Real Estate

This function is exclusive for Premium subscribers

DATABASE (76)

ARTICLES (38)

After earning his MBA at the Wharton School of the University of Pennsylvania, Zhang worked as an advisor at American Management Systems, an IT consulting firm based in the US. In 2003, he founded Dianping.com, one of China’s biggest online lifestyle services providers, and served as CEO and chairman until 2015. After Dianping.com merged with group-buying giant Meituan in 2015, Zhang became chairman of Meituan-Dianping.

After earning his MBA at the Wharton School of the University of Pennsylvania, Zhang worked as an advisor at American Management Systems, an IT consulting firm based in the US. In 2003, he founded Dianping.com, one of China’s biggest online lifestyle services providers, and served as CEO and chairman until 2015. After Dianping.com merged with group-buying giant Meituan in 2015, Zhang became chairman of Meituan-Dianping.

Established in Shenzhen in 2007, Share Capital has invested in over 100 companies. Some of its portfolio companies – e.g., NavInfo, Perfect World and BGI – have gone public. Its investment team of nearly 50 members manages more than RMB 6 billion worth of assets. Share Capital has set up a healthcare fund of RMB 1.5 billion and invested in over 70 health-related projects.

Established in Shenzhen in 2007, Share Capital has invested in over 100 companies. Some of its portfolio companies – e.g., NavInfo, Perfect World and BGI – have gone public. Its investment team of nearly 50 members manages more than RMB 6 billion worth of assets. Share Capital has set up a healthcare fund of RMB 1.5 billion and invested in over 70 health-related projects.

Fosun RZ Capital (Fosun Kinzon Capital)

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Fosun RZ Capital was founded as the investment arm of the Fosun Group in 2013. Formerly known as Fosun Kinzon Capital, the firm changed its name in 2017. With assets of over RMB 10 billion under management, the firm invests mainly in the internet, finance, education, healthcare, automotive, consumer products and business services fields. Headquartered in Beijing, Fosun RZ Capital has branch offices in Shanghai, Shenzhen, Silicon Valley, New Delhi, Bangalore, Lagos, Jakarta, Singapore, among other locations.

Prometheus Capital was founded in 2012 as a family fund of Wang Jianlin, founder and chairman of the Dalian Wanda Group, China's biggest real estate conglomerate, and his son Wang Sicong. It is now owned and controlled by Wang Sicong. With over US$1 billion assets under management, the firm invests mainly in early- and growth-stage startups in the real estate, consumer products, entertainment and fintech sectors around the world. It has made investments worth RMB 3 billion in total.

Prometheus Capital was founded in 2012 as a family fund of Wang Jianlin, founder and chairman of the Dalian Wanda Group, China's biggest real estate conglomerate, and his son Wang Sicong. It is now owned and controlled by Wang Sicong. With over US$1 billion assets under management, the firm invests mainly in early- and growth-stage startups in the real estate, consumer products, entertainment and fintech sectors around the world. It has made investments worth RMB 3 billion in total.

Indonesian Paradise Property is a group of property developers and management companies focusing on lifestyle destinations and hospitality properties in prime locations in Indonesia. Its portfolio includes Jakarta's Plaza Indonesia mall and Grand Hyatt Jakarta, as well as the Sahid Kuta resort in Bali.

Indonesian Paradise Property is a group of property developers and management companies focusing on lifestyle destinations and hospitality properties in prime locations in Indonesia. Its portfolio includes Jakarta's Plaza Indonesia mall and Grand Hyatt Jakarta, as well as the Sahid Kuta resort in Bali.

UCommune is a Chinese coworking space operator, best known for its UrWork brand. As of November 2018, it has raised over US$650 million and has most recently completed series D funding. UCommune has also invested in Chinese companies Danke Apartment and Huodongxing, as well as Indonesian coworking space operator Rework (now GoWork).

