Shanghai in 1973, Zhang and his parents immigrated to the US in 1987. He received his bachelor’s in Neurobiology from the University of California, San Francisco in 1995 and his master’s in Biotechnology and Business from Northwestern University in 1999. Zhang worked at Salomon Smith Barney and ABN AMRO Capital from 1999–2001. He then served as managing director and head of China operations at venture capital firm WI Harper Group from 2002–2008. Zhang has since served as founding managing partner at Matrix Partners China.

Lei is co-founder, chairman and CEO of Xiaomi, one of the world’s largest smartphone companies. Born in December 1969, he holds a degree in Engineering from Wuhan University. With a personal net worth of US$11.2 billion, Lei has invested in 33 companies as a business angel, including Vancl.com, UCWeb, and YY Inc., a live streaming social media platform in China. He has also invested in 270 companies through Shunwei Capital, where he is a founding partner. Lei's investment focuses are e-commerce, mobile internet and social networking.

Lei is co-founder, chairman and CEO of Xiaomi, one of the world’s largest smartphone companies. Born in December 1969, he holds a degree in Engineering from Wuhan University. With a personal net worth of US$11.2 billion, Lei has invested in 33 companies as a business angel, including Vancl.com, UCWeb, and YY Inc., a live streaming social media platform in China. He has also invested in 270 companies through Shunwei Capital, where he is a founding partner. Lei's investment focuses are e-commerce, mobile internet and social networking.

Owned by French investment group Eurazeo, Idinvest Partners was founded in 1997 in Paris, France, as AGF Private Equity and operated as part of German multinational Allianz until 2010, when it became an independent entity. With additional offices in Madrid, Frankfurt, Shanghai and Dubai, Idinvest manages €8bn in assets and has invested in around 4,000 companies, with 75 exits. It specializes in private equity and venture capital financing of European small and mid-size startups and has been named Best Private Equity Team by Deloitte in its 2012 Technology Fast 50 Awards. The company was acquired by Eurazeo in April 2018.

Owned by French investment group Eurazeo, Idinvest Partners was founded in 1997 in Paris, France, as AGF Private Equity and operated as part of German multinational Allianz until 2010, when it became an independent entity. With additional offices in Madrid, Frankfurt, Shanghai and Dubai, Idinvest manages €8bn in assets and has invested in around 4,000 companies, with 75 exits. It specializes in private equity and venture capital financing of European small and mid-size startups and has been named Best Private Equity Team by Deloitte in its 2012 Technology Fast 50 Awards. The company was acquired by Eurazeo in April 2018.

Partech Ventures is a global venture capital firm established in San Francisco in 1982 as Paribas Technologies, a subsidiary of French bank Paribas that currently holds €1.3 billion in assets under its management. In addition to San Francisco, Partech also has offices in Paris, Berlin and Dakar, Senegal, with the latter focused exclusively on African startups. The company is now based in Paris and has invested in over 300 companies across different funding stages with 48 exits to date.

Partech Ventures is a global venture capital firm established in San Francisco in 1982 as Paribas Technologies, a subsidiary of French bank Paribas that currently holds €1.3 billion in assets under its management. In addition to San Francisco, Partech also has offices in Paris, Berlin and Dakar, Senegal, with the latter focused exclusively on African startups. The company is now based in Paris and has invested in over 300 companies across different funding stages with 48 exits to date.

Lanzadera was founded in 2013 by entrepreneur Juan Roig, Spain's third richest individual and the CEO and biggest single shareholder of the country's largest supermarket group, Mercadona. Roig personally keeps track of the performance of the startups managed by the business incubator and accelerator based in Valencia, Spain.Lanzadera has invested €21m in almost 200 tech startups and consumer-focused offline businesses. To date, it has completed one exit via Groupify. Since 2016, Lanzadera has also specialized in video game development with Sony Interactive Entertainment Spain. The Lanzadera programs include training and assessments over a period of 9–11 months at its attractive Valencia marina location.

Lanzadera was founded in 2013 by entrepreneur Juan Roig, Spain's third richest individual and the CEO and biggest single shareholder of the country's largest supermarket group, Mercadona. Roig personally keeps track of the performance of the startups managed by the business incubator and accelerator based in Valencia, Spain.Lanzadera has invested €21m in almost 200 tech startups and consumer-focused offline businesses. To date, it has completed one exit via Groupify. Since 2016, Lanzadera has also specialized in video game development with Sony Interactive Entertainment Spain. The Lanzadera programs include training and assessments over a period of 9–11 months at its attractive Valencia marina location.

