E-commerce

This function is exclusive for Premium subscribers

DATABASE (251)

ARTICLES (146)

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Jonathan Neman is a co-founder and co-CEO of USA healthy-eating restaurant franchise Sweetgreen. As co-CEO, he has managed the salad chain since opening its first outlet in 2007, raising more than $470m in VC funding in the process. Neman is also an investor in various F&B startups, such as frozen food maker EatPops and Indonesian coffee chain Kopi Kenangan.

Jonathan Neman is a co-founder and co-CEO of USA healthy-eating restaurant franchise Sweetgreen. As co-CEO, he has managed the salad chain since opening its first outlet in 2007, raising more than $470m in VC funding in the process. Neman is also an investor in various F&B startups, such as frozen food maker EatPops and Indonesian coffee chain Kopi Kenangan.

Lighthouse Capital is a boutique investment bank established in 2014. The firm has helped to raise finance for over 75 companies, completing more than 120 private funding deals worth over $11bn in total. Its portfolio of companies is valued at over $100bn, including 19 with unicorn status.Lighthouse Capital also manages four PE funds, worth $250bn, targeted at companies in the growth and later stages in emerging sectors.

Lighthouse Capital is a boutique investment bank established in 2014. The firm has helped to raise finance for over 75 companies, completing more than 120 private funding deals worth over $11bn in total. Its portfolio of companies is valued at over $100bn, including 19 with unicorn status.Lighthouse Capital also manages four PE funds, worth $250bn, targeted at companies in the growth and later stages in emerging sectors.

Founded in 2010, Shenzhen-based Sinoagri E-Commerce is China’s biggest B2B trading platform for agricultural products. It also provides a wide range of services including intelligence, third-party storage & logistics, financing and technical support to producers, manufacturers, suppliers and retailers along the whole supply chain.

Founded in 2010, Shenzhen-based Sinoagri E-Commerce is China’s biggest B2B trading platform for agricultural products. It also provides a wide range of services including intelligence, third-party storage & logistics, financing and technical support to producers, manufacturers, suppliers and retailers along the whole supply chain.

Juan García Perrote is an IESE Business School MBA graduate with over 10 years of experience in executive marketing roles. He is also serial entrepreneur in marketplace and digital marketing startups. He was the co-founder of Tick4all, the “last-minute of movie-tickets,” offering discounted seats at local cinemas, and COO of the referral marketing platform Fulltip. He was also partner and CEO of the digital marketing company Smart Client.Currently, he is CEO and founder of Ketplace, a marketplace sales management consultancy advising companies how to get the best sales performance in leading marketplaces such as Amazon, eBay, and AliExpress. García Perrote is also a partner and advisor in The Beemine Lab, the first biotechnology company in Spain to produce cannabidiol-based cosmetics.

Juan García Perrote is an IESE Business School MBA graduate with over 10 years of experience in executive marketing roles. He is also serial entrepreneur in marketplace and digital marketing startups. He was the co-founder of Tick4all, the “last-minute of movie-tickets,” offering discounted seats at local cinemas, and COO of the referral marketing platform Fulltip. He was also partner and CEO of the digital marketing company Smart Client.Currently, he is CEO and founder of Ketplace, a marketplace sales management consultancy advising companies how to get the best sales performance in leading marketplaces such as Amazon, eBay, and AliExpress. García Perrote is also a partner and advisor in The Beemine Lab, the first biotechnology company in Spain to produce cannabidiol-based cosmetics.

Zhongguancun Longmen Investment

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

Artesmedia is a Spanish media group, with a cross-channel presence through television, radio and cinemas. The company typically invest through media for equity deals.The group has backed to date fast-growing and customer-oriented startups in Spain such as Wallapop, Groupalia and Restaurantes.com

Artesmedia is a Spanish media group, with a cross-channel presence through television, radio and cinemas. The company typically invest through media for equity deals.The group has backed to date fast-growing and customer-oriented startups in Spain such as Wallapop, Groupalia and Restaurantes.com

IDC Ventures is the VC arm of Grupo IDC, a Latin American investment bank. The fund was created in 2019 by corporate executives, entrepreneurs and investors from Latin America, focused on pre-Series A to Series B rounds. Headquartered in Madrid with offices in Copenhagen and Guatemala, the company acts as an international VC working with tech companies to accelerate expansion across LatAm markets. Sectors of interest include fintech, on-demand transportation, digital tools for small and large retailers, and commercialization platforms for robotics.

IDC Ventures is the VC arm of Grupo IDC, a Latin American investment bank. The fund was created in 2019 by corporate executives, entrepreneurs and investors from Latin America, focused on pre-Series A to Series B rounds. Headquartered in Madrid with offices in Copenhagen and Guatemala, the company acts as an international VC working with tech companies to accelerate expansion across LatAm markets. Sectors of interest include fintech, on-demand transportation, digital tools for small and large retailers, and commercialization platforms for robotics.

Founded in 1999, TLCOM Capital now has offices in Kenya, Nigeria and the UK. Originally a global VC investor, its key investment objective now is to tackle Africa’s greatest challenges via its TIDE Africa Fund that was established in 2017.Total funding to date stands at $300m and investments range from $500,000 to $10m. It currently has 12 portfolio companies and has managed 13 exits. Recent investments include the $6m Series A round of Kenyan agro-focused insurtech PULA and the $7.5m Series A round of Nigerian edtech uLesson Education.

Founded in 1999, TLCOM Capital now has offices in Kenya, Nigeria and the UK. Originally a global VC investor, its key investment objective now is to tackle Africa’s greatest challenges via its TIDE Africa Fund that was established in 2017.Total funding to date stands at $300m and investments range from $500,000 to $10m. It currently has 12 portfolio companies and has managed 13 exits. Recent investments include the $6m Series A round of Kenyan agro-focused insurtech PULA and the $7.5m Series A round of Nigerian edtech uLesson Education.

Founded in 2015, M25 is an early-stage VC based in Chicago, investing solely in companies headquartered in the US Midwest across tech sectors, almost exclusively at seed stage. It currently has 77 companies in its portfolio and has managed eight exits to date. Its most recent investments include in gaming monetization app Metafy’s $3m seed round in December 2020 and in the $2.7m seed round of mobile online store creation app CASHDROP in August 2020. It invests from $100,000 at the idea stage through to $25m per startup.Im sorry but I dont see that investing in 15 different sectors is actually a focus that is why I put General. it´s mosre like what sectors do they not invest in?

Founded in 2015, M25 is an early-stage VC based in Chicago, investing solely in companies headquartered in the US Midwest across tech sectors, almost exclusively at seed stage. It currently has 77 companies in its portfolio and has managed eight exits to date. Its most recent investments include in gaming monetization app Metafy’s $3m seed round in December 2020 and in the $2.7m seed round of mobile online store creation app CASHDROP in August 2020. It invests from $100,000 at the idea stage through to $25m per startup.Im sorry but I dont see that investing in 15 different sectors is actually a focus that is why I put General. it´s mosre like what sectors do they not invest in?

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

PayPal is the US-based online payments company founded in 1999 and acquired by eBay in 2002. It is listed in NASDAQ under the ticker code PYPL.Besides facilitating online payments and money transfers for many e-commerce companies and other internet-based businesses, it is famous for its network of former founders and other alumni, many of whom went on to establish successful companies or became investors in the tech and internet industries. Some famous names linked to this network, sometimes called “PayPal Mafia”, include ex-CEO Peter Thiel, Elon Musk, Dave McClure (founder of 500 Startups), and Reid Hoffman (LinkedIn co-founder).PayPal has invested in several companies, including ride-hailing firms Gojek and Uber and e-commerce platform MercadoLibre. It has also established PayPal Ventures as a separate VC arm and PayPal Incubator to support early-stage startups.

PayPal is the US-based online payments company founded in 1999 and acquired by eBay in 2002. It is listed in NASDAQ under the ticker code PYPL.Besides facilitating online payments and money transfers for many e-commerce companies and other internet-based businesses, it is famous for its network of former founders and other alumni, many of whom went on to establish successful companies or became investors in the tech and internet industries. Some famous names linked to this network, sometimes called “PayPal Mafia”, include ex-CEO Peter Thiel, Elon Musk, Dave McClure (founder of 500 Startups), and Reid Hoffman (LinkedIn co-founder).PayPal has invested in several companies, including ride-hailing firms Gojek and Uber and e-commerce platform MercadoLibre. It has also established PayPal Ventures as a separate VC arm and PayPal Incubator to support early-stage startups.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

SoftBank Internet and Media Inc (SIMI)

Founded by the charismatic Japanese billionaire Masayoshi Son, SoftBank Group Corp is a multinational conglomerate with assets totaling about $342bn in 2020. SoftBank is best known in Japan for its mobile phone network and distribution business, and it was the sole distributor of the Apple iPhone in Japan until 2011. SoftBank also has subsidiaries in online gaming, publishing, and energy, and owns stakes in Alibaba Group and Sprint.Outside of Japan, SoftBank is known for its venture capital investments. In October 2016, it teamed up with Saudi Arabia's Public Investment Fund to lead a $100bn tech fund, named Vision Fund. Through Vision Fund, SoftBank has made some major high-profile investments into tech companies, such as TikTok developer ByteDance, e-commerce platforms like Coupang, Tokopedia and Flipkart, and coworking operator WeWork.

Founded by the charismatic Japanese billionaire Masayoshi Son, SoftBank Group Corp is a multinational conglomerate with assets totaling about $342bn in 2020. SoftBank is best known in Japan for its mobile phone network and distribution business, and it was the sole distributor of the Apple iPhone in Japan until 2011. SoftBank also has subsidiaries in online gaming, publishing, and energy, and owns stakes in Alibaba Group and Sprint.Outside of Japan, SoftBank is known for its venture capital investments. In October 2016, it teamed up with Saudi Arabia's Public Investment Fund to lead a $100bn tech fund, named Vision Fund. Through Vision Fund, SoftBank has made some major high-profile investments into tech companies, such as TikTok developer ByteDance, e-commerce platforms like Coupang, Tokopedia and Flipkart, and coworking operator WeWork.

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

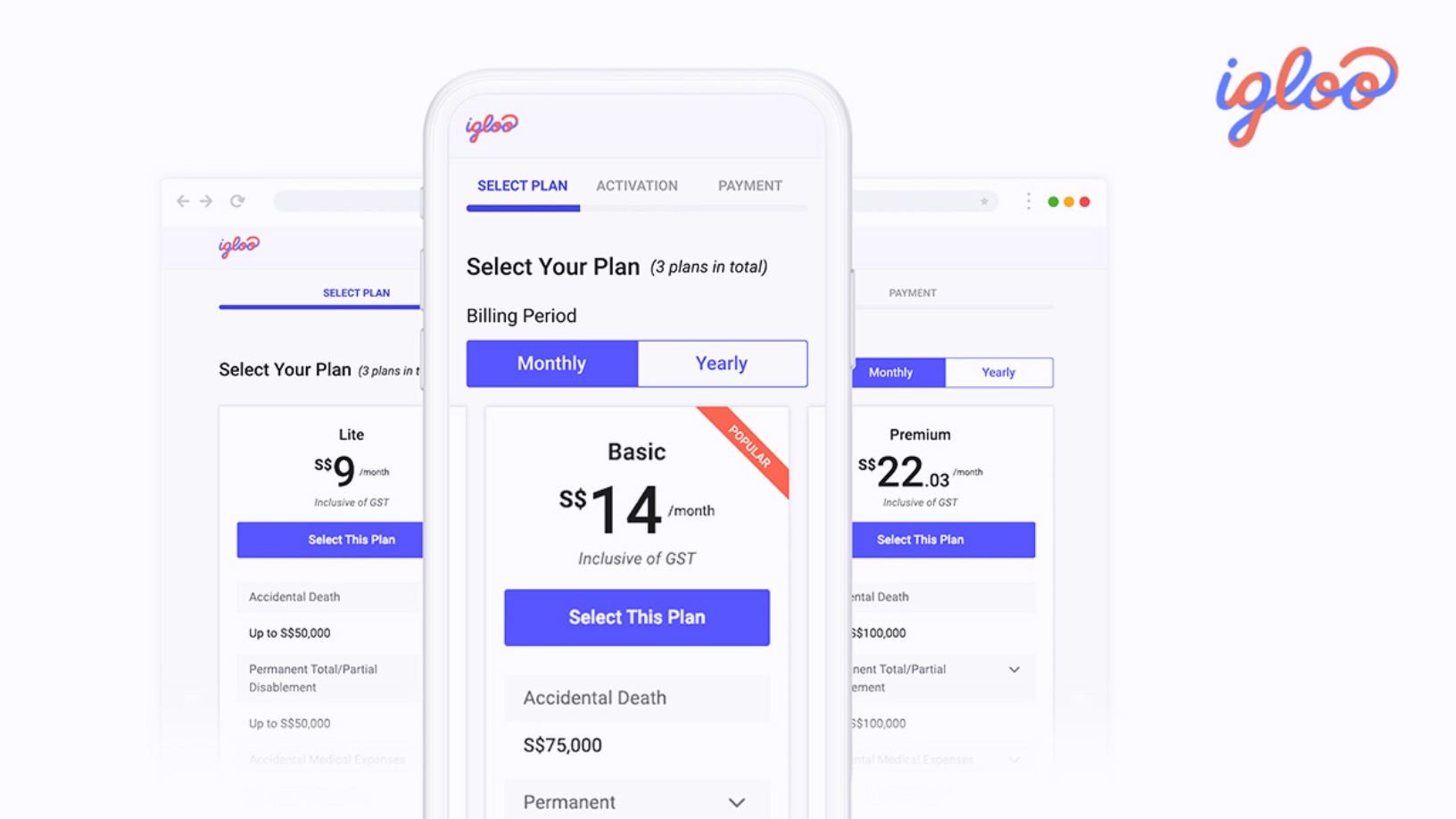

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Petit Pli: Origami-inspired clothes that still fit, even after the body has grown

Founded by a young aeronautical engineer, Petit Pli produces stylish, sustainable pleated garments made from recycled plastic that expand up to seven sizes

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Scoobic: Nifty electric three-wheelers for last-mile deliveries

Traveling up to 100 km on a single battery charge, Scoobic’s EVs, with delivery capacities of vans, is a sustainable solution to traffic jams and parking restrictions

Bukalapak to raise IDR 21tn in Indonesia's biggest IPO yet

Although trailing rivals Tokopedia and Shopee in market share, Bukalapak cut its losses last year and will be Indonesia’s first unicorn to go public

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Gojek and Tokopedia merge to form GoTo

The new entity, now Indonesia’s largest tech group, plans to go public in Indonesia and the US, targeting a $40bn valuation

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic