Fintech

This function is exclusive for Premium subscribers

DATABASE (313)

ARTICLES (110)

The most popular app and online brokerage of Chinese-speaking investors to trade US- and HK-listed shares is also backed by the legendary Jim Rogers.

The most popular app and online brokerage of Chinese-speaking investors to trade US- and HK-listed shares is also backed by the legendary Jim Rogers.

Customers can easily pay for regular expenses using their favorite cashless payment methods hosted by digital financial services platform Infra Digital Nusantara.

Customers can easily pay for regular expenses using their favorite cashless payment methods hosted by digital financial services platform Infra Digital Nusantara.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Tapping into the financial services market for Indonesia’s 49 million unbanked SMEs, KoinWorks offers investors a Protection Fund in partnership with credit insurance firms.

Tapping into the financial services market for Indonesia’s 49 million unbanked SMEs, KoinWorks offers investors a Protection Fund in partnership with credit insurance firms.

Indonesia’s startup IPO pioneer Kioson is poised to grab a lion’s share of the local O2O e-commerce and financial services by targeting unbanked communities.

Indonesia’s startup IPO pioneer Kioson is poised to grab a lion’s share of the local O2O e-commerce and financial services by targeting unbanked communities.

Xhockware reduces supermarket shopping checkout times to under one minute, so retailers increase inventory turnover and customer satisfaction. Zero capital investment needed.

Xhockware reduces supermarket shopping checkout times to under one minute, so retailers increase inventory turnover and customer satisfaction. Zero capital investment needed.

Amid explosive microcredit growth in China, Experian and Alibaba partner Shenzhourong is the first big-data-based credit risk management SaaS, offering consumer finance players affordable services.

Amid explosive microcredit growth in China, Experian and Alibaba partner Shenzhourong is the first big-data-based credit risk management SaaS, offering consumer finance players affordable services.

Targeting SME financial services, AI-powered risk management platform James saves time, increases accuracy and reduces default rates by up to 30%.

Targeting SME financial services, AI-powered risk management platform James saves time, increases accuracy and reduces default rates by up to 30%.

With €42m in investment and trusted by microfinance institutions and unicorns, Mambu is an agile, customizable cloud-based banking architecture SaaS, quick to deploy and transact.

With €42m in investment and trusted by microfinance institutions and unicorns, Mambu is an agile, customizable cloud-based banking architecture SaaS, quick to deploy and transact.

Connecting cashflow-challenged SMEs with individual lenders seeking alternative investments, P2P lending marketplace Investree processes loans in just three days, with no default to date.

Connecting cashflow-challenged SMEs with individual lenders seeking alternative investments, P2P lending marketplace Investree processes loans in just three days, with no default to date.

The latest bright idea from Aldi Haryopratomo’s social enterprise success Ruma, the Mapan app gives a unique twist to an Indonesian group-buying culture.

The latest bright idea from Aldi Haryopratomo’s social enterprise success Ruma, the Mapan app gives a unique twist to an Indonesian group-buying culture.