Established in 2014, WOW Aceleradora is a startup accelerator based in Porto Alegre, Brazil. It has invested over BR$8 million (US$2.1 million) through its network of 170 angel investors, specializing in tech companies.

Established in 2014, WOW Aceleradora is a startup accelerator based in Porto Alegre, Brazil. It has invested over BR$8 million (US$2.1 million) through its network of 170 angel investors, specializing in tech companies.

Seedrocket 4Founders Capital is a business accelerator based in Barcelona. Established in 2017, it has invested in 60 startups including six exits. The accelerator provides promising startups with initial funding of €30,000–€50,000. Additional finance of up to €700,000 per company may also be available for the lifetime of the investment, in conjuction with other business angels and partners.

Seedrocket 4Founders Capital is a business accelerator based in Barcelona. Established in 2017, it has invested in 60 startups including six exits. The accelerator provides promising startups with initial funding of €30,000–€50,000. Additional finance of up to €700,000 per company may also be available for the lifetime of the investment, in conjuction with other business angels and partners.

Rocky Pesik is the son of Rudy Pesik, founder of the Caraka Group of logistics companies and Birotika Semesta, DHL's partner company in Indonesia. Rocky is a director at both the Caraka Group and Birotika Semesta and has invested in two startups, logistics startup Pakde and international shopping intermediary GudangImpor.

Rocky Pesik is the son of Rudy Pesik, founder of the Caraka Group of logistics companies and Birotika Semesta, DHL's partner company in Indonesia. Rocky is a director at both the Caraka Group and Birotika Semesta and has invested in two startups, logistics startup Pakde and international shopping intermediary GudangImpor.

Established in 2014 as a private equity firm, Hawthorn Investment engages in equity investment, M&As and capital management. It invests mainly in the emerging automotive technology, healthcare, high-end manufacturing, culture and sports sectors.

Established in 2014 as a private equity firm, Hawthorn Investment engages in equity investment, M&As and capital management. It invests mainly in the emerging automotive technology, healthcare, high-end manufacturing, culture and sports sectors.

Established in Shenzhen in 2007, Share Capital has invested in over 100 companies. Some of its portfolio companies – e.g., NavInfo, Perfect World and BGI – have gone public. Its investment team of nearly 50 members manages more than RMB 6 billion worth of assets. Share Capital has set up a healthcare fund of RMB 1.5 billion and invested in over 70 health-related projects.

Established in Shenzhen in 2007, Share Capital has invested in over 100 companies. Some of its portfolio companies – e.g., NavInfo, Perfect World and BGI – have gone public. Its investment team of nearly 50 members manages more than RMB 6 billion worth of assets. Share Capital has set up a healthcare fund of RMB 1.5 billion and invested in over 70 health-related projects.

Fosun RZ Capital (Fosun Kinzon Capital)

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Mastercard, established in 1966, has made 12 acquisitions to date and has a special interest in secure payment systems and different technologies associated with their implementation. It has a special interest in secure payment systems and different technologies associated with their implementation. Since launch in early 2014, MasterCard Start Path, the company’s effort to support innovative early stage startups around the world, has partnered with over 40 startups across the globe in areas including biometrics, big data, wearable technology, beacons, B2B payments, and logistics.

Mastercard, established in 1966, has made 12 acquisitions to date and has a special interest in secure payment systems and different technologies associated with their implementation. It has a special interest in secure payment systems and different technologies associated with their implementation. Since launch in early 2014, MasterCard Start Path, the company’s effort to support innovative early stage startups around the world, has partnered with over 40 startups across the globe in areas including biometrics, big data, wearable technology, beacons, B2B payments, and logistics.

Founded in 2014, Midas Capital invests mainly in businesses offering customer products and services over the Internet. With offices in Guangzhou, Shenzhen, Beijing and Hangzhou, it currently manages assets worth around RMB 3bn.

Founded in 2014, Midas Capital invests mainly in businesses offering customer products and services over the Internet. With offices in Guangzhou, Shenzhen, Beijing and Hangzhou, it currently manages assets worth around RMB 3bn.

