Retail

This function is exclusive for Premium subscribers

DATABASE (95)

ARTICLES (84)

Founded in 2007, private equity investment firm Cathay Capital runs eight funds with a total of more than €2.1 billion in assets under management. It operates six offices around the globe and has invested in 85 startups in Asia, Europe and America, focusing on the consumer products, healthcare and advanced manufacturing industries.

Founded in 2007, private equity investment firm Cathay Capital runs eight funds with a total of more than €2.1 billion in assets under management. It operates six offices around the globe and has invested in 85 startups in Asia, Europe and America, focusing on the consumer products, healthcare and advanced manufacturing industries.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Established in 2016, LEADx Capital Partners is a German-based VC and is the investment arm of major retailer METRO Group. Since its founding, the VC has invested in 36 different companies, with a special focus on European retail, the same sector as METRO Group. It has already had one successful exit, the M&A of GuestU, which provides free internet to tourists. LEADx was the lead investor in the €18m Series B round of online printing marketplace 360imprimir, known as 360 Onlineprint in markets outside Iberia and Latin America.

Established in 2016, LEADx Capital Partners is a German-based VC and is the investment arm of major retailer METRO Group. Since its founding, the VC has invested in 36 different companies, with a special focus on European retail, the same sector as METRO Group. It has already had one successful exit, the M&A of GuestU, which provides free internet to tourists. LEADx was the lead investor in the €18m Series B round of online printing marketplace 360imprimir, known as 360 Onlineprint in markets outside Iberia and Latin America.

Jungle Ventures was founded by serial entrepreneur Anurag Srivastava and business angel Amit Anand in Singapore. Anurag arrived in Singapore in 1993 and established interior design Space Matrix group in 2006. Amit was a vice chairman of Business Angels Network South East Asia (BANSEA). He is currently a member of the Advisory Council for Ethics in AI & Data in Singapore.The VC specializes in the finance, retail, software, media, travel and hospitality sectors. Investments include budget hotel network RedDoorz, microfinancing fintech Kredivo, photography services platform SweetEscape and digital logistics Waresix.

Jungle Ventures was founded by serial entrepreneur Anurag Srivastava and business angel Amit Anand in Singapore. Anurag arrived in Singapore in 1993 and established interior design Space Matrix group in 2006. Amit was a vice chairman of Business Angels Network South East Asia (BANSEA). He is currently a member of the Advisory Council for Ethics in AI & Data in Singapore.The VC specializes in the finance, retail, software, media, travel and hospitality sectors. Investments include budget hotel network RedDoorz, microfinancing fintech Kredivo, photography services platform SweetEscape and digital logistics Waresix.

Founded in Beijing in May 2015, Chunxiao Capital mainly invests in angel/seed to Series B funding rounds. With staff of 22, the VC has invested in over 50 companies by March 2019. Investments include technology innovations in fintech, big data and AI. Other investment sectors involve corporate services, Industry 4.0, B2B and SaaS for industrial enterprises and consumer-oriented businesses like retail, sports, maternal and infant care.In May 2019, the Asset Management Association of China revoked Chunxiao's private equity certification due to links with five online P2P lending firms facing default problems.

Founded in Beijing in May 2015, Chunxiao Capital mainly invests in angel/seed to Series B funding rounds. With staff of 22, the VC has invested in over 50 companies by March 2019. Investments include technology innovations in fintech, big data and AI. Other investment sectors involve corporate services, Industry 4.0, B2B and SaaS for industrial enterprises and consumer-oriented businesses like retail, sports, maternal and infant care.In May 2019, the Asset Management Association of China revoked Chunxiao's private equity certification due to links with five online P2P lending firms facing default problems.

Boyu Capital is a China-focused investment firm with offices in Beijing and Hong Kong. It manages tens of billions of US dollars and is one of the largest private equity investment firm in China, and mainly invests in sectors of consumer and retail, financial services, healthcare, media and technology.Boyu Capital was founded in 2011 by the late Ma Xuezheng (died in September 2019), former senior vice-president and financial director of Lenovo Group and managing director and partner of TPG, and Zhang Zixin (Louis Cheung), former general manager of Ping An Insurance. Boyu Capital's first chairman of the board was Jiang Zhicheng (Alvin Jiang), the grandson of former Chinese president Jiang Zemin.