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

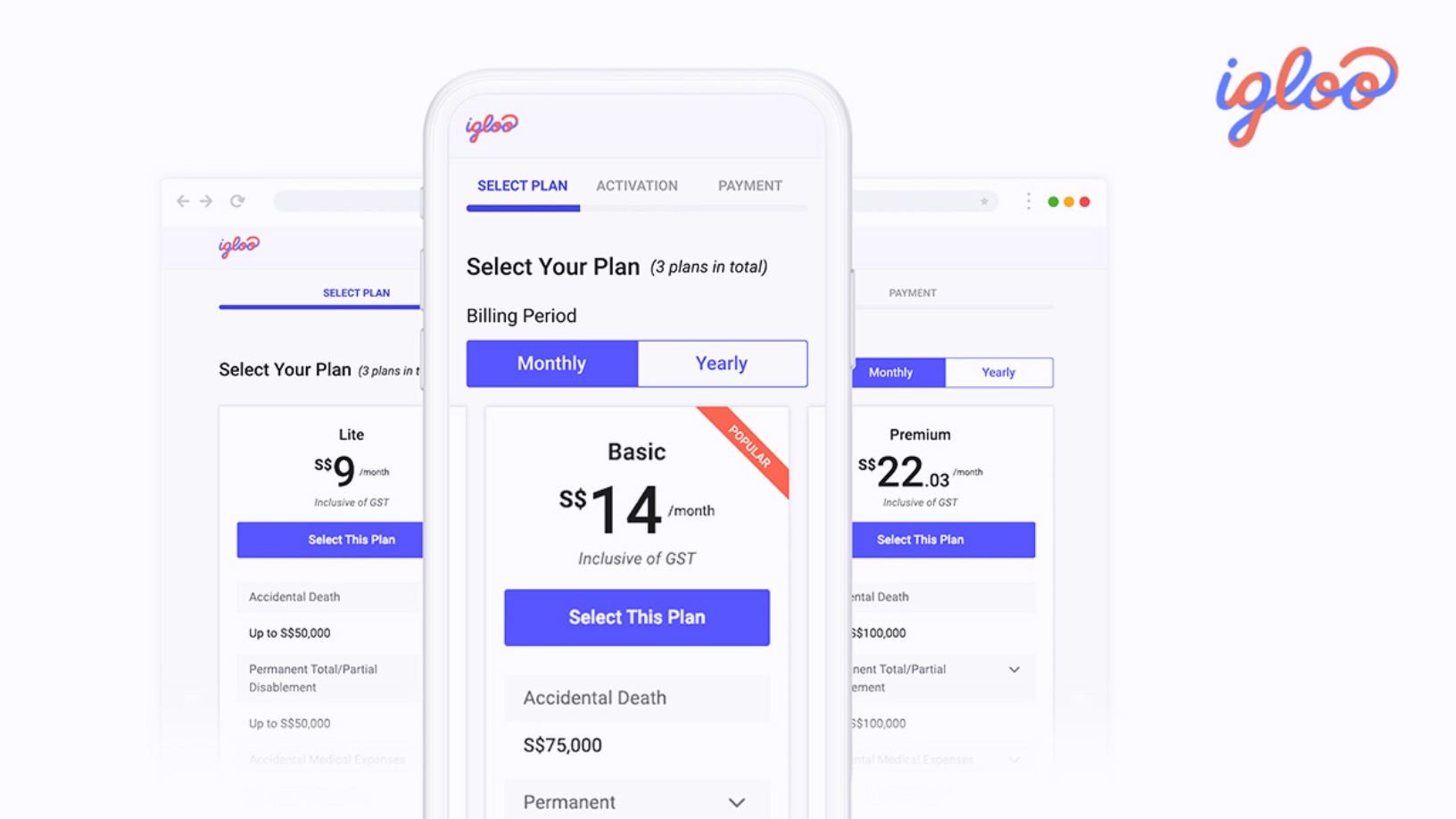

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Gigacover: Providing a financial safety net for gig workers

Gigacover is eyeing multi-billion-dollar opportunities in income and healthcare protection and financial services for the 150m self-employed workers in Southeast Asia, about half of whom are underbanked

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Gojek and Tokopedia merge to form GoTo

The new entity, now Indonesia’s largest tech group, plans to go public in Indonesia and the US, targeting a $40bn valuation

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Pula: Pioneering insurtech helps to improve Africa's food security

With Kenyan insurtech Pula’s micro-insurance products, millions of farmers no longer have to bear the full risk of losses from natural disasters and crop failures

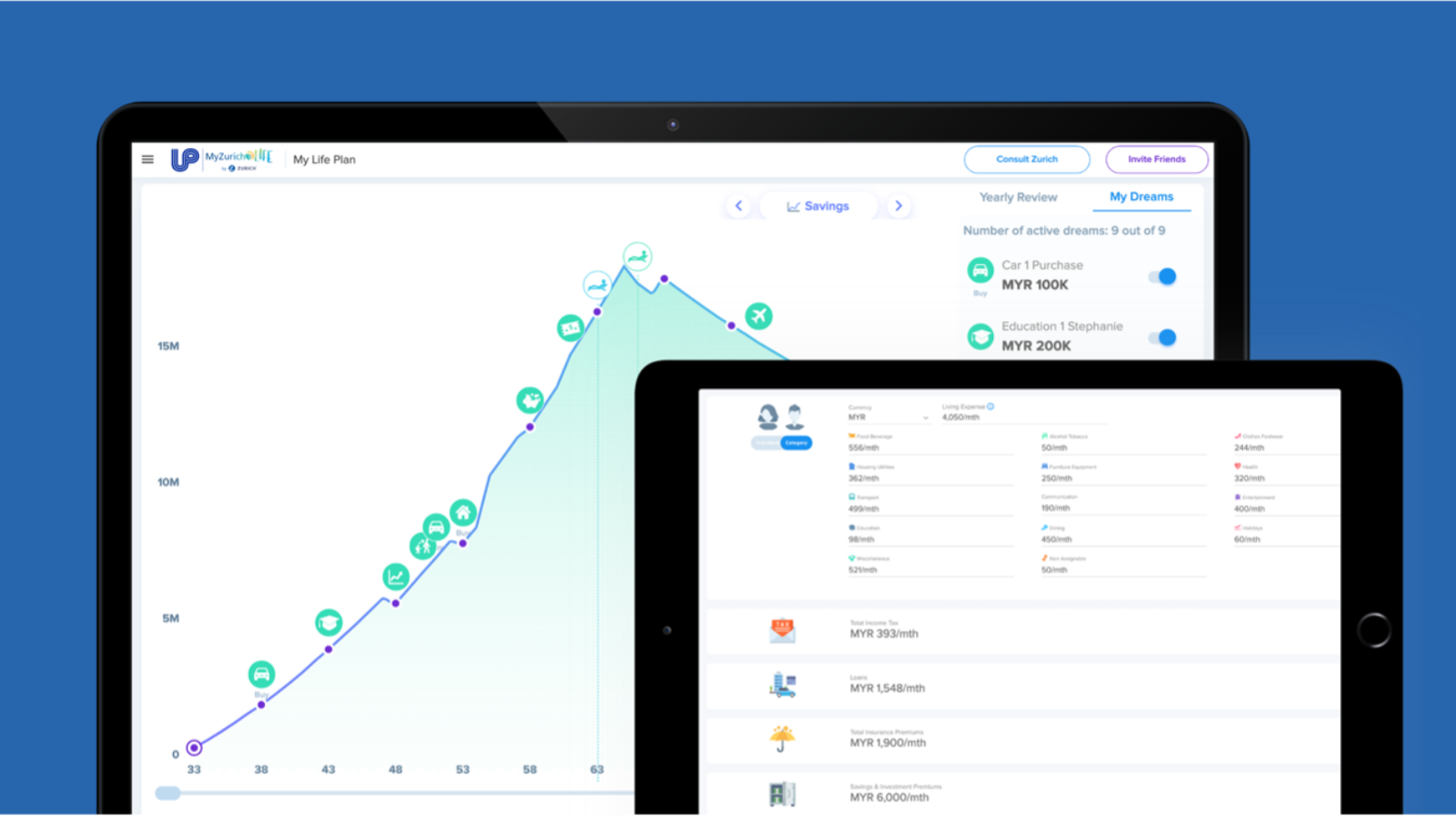

BetterTradeOff: Taking the pain out of financial planning

The Singapore-based startup’s user numbers rose sharply during Covid-19. It wants to raise $11.5m by year-end, is planning a launch in Australia and is eyeing the US market