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

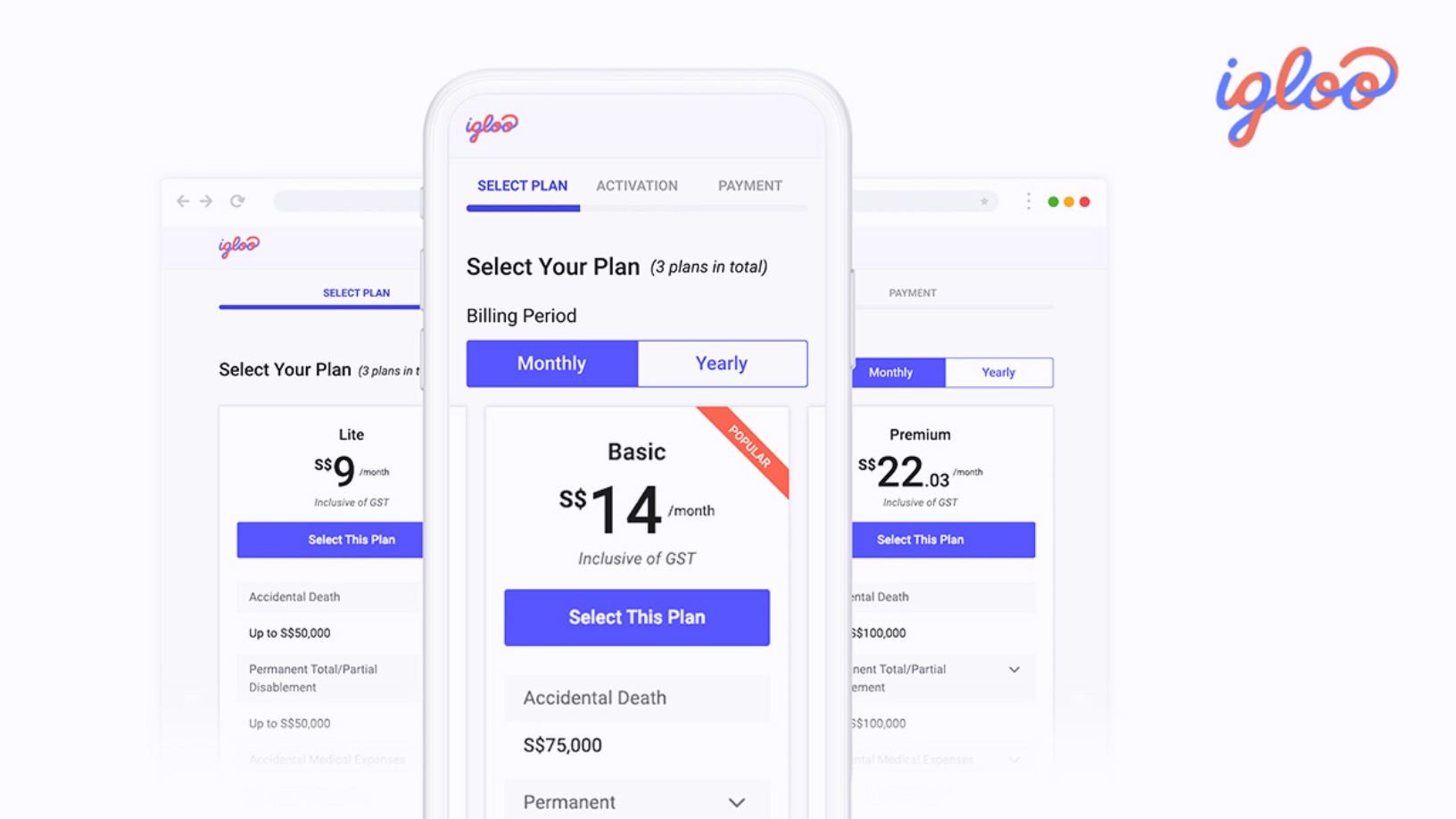

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Petit Pli: Origami-inspired clothes that still fit, even after the body has grown

Founded by a young aeronautical engineer, Petit Pli produces stylish, sustainable pleated garments made from recycled plastic that expand up to seven sizes

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Scoobic: Nifty electric three-wheelers for last-mile deliveries

Traveling up to 100 km on a single battery charge, Scoobic’s EVs, with delivery capacities of vans, is a sustainable solution to traffic jams and parking restrictions

Bukalapak to raise IDR 21tn in Indonesia's biggest IPO yet

Although trailing rivals Tokopedia and Shopee in market share, Bukalapak cut its losses last year and will be Indonesia’s first unicorn to go public

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Gojek and Tokopedia merge to form GoTo

The new entity, now Indonesia’s largest tech group, plans to go public in Indonesia and the US, targeting a $40bn valuation

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic