Entertainment

This function is exclusive for Premium subscribers

DATABASE (124)

ARTICLES (50)

Winning (Shanghai) Investment Management

Winning (Shanghai) Investment Management was founded in 2015 with Winning (Shanghai) Asset Management as its controlling shareholder. It mainly invests in the sectors of healthcare, consumer goods, entertainment and sports, and advanced manufacturing.

Winning (Shanghai) Investment Management was founded in 2015 with Winning (Shanghai) Asset Management as its controlling shareholder. It mainly invests in the sectors of healthcare, consumer goods, entertainment and sports, and advanced manufacturing.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Voicemod: Voice-tweaking tech that's conquering esports and streamers

Backed by esports and gaming VC BITKRAFT Ventures, Voicemod has become a leading name in voice modification tech for gamers and livestreamers, with 2.5m MAU across 65 countries

South Summit 2021: Key insights on going from startup to scaleup in Spain

Company culture, talent acquisition and ecosystem support are top-of-mind for Voicemod’s Jaime Bosch and Jobandtalent’s Juan Urdiales in scaling startups up from zero to hero

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Gojek and Tokopedia merge to form GoTo

The new entity, now Indonesia’s largest tech group, plans to go public in Indonesia and the US, targeting a $40bn valuation

ScentRealm: Digitally reproducing scents on demand

Unlike colors and sounds, scents are hard to code and digitalize. ScentRealm has not only done it, but has also opened its scent editor and database to the public

Indonesian startup Traval goes virtual to stay afloat during pandemic

The startup is also trying to set itself apart from mainstream tourism with tours like Zero Waste Journey where travelers do not bring plastic items and even plant trees

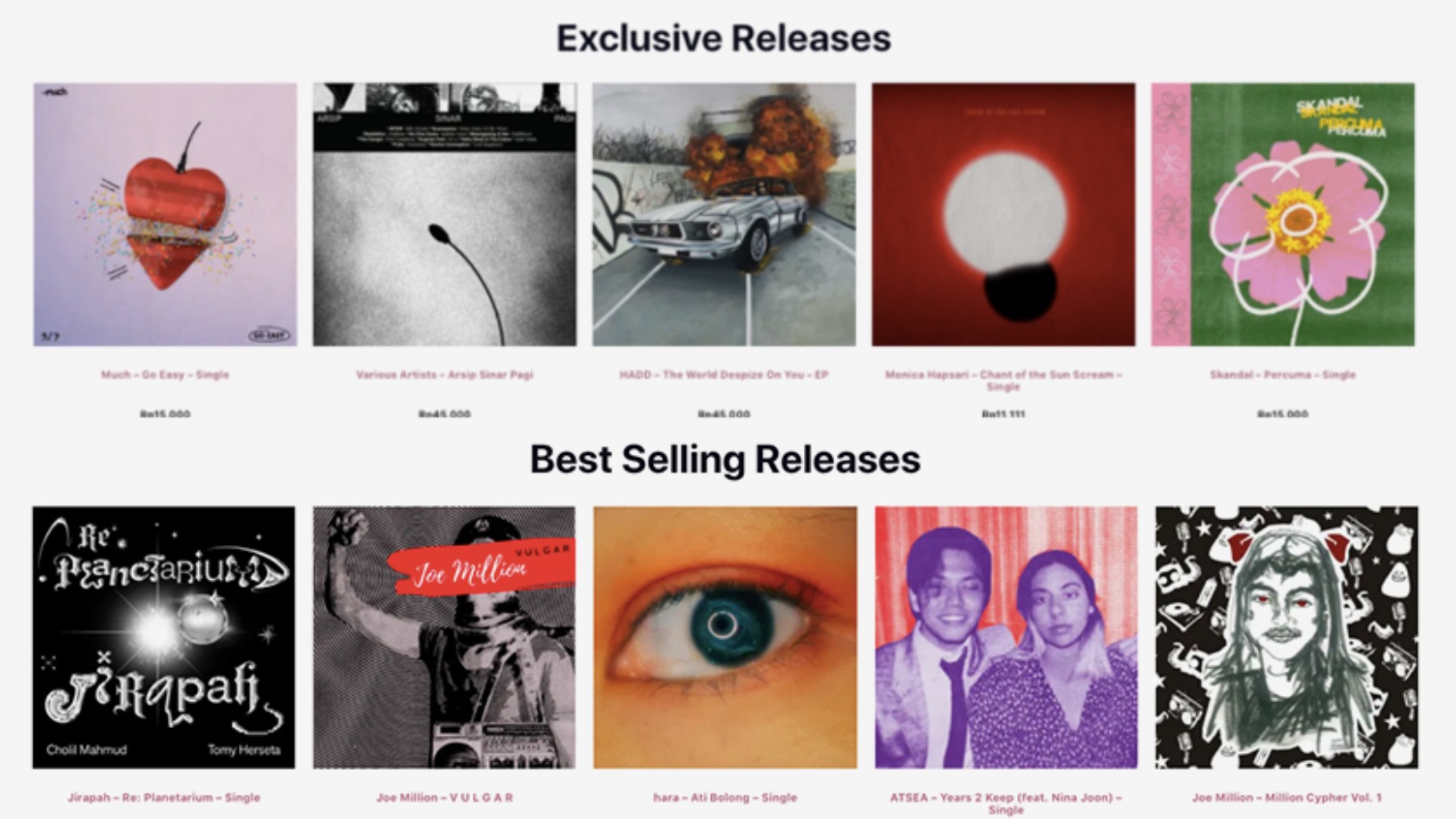

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

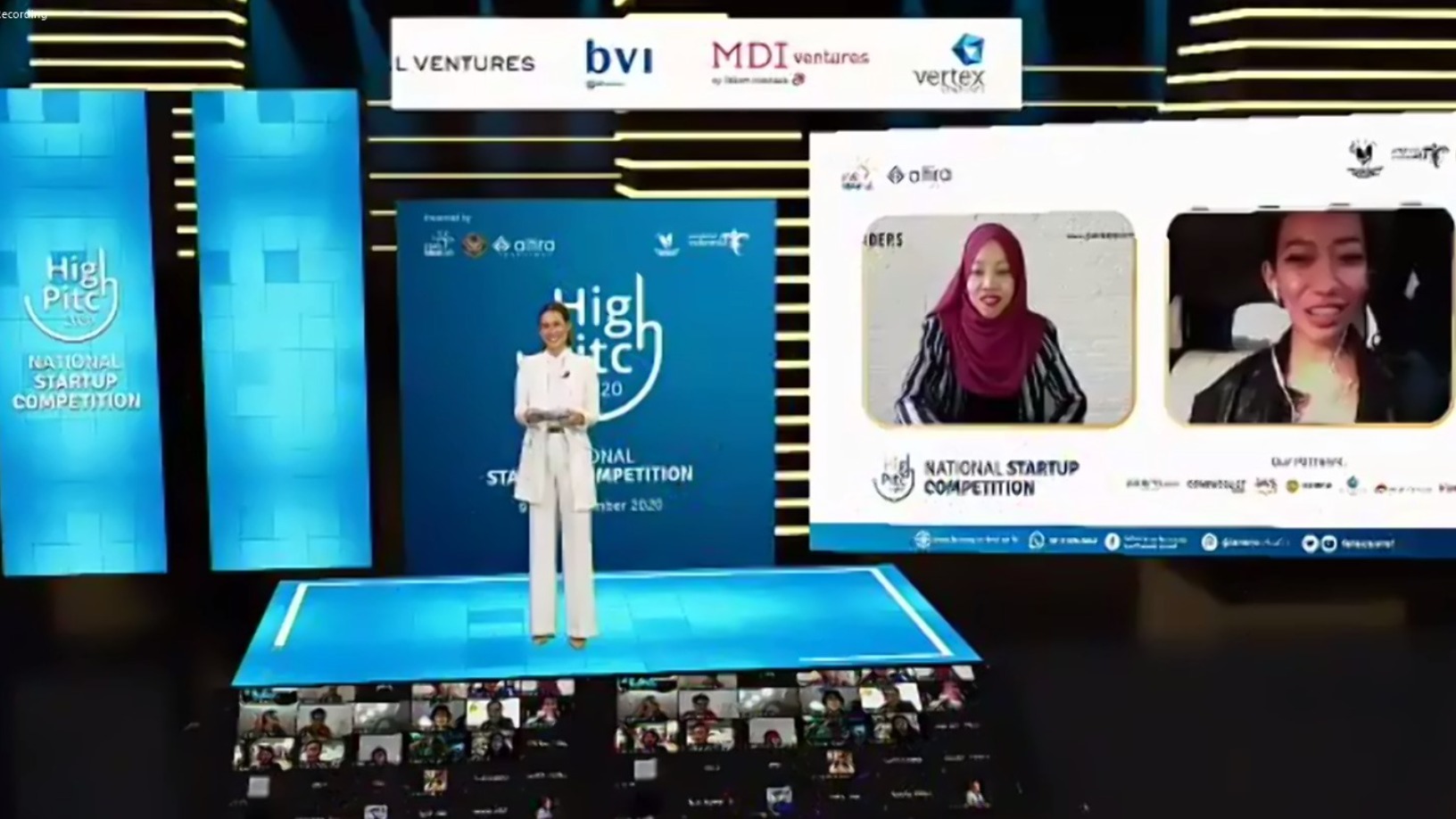

HighPitch 2020: In conversation with top winners and UMG Idealab head Kiwi Aliwarga

Goers, Izy and CekLab demonstrated quick thinking when adapting their businesses to the pandemic, a capability they will need to stay competitive post-Covid

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

HighPitch 2020: Event ticketing and legal tech startups come up tops in Jakarta chapter

VC judges favored Goers’s strong pivot amid Covid and HAKITA’s outstanding pitch

Spanish VR edtech Play2Speak targets China's K-12 market

Keen on the multibillion-dollar tutoring market in Asia, Play2Speak creates VR immersive learning to help kids overcome the fear of learning a new language

SFTC: Riding on the rise of independent music and alternative media

From recording music sessions for its YouTube channel, Sounds From The Corner has expanded into content production, reflecting Indonesia’s fast-evolving media landscape

Kuaishou: Grabbing a share of China's near-trillion-RMB livestreaming e-commerce market

With 300m daily users, the short video app for the grassroots has partnered JD.com to offer discounts to convert users into online shoppers

In depth: The business ecosystems China’s tech giants and unicorns build

Startups could accept to join Alibaba, Tencent or other tech giants in their ecosystems and scale quickly. Or they could say no and keep their independence. But do they really have a choice?