Boyu Capital is a China-focused investment firm with offices in Beijing and Hong Kong. It manages tens of billions of US dollars and is one of the largest private equity investment firm in China, and mainly invests in sectors of consumer and retail, financial services, healthcare, media and technology.Boyu Capital was founded in 2011 by the late Ma Xuezheng (died in September 2019), former senior vice-president and financial director of Lenovo Group and managing director and partner of TPG, and Zhang Zixin (Louis Cheung), former general manager of Ping An Insurance. Boyu Capital's first chairman of the board was Jiang Zhicheng (Alvin Jiang), the grandson of former Chinese president Jiang Zemin.

Shanghai-based Shengyin Incubation is a wholly-owned subsidiary of Shengyin Investment, specialized in private equity investment, merger & acquisition, investment consultancy and startup incubation. It invests mainly in early-stage startups in agritech, new retail, education and enterprise services. Shengyin Incubation is also eyeing commercial opportunities brought by new technologies such as AI, blockchain and IoT. Since its establishment in 2006, Shengyin Incubation has invested in over 100 startups, of which 26 have been listed on China's stock exchanges in Shanghai and Shenzhen.

Shanghai-based Shengyin Incubation is a wholly-owned subsidiary of Shengyin Investment, specialized in private equity investment, merger & acquisition, investment consultancy and startup incubation. It invests mainly in early-stage startups in agritech, new retail, education and enterprise services. Shengyin Incubation is also eyeing commercial opportunities brought by new technologies such as AI, blockchain and IoT. Since its establishment in 2006, Shengyin Incubation has invested in over 100 startups, of which 26 have been listed on China's stock exchanges in Shanghai and Shenzhen.

Eurovending is a family-run, Italian business in the automatic vending sector based in Trento. To date, it has only invested in one tech startup, the Spanish vending machine hardware and interactive payment app Orain, leading its €1m seed investment round in 2017. The company is a producer of plastic cups and also rents and services automatic vending machines across Italy and Spain.

Eurovending is a family-run, Italian business in the automatic vending sector based in Trento. To date, it has only invested in one tech startup, the Spanish vending machine hardware and interactive payment app Orain, leading its €1m seed investment round in 2017. The company is a producer of plastic cups and also rents and services automatic vending machines across Italy and Spain.

Picart Petcare is the family business of Albert Icart Martori, co-founder of Kibus Petcare. It has been in operation since 1953 and is based in Barcelona. Not usually an investor in tech or startups, it has invested solely in healthy pet food preparation hardware startup Kibus with a pre-seed investment of €120,000 in 1Q 2019. Picart distributes pet food and animal feed in more than 25 European and Middle Eastern markets and is set to be a key distributor of Kibus' hardware.

Picart Petcare is the family business of Albert Icart Martori, co-founder of Kibus Petcare. It has been in operation since 1953 and is based in Barcelona. Not usually an investor in tech or startups, it has invested solely in healthy pet food preparation hardware startup Kibus with a pre-seed investment of €120,000 in 1Q 2019. Picart distributes pet food and animal feed in more than 25 European and Middle Eastern markets and is set to be a key distributor of Kibus' hardware.

Rentracks is an adtech company from Japan, listed in the “Mothers” (Market of the High-Growth and Emerging Stocks) board of the Tokyo Stock Exchange. The company provides consultancy services for web development (for SEO, SEM, and other ad purposes) and Internet-based ads. Rentracks also has a network of affiliate companies in various Asian countries, including China, India, Indonesia, and the Philippines.

Rentracks is an adtech company from Japan, listed in the “Mothers” (Market of the High-Growth and Emerging Stocks) board of the Tokyo Stock Exchange. The company provides consultancy services for web development (for SEO, SEM, and other ad purposes) and Internet-based ads. Rentracks also has a network of affiliate companies in various Asian countries, including China, India, Indonesia, and the Philippines.

