Edtech

This function is exclusive for Premium subscribers

DATABASE (163)

ARTICLES (75)

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Established in 2012, Cyzone Angel Fund is an angel venture investment fund subsidiary of Cyzone, which runs the Chuangyebang magazine. They focus on early stage investment in internet, mobile internet, digital media, hardware and life style sectors.

Established in 2012, Cyzone Angel Fund is an angel venture investment fund subsidiary of Cyzone, which runs the Chuangyebang magazine. They focus on early stage investment in internet, mobile internet, digital media, hardware and life style sectors.

Samator Education is part of the Indonesian conglomerate PT Samator, with business interests in the petrochemical, real estate, healthcare and automotive industries. To date, it has only backed one company: HarukaEdu, an edtech startup that provides online courses and degree programs in Indonesia.

Samator Education is part of the Indonesian conglomerate PT Samator, with business interests in the petrochemical, real estate, healthcare and automotive industries. To date, it has only backed one company: HarukaEdu, an edtech startup that provides online courses and degree programs in Indonesia.

Pearson Affordable Learning Fund

Pearson Affordable Learning Fund (PALF) is the venture capital arm of Pearson, the world’s largest education company. With investments in 10 education startups and a total of 350,000 learners,PALF is expanding its range of affordable education solutions in Africa, Asia and Latin America. Indonesia’s online learning provider HarukaEdu is the 11th addition.It is PALF’s first foray into the online higher education market.

Pearson Affordable Learning Fund (PALF) is the venture capital arm of Pearson, the world’s largest education company. With investments in 10 education startups and a total of 350,000 learners,PALF is expanding its range of affordable education solutions in Africa, Asia and Latin America. Indonesia’s online learning provider HarukaEdu is the 11th addition.It is PALF’s first foray into the online higher education market.

One of the earliest VC/PE firms in China, Shenzhen GTJA Investment focuses on the healthcare/biotech industry. It manages about RMB 10 billion and has invested in more than 100 companies since its inception in 2001.

One of the earliest VC/PE firms in China, Shenzhen GTJA Investment focuses on the healthcare/biotech industry. It manages about RMB 10 billion and has invested in more than 100 companies since its inception in 2001.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

Founded in 2010, Runa Capital is an early-stage VC that invests across North America, Asia and Europe. It manages funds worth US$270m and has invested in more than 40 companies, primarily in the healthcare, fintech, B2B SaaS and education sectors. The firm invested in Capptain, an app management platform acquired by Microsoft in 2014.

Founded in 2010, Runa Capital is an early-stage VC that invests across North America, Asia and Europe. It manages funds worth US$270m and has invested in more than 40 companies, primarily in the healthcare, fintech, B2B SaaS and education sectors. The firm invested in Capptain, an app management platform acquired by Microsoft in 2014.

Mustard Seed MAZE is a Lisbon-based VC firm that invests in early-stage startups, primarily in social impact enterprises. Endowed with €40m, the VC has invested in projects dealing with food wastage, human trafficking, postnatal depression and general healthcare.So far, it has managed one exit, with the majority of its portfolio of 20 companies based in Europe. Recent investment rounds include $3m seed funding for Portuguese mesh network tech HypeLabs, €1.15m seed round for Spanish fintech StudentFinance and $12m Series B round for UK-based food waste app Winnow.

Mustard Seed MAZE is a Lisbon-based VC firm that invests in early-stage startups, primarily in social impact enterprises. Endowed with €40m, the VC has invested in projects dealing with food wastage, human trafficking, postnatal depression and general healthcare.So far, it has managed one exit, with the majority of its portfolio of 20 companies based in Europe. Recent investment rounds include $3m seed funding for Portuguese mesh network tech HypeLabs, €1.15m seed round for Spanish fintech StudentFinance and $12m Series B round for UK-based food waste app Winnow.

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

KTB Network is a leading investment firm in South Korea, conducting investments across all stages in South Korea, China and the US. KTB Network is the first South Korean investment firm to enter the Chinese PE/VC market. Since 2000, it has invested in 40+ companies in China.

Creadev was created in 2002 in France as the private equity arm of the Mulliez family. Creadev expanded to Shanghai in 2012, through a unit called Crehol China. It has since been renamed Creadev China.

Creadev was created in 2002 in France as the private equity arm of the Mulliez family. Creadev expanded to Shanghai in 2012, through a unit called Crehol China. It has since been renamed Creadev China.

Founded in October 2015, Pagoda Investment is a private equity firm focusing on TMT, consumer products, healthcare and education. Its key investors include Queensland Investment Corporation Limited, a Queensland-based Australian VC, and some European-based family funds as well as pension funds, with a total of RMB 5bn under management.

Founded in October 2015, Pagoda Investment is a private equity firm focusing on TMT, consumer products, healthcare and education. Its key investors include Queensland Investment Corporation Limited, a Queensland-based Australian VC, and some European-based family funds as well as pension funds, with a total of RMB 5bn under management.

Founded by famous angel investor Cai Wensheng, founder and chairman of Meitu, Longling Capital is an equity investment firm that invests primarily in early-stage tech startups.

Founded by famous angel investor Cai Wensheng, founder and chairman of Meitu, Longling Capital is an equity investment firm that invests primarily in early-stage tech startups.

Algobash: SaaS for more effective IT hiring in Indonesia

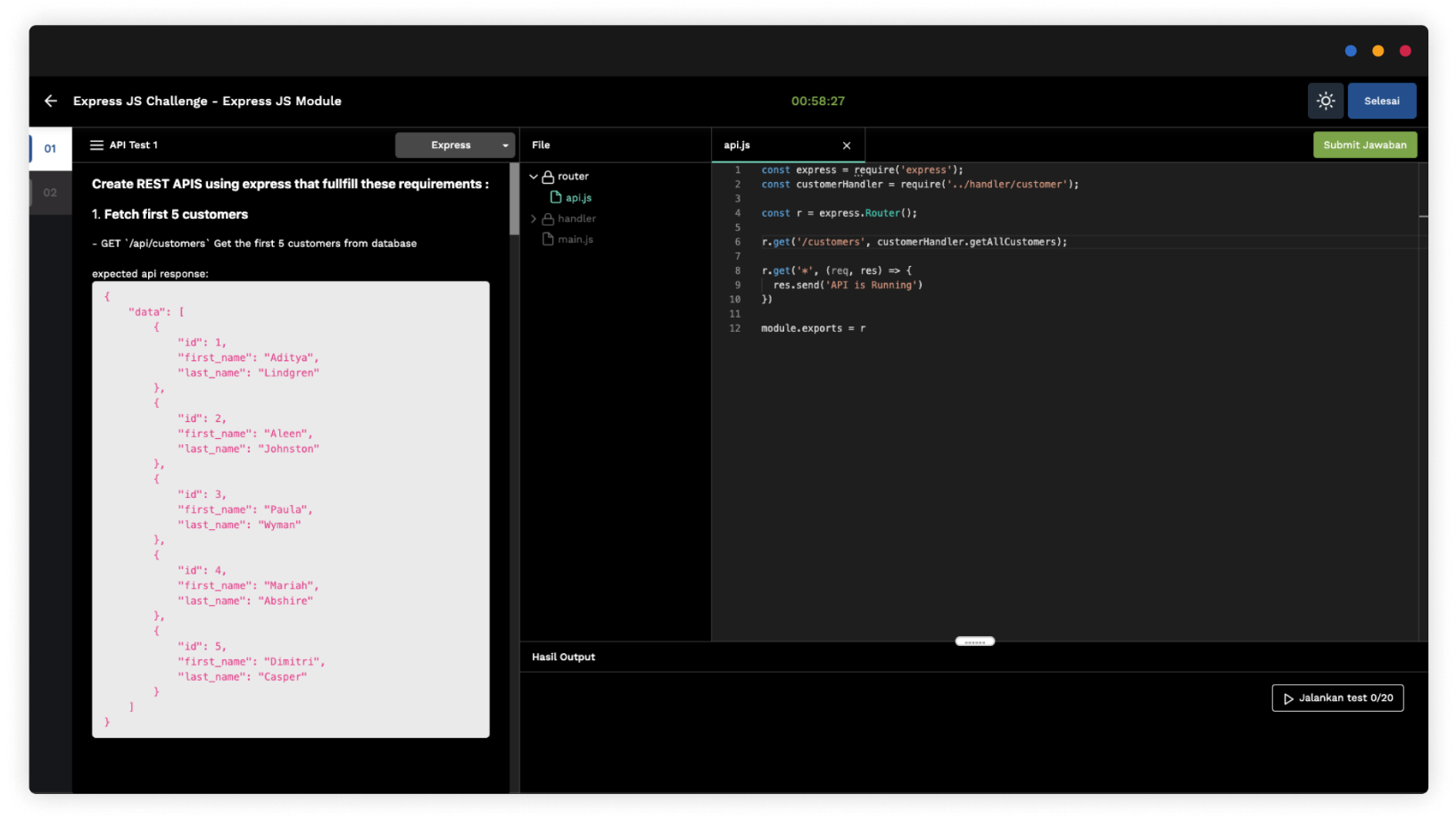

With its remote assessment and automated interview platform, Algobash seeks faster, fairer and more inclusive recruitment and training of coders, to support tech growth in Indonesia

China edtech companies pivot to survive private tutoring crackdown

AI adaptive personalized learning is the bright star, attracting investors and corporates

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

Mindtera: Building mental resilience through bite-sized lessons

Mindtera wants to nip mental health issues in the bud by equipping working adults with skills to navigate work challenges and personal relationships, using their phones

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic

Indonesian edtechs attract funding even as students head back to school

With services that complement and support conventional schools at a fraction of offline tuition cost, edtech companies are likely to continue growing

Can Indonesia plug its tech talent gap to keep its digital economy growing?

Local institutions are stepping up to boost tech skills among students and jobseekers, as the government opens the way for more foreign talent joining startups

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Indonesia 2021 outlook: VCs "cautiously optimistic" on Southeast Asia's largest country

Investors expect Indonesian startups to regain their growth opportunities when the economy reopens with the Covid-19 vaccine rollout, even as some online living and working habits have stuck

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

Intelligent Learning: math app helps students improve their exam score in weeks

Intelligent Learning prepares K7–11 math students for the national senior high school entrance exam, or "zhongkao," by trawling through past questions and predicting what might be tested