UCommune is a Chinese coworking space operator, best known for its UrWork brand. As of November 2018, it has raised over US$650 million and has most recently completed series D funding. UCommune has also invested in Chinese companies Danke Apartment and Huodongxing, as well as Indonesian coworking space operator Rework (now GoWork).

The 10100 Fund (pronounced "ten one-hundred") was established by former Uber CEO Travis Kalanick as a vehicle for both his for-profit investments and non-profit projects. The fund focuses on China and India and has been described as a "home to [Kalanick's] passions, investments, ideas and big bets". 10100 had earlier invested in Kalanick's venture to develop kitchens for on-demand food delivery, CloudKitchens (now known as City Storage Systems).

The 10100 Fund (pronounced "ten one-hundred") was established by former Uber CEO Travis Kalanick as a vehicle for both his for-profit investments and non-profit projects. The fund focuses on China and India and has been described as a "home to [Kalanick's] passions, investments, ideas and big bets". 10100 had earlier invested in Kalanick's venture to develop kitchens for on-demand food delivery, CloudKitchens (now known as City Storage Systems).

China Merchants Venture, a subsidiary of China Merchants Group, was founded in November 2015. It is headquartered in Shenzhen and has opened offices in Beijing, Hong Kong, Israel and Silicon Valley. The company invests in finance, real estate, logistics, transportation, healthcare, AI, among other industries. Of the RMB 5 bn capital under its management, RMB 2bn is earmarked for a fund of funds (FOF) and the other RMB 3 bn for direct investment. As of April 2019, the FOF has invested in 28 early and growth stage funds, and directly invested in over 50 startups.

China Merchants Venture, a subsidiary of China Merchants Group, was founded in November 2015. It is headquartered in Shenzhen and has opened offices in Beijing, Hong Kong, Israel and Silicon Valley. The company invests in finance, real estate, logistics, transportation, healthcare, AI, among other industries. Of the RMB 5 bn capital under its management, RMB 2bn is earmarked for a fund of funds (FOF) and the other RMB 3 bn for direct investment. As of April 2019, the FOF has invested in 28 early and growth stage funds, and directly invested in over 50 startups.

Bo Shao graduated with a Harvard degree in Physics and Electrical Engineering in 1995 and worked at the Boston Consulting Group for almost two years until 1997. After obtaining an MBA from Harvard in 1999, he started EachNet in China. The e-commerce platform was acquired by eBay in 2003 for US$225m and Bo went on to other ventures like Babytree and Parent Lab Inc.Based in San Francisco, the angel investor became a founding partner of Matrix Partners China in 2008. He focuses on early-stage investments in the internet, e-commerce and new media sectors.

Bo Shao graduated with a Harvard degree in Physics and Electrical Engineering in 1995 and worked at the Boston Consulting Group for almost two years until 1997. After obtaining an MBA from Harvard in 1999, he started EachNet in China. The e-commerce platform was acquired by eBay in 2003 for US$225m and Bo went on to other ventures like Babytree and Parent Lab Inc.Based in San Francisco, the angel investor became a founding partner of Matrix Partners China in 2008. He focuses on early-stage investments in the internet, e-commerce and new media sectors.

Billing itself as the "world's first venture builder focused on the real estate and construction sectors," Construtech Ventures is a Brazilian investor and venture builder established in 2017 in Florianópolis. To date, it has invested in 11 companies, all of them local with the exception of Portuguese Infraspeak. Its most recent investments are in Infraspeak's seed round and in real estate marketplace EmCasa's Series A round. The company also has a second office in São Paulo.

Billing itself as the "world's first venture builder focused on the real estate and construction sectors," Construtech Ventures is a Brazilian investor and venture builder established in 2017 in Florianópolis. To date, it has invested in 11 companies, all of them local with the exception of Portuguese Infraspeak. Its most recent investments are in Infraspeak's seed round and in real estate marketplace EmCasa's Series A round. The company also has a second office in São Paulo.

Farben Consulting is a Portuguese real estate investor and consultancy based in Torres Novas and established in 1996. It has no website and has not disclosed any information about its business. In 2014 and 2015, Farben invested €1.5m for an equity stake of 98% in CoolFarm. The agtech became insolvent in October 2018 when Farben decided to stop supporting the startup due to lack of sales and market potential for B2B indoor farming solutions.

Farben Consulting is a Portuguese real estate investor and consultancy based in Torres Novas and established in 1996. It has no website and has not disclosed any information about its business. In 2014 and 2015, Farben invested €1.5m for an equity stake of 98% in CoolFarm. The agtech became insolvent in October 2018 when Farben decided to stop supporting the startup due to lack of sales and market potential for B2B indoor farming solutions.

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

Headquartered in Nanjing, Fullshare Group was founded in 2002 and listed on the Stock Exchange of Hong Kong in 2013. Its business includes multiple industries, namely, tourism, education, healthcare, real estate and renewable energy. It has expanded to Europe, America, Africa, Central Asia and Australia.

Headquartered in Nanjing, Fullshare Group was founded in 2002 and listed on the Stock Exchange of Hong Kong in 2013. Its business includes multiple industries, namely, tourism, education, healthcare, real estate and renewable energy. It has expanded to Europe, America, Africa, Central Asia and Australia.

Mubadala was founded in 2017 and was directly listed as a Public Joint Stock Company, merging the Mubadala Development Company and the International Petroleum Investment Company (IPIC).Mubadala is owned by the government of Abu Dhabi in the United Arab Emirates (UAE) with approximately $299bn assets under management and operations across 50 countries. Mubadala owns the Advanced Technology Investment Company (ATIC), a firm acting as an investment vehicle in high technology sectors.

Mubadala was founded in 2017 and was directly listed as a Public Joint Stock Company, merging the Mubadala Development Company and the International Petroleum Investment Company (IPIC).Mubadala is owned by the government of Abu Dhabi in the United Arab Emirates (UAE) with approximately $299bn assets under management and operations across 50 countries. Mubadala owns the Advanced Technology Investment Company (ATIC), a firm acting as an investment vehicle in high technology sectors.

SWITCH Singapore 2021: Driving renewable energy impact through better business models

Startups need to communicate the business benefits of green solutions to their customers, rather than just pitching the hi-tech

SWITCH Singapore 2021: How startups, corporates and government can co-create smart cities

The next generation of adaptive spaces will harness big data, deep tech and analytics to respond intelligently to both changing environments and human needs, says an expert panel

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Psquared: Providing flexible workplaces to help early-stage startups

The Barcelona-based startup converts a variety of buildings to hybrid office spaces for flexible work brought about by Covid-19, includes a reservations system to manage desk and meeting spaces

Switch Automation: On-demand, data-driven building management

The Denver-based company kicked off operations in Singapore last year, intends to use the city-state as a spring board to expand in the Asia Pacific

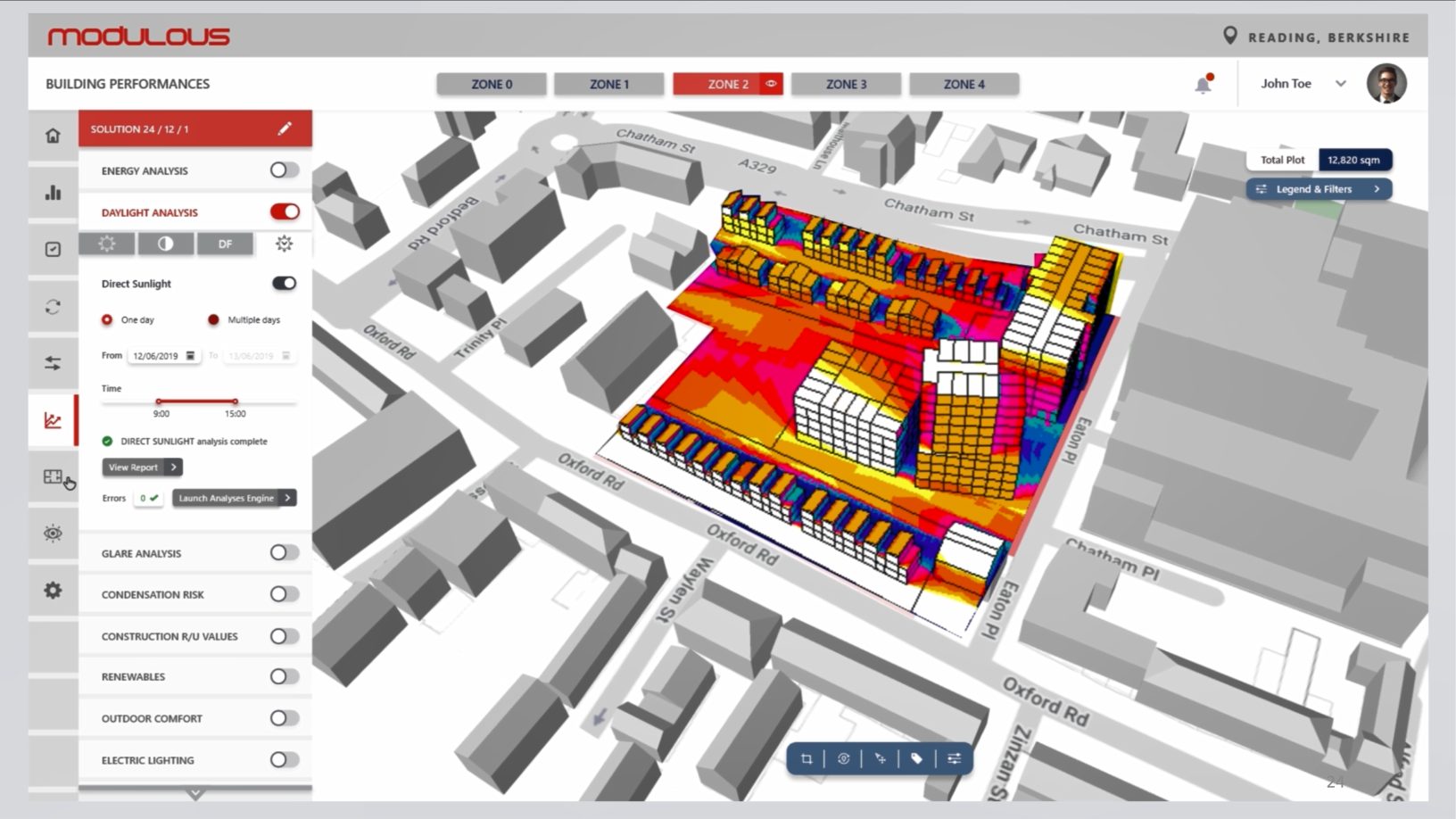

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

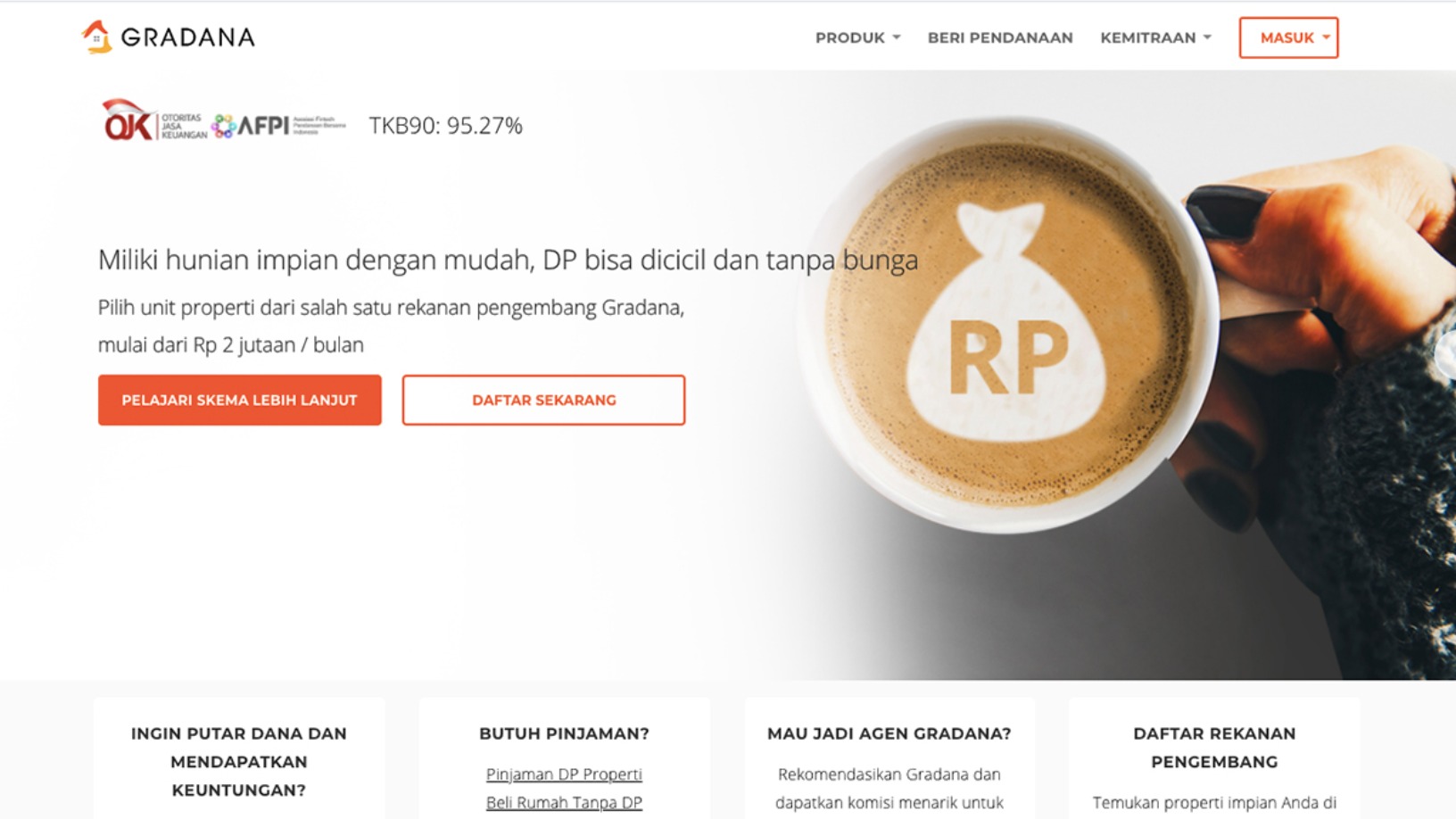

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

DORM: New-generation housing for Indonesia’s tech-savvy, community-driven students

Combining online features with offline services, DORM goes way beyond what the market typically offers in student accommodation

Amid Covid-19, contactless smart mailbox startup Mayordomo eyes €75m revenue by 2024

Mayordomo's Smart Point app-locker system helps consumers get the best deals online while minimizing CO2 emissions from multiple vendors’ last-mile deliveries

Onesight: Construction remote management tech amid Covid-19 and beyond

Architects, site managers and engineers avoid costly fixes and delays using Onesight’s building information modeling (BIM) apps to create full-scale 3D building models, spot errors

Last-mile delivery disrupted post-Covid: How Spanish startups can show a better way forward

As the recent jump in online retail and home deliveries looks set to stay, startups are playing a key role in reshaping the Spanish last-mile logistics scene to meet new challenges

NANOxARCH: Pioneering awareness and use of sustainable materials in China

Founder Lei Yuxi reckons Covid-19 could usher China into a new era of sustainability, as her startup seeks to make sustainable materials more affordable

QinLin Tech gets advertisers to pay for your local security systems

Besides keeping residents safe from intruders, QinLin’s smart community business model also offers essential home services, social activities and group-buying discounts