Drake Enterprises is a Swiss fund with offices in New York and Miami. The board of Drake Enterprises and its committees are responsible for the direction of the group’s businesses.The firm was founded in 2000 by Mr Nicolas Ibañez Scott, born into a family of merchants and entrepreneurs with interests in Chile and the UK. The Drake Group initially focused its entrepreneurial activities on the grocery business in Chile that was then sold in 2009 to Walmart. Since 2014, the group has been focusing its investment and philanthropic activities in companies such as Papa John's and Glovo.

Drake Enterprises is a Swiss fund with offices in New York and Miami. The board of Drake Enterprises and its committees are responsible for the direction of the group’s businesses.The firm was founded in 2000 by Mr Nicolas Ibañez Scott, born into a family of merchants and entrepreneurs with interests in Chile and the UK. The Drake Group initially focused its entrepreneurial activities on the grocery business in Chile that was then sold in 2009 to Walmart. Since 2014, the group has been focusing its investment and philanthropic activities in companies such as Papa John's and Glovo.

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

GenBridge Capital is a private equity fund started by former executives from e-retailer JD.com and TPG Capital in 2016. It raised $500m from JD.com, international corporations, sovereign wealth funds and family funds. GenBridge Capital mainly invests in the consumer goods sector, including new-generation brands and offline stores.

GenBridge Capital is a private equity fund started by former executives from e-retailer JD.com and TPG Capital in 2016. It raised $500m from JD.com, international corporations, sovereign wealth funds and family funds. GenBridge Capital mainly invests in the consumer goods sector, including new-generation brands and offline stores.

Artesmedia is a Spanish media group, with a cross-channel presence through television, radio and cinemas. The company typically invest through media for equity deals.The group has backed to date fast-growing and customer-oriented startups in Spain such as Wallapop, Groupalia and Restaurantes.com

Artesmedia is a Spanish media group, with a cross-channel presence through television, radio and cinemas. The company typically invest through media for equity deals.The group has backed to date fast-growing and customer-oriented startups in Spain such as Wallapop, Groupalia and Restaurantes.com

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

MIWA Technologies: Reducing food waste and packaging with smart refill vending system

MIWA’s solution lets consumers buy exact refill quantities in personalized containers, eradicating need for single-use plastics throughout the supply chain

Bukalapak to raise IDR 21tn in Indonesia's biggest IPO yet

Although trailing rivals Tokopedia and Shopee in market share, Bukalapak cut its losses last year and will be Indonesia’s first unicorn to go public

Node: Fighting deforestation with fashionable footwear from agricultural waste

Using patented technology developed with Indonesia’s Ministry of Agriculture, Node turns farm waste and plant materials into biodegradable vegan footwear and shoe components to help fight deforestation.

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

ScentRealm: Digitally reproducing scents on demand

Unlike colors and sounds, scents are hard to code and digitalize. ScentRealm has not only done it, but has also opened its scent editor and database to the public

Kathy Xu stays ahead of the curve in China's VC scene

Dubbed “Queen of VC” in China, Xu has spotted great companies that others were not quite interested in, like Chinese online retail giant JD.com

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

Bizhare equity crowdfunding attracts over 50,000 retail investors, starts secondary trading

A partner of the Indonesia Central Securities Depository, Bizhare also lowered minimum investment amounts, implemented scripless trading and handpicked businesses on its platform

Koinpack tackles Indonesia's sachet waste problem with refillable bottles

Partnering with FMCG companies, Koinpack is making small amounts of household consumables available to lower-income groups without using traditional sachet packaging

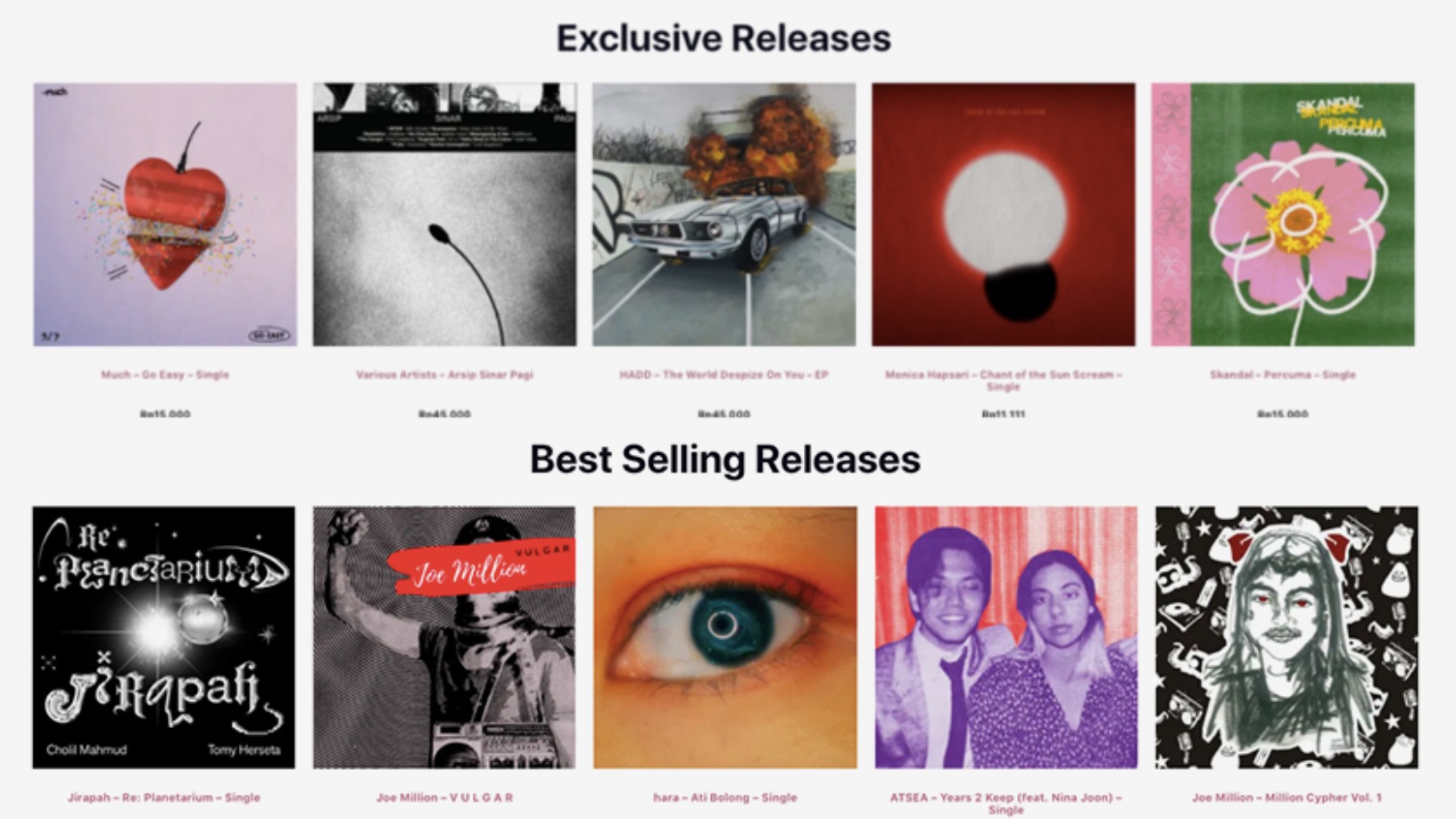

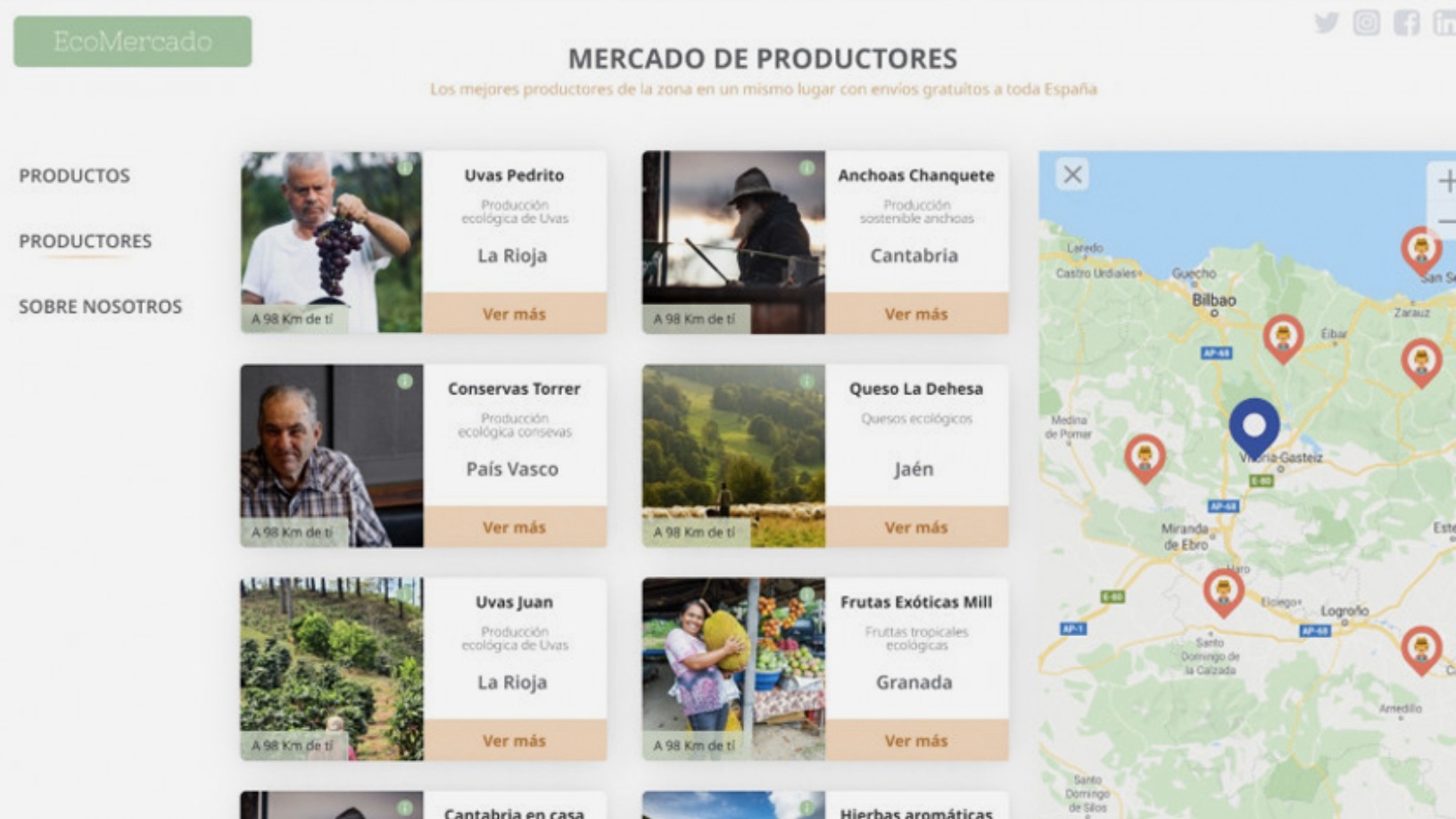

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

Indonesia 2021 outlook: VCs "cautiously optimistic" on Southeast Asia's largest country

Investors expect Indonesian startups to regain their growth opportunities when the economy reopens with the Covid-19 vaccine rollout, even as some online living and working habits have stuck

Plant on Demand: Helping small-scale organic farmers to thrive, sustainably

Plant on Demand will soon deploy product PODX’s “prescriptive” analytics to boost organic farmers’ productivity and prices, by optimizing future crop yields to match seasonal sales trends

Oimo: Biodegradable marine-based bioplastics for environmentally friendly food packaging

Its pellets already work well in current factory machinery, so Oimo wants to scale when the EU’s ban on single-use plastics kicks in next year

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Indonesian B2B e-procurement platforms: Disrupting long-standing practices

Indonesia’s B2B e-commerce players are winning over corporate clients with education and government support, growing a market forecast to be worth $13.4bn